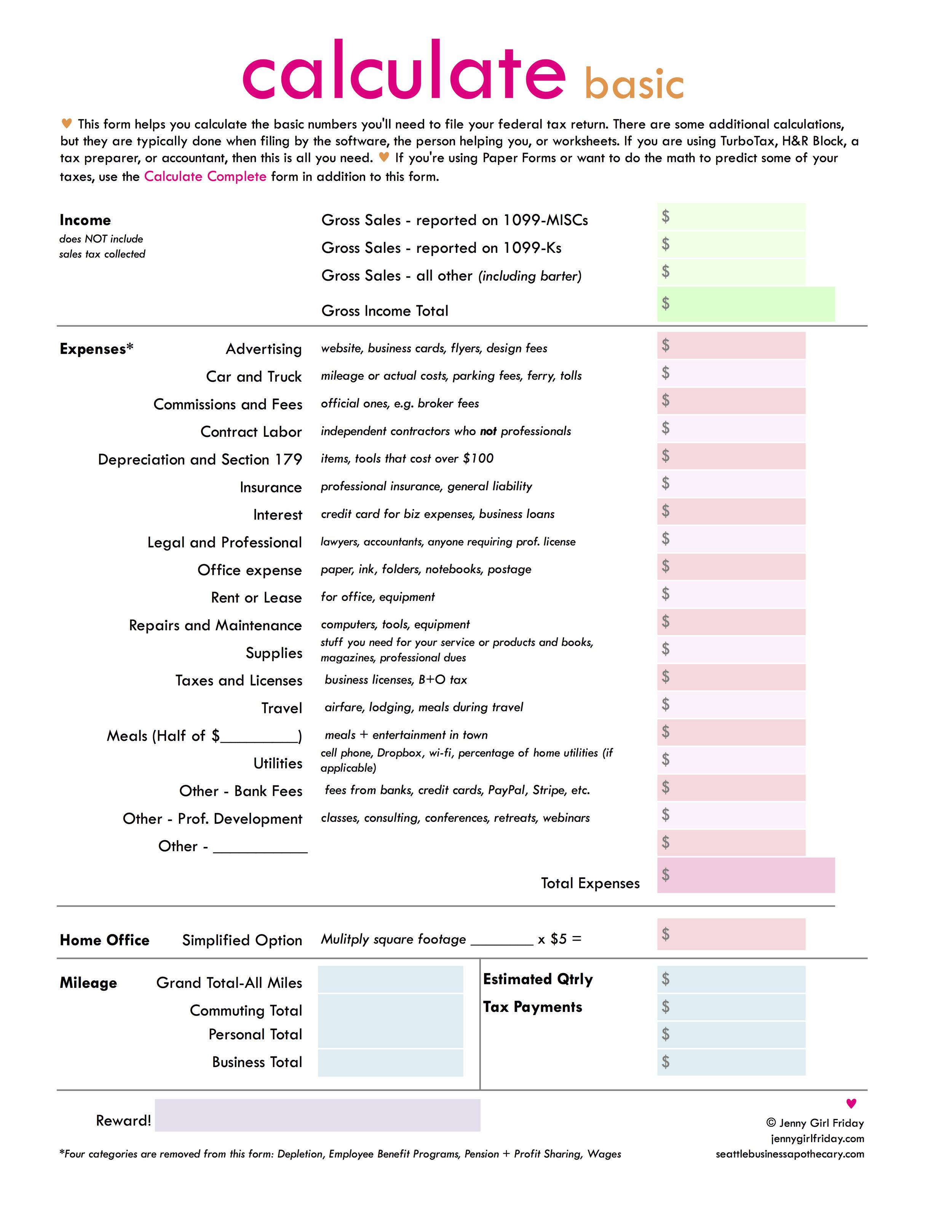

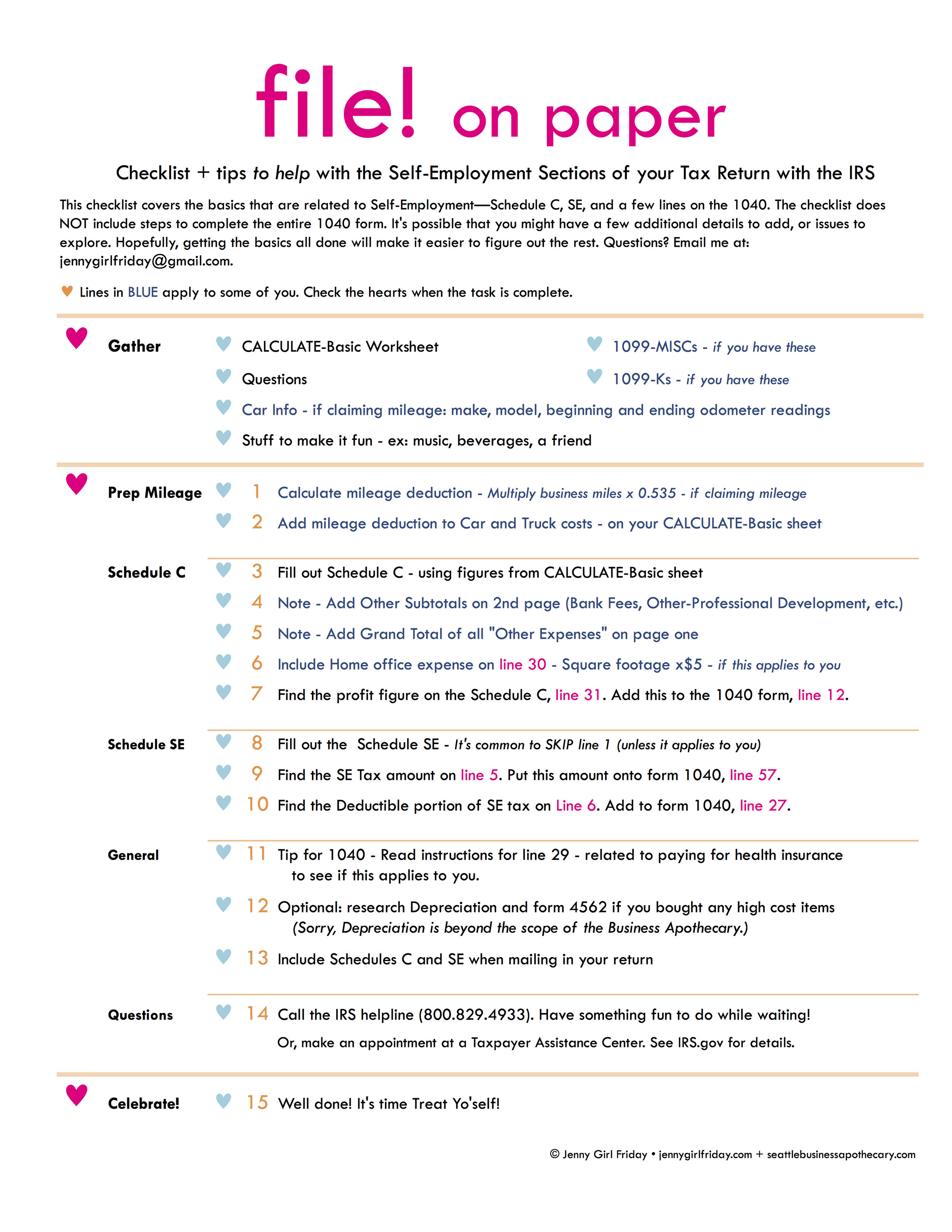

What can I write-off? / What can I claim? / What is a business expense or deduction?

Almost everything you spend on your business - can be a deduction. It’s just a matter of what amount, and what category. The IRS uses the phrase, “ordinary and necessary”.

Quote from the IRS:

“To be deductible, a business expense must be both ordinary and necessary. An ordinary expense is one that is common and accepted in your industry. A necessary expense is one that is helpful and appropriate for your trade or business. An expense does not have to be indispensable to be considered necessary.”

What about something that is part for business, party for personal … like my cell phone, or my laptop?

These are referred to as Shared Use items. The basic strategy is to calculate - or decide - on what percentage is for business, and claim that amount. The default is 50/50, though you can split them other ways as well.

So, if you buy a new computer for $1800, and claim 50% for business, you would claim $900 as a business expense.

Let’s say your phone bill is split between your business, personal, and 2 other people. You could say that 25% is for business. Then take 25% of the total phone bill for the year as a deduction.

Does it matter what category I put things in?

Sorta no, sorta yes.

As long as you claim things only one time, you’re generally fine. The category doesn’t change the taxable amount. And if you’re paying the right amount of tax, you’re good.

Putting things in the reasonable categories does help though! Part of the risk factor for getting audited - is - do these expenses line up for this type of work.

What if I don’t see a category that fits?

You can either pick the closest category, that might make sense.

OR, make an “Other” category, and give it a label.

For example, I have checking account fees, for $84 a year. I could maybe put it into the “Office” category, though it’d be a stretch. So instead, I put it into “Other - Bank Fees”.

How do I handle mileage?

answer coming soon

What about a home office deduction?

Sometimes you can take a deduction for your Home Office. Additionally, you can deduct furniture and items used in your office. (Note, very often, the home office deduction doesn’t add up to that much. The simplified method generally yields a savings of $100 - $300 when all said and done.)

A – Home Office Deduction.

First, check to see if you meet the criteria:

Used exclusively for business – meaning no other activities take place there

Used on a regular basis

For the purpose of making a profit

Principle place of business

If yes, there are two methods:

Simplified Method: Calculate the square footage of your home office. Add this number when filing (with software or accountant.) Generally, you’ll get $5 per square foot as a deduction.

Actual Expenses Method: This is complex, and beyond my scope. The basic idea is that you calculate the percentage of your home that is your office. Say it’s 8%. Then, you add up all home expenses – mortgage/rent, utilities, insurance, etc. – then take 8% of those costs. I think.

B - Furniture and items

All or most things you buy for your office can be deducted – like chairs, rug, couch, artwork.

What do I do with the 1099 forms I received? What’s a 1099-NEC? And 1099-K?

1099 forms are a family of forms that track - whenever we get paid. There are different suffixes, here are some examples:

1099-INT … interest you earned from a bank or investment

1099-DIV … dividends you earned

1099-NEC … income from “Non-employee compensation”

1099-MISC … income from “Miscellaneous source”.

These are the forms you get PAYERS, and are straightforward to work with.

These might come from businesses that hired you, programs you’ve contracted with, insurance companies, people you supervise. You’ll need to input all the data from these forms into the tax software, or give to your accountant. These count as part of tallying up your gross sales.

You may also get 1099-Ks, these come from payment PROCESSORS:

You might get these from Square, Stripe, Venmo, PayPal, etc. These are a little trickier, as the amount reflected in the 1099-K may overlap with other income. Be sure to get guidance on how to enter these when filing.

What if I didn’t receive a 1099 form?

Short answer: You still report the income, whether or not you received the form.

Longer answer: Ask the person/business if they sent one. Or look up on online. If they submitted one to the IRS, it can be a problem if you don’t report it. If they did NOT submit one, you’re in the clear. It’s the responsibility of the Payer to complete the form….