Sole Proprietor or LLC: Which is best for me?

When you work for yourself, you fill two roles in one. The employee and the employer. In order to do this, you have to create a business entity that essentially hires you. It feels a little like make-believe play – All I want to do is my work! – but it is necessary. The two most common options are sole proprietor and limited liability company, or LLC.

It is the first decision that you need to make, because it determines your legal status and name options. And, you’ll be asked about it right away when registering your license.

Sole Proprietor

Advantages: simplest and cheapest

Legal Name: must be your name

Disadvantage: liability – if someone sues your business, they are suing you

In this case, you and the business are considered one in the same. There’s no real structure to set up or maintain. You simply are required to have licenses and pay taxes. It is free. There are no additional obligations, and no special benefits. Except that the paperwork is the most streamlined.

There is a risk, though. If someone sues your business, they are suing you too. Meaning, if they win and you owe them money, it comes out of your personal accounts. In a worst case scenario, you’d have to sell your house or drain accounts to pay them.

You can do business under a different name, called your trade name, or DBA, Doing Business As. For example, Jane Doe’s legal business name would be Jane Doe. She could do business as, Polka Dot Consulting. She just has to register this name, so her business activity is traceable to her legal name. These only cost $5 each. When you apply for your license, you can choose 1 or more.

LLC

Advantages: protection from lawsuits, looks official

Legal Name: must include a version of LLC*

Disadvantage: it costs some money each year

In this case, the business is a company that is separate from you. It offers a layer of protection. If someone sues your company and wins, then they can take company assets (not your personal ones). In my case, this includes a small business savings account, my computer, printer, and lots of great books. The idea is that your home and personal monies are protected. Having said that, it is possible to get around that protection – depending on the case and the lawyer. If you want to know more on the subject, I suggest meeting with a small business lawyer to share more about your specific situation.

You must apply with the Secretary of State to be granted this entity. It costs about $200. And, you must renew each year on the anniversary month, for about $80.

The LLC also looks serious and cool. For people that don’t know, it helps you to look official. This can be a boon for certain types of business. You can also use DBAs. (But they may not include variations of LLC.)

Concerning the IRS – Good news!

A cool thing is that you don’t have to do anything different for the IRS! That is, if you are a single-member LLC. Because you are still a one-person business, and there’s no dividing of profit, the IRS lumps you in with Sole Proprietors. In fact, they refer to you as a “disregarded entity”. You are not regarded! You are ignored. This is great because it keeps your paperwork simple.

•

In the end, both serve different purposes. Often - people who are tight on cash, or starting before they're totally ready, or intimidated by the LLC – choose sole proprietor. For others who have the money, and/or are really committed to their vision, tend to go for the LLC! You even get a certificate with borders and a golden seal to frame.

If you have questions, please, get in touch. Click here to read a post on how to get licensed in Seattle.

Happy Working,

Jenny Girl Friday

Girl Friday LLC

DBAs:

Jenny Girl Friday

Jenny MacLeod

Girl Friday

girlFriday

*Limited Liability Company, Limited Liability Co., LLC, or L.L.C.

• Renew Your Seattle (City) Business License - December 31st

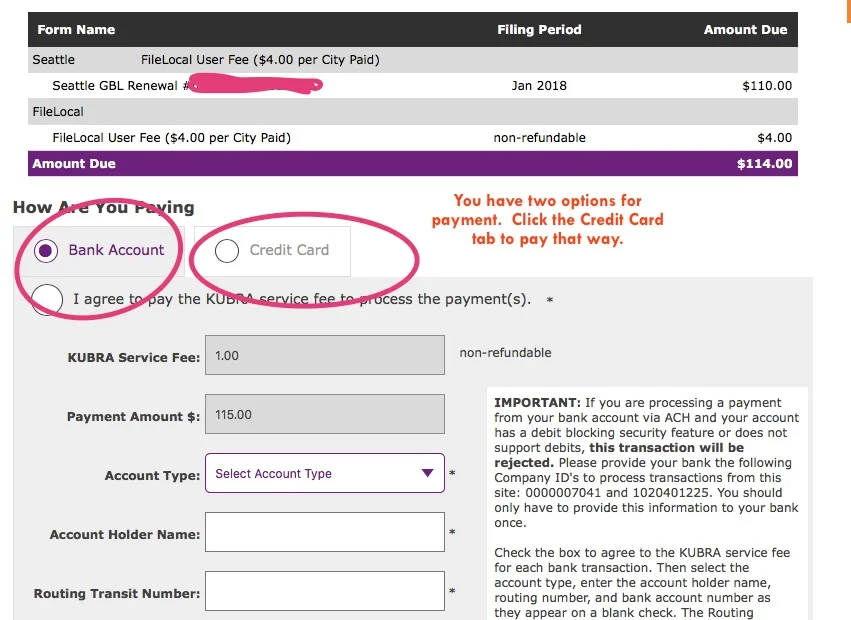

Your first TAX season hoop is here! Renew your Seattle business license by December 31st. Cost is $55 if you earn under $20K, or $110 if over $20K (plus fees if you renew online).

A friendly reminder ~ all self-employed folks need to have two business licenses, one from the state and one from the city.

This post is about renewing your business license with Seattle. (Its longer name is Business License Tax Certificate.) To read more about it, go to: seattle.gov/licenses/get-a-business-license. [Post coming soon about state business licenses.]

Your city business license is the one with the year printed diagonally across ... and the Seattle symbol in the corner.

Due: December 31st

Time: 5 minutes

Frustration: 5 out of 10

(on FileLocal)

Cost:

$57 if you make under $20K annually

$113 if you make over $20K

+Fees: $2 - 7 for processing credit cards

Note: There is a grace period until January 31st. After that, a late penalty applies.

you have 2 options for renewing your license.

Renew through the mail.

Hopefully, you've received a renewal form in the mail. If not, and prefer to renew this way, call the city at: 206-684-8484. Or email them at: tax@seattle.gov

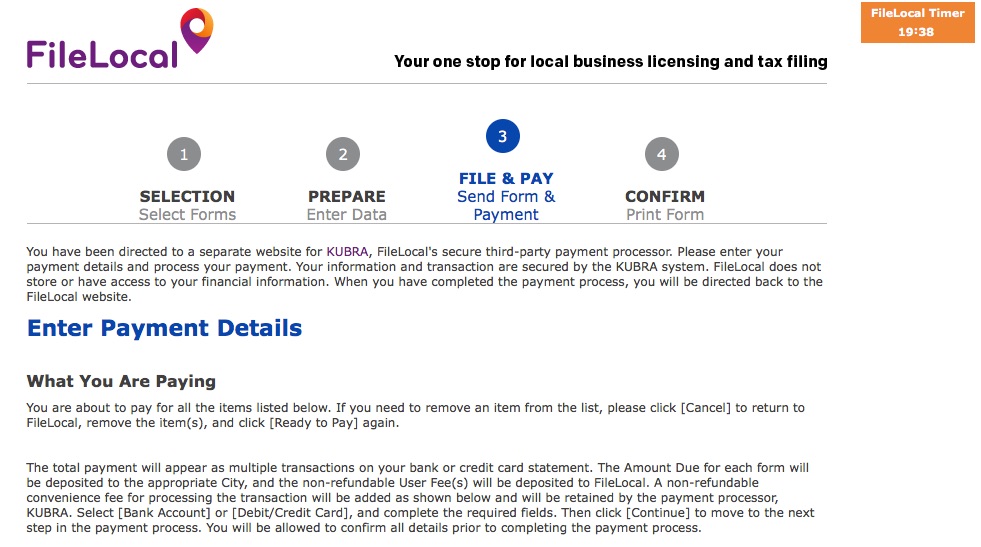

Online ~ FileLocal Portal - This is the new portal.

If you've already created your account, it's pretty easy to renew your license. If you haven't set up your new account, read this article, and plan an extra 20 - 30 minutes for that step. Instructions and screenshots below for renewing your license.

Renew with FileLocal

If you need to set up your account, read this article first. Allow 20 - 30 minutes.

NOTE - The specific screens and steps might have changed a little bit. This will at least give you an idea of what to expect.

1. Sign in to FileLocal

2. Select Renew A License

3. Now you're in the Activity Center. It should have "Renewals and Applications" set as the "TYPE" of activity, with your business information below. [If not, adjust as needed. Call FileLocal if you need help 1.877.693.4435 Select Continue.

4. Continue through screens to confirm your information. Then look for the "READY TO PAY" button.

5. Look for the HOW ARE YOU PAYING tabs. It's set on Bank Account. You can use that, or select the tab for CREDIT CARD.

6. Complete the checkout process.

7. Print a copy for your records. (It's an expense/deduction.) Or, save a pdf and put into special folder.

8. Check this off your Tax Season List!

Well Done! One more Hoop accomplished / one more thing checked off your TAX Season checklist!

♥ ♥ ♥ ♥ ♥ ♥ ♥ ♥ ♥

Are you already signed up for Sidekick Services? Get tax and license reminders delivered right to your Email Inbox, so you can stay current + feel peace of mind all year long. Did this article help you? Please share with a friend or two, or 5!

{I'm on a mission to help every self-employed woman* in Seattle get the support she needs to be awesome.}