How many newsletters will I get?

12 - 20 each year.

One, at the beginning of each month, with the important due dates, helpful links, and tools. Sometimes, you may receive an extra newsletter, if it pertains to a timely + specific topic. For instance, opportunities - like the PPP Loan, or if there are important changes with tax + licensing rules or procedures.

What will be included, specifically?

Reminders for Due Dates - for taxes, license renewal, and LLC / PLLC renewal.

Links to how-to articles, walkthroughs, or information.

Handy tools + worksheets to make biz chores easier.

And

Planned for 2022: more tools for tending your Money Garden and being Happy at Work.

Topics cover:

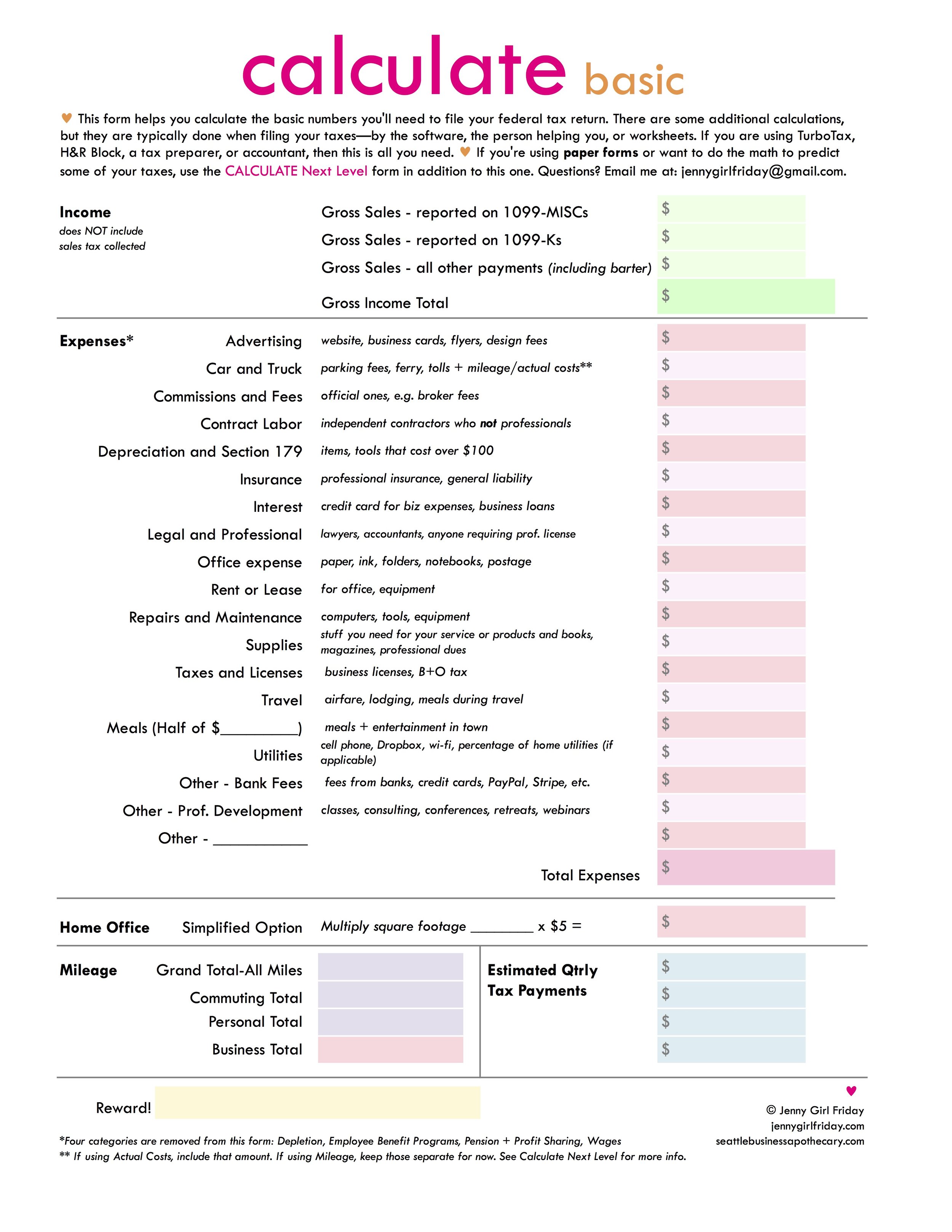

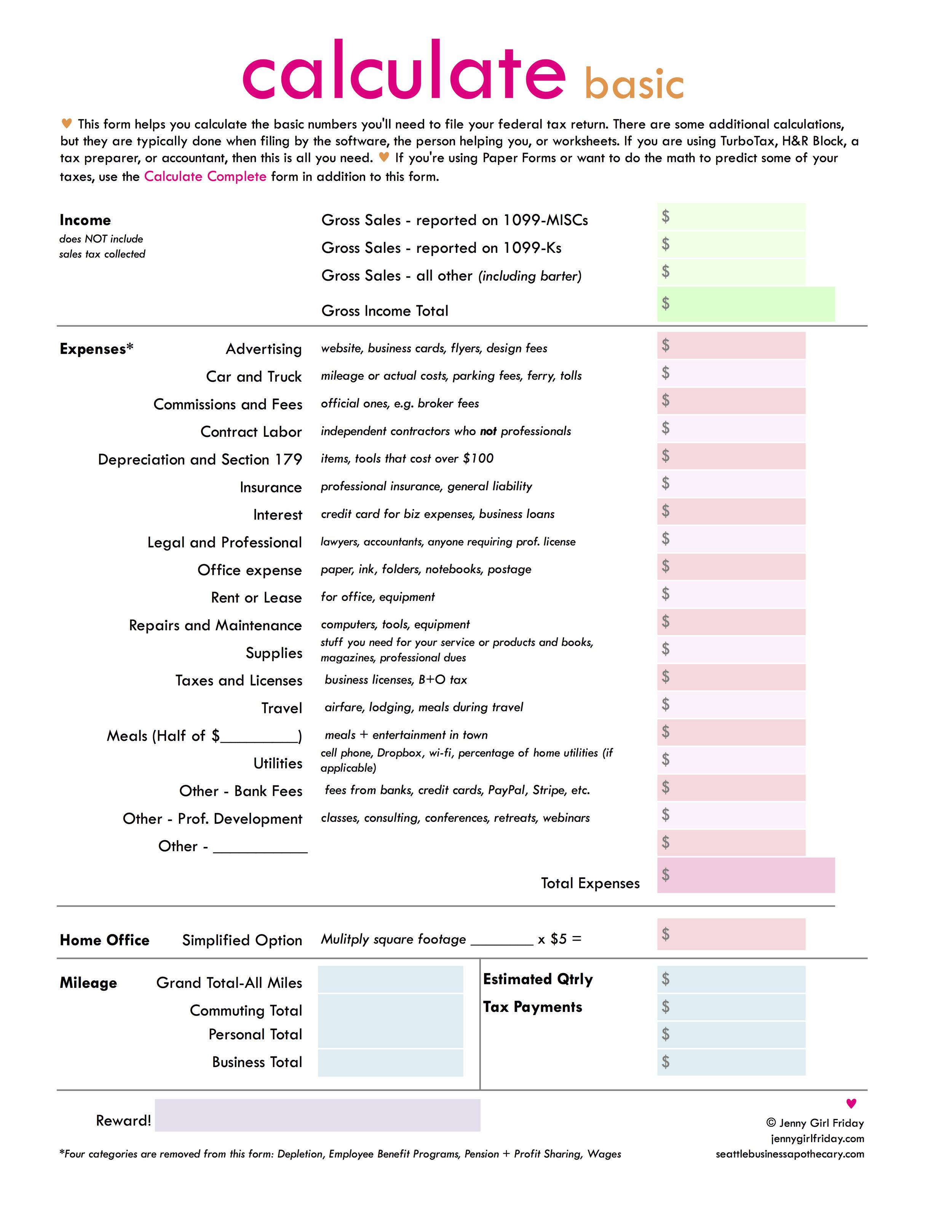

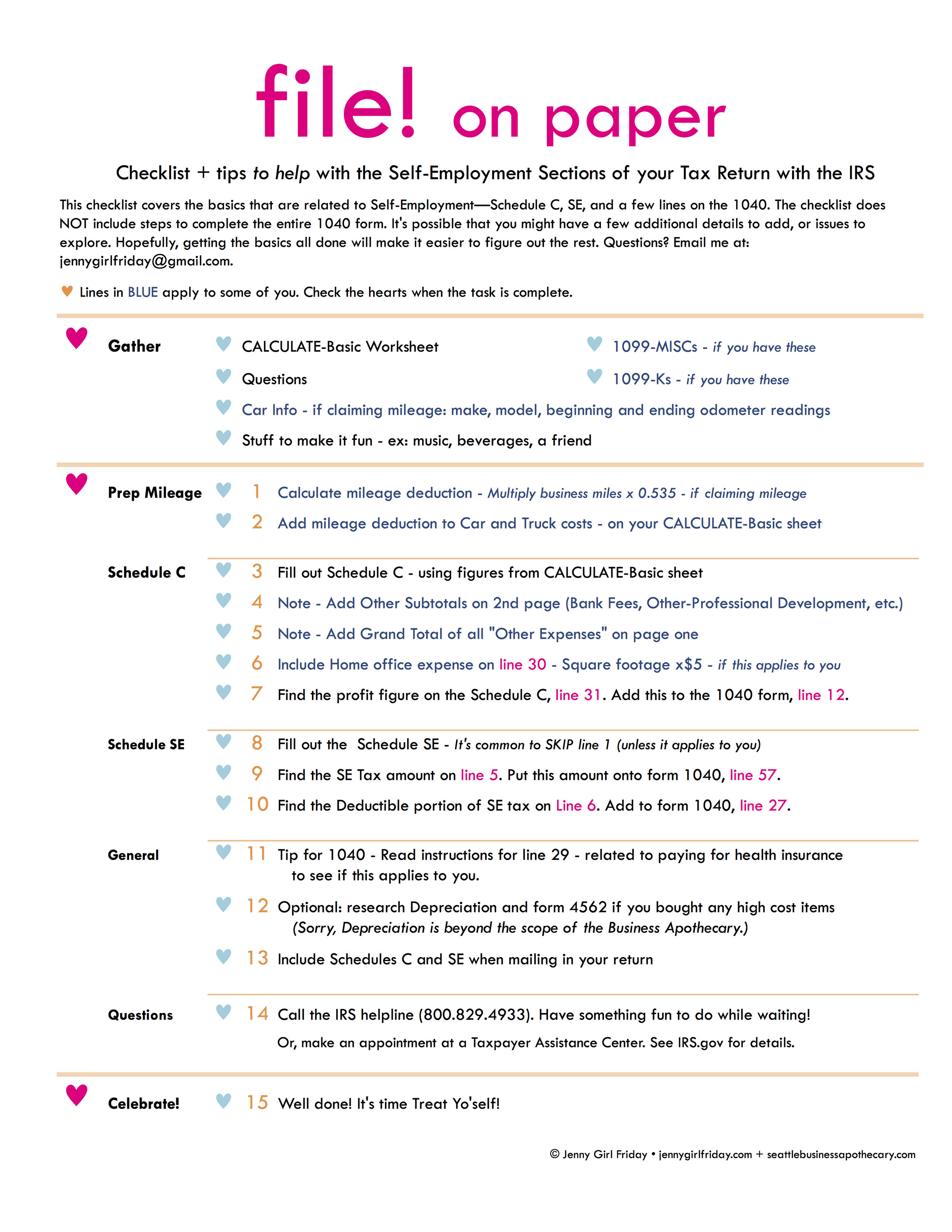

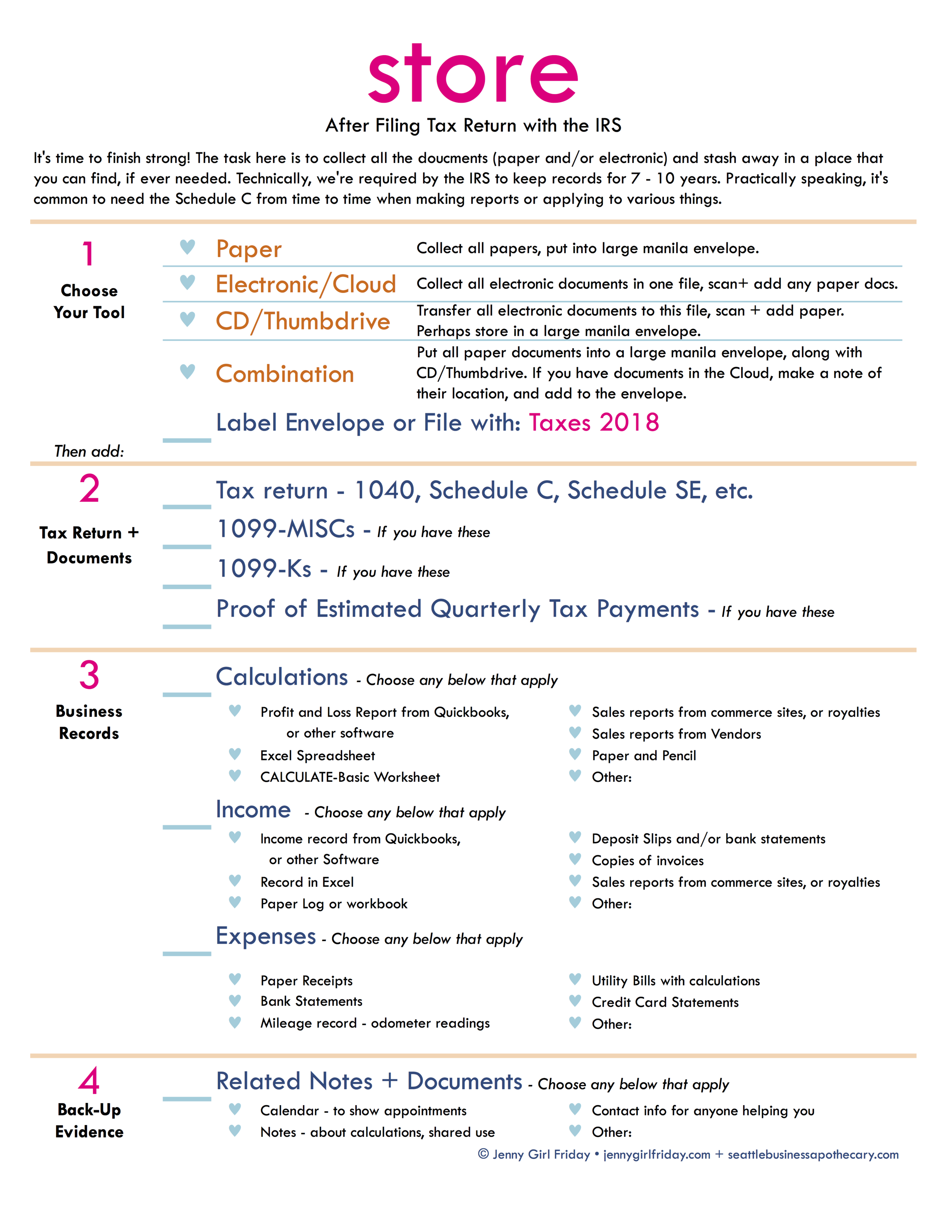

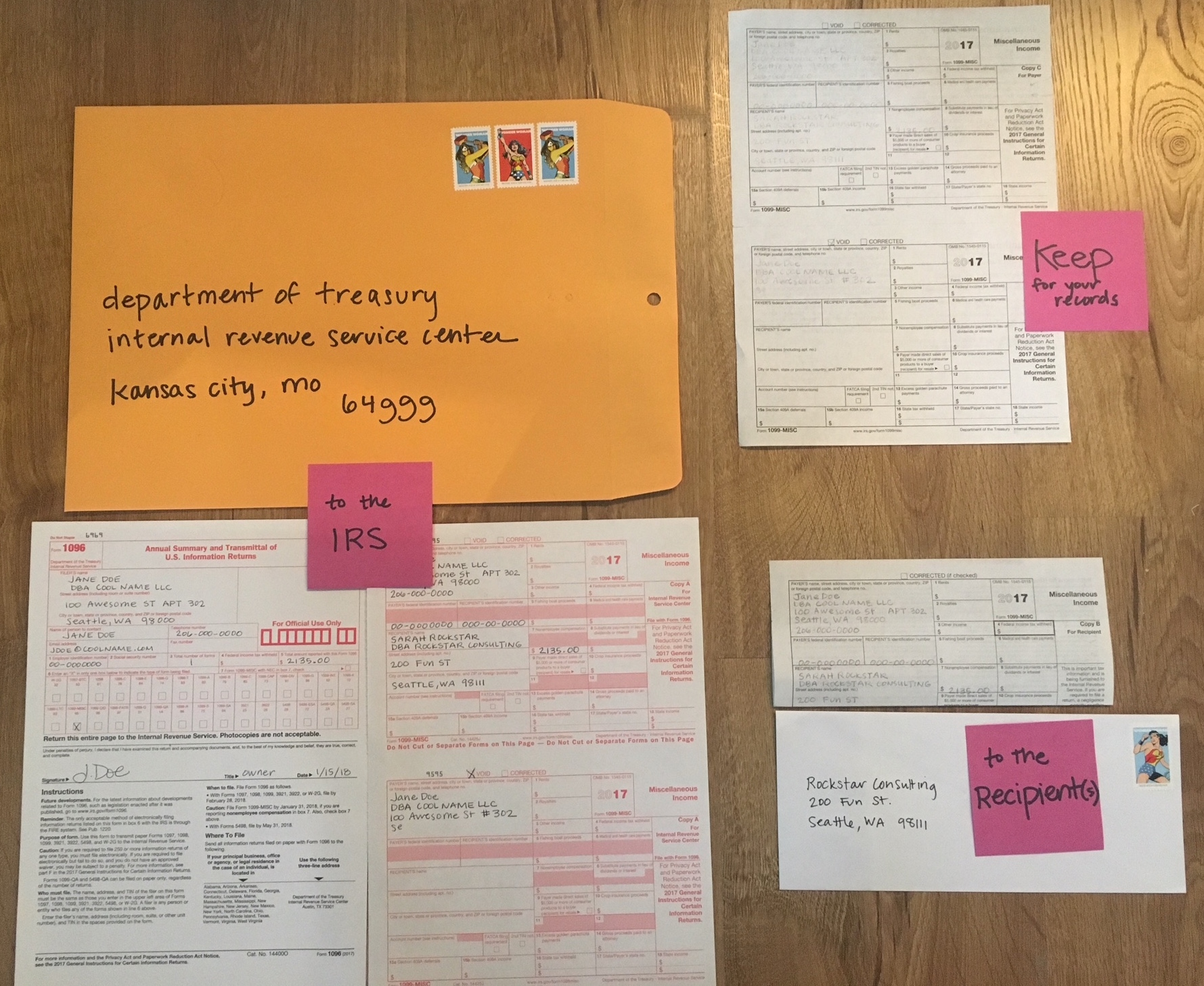

IRS Taxes - Filing and Prep

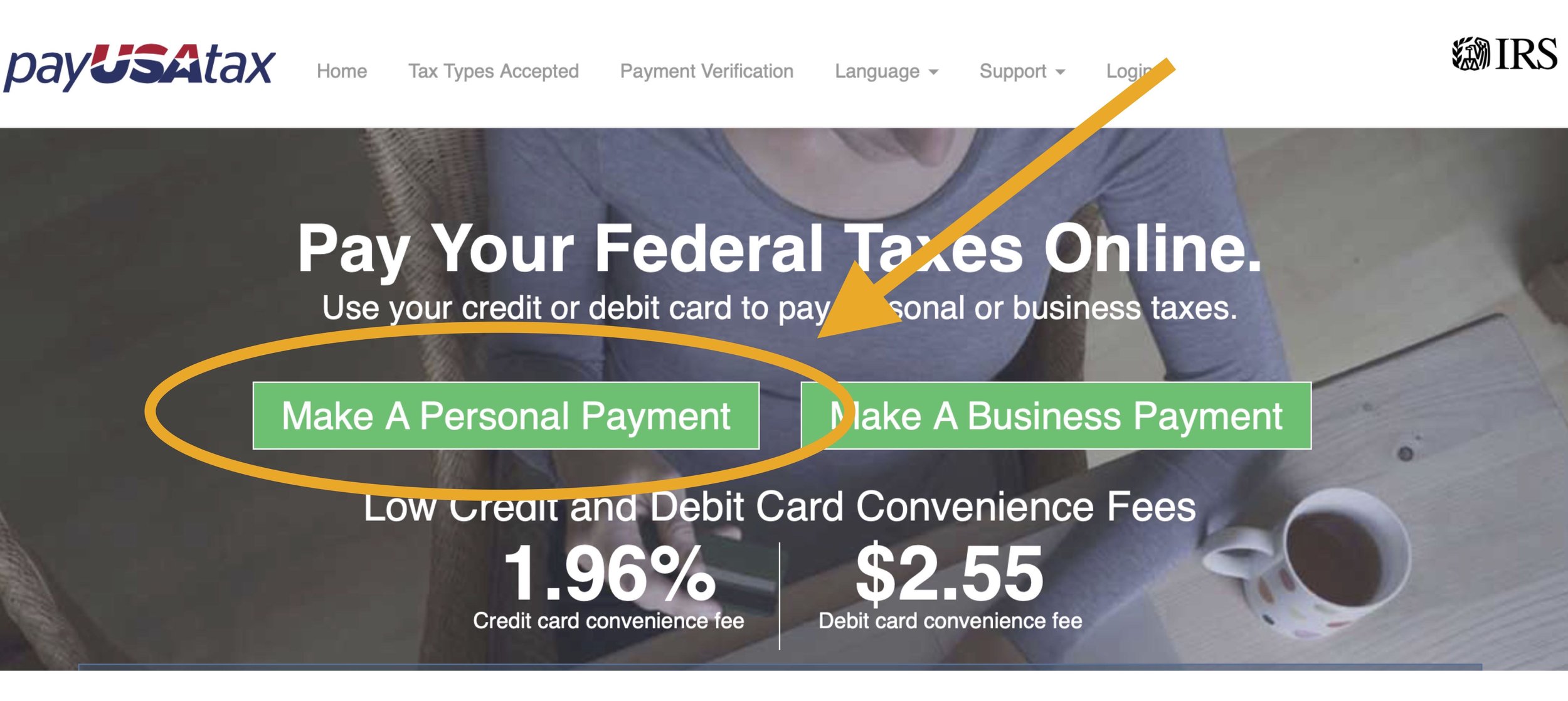

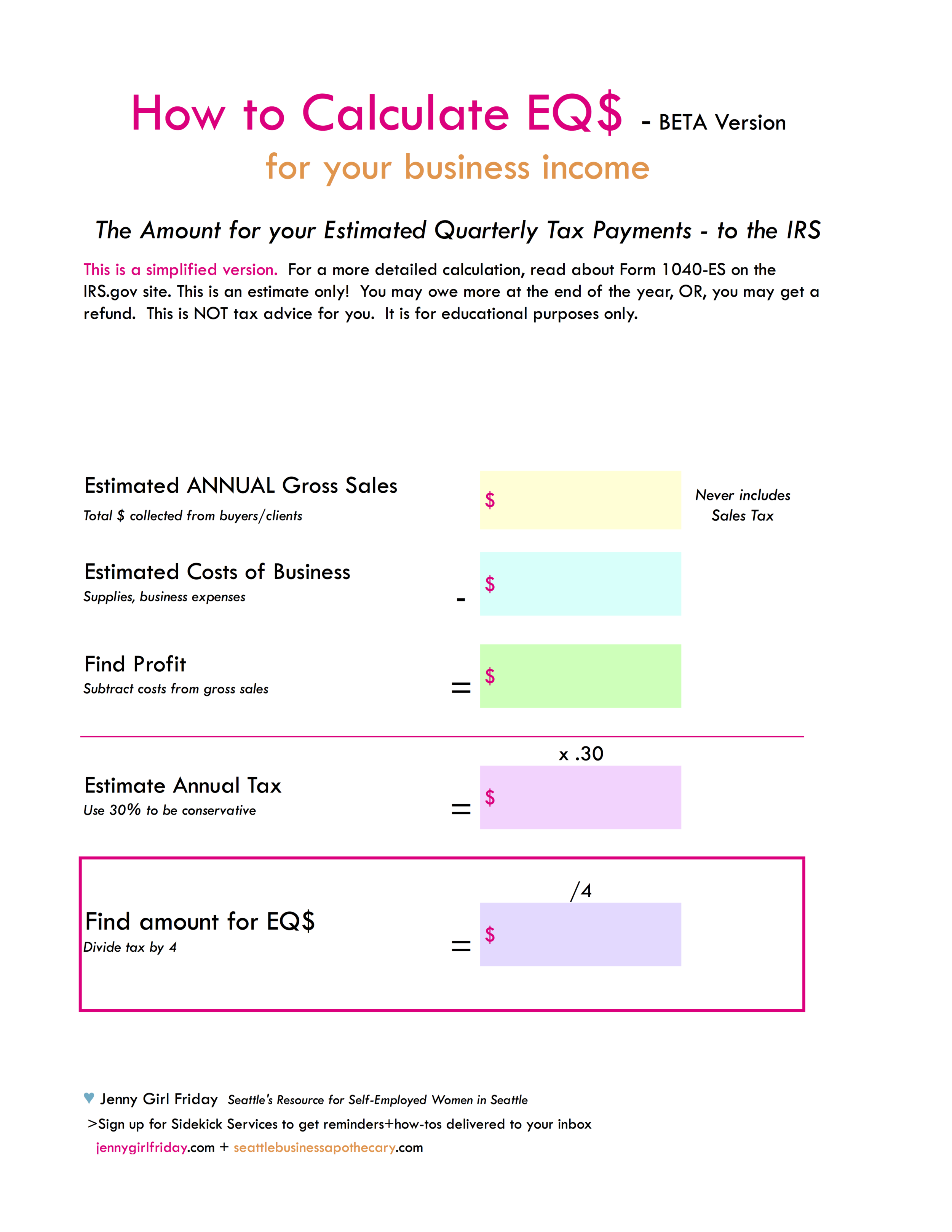

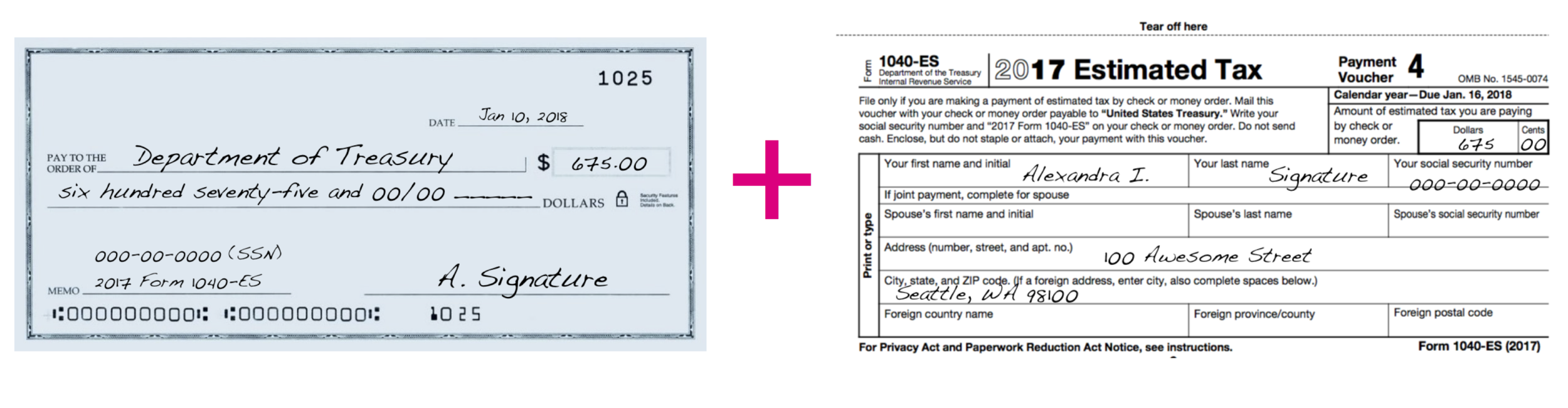

Sending in Estimated Quarterly Payments to the IRS

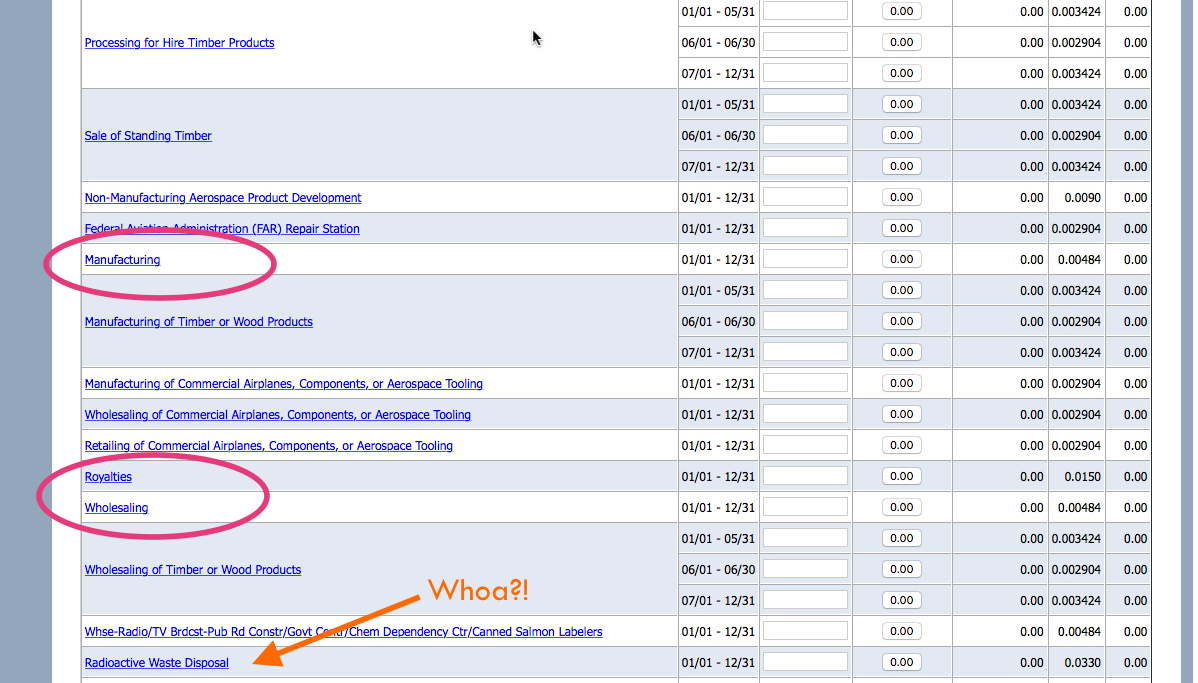

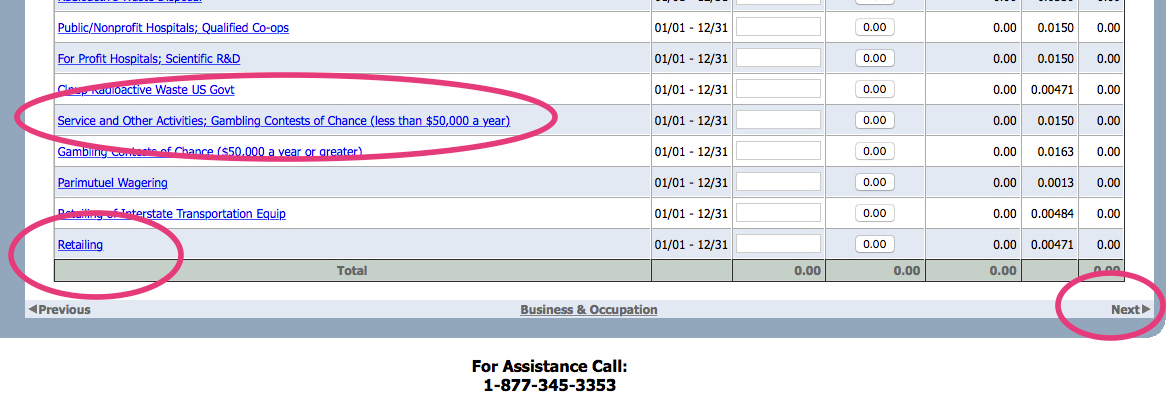

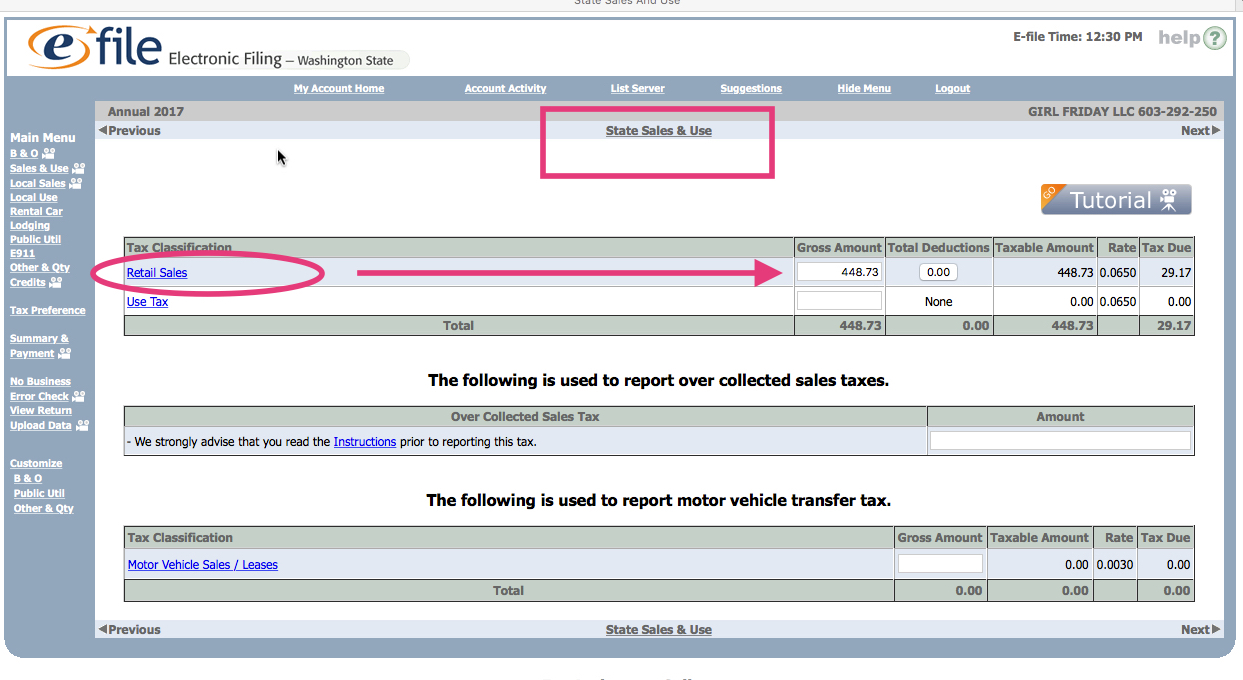

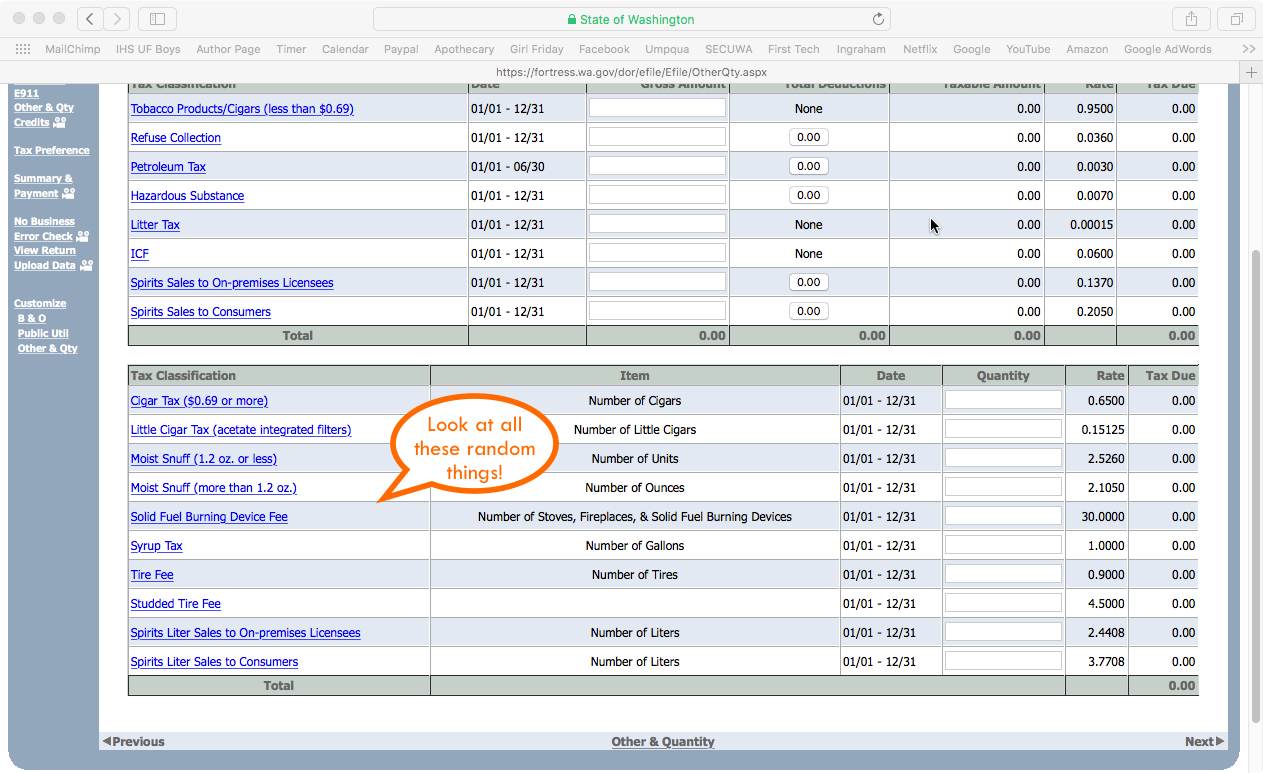

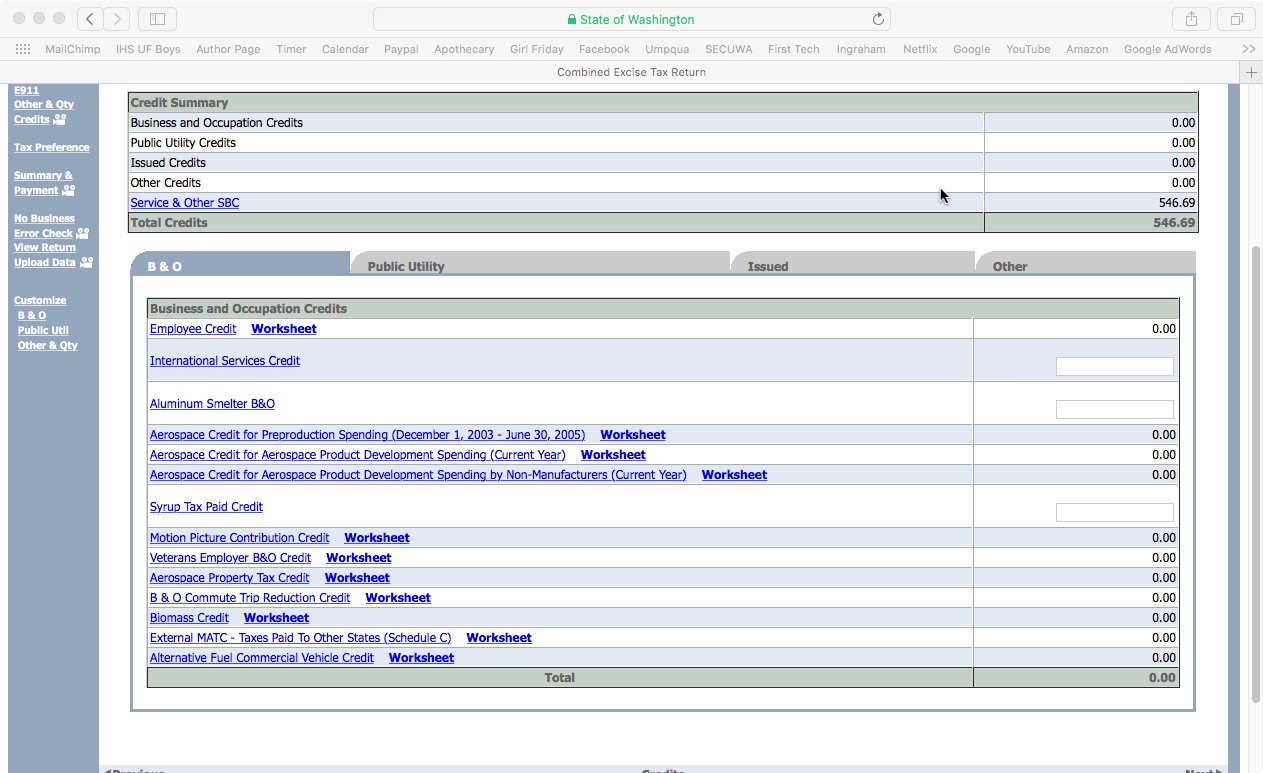

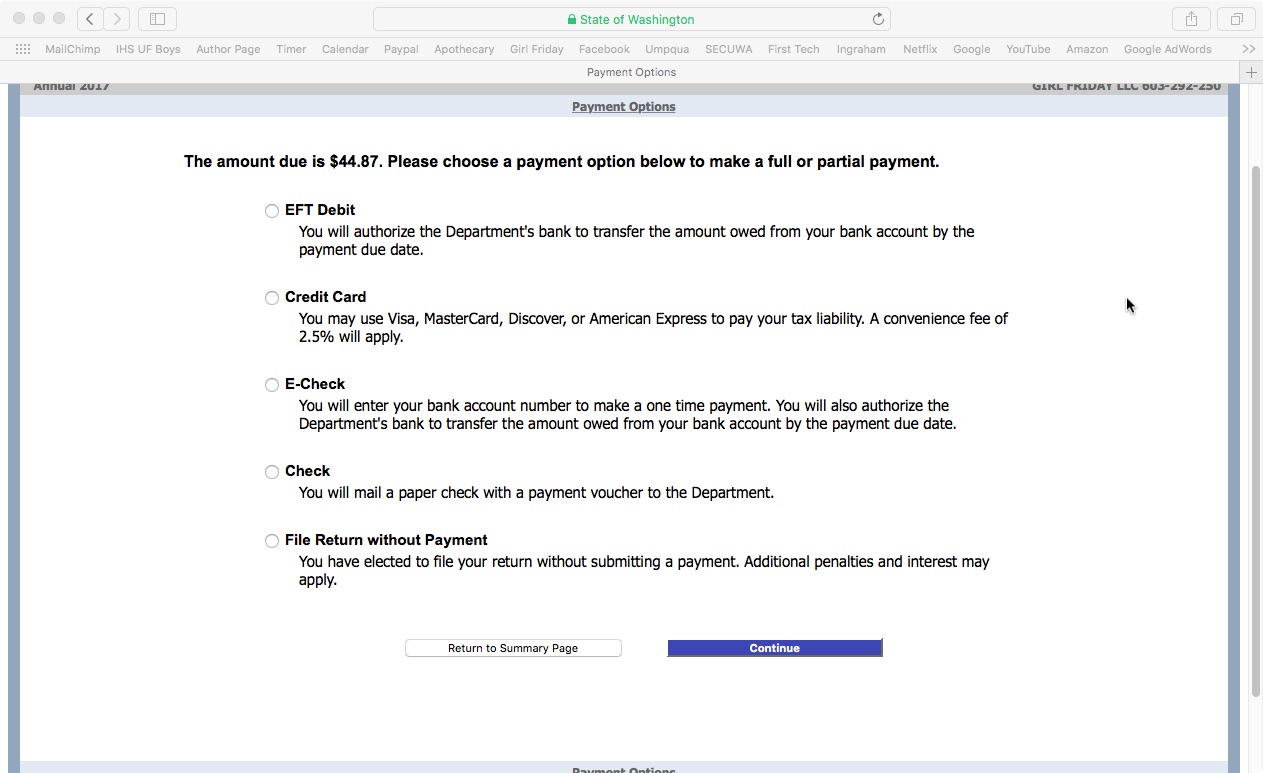

WA State Taxes

King County Taxes

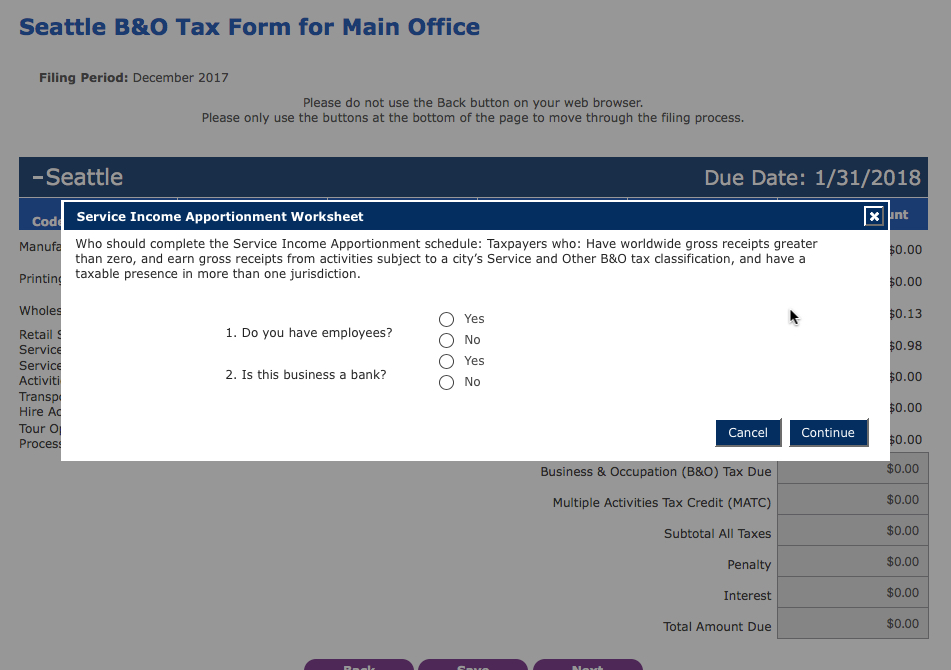

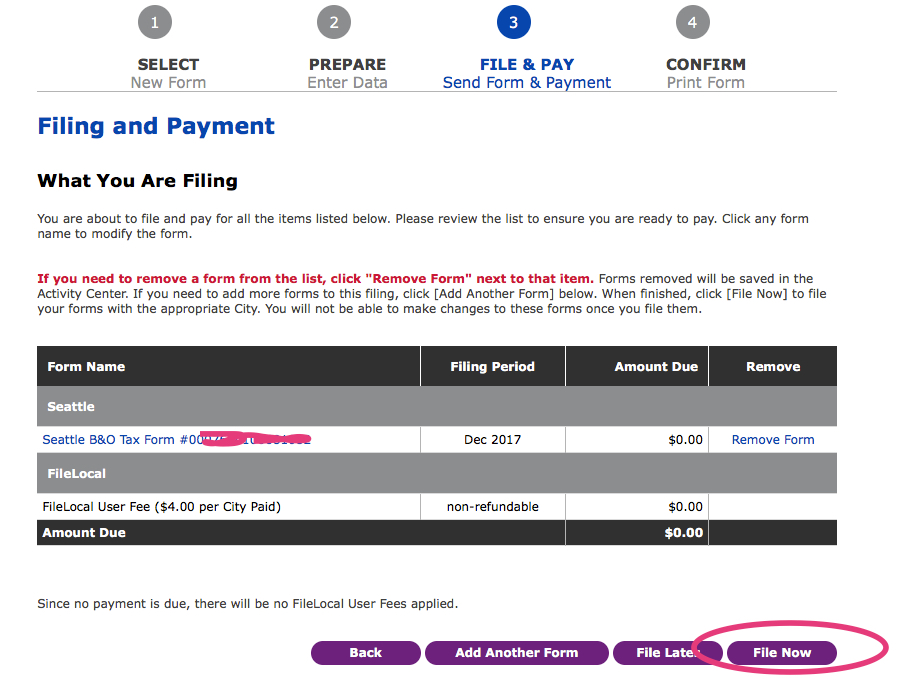

Seattle Taxes

+

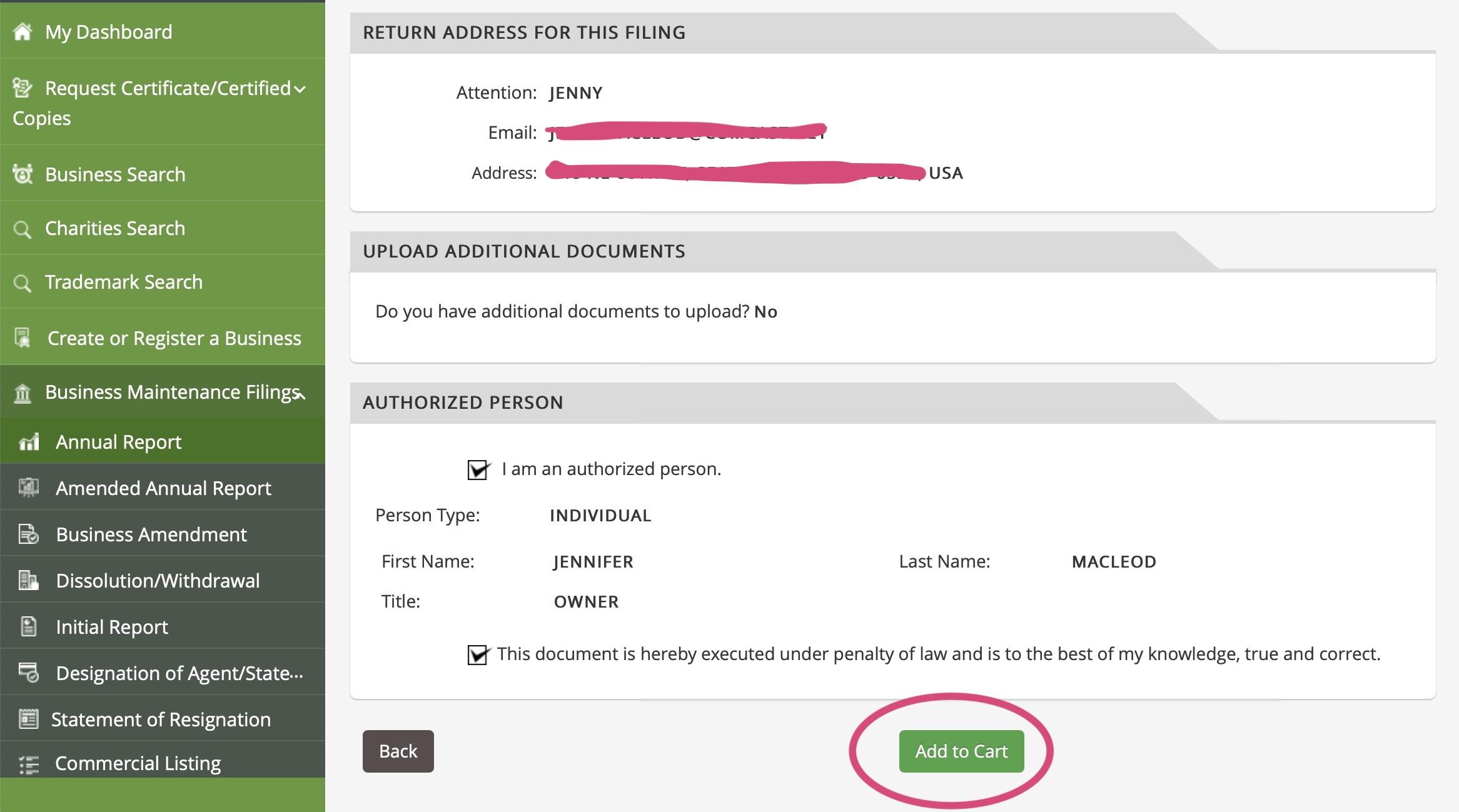

Renewing PLLC / LLC

Renewing Seattle License

+ More

What does the newsletter cost?

There is a monthly fee for the newsletter. You can choose what you’d like to pay, based on your situation and how you feel. Suggested prices:

$15 - I’m new to business / on a strict budget

$20 - I want to pay the Suggested amount

$25 - I’m thriving and want to send some love back your way

$26+ (custom amount) - You have saved my life! I want to show a huge gratitude!

How many months is something due?

5 - 9 months, depending on your situation.

If you file Annually with WA State, you’ll have things due 5 - 7 months out of the year.

If you file Quarterly with WA State, you’ll have things due 7 - 9 months out of the year.

Why am I paying you monthly, if some months there is nothing due?

Three Reasons:

1 ) It’s helpful to know when nothing is due, so you can have peace of mind.

2 ) Some months you’ll be receiving a LOT of content and forms. Others are very light. Your monthly fee reflects the average value.

3) Providing regular payments, helps me to be building materials for you year-round.

Also, the months in between are a great time to rest from biz chores, to refine systems, or to work on being Happier in your job. Sometimes I will provide tools or articles related to this other work.

Is there a bonus for signing up?

Currently … there is no bonus for signing up.

If I develop one in the future, I’ll send it to all the subscribers first!

What if I no longer wish to receive Sidekick Services, but want to know about classes, workshops and other services?

I have a new Announcement List. It’s free to join. I will share about any new workshops, classes, books, and openings available for Friendly Tax/License Consults. (FYI - These announcements will go out first to Sidekick Services.)

Do I need to join the Announcement list as well?

The simple answer - No.

Why? If you are on Sidekick Services, you’ll receive all Announcements. And, you’ll receive them first! The Announcement List is a great option if you decide to leave Sidekick Services.

Is this useful if I live outside of Seattle?

Many readers have shared … that Yes! It’s still helpful if you live outside of Seattle.

For two reasons:

1 ) You get supported for IRS tax prep and filing, relevant to anyone working in the U.S.

2 ) The reminders about local taxes (city, county, state) often prompt readers to get in touch with their own local agencies to find out what is due.

Will it be different, now that we’re paying for it?

At first, not really. Eventually……….Yes!

With your support, I’m planning to up-level both the Sidekick Services and the Business Apothecary. But, it will take some time + money.

Hopefully, you will someday see:

New design of the newsletter

Additional and redesigned tax + money tools

Updated how-tos and walkthroughs

A web re-design for the Apothecary

+ More!

Why did you switch to a Paid Newsletter … when you said earlier that you wanted to keep it free?

I really, really wanted to keep it free, modeling after NPR or Wikipedia. Over time, I learned that it wasn’t sustainable. I had a few donors (thank you!), which was encouraging and so helpful. Also, it was only just enough to cover tech costs and provide a tiny bonus.

Over time, I realized the following foundational ideas:

To fully develop the newsletter and tools, and to really serve you all abundantly, I need 1 - 3 days a month for writing and design.

NPR and Wikipedia have regular fundraising campaigns. I didn’t want to start inundating you with those kinds of messages! I’m a fan of only sending need-to-know stuff to you and your inboxes.

The value of what I’m providing is designed to save you $500 - $1500 a year or more + intangibles like less stress, more peace, empowerment. And this is worth charging for.

Anyone desiring to thrive in self-employment can afford this monthly fee.

This model will be like Spotify, Hulu, G-Suite. It’s something you want or need, and it costs money.

Is this a Business Deduction for IRS taxes?

Yes! I would suggest putting this under “Supplies”.

What is Memberful?

It is the company that will process your payments, and keep the subscriber list updated. Whenever you’re changing your payment information, updating a credit card, or canceling, it will be through Memberful.

What if I want to cancel?

You can cancel any time, through Memberful. If you’re not sure how, please email me at jennygirlfriday@gmail.com, and I can do it for you. (Please allow 5 - 10 days, if you cancel through me.)

What if I want to change my monthly amount?

Stay tuned … I will find an answer and report back. And/or email me at jennygirlfriday@gmail.com, and I’ll see how to do this for you. (Please allow 5 - 10 days, if you are requesting a change through me.)

This service has been a game-changer for me. What can I do to show appreciation?

Thank you so much! I’m thrilled to hear it! All of the following are welcome: sending me a note in email, leaving a little Love in the Tip Jar, increasing your monthly fee, and/or encouraging friends to sign up. Thank you again! It’s my goal to help you THRIVE and it’s such a joy to know when things are working for you!