The Home Office deduction / IRS taxes

ROUGH DRAFT

If you have a home office…….. you can count some of your housing cost as a biz expense! This brings your profit down more, lowering your taxes. :)

There are two methods

Simplified

Actual Expense

Simplified is easy, though will not save you much money.

Simply put the total square feet into the tax software, and it will multiply it by $5 to calculate your deduction.

Example, if your office is 8 x 10 feet, it’s 80 square feet times $5 … so a $400 deduction. This might save you about $80-$120.

Actual expense … a little more work. Almost always a better deal.

You will need:

Square footage of your office

Square footage of your entire home

All costs of your home for the full year (see worksheets as example).

So…..let’s say we’re working with the same office, 8 x 10, so 80 square feet. And your home is 1200 square feet. You put these numbers into the tax software, and it calculate that your office is using about 7% of your home. This means…that we get to deduct 7% of ALL costs for our home for the year!

Example………

Imagine in this example, if you RENT

Rent for the year ………………….… 30,000

All utilities for the year …………. 6000

Insurance………………………………… 150

Total cost is ………………………………36,150

Your home office portion would be ……. 7%, or $2530

Saving you $500 - $700 in taxes

Imagine in this example, if you OWN

Mortgage interest for the year ………………20,400

All utilities for the year ……………………….…. 6000

Insurance……………………………………..…………… 1500

Property taxes…………………………………………….8000

Total cost is ………………………………………….……35,900

Your home office portion would be ……. 7%, or $2531

Saving you $500 - $700 in taxes

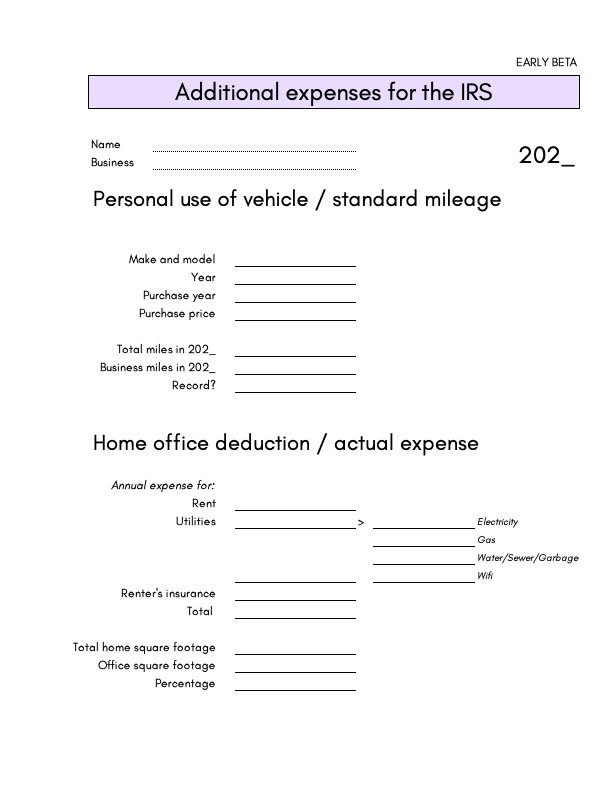

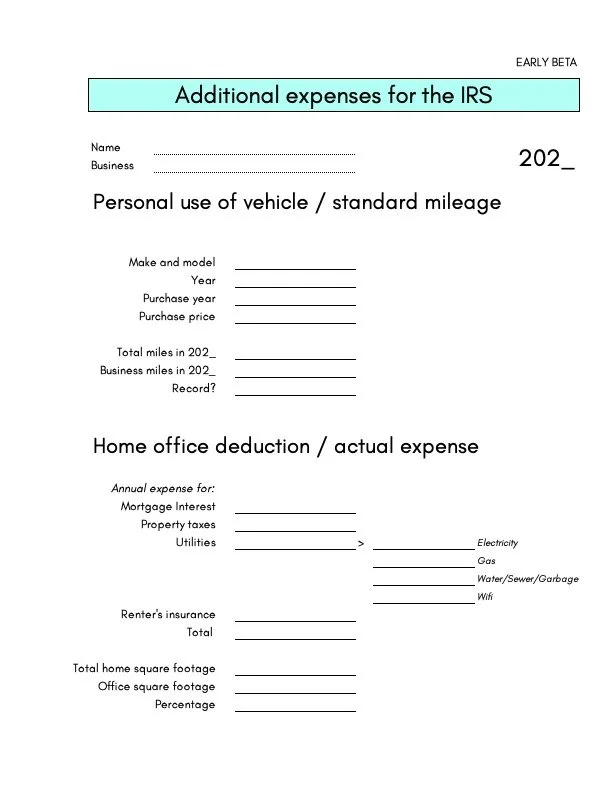

Here are some very EARLY BETA worksheets…………..

If you OWN

If you RENT

WA state expanding who needs to collect sales tax

Washington state earns most of its money from sales tax. It requires businesses that sell products to collect sales tax.

It also requires certain services to collect sales tax. Often if these services are related to physical things, e.g. painting a mural on a wall, fixing a fence.

This is called Retail Service.

Now WA is adding more industries to the Retail Service category.

Which means new types of services will need to collect + submit sales tax.

Some new examples:

Advertising services

Graphic design

Presentations, workshops

Web design

Over the years, WA is constantly adjusting who needs to collect sales tax. Some people are not aware that technically their work is considered Retail or Retail Service.

You might not know …

That these services and products also need to collect sales tax:

Photography - services and photos

Selling digital products - newsletters, digital art, webinars

Painting murals

Repairing, improving furniture or other objects

Is this feeling scary or overwhelming?

Are you thinking things like…..

Oh Sh*t! I can’t afford to pay more taxes? Why am I burdened with this? Will clients think my prices are too high? This is not fair! I already hate number, now I have to do this?

I got you!

Here are some key things to know upfront

1 - This won’t cost you any extra money. This is tax that you collect from the customer, and sent on to the state. (Though it will take a little extra time.)

2 - Once you know what to do, it’s not that hard.

3 - Not sure where to start? Just add 10% sales tax to everything for now, you can get more precise later. Set that money aside in a separate account if possible.

4 - Our customers are used to paying sales tax, so hopefully, for most people, this will not be a big deal.

5 - When it’s time to file, the phone support at the WA Department of Revenue is usually really nice, and it is their job to help you. (You can also tag me in to help with a Quickie Consult-Call )

6 - Other people not as smart as you have figured it out, you can too!

I’ll be creating more support materials and resources in the future. In the mean time, feel free to hit me up for a Quickie Consult-Call for a small fee. Or, if you’re a new client, find me in a free 20-min Zoom chat.

You got this!

Once you’ve got your system, this is just one more way to feel like a Bo$$!

xo Jenny

Accountant help with IRS taxes ~ if you're on a tight budget

“Do you any CPAs/accountants who can help me file IRS taxes? I’m a single-member LLC/PLLC on a budget….”

Or ”…I’m a Sole Proprietor on a budget.”

Hi Friends,

This is probably the #1 most common question I get via email. And it’s a little complex to answer. Short answer ~ Not really, but I can still help you!

Please read on for some context, then options for you.

Context

Great accountants cost a little money. The ones I know generally charge $900 - $3000 for filing IRS taxes, with good reason. A great accountant is easier to work with, good with people, they will answer questions, they use robust software, and can advise you on decisions. And if you’re asking for a CPA, certified public accountant, they are more spendy because they have extra certifications and answer to a higher standard.

Here’s a list of accountants I know, and a few other finance folks.

Many self employed people - do not need an accountant. If your taxes are simple, you can file directly. Filing software is excellent at prompting us for what to report.

Also….if your taxes are simple, all the accountant is doing is entering it into their software. Without any value-add! A great one will look it over. Many of the cheaper-priced accountants simply enter it into the software for you. By the time you’ve given them all the info, you could have filed your own taxes.

Reasons to get an a great accountant:

You have tricky taxes: investments, rentals, more than one home, etc.

You’re filing as an S-corp

You have employees

To help you with decisions

They lead you through the process of prepping your business info

They answer questions in a friendly way

Reasons to get an a cheaper accountant:

You like the deadline of getting all your forms + numbers to them

It gives you peace of mind, it feels more official

It’s part of your annual ritual

Options / to get accountant help on a budget

The most affordable way is to use tax software, and access the accountants / tax pros they offer!

Work with H&R Block. You can go into an H&R Block center, or get help online. I think you still enter everything into the computer, and for an extra fee, you can get a real person to help you with it.

Use TurboTax with “Live Full Service”. Or file yourself, using the Live Chat for questions.

Try Tax Slayer. Their standard package includes access to tax pros.

Friendly Reminder

No matter who you file with, you still have to do all of the prep work! It’s still on you to find all of the tax forms. And to collect all your business numbers. The “Filing” step is putting all of that info into the software. It’s the easier part…. Check out this newsletter for a few tools to help you with the prep step. If you like it, please leave a tip in the Tip Jar!

Good luck, you got this!

♡ Jenny

How to Update Your Business Address ... in all the places!

EARLY DRAFT

First, here’s a short list of places to update your address.

Scroll down for more details and screenshots for the first, big three!

Standard

For LLCs/PLLC ~ with the Secretary of State

WA State Biz License ~ with the Dept. of Revenue

City Biz License ~ either FileLocal or the Dept. of Revenue ~ see below

Business bank accounts

No need to update the IRS. When you file next year, you’ll simply use your new address at that time.

Custom/As-Needed

Registered Agent ~ if they handle your LLC/PLLC paperwork

Professional License ~ the WA dept. that matches

FMLA account ~ Paid Family Leave / Employment Security Dept. ~ via Secure Access WA

Health Insurance companies

Paperwork/As-Needed

Any w-9 forms ~ for current and future contracts

Third party money processors ~ Venmo, PayPal, etc.

Online retail platforms ~ Shopify, Etsy

Some Details and screenshots

1 - Secretary of State

There are two places to update your address:

Business Amendment

This changes the official address of your business. It will cost $20 - $50 (?) to file it.

Log into the Corps and Charities Filing System

Look at the Left Navigation

Open up Business Maintenance Filings (it might be open already)

Look below for “Business Amendment”

Fill out the form, pay and submit

Your Profile

Log into the Corps and Charities Filing System

Look at the Left Navigation

Scroll down, find “Account Preferences”

Open, choose “Change Profile”

Add your info, choose “Update”

2 - Department of Revenue - draft

Sometimes the DOR charges a processing fee for this change. It can be anywhere from $10 - $50, depending on the year.

Log in to MyDOR

Click “Get Started” ~ the big green button at the top

Scroll down to the section that is labeled “Licensing”

Look to the right, there’s a section labeled “Account”. Look toward the bottom, and click “Other updates”

Look to the right again, there’s a section called “Manage Business Name and Addresses”. Look toward the bottom, and click on “Update location and mailing addresses”

You will see a few sections ~ all with the associated address. Click on the Address that you want to change.

3 - FileLocal ~ for these Cities

Go to FileLocal if you have a business license in:

Seattle, Bellevue, Tacoma

Shoreline, Lake Forest Park, Everett

Des moines, Kent, Renton

For other cities, see #4 below

Log in to Filelocal

Click on “Account Center” from the Top Nav

Choose “My Account” from the drop-down menu

You’ll see “User Information” and “Corporate Information”. Use the edit buttons to make your changes

(For other cities, see #4 below.)

4 - Other cities - draft

For any city where you have a “City endorsement”,

♡♡♡

Wishing you all the luck! If you run into any issues, please email me, or set up a free 20-min Zoom chat.

Cheers, Jenny

Book$ about Money / A short list ♡ and some guiding ideas

If you wish to see the list only, scroll down. :)

First, I wished to share some thoughts about books on money….

I love when people ask me about good books on money! And then immediately get confounded … for 2 reasons.

1 - Because most of the books I read are a bit older, and I can’t fully remember if they feel modern enough now. (I stopped reading books on this topic, once I got enough knowledge, and found my own good relationship with money.) I’m sure there are great ones out that that I just don’t know about!

2 - Most importantly, because it really depends on what you’re looking for! There are so many aspects to working with money! I can answer this best when we have a little conversation first. (In fact, feel free to hit me up for a free 20 min Zoom chat.)

The best books on money, are the ones where: you like the tone, it gives you the knowledge you’re seeking, and motivates you to make some changes! Avoid books that feel too daunting, make you feel behind, or that you’re doing something wrong. Or define a protocol that feels too strict.

Below is a list of money topics.

I list them out, to offer you as menu, in case you’re still figuring out what you want to learn.

Also, I wish to point out that … there are many ways to “be good” with money. Though in our society, women have been steered to only one corner of this skill set: budgeting, saving money, being thrifty, paying off debt. Here are more ways to be good with money, that might get you a bigger bang for the buck!: earning more, feeling worthy and empowered, building wealth, being literate with our money systems.

These are the most common topics people are asking about:

How to control or direct your spending (budgeting)

Ways to save more

How to get out of debt

Investing, growing wealth

Retirement

Adulting money skills, building some basic money literacy and know-how

Basic bookkeeping and accounting for business

I would love to get these topics on people’s radar too:

Get fired up to earn more ~ how to feel worthy

Learn what your thriving life costs, and put a price on it

How to earn more

If you work for yourself, design your rates to earn enough+, If you have an employee job, find a way to ask for more

How our money system is a bit whack, and you’re great!, but it’s still good to know how to play the game

How your taxes work, so you can factor them into plans

Feeling better about money, building a more peaceful relationship, being empowered

How to work with people in the Finance world (financial advisor, accountant, etc.)

List of Money Books

I wish I had more modern books to offer you! If you find any that you love, please let me know.

Feminism and building wealth

I haven’t read these, but this is where I’d start today

Rebel Millionaire: Get rich on your own terms

Peg Cheng

Perhaps heck out Suze Orman books

All-around Money Skills ~ Getting out of debt and building wealth

#7-Figure Net Worth: Modern Wealth Blueprint for Black Americans

by Brielle Mabrey

Your Money or Your Life: Transforming Your Relationship with Money and Achieving Financial Independence

by Joe Dominguez and Monique Tilford

This is an oldie, but goodie. Though the program is kinda strict.

Adulting Money Skills with a Narrative

I Survived Capitalism and All I Got Was This Lousy T-Shirt: Everything I Wish I Never Had to Learn About Money

by Madeline Pendleton

Charging enough if you’re self-employed

Sections of these books cover how to charge more.

If you follow this guidance, it’ll pay for the book in no time!

Unstuck: Method + Magic for Stepping Into your Worth

by Roxie Jane Hunt

How to Become Self-Employed in Seattle: A Guidebook, Companion, and Reference

by Jenny MacLeod (yours truly!)

Working with money if you’re self-employed

Accounting Made Simple: Accounting Explained in 100 Pages or Less

by Mike Piper

Profit First: Transform Your Business from a Cash-Eating Monster to a Money-Making Machine

by Mike Michalowicz

This book is overpromises (it could have been an article)…however, it’s got some great strategies around using bank accounts.

Feeling better about working with money

The Soul of Money: Transforming your Relationship with Money and Life

by Lynne Twist

Thank you for reading! I’d love to hear which books you found helpful, whether from this list, or beyond. Good luck in your journey! And way to go for building up your money skills! I think it’s one of the most beautiful, simple, radical acts as a Feminist!

♡ Jenny

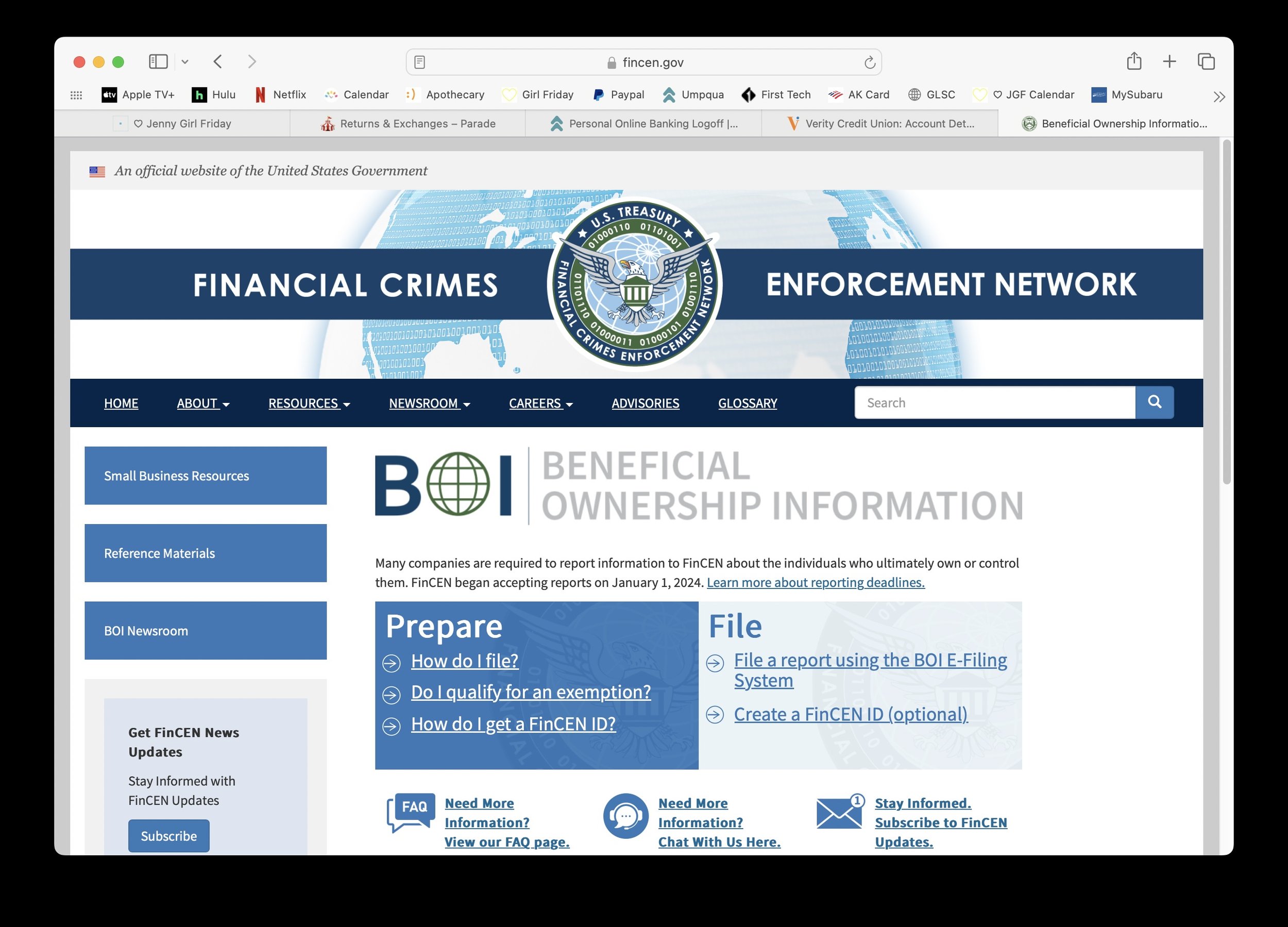

Filing your BOI Report with FINCEN - a New Requirement for LLCs/PLLCs starting in 2024

UPDATE on 1.7.2025

This requirement is now paused. Here’s a quote from FINCEN:

In light of a recent federal court order, reporting companies are not currently required to file beneficial ownership information with FinCEN and are not subject to liability if they fail to do so while the order remains in force. However, reporting companies may continue to voluntarily submit beneficial ownership information reports. More information is available at https://www.fincen.gov/boi .

Check back with FINCEN, join the Sidekick Service Newsletter, or email me to stay tuned!

Here is the original blogpost, written in March 2024:

Hi there,

This is a new federal requirement - in 2024 - for anyone who has an LLC / PLLC.

Good news! It’s actually simple and quick and free.

It just looks kinda scary. (And some people in social media try to make it look scarier than it is to get your attention, and try to get money out of you.)

Short Story

You just have to log in, and provide the government with information about your LLC/PLLC and the people who own it. That’s it!

Some Details

The requirement includes filing a BOI Report. This stands for Beneficial Ownership Information. You might also see the acronym BOIR, where the R stands for Report.

If you registered your LLC/PLLC before January 1, 2024 … then you have all year to get it done! For you, it’s due by January 1, 2025

If you registered your LLC/PLLC this year, in 2024 … then you need to complete the BOIR within 90 days of registering your LLC/PLLC.

More of the Story

…Some people use LLCs to cover up criminal activity. So a branch called the Financial Crimes Enforcement Network (FINCEN) is tasked with getting info on all the LLCs/PLLCs and their owners, to verify legal activity. And look for the criminal activity.

Filing your BOIR

Get prepped:

It’s easy … you’ll just need:

The EIN for your business (or social security number if you don’t use an EIN)

A photo of your Driver’s License or Passport

The process takes 10-20 minutes. (More if you like to read, and re-read instructions!)

Links:

To File Online - Click here

For helpful walkthroughs and screenshots - Click here

ProTips

Question 16 looks a little confusing at first. They’re basically asking if your LLC/PLLC existed before January 1, 2024. If yes, they refer to it as an “Existing reporting company”. If you click Yes to this, you can skip a whole section.

There are little “Need help?” prompts throughout, with more information.

At the end, they’ll offer you a PDF of the report to download. BE SURE TO DOWNLOAD YOUR TRANSCRIPT! Currently, this is the only way to get confirmation that you filed. You’re not able to do it later….

And/or record somewhere that you finished your BOIR. Later this year, there will probably be lots of scary looking ads out there … and your system might get activated. Then, when you remember that you did this, you can feel calm and victorious.

Wishing you a quick and successful filing.

Considering getting a little reward for yourself for dealing with this pesky chore!

♡ Jenny

Do you work with people outside of Seattle? / In other states?

rough draft form

Short Answer

Yes! I work with people outside of Seattle, in any state.

Longer Answer

Depending on what you need, I can usually help with most or all of your business/tax support needs.

In my wheelhouse anywhere:

Understanding and doing IRS taxes, your money systems, how to set up a new business, figuring out prices, raising rates, ideal schedule and more. Being a great boss to yourself, so that it’s sustainable to be self-employed.

Outside of my wheelhouse:

The city and state requirements where you live. This affects both getting your business legally set-up, and for ongoing local tax + business chores. However, I can research that alongside you, and usually get pretty clear very quickly … and then can help you create a custom checklist for you to keep it all straight. Prices/expectations in your area. Filing taxes with S-Corps. Dealing with payroll.

Please feel free to reach out with your specific needs, and I can let you know if I might be a match for you.

:) Jenny

Filing WA State Taxes / Just the Basics!

Hello there,

The post below gives the most stripped-down basics for filing WA state taxes. If you’d like to read more detailed posts, and see some screenshots, click on these links: for Service Providers and Retail / Combo.

Also, I want to share this GOOD NEWS right upfront. Once you know what you’re doing, this business chore only takes 5 - 20 minutes. It will take way longer to learn about it, than to actually do them….

:) Jenny Girl Friday

Due for you IF:

You have a WA state Business License

Estimated Time:

5 - 10 minutes - Filing

0.5 - 2 hours - Prepping

How:

Online with MYDOR

Due Dates:

Businesses are assigned annually, quarterly, or monthly

Annual Due Date

• April 15

Quarterly Due Dates

• Apr 30

• Jul 31

• Oct 31

• Jan 31

The Tax Form is called:

Combined Excise Tax Return

What everybody will need:

__ MyDOR / SAW - Log-in and Password

__ Gross Sales Total - per time period

Annual Filers

• From January 1 - December 31

Quarterly Filers

• Q1 - January 1 - March 31

• Q2 - April 1 - June 30

• Q3 - July 1 - September 30

• Q4 - October 1 - October 31

Some of you:

__ Subtotals of Gross Sales by Category

And, if you Retail, you may need:

__ Retail Sales Subtotal

__ Retail Sales out-of-state

__ Retail Sales where Tax is collected by a "Facilitator"

__ Sales Tax Paid at the Source

Types of Tax:

B&O (Business & Occupation Tax)

Sales Tax

Use Tax

Note: These are all types of “Excise” tax. That is why the form is called “Combined Excise Tax Return” because it’s asking about all three - and some others - in one, combined form.

B&O Tax: small businesses will receive a tax credit. So, if you gross under about $55K, you will not have to pay any tax. As your income goes up above that number, the tax credit will get smaller, then disappear

Sales Tax: applies to selling products or retail services

Use Tax: applies if your business purchased items/tools outside of WA state

Thriving Plan for the Year Ahead

Rough Draft

Thriving takes cultivation!

And time!

And you are so worth it.

Ever feel like you're back in a hamster wheel with work? This is very common, as we try to please all our clients, families, friends...we can get stuck in a rut, so, so easily. It turns out, that loving your job, having things in balance, earning enough ... in other words, thriving, has to be cultivated. One strategy, is to set up an annual Thriving Plan.

Here's a tool for you to try out. (You might recognize it, it's revised from an earlier tool.)

Taking even 20-30 minutes to fill this out can make all the difference!

Start with the easiest boxes on the outside. Continue to fill them in to see what your priorities are for the year. Add any vacations, trips, retreats. Lastly, create your weekly schedule(s) and monthly routines - as a way to fit in all of your priorities.

Not sure what to write? Or trying to get it “perfect”. …Just guess! You can always change it later. There is great power in starting. And often, our gut-initial-instincts are what we really need/want.

First, I’ll share my example to give you an idea. Then, there are 4 different templates to choose from.

My Example

My biz year goes from Sep - Aug

Click on the image or the Option # to download.

Option 2

Year going from January - December

With 2 different weekly schedules - a and b

Option 1

Year going from January - December

With one type of weekly schedule

Option 4

Year going from September - August

With 2 type of weekly schedules

Option 3

Year going from September - August

With 1 type of weekly schedule

Wishing you some time in your schedule … to do this important work! I hope it feels fun and magical.

♡ Jenny

P.S. Want a little company or guidance with this? I’d love to help! I offer One-Time consults - and the goal is that they are game-changers. We can fill out your plan, talk through any roadblocks, highlight new desires, and whatever else you need to feel great about your job and life. Oh, and starting this year, you can bring a friend to the consult, and I can meet with both of you for the same price.

How do I know if I file ANNUALLY or QUARTERLY with WA state?

Quick Answers

Your filing schedule is assigned to you, after you register for a business license. Here are ways to find out your schedule.

Look for a letter you received from the Washington State Department of Revenue (DOR) - after you registered for your business license. It will tell you your schedule.

Call the DOR to ask them. They’re usually very friendly. It helps to have your UBI on hand, if you know where that is. (UBI is your WA state business number.) 360-705-6705

Log into your DOR account, navigate to Manage Returns, and see what it says there. If you’re on the Annual schedule, it will say that. If you’re quarterly or monthly, I believe it just shows the date that it’s due. So you can easily infer the schedule.

Some context and FAQs

Like all states, WA relies on taxes to fund programs. It collects all of these taxes through the Department of Revenue. There are two main categories. One, you’re already familiar with - sales tax. If your business provides any retail products or services, you’ll be required to collect and submit these taxes. The 2nd category is taxing businesses in a few different ways. The most common of these is Business and Occupation tax. These dollars help the state support and monitor businesses, to be safer for consumers, etc.

The state needs to collect its taxes on a regular basis. So, your filing schedule - annually, quarterly, monthly - is based on your projected taxes. If you’re going to earn a lot, and collect sales tax, then you’ll likely be put on a quarterly or monthly schedule.

If you earn less and/or are service only (no sales tax), then you’ll be put on an Annual schedule.

This is all based on your Gross Sales (all the money you collect from customers/clients … before business expenses). And, if you collect sales tax or not.

I heard that I have to send in Estimated Quarterly Tax Payments? Is this the same or different?

This is a super common question. This different. When you have a business, you must report to all levels of government: city, county, state, and the IRS. It's easy and reasonable to get them mixed up!

"Estimated quarterly tax payments" are part of paying your federal taxes to the IRS. These are estimated based off the profit your business is likely to make. They are due four times a year: Jan 15, Apr 15, Jun 15, Sep 15. Click here to read more.

If the state says that you must report quarterly, that is for state taxes, which include: B&O, sales tax, use tax. These are calculated from your actual sales.

I was assigned Quarterly payments. Ugh. Why is that? Can I change it?

Basically, the state wants to collect tax money on a regular basis. If you have a Retail business (meaning you'll be collecting sales tax) and/or if it looks like your income will be high, they will assign you to making reports quarterly.

♥ Please don't worry too much though! Once you know how to make reports to the state, it only takes a few minutes!

If you want to change it to reporting annually, in the past, the only way was to call the state in January. If your income is low enough, they'll make the change. That number is: 360-705-6705. It's possible that there are new rules, so you might try calling soon if you want to check.

You talk about Making Reports, Paying Taxes, Submitting Taxes, are these all the same thing?

Great question. They're slightly different. I like to think about things at the most basic level first. Once you have a business, you are required to Make Reports to the state. Sometimes, if you're very small, and/or do service work, then you won't owe any money. Yay! BUT, you still have to make the reports so the state knows this. This is step one of the process.

Paying taxes are when your business is actually being taxed. That's the B&O tax, and Use Tax. This is based off a percentage of your Gross Sales, and any purchases out of state. The money comes out of your pocket.

Submitting taxes is different. This is Sales Tax that you've collected from your buyers. It is tax based on their purchase. It comes from their pocket. You're simply the carrier of that money.

How can I get more info + help with this?

Lots of ways!

♥ Get help from the state DOR. They offer workshops, online tutorials, and even consulting! Click here to see more info at DOR.wa.gov.

♥ If you currently work with an accountant or bookkeeper, check with them.

♥ Get 1-on-1 help with Yours Truly. Sign up for a One-Time consult. We can work 1-on-1, or you can bring a friend to split the fee.

♥ Join me for Book$ Club! A monthly event, where self-employed folks gather to work on bookkeeping and biz chores - just like this one. In a Happy Hour setting. I provide 1-on-1 help, as time allows. And/or, you can ask other folks in the group. Like study hall, but more fun! Click to … Read More … or to Register

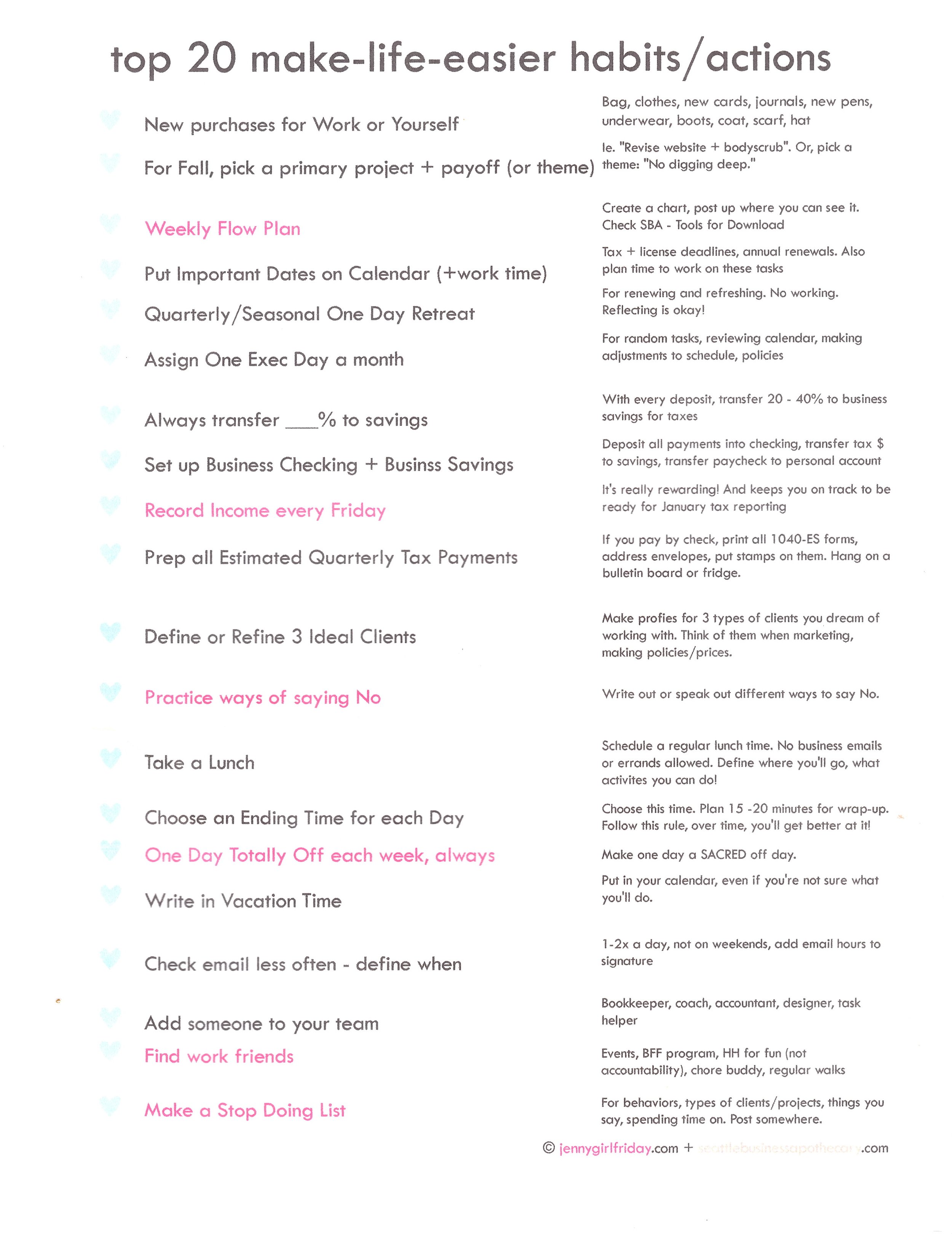

The Fall Refresh

A huge part of being a Great Boss, is to find ways to make your life easier and to feel good. This might look like:

making sure you have the right tools for your job

trying new little routines that bring more ease

cutting things out of your job description

infusing a little fun or joy

The Fall is a natural time to check in, and do a little Refresh. The idea here is that it’s a quick little adjustment - that moves something stale out, and something fresh in.

This can take as little as 5 minutes, more if you like. And it can make a huge difference.

Check out the worksheet below. And/or consider these questions for a moment. Then, pick 1 or both actions to commit to. Please, go with your gut!

One year, I committed to taking a lunch break every day. It felt like an underwhelming choice … but, it turned out to be very eye-opening, and a bit of a game-changer. At first, I could only manage 5-10 minutes, because of the ways I’d scheduled my days. Also, my body just wasn’t used to it! But over time, I realized how much I’d been in the habit of just pushing through the whole work day, in one big slog. And even though my stomach was fine, my brain was very taxed. I slowly expanded my lunch break, and this has made a huge difference.

For your Fall Refresh, you might check out the worksheet below. (Sorry, it’s a little faded.) Or, simply think on these questions, then choose 1 thing to add or change.

♡ How can I make my work (and life) a little easier for myself?

♡ What can I adjust to feel better, or more nourished?

For extra credit, tell people about this action - as often as you can. It’s great to be a Great Boss and to be seen doing it! (And who knows, you might inspire someone else to follow suit.)

Cheers, Jenny

Estimated Quarterly Payments (EQ$) to the IRS / Just the Basics

The WHY behind EQ$

The IRS is a Pay-as-You-Go tax system. We're required to send in 4 estimated payments throughout the year ... then, it's True Up time when we actually file our taxes. If we overpaid, we'll get a refund. If we underpaid, we'll owe more.

Good news!

Once you know what you’re doing … it only takes about 5 minutes!

It can feel really satisfying, like you’re a BOSS of your business.

It makes Filing Taxes in April a lot nicer.

A Few Quick Facts about Sending in EQ$

When we send in an EQ$, it’s simply sending in money. It’s not filing taxes. There are no numbers to report. We just send money and make sure it’s attached to our name and tax ID.

If sending by check, there’s just a small voucher. If online, just a few fields to fill out to verify your identity.

You can send payments online, or via snail mail. Click here to read more.

IMPORTANT - if sending payments online, see note below.

It's fine to use your SSN with these payments. (Even if you have an EIN.)

The Due Dates are not even! (Weird, right?)

DUE Dates

April 15

June 15

September 15

January 15

Note - When these dates fall on the weekend or holiday, they will shift to the following business day.

To Send in or Not Send In….

If total tax for the year (related to your biz profit) is $2000 or less, then the IRS says that we do NOT need to send in payments.

If total tax for the year (related to your biz profit) is $2000 or more ... we're required to send in payments.

If we send in partial payments, or none at all, we might have to pay a penalty. Usually these are a few hundred dollars or less.

How Much to Send

The IRS offers a complex way to calculate your EQ$. I offer simpler alternatives. Three different methods to choose from. Click here for the NEW worksheet with instructions.

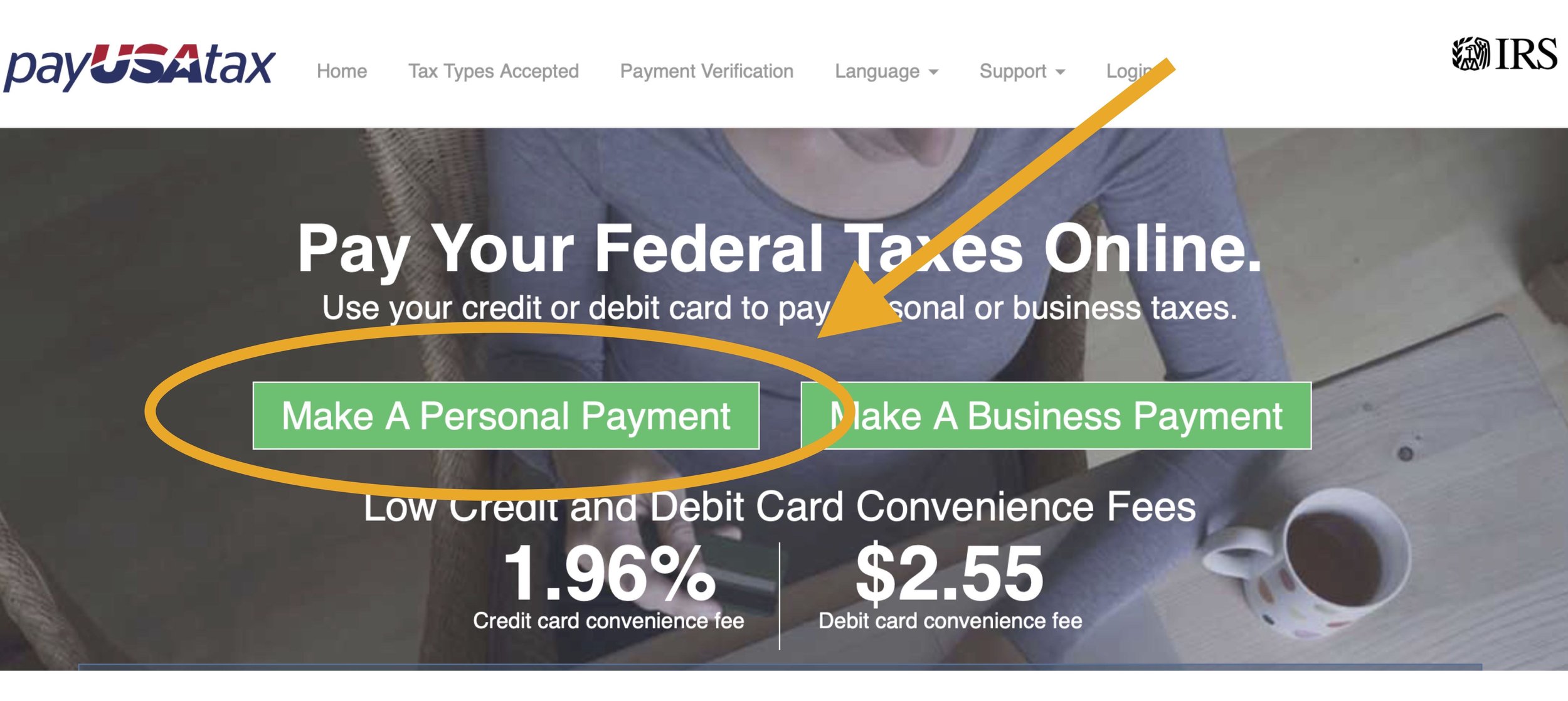

IMPORTANT NOTE / If Paying Online

IF you pay online, and use a 3rd party, be sure to choose "Personal Taxes"

Why? Because your business does NOT pay taxes, you pay personal taxes on the income you earned through your business....

Well those are all the basics on EQ$. It might feel intimidating at first … but it really gets easier over time!

Finding Your IRS Numbers - Notes and FAQs

This is a brand new post … I’ll keep adding to it throughout March 2023

Some General Notes

The IRS taxes you on profit.

To formula to finding this is: GROSS SALES - Biz EXPENSES = PROFIT

To show this work, the IRS asks us to fill out a Schedule C, a type of “Profit or Loss Form”.

The Schedule C is only 2 pages, and not that hard!

In reality, we don’t fill out the form … if we file ourselves, we’ll enter the numbers into software or a website (like TurboTax, FreeTax, H&R Block).

OR, we’ll give our numbers to our tax preparer.The Schedule C gets added to your personal IRS taxes. You don’t have to do a separate tax return. (Isn’t that great?)

Did you know … your business doesn’t pay any IRS taxes? You are paying personal taxes … on the money you earned from your business.

When you are self-employed, you’ll be paying 2 types of tax. Income tax (what you’ve been paying your whole life) and Self-Employment tax.

Business deductions, write-offs, business expenses - all mean the same thing.

What can I write-off? / What can I claim? / What is a business expense or deduction?

Almost everything you spend on your business - can be a deduction. It’s just a matter of what amount, and what category. The IRS uses the phrase, “ordinary and necessary”.

Quote from the IRS:

“To be deductible, a business expense must be both ordinary and necessary. An ordinary expense is one that is common and accepted in your industry. A necessary expense is one that is helpful and appropriate for your trade or business. An expense does not have to be indispensable to be considered necessary.”

What about something that is part for business, party for personal … like my cell phone, or my laptop?

These are referred to as Shared Use items. The basic strategy is to calculate - or decide - on what percentage is for business, and claim that amount. The default is 50/50, though you can split them other ways as well.

So, if you buy a new computer for $1800, and claim 50% for business, you would claim $900 as a business expense.

Let’s say your phone bill is split between your business, personal, and 2 other people. You could say that 25% is for business. Then take 25% of the total phone bill for the year as a deduction.

Does it matter what category I put things in?

Sorta no, sorta yes.

As long as you claim things only one time, you’re generally fine. The category doesn’t change the taxable amount. And if you’re paying the right amount of tax, you’re good.

Putting things in the reasonable categories does help though! Part of the risk factor for getting audited - is - do these expenses line up for this type of work.

What if I don’t see a category that fits?

You can either pick the closest category, that might make sense.

OR, make an “Other” category, and give it a label.

For example, I have checking account fees, for $84 a year. I could maybe put it into the “Office” category, though it’d be a stretch. So instead, I put it into “Other - Bank Fees”.

How do I handle mileage?

answer coming soon

What about a home office deduction?

Sometimes you can take a deduction for your Home Office. Additionally, you can deduct furniture and items used in your office. (Note, very often, the home office deduction doesn’t add up to that much. The simplified method generally yields a savings of $100 - $300 when all said and done.)

A – Home Office Deduction.

First, check to see if you meet the criteria:

Used exclusively for business – meaning no other activities take place there

Used on a regular basis

For the purpose of making a profit

Principle place of business

If yes, there are two methods:

Simplified Method: Calculate the square footage of your home office. Add this number when filing (with software or accountant.) Generally, you’ll get $5 per square foot as a deduction.

Actual Expenses Method: This is complex, and beyond my scope. The basic idea is that you calculate the percentage of your home that is your office. Say it’s 8%. Then, you add up all home expenses – mortgage/rent, utilities, insurance, etc. – then take 8% of those costs. I think.

B - Furniture and items

All or most things you buy for your office can be deducted – like chairs, rug, couch, artwork.

What do I do with the 1099 forms I received? What’s a 1099-NEC? And 1099-K?

1099 forms are a family of forms that track - whenever we get paid. There are different suffixes, here are some examples:

1099-INT … interest you earned from a bank or investment

1099-DIV … dividends you earned

1099-NEC … income from “Non-employee compensation”

1099-MISC … income from “Miscellaneous source”.

These are the forms you get PAYERS, and are straightforward to work with.

1099-NEC (non-employee compensation)

1099-MISC (miscellaneous)

These might come from businesses that hired you, programs you’ve contracted with, insurance companies, people you supervise. You’ll need to input all the data from these forms into the tax software, or give to your accountant. These count as part of tallying up your gross sales.

You may also get 1099-Ks, these come from payment PROCESSORS:

You might get these from Square, Stripe, Venmo, PayPal, etc. These are a little trickier, as the amount reflected in the 1099-K may overlap with other income. Be sure to get guidance on how to enter these when filing.

What if I didn’t receive a 1099 form?

Short answer: You still report the income, whether or not you received the form.

Longer answer: Ask the person/business if they sent one. Or look up on online. If they submitted one to the IRS, it can be a problem if you don’t report it. If they did NOT submit one, you’re in the clear. It’s the responsibility of the Payer to complete the form….

Accountants + Tax Help for Therapists

Hey there,

Here’s a list of Accountants and Financial folks especially collected for therapists. Most of these names come from Bethany Bylsma of the famed + super fun Therapy Godmothers. Friends of mine, offering all types of support for therapists setting up, or running, a private practice.

Also, hey, would you like to learn more about IRS taxes - either to file yourself. Or, to help you work with an accountant in a more empowered way? Check out Taxes + Snaxes, with Yours Truly as a Guest Presenter. Online or in-person workshops (in Seattle).

:) Jenny

Heard

Offering wholistic services - with accounting and bookkeeping combined

joinheard.com/pricing

MaClean Wealth

Retirement and Income Planning

macleanwealthplanning.com/team

TLDR

Extra support for new therapists

tldraccounting.com/accounting-for-therapists/

Nth Degree CPAS

Taxes and help with cash flow

nthdegreecpas.com/

+

Wise Mind Financial

Money Coaching, by a trained therapist

wisemindfinancial.com

How to do a Retreat / Worksheets V.2

ROUGH DRAFT

I'm a huge fan of retreats!

Especially in the summer.

Yes, it's true ... it can feel super difficult to find the time, space, and money. And yes, it's true, it can feel indulgent. And bring up weird/uncomfortable feelings. (I feel guilty. Am I allowed to do this? Why am I so tired? Why am I sad, when this is supposed to be fun?)

Also, retreats pay off - both for you, to feel better. And for your business.

Also, you are worth it.

You are the talent, you need support.

You are the leader of your business, you need space for inspiration and setting the next direction.

You are the manager of your talent, you need strategies to stay in alignment with your vision.

We spend most of our time during the year meeting other people's needs.

This is the time of year to tune into your needs.

And then, to adjust the business to make it a more ideal job for you AND to offer more value for your clients/customers.

I believe it's essential to both you as a person, and the success of your business!

(Also, you can write-off the cost / it's a business deduction.)

♥

Interested in setting one up for yourself?

Check out these worksheets below. They are all in BETA form.

Read this one first - How to Do a Personal/Professional Retreat

Then program Options:

Taking Stock

Rest / Fill the Reserves

Intuition

Inspiration

New Skill

Focused Work

Debrief/Reflect on a specific experience or chapter.

Ways to Say NO ... Including MAYBE (Probably No).

This blog post will grow!

For now, here are some great ways to say NO … including MAYBE (Probably No).

Basic No-s

No thank you, I’m going to pass on this.

Thank you for inquiring … I’m going to pass.

Hmmm… I think I need to pass on this.

Oh bummer, I’m actually phasing out that service … so I have to say no.

I’m not currently set up / prepared / ready for that type of project, so need to say no.

No thanks.

Thanks, but no thanks.

I’ve got to say no for now, but thanks for asking.

I’d rather not, but thanks for asking.

I appreciate you asking. I need to say No at this time.

Oh shoot, that’s a hard no.

Oh sorry, that won’t work for me.

I need to RSVP no for this event.

I wish there were 2 of me, in that case I would say yes!

I need to bow out this time.

Sorry, no. Nat at this time.

I’m otherwise engaged, sorry!

Ooh, it’s not likely I can make that work. I’ll let you know if anything changes.

I’m sorry, I’m all booked up that week/month.

I’m booked up until the end of the year.

Oh shoot, I’m already committed that ___[evening/week/etc.]____.

I’d love to, but my plate is totally full right now!

I’m honored that you asked! Currently, I’m at capacity, so have to say no. If I had a clone, I would totally do it.

What you need is beyond my wheelhouse / my scope / my expertise…sorry, I need to say no.

Sounds tempting, but I need to pass.

If you asked me __ month/years ago … I would have said yes! But now, I’m doing something different, and have to say no.

Thank you for asking. I’m not able to take this project on right now.

I wish I could make this work right now, but need to pass.

Oh man, it’s just not possible for me to take that on right now.

Helpful No-s

My business has changed, and I no longer offer that service. Here’s a referral … or All the best with your search.

What you need is beyond my wheelhouse / my scope / my expertise…and I want you to get what you need and deserve. So, I need to say no.

Sorry no, I can’t do that. But here’s what I can do….

Ask Me Later

Oh wow, that’s a cool opportunity. At this time, I need to say no / pass. Please ask me again in the future!

Maybe someday I can say yes. For now, I need to say no.

I need to say no for now, maybe another time?

I’m at capacity, and currently not booking any future work. Feel free to check back with me in __ months.

I need to bow out this round.

Thank you for thinking of me, I need to pass this round.

Oh bummer, I’m just not able to fit that in currently. Feel free to check back with me later.

Can I take a rain check?

Maybe (Probably No)

Hmm. Let me think on that, and I’ll get back to you.

I’ll check my calendar later – when I get home / during my office hour – and will get back to you by _____.

If you don’t hear back by this date, then I’m a no.

Hmm, I’m guessing that I’m booked already. So I’ll say no for now, and if something changes, I’ll let you know!

♥

Do you know any great Accountants or Bookkeepers?

This is a great question. Also, it is the #1 question I receive through email … so I decided to keep a full answer here for you - that I can update regularly.

Short answer - Yes! I know some amazing folks.

Longer answer - They are often booked. Below is my current list of people I know, and others recommended to me. If none of these folks work out, read some tips for searching for your own tax/money pro - at the bottom of this post.

Note: If you’re a Therapist - please see this list, specially collected for you.

/ / / / /

One last note: If you end up hiring one of these amazing folks, please consider coming back, and leaving a Tip in the Tip Jar. It took me years and hours+hours to find these good people. Thank you!

Valerie Moseley, CPA

valeriemoseleycpa.com

Available for consults: self-employed, S-corps, interesting tax situations, etc.

Limited openings for perfect-fit clients

Jocelyn Muhl, CPA

northseattleaccountant.com

Accounting services include time for questions

Available for consults, and perfect-fit clients

Kathy Coggins

cogginsaccounting.com

Kathy loves to work with S-Corps!

She has a full team to support you with other services too, like payroll, bookkeeping

Luke and Amy Weissgarber

ltwcpa.com/

Based in Bellevue, just moved up from Texas. Recommended by trusted CPA, actively looking for clients.

Julia Ensign

ensign-bookkeeping.com

Bookkeeping services for local businesses

Friendly! Offers phone call to take about working together

Patty Kelley, CPA and Katherine Griswold, MBA

portumbooks.com

Taking new clients, focus on small business. Offering full bookkeeping services, preparing documents for taxes, consulting, Quickbooks advising, and more!

Lindsey Gaughn, CPA

gaughanlindsey@gmail.com

Available for consults, bookkeeping and accounting services

Email to get in touch

Hipster Money / Alexandra Perwin, CPA

hipstermoney.com

Usually booked … sometimes available for consults, new clients who are perfect-fit

Clear Sky Money Matters / Emily Zillig

emilyzillig.com

Bookkeeping, money coaching

Sadie Frederick / Bookkeeper

sadieaccounts.com

Specializing in small Seattle nonprofit clients (also a long-time client of mine)

Justin Bourn, CPA

wzbcpa.com/team/justin-a-bourn/

A client said he’s friendly and easy to work with. Now the co-owner of this company. I hope to meet him some time.

♥

Tips for finding your own Tax/Money Pro

Keep asking everyone you know, to get a list of names 3-5 or more if possible

Try to meet at least 2-3 - for some type of initial consult. You will learn a little bit each time, and you’ll get a sense of the various communication styles. And what you like and don’t like.

Keep in mind - this is an equal power situation. You are the client, you’re an expert on your biz and your personality and work style. They are the expert of filing taxes and numbers. Be sure it feels good to talk with them and work with them.

If you want someone who will teach you things, ask them specifically if they like explaining how taxes and bookkeeping work.

For Accountants, be sure to ask if they file city and state taxes too! Many accountants do not.

Good luck with your search! … and please do let me know if you find any great people to add to this list.

Jenny Girl Friday

Weekly Staff Support / Check-in Meeting (For being happier at work)

Here’s my latest tool and practice for being happier at work: Weekly Staff Support Check-in Meetings.

In a nutshell

The idea is to look at the week ahead, and to ask myself, What support do I need to get everything done, and feel great?

Context and Guiding Ideas

It’s easy to move through the days and weeks, working constantly, to complete all of the things on our to-do list. Showing up for clients, finishing projects, handle business chores, etc. We are often driven by due dates. And many of us do whatever it takes to fulfill those commitments. We use the tools of: fit-stuff-in, dig-deep, work-until-it’s-done.

That’s cool, and gets results. …though, after a while, it can be very wearing on the mind, body, and spirit.

Here’s what we forget - how to give ourselves support to get through these big lists of work. Support can range from: getting tools we need, creating more time and space, gatekeeping small things out, taking things off the calendar, fuel or nourishment, ideal working conditions, encouragement, company … the list goes on. It’s whatever you need to get things done (and not be depleted).

Enter the Weekly Staff Support Check-in Meeting

You invite your two selves, the Boss You and the Talent You, hence the “meeting” part.

Talent You can write out all of the things on your plate. And then shares (with the Boss You): here’s how I’m feeling, here’s what I need, here’s what I wish. Then, the Boss You can make some decisions and provide support. After all Boss You wants to keep the Talent in the business!

Here’s how to use it

1 - Write some notes in the calendar section. Perhaps put in critical meetings, periods for working, breaks.

2 - Fill in the 2nd row - looking at tasks on your mind or list. Perhaps assign some to the calendar above.

3 - Make some observations. What do you notice - thoughts, feelings?

4 - Drill down - What’s a theme? What energy is needed? What support do I need? Perhaps add - how you want to feel at the end of the week?

5 - With all of that in mind, define some specific staff support. And then, make plans to give it to yourself.

The Quickie Version

At the beginning of your work week ……. let your eyes glaze over your calendar and to-do list.

Then, ask, “What’s one thing I can do or give myself to move through the week, get things done, and feel great?”

Channel the idea that you want to be the best boss in the world.

Give it a whirl, and let me know what you think!

: ) Jenny Girl Friday

Sidekick Services / Paid Newsletter FAQs

How many newsletters will I get?

12 - 20 each year.

One, at the beginning of each month, with the important due dates, helpful links, and tools. Sometimes, you may receive an extra newsletter, if it pertains to a timely + specific topic. For instance, opportunities - like the PPP Loan, or if there are important changes with tax + licensing rules or procedures.

What will be included, specifically?

Reminders for Due Dates - for taxes, license renewal, and LLC / PLLC renewal.

Links to how-to articles, walkthroughs, or information.

Handy tools + worksheets to make biz chores easier.

AndPlanned for 2022: more tools for tending your Money Garden and being Happy at Work.

Topics cover:

IRS Taxes - Filing and Prep

Sending in Estimated Quarterly Payments to the IRS

WA State Taxes

King County Taxes

Seattle Taxes

+

Renewing PLLC / LLC

Renewing Seattle License

+ More

What does the newsletter cost?

There is a monthly fee for the newsletter. You can choose what you’d like to pay, based on your situation and how you feel. Suggested prices:

$15 - I’m new to business / on a strict budget

$20 - I want to pay the Suggested amount

$25 - I’m thriving and want to send some love back your way

$26+ (custom amount) - You have saved my life! I want to show a huge gratitude!

How many months is something due?

5 - 9 months, depending on your situation.

If you file Annually with WA State, you’ll have things due 5 - 7 months out of the year.

If you file Quarterly with WA State, you’ll have things due 7 - 9 months out of the year.

Why am I paying you monthly, if some months there is nothing due?

Three Reasons:

1 ) It’s helpful to know when nothing is due, so you can have peace of mind.

2 ) Some months you’ll be receiving a LOT of content and forms. Others are very light. Your monthly fee reflects the average value.

3) Providing regular payments, helps me to be building materials for you year-round.

Also, the months in between are a great time to rest from biz chores, to refine systems, or to work on being Happier in your job. Sometimes I will provide tools or articles related to this other work.

Is there a bonus for signing up?

Currently … there is no bonus for signing up.

If I develop one in the future, I’ll send it to all the subscribers first!

What if I no longer wish to receive Sidekick Services, but want to know about classes, workshops and other services?

I have a new Announcement List. It’s free to join. I will share about any new workshops, classes, books, and openings available for Friendly Tax/License Consults. (FYI - These announcements will go out first to Sidekick Services.)

Do I need to join the Announcement list as well?

The simple answer - No.

Why? If you are on Sidekick Services, you’ll receive all Announcements. And, you’ll receive them first! The Announcement List is a great option if you decide to leave Sidekick Services.

Is this useful if I live outside of Seattle?

Many readers have shared … that Yes! It’s still helpful if you live outside of Seattle.

For two reasons:

1 ) You get supported for IRS tax prep and filing, relevant to anyone working in the U.S.

2 ) The reminders about local taxes (city, county, state) often prompt readers to get in touch with their own local agencies to find out what is due.

Will it be different, now that we’re paying for it?

At first, not really. Eventually……….Yes!

With your support, I’m planning to up-level both the Sidekick Services and the Business Apothecary. But, it will take some time + money.

Hopefully, you will someday see:

New design of the newsletter

Additional and redesigned tax + money tools

Updated how-tos and walkthroughs

A web re-design for the Apothecary

+ More!

Why did you switch to a Paid Newsletter … when you said earlier that you wanted to keep it free?

I really, really wanted to keep it free, modeling after NPR or Wikipedia. Over time, I learned that it wasn’t sustainable. I had a few donors (thank you!), which was encouraging and so helpful. Also, it was only just enough to cover tech costs and provide a tiny bonus.

Over time, I realized the following foundational ideas:

To fully develop the newsletter and tools, and to really serve you all abundantly, I need 1 - 3 days a month for writing and design.

NPR and Wikipedia have regular fundraising campaigns. I didn’t want to start inundating you with those kinds of messages! I’m a fan of only sending need-to-know stuff to you and your inboxes.

The value of what I’m providing is designed to save you $500 - $1500 a year or more + intangibles like less stress, more peace, empowerment. And this is worth charging for.

Anyone desiring to thrive in self-employment can afford this monthly fee.

This model will be like Spotify, Hulu, G-Suite. It’s something you want or need, and it costs money.

Is this a Business Deduction for IRS taxes?

Yes! I would suggest putting this under “Supplies”.

What is Memberful?

It is the company that will process your payments, and keep the subscriber list updated. Whenever you’re changing your payment information, updating a credit card, or canceling, it will be through Memberful.

What if I want to cancel?

You can cancel any time, through Memberful. If you’re not sure how, please email me at jennygirlfriday@gmail.com, and I can do it for you. (Please allow 5 - 10 days, if you cancel through me.)

What if I want to change my monthly amount?

Stay tuned … I will find an answer and report back. And/or email me at jennygirlfriday@gmail.com, and I’ll see how to do this for you. (Please allow 5 - 10 days, if you are requesting a change through me.)

This service has been a game-changer for me. What can I do to show appreciation?

Thank you so much! I’m thrilled to hear it! All of the following are welcome: sending me a note in email, leaving a little Love in the Tip Jar, increasing your monthly fee, and/or encouraging friends to sign up. Thank you again! It’s my goal to help you THRIVE and it’s such a joy to know when things are working for you!

PPP Forgiveness Info + Tips ~ For First Time Borrowers

You got that cash … now it’s time to keep that cash!

Great news for PPP recipients in 2021. The SBA made it a lot quicker and easier to apply for Forgiveness! For my part, it took only about 10 minutes … once I found the right location on my bank’s portal. (Full disclosure, I did spend about 30 minutes doing the wrong things first….)

Important - this blog post is for you, if you are a 1st time borrower, with under $150K in a loan.

The Basic Process ...

First, the process depends on the bank. Usually, it's two steps - the bank will give preliminary approval, then send to the SBA for final approval.*

In most cases, we just need to get form 3508S - the Simplified Forgiveness Application - to the SBA ... Either the bank will ask you to fill out the form, OR, they will ask you for information and create the form.

In many cases, No supporting documents are required!

The bank will review your application. If satisfied, they submit to the SBA.

It's possible that the bank or the SBA may come back to you to ask for documentation.

Once approved, you'll be notified. And, the SBA sends the money to the bank to pay off your loan.

*It's possible you may be able to apply directly with the SBA - they have opened a Direct Forgiveness Portal just this week - though it is in the Pilot phase. Click here to see it.

This is what you’re going for … to see this sent to you:

Important Info

It is required for us to keep our paperwork for 6 years. This includes the SBA loan paperwork that grants Forgiveness. And, records to show that you used the funds for 60 - 100% for Payroll. See this blog post for more info on records and acceptable uses for the funds.

The deadline for applying for Forgiveness ... is within 16 months after you received the funding.

If you are a 2nd time borrower

You have an extra requirement - you must prove that you had a 25% reduction between 2019 and 2020 (by comparing 2 quarters).

Please talk to your bank to learn what they will need.

Things to Do

Check with your bank / credit union to see if they are open for Forgiveness Applications. In many cases, they will send you an email to invite you to apply.

Click on the link to see the Simplified Forgiveness Application (3508S) - to warm yourself up for the process. You will see that the info needed is pretty basic.

Put time on your calendar to do this work.

Tips

Reach out to any friends with a PPP at the same bank. Learn from them, or go through the process together.

Plan a large chunk of time for this - even if it's quick. It takes a mental toll, so it's nice to have space.

Have something sugary at the start of this session - glucose helps the brain.

If possible, plan a massage, or trip to Olympus, or a bath, or a walk afterward to reward yourself.

Totally intimidated? Call your bank and ask how to get help.

FAQs

What was I allowed to spend the money on? (What do I need to prove about how I used the money?)

You must use 60-100% of the PPP money for "payroll" costs to be forgiven. There are a few other approved costs - such as benefits, rent, utilities, operational - that can be used for up to 40%. Ask your bank.

Am I allowed to use it to pay taxes?

If you are a sole prop or single member LLC ... technically, you, as a person pay taxes (not your business). So, after you give yourself a Paycheck (into your personal account), you can send in IRS estimated taxes from those monies. Having said that, you may NOT use them for city or state taxes - those are taxes your business pays.

I work by myself, I thought Self-Employed people didn't get Paychecks or have Payroll.

You are absolutely correct! Technically, we have profit or an owner draw. Having said that, the PPP Loan is including us, and equating our "profit" with our "payroll".

What happens if it’s not forgiven?

It stays a loan with a 1% interest rate. I think you may also defer payments, but am not totally sure about that yet.

You got this! Wishing you an easy and quick forgiveness.

♥ Jenny Girl Friday

P.S. Are you self-employed? Be sure you’re getting Sidekick Service emails - tax + license reminders sent to your inbox monthly, with links to how-to articles and tools to make things easier and fun.