WA state expanding who needs to collect sales tax

Washington state earns most of its money from sales tax. It requires businesses that sell products to collect sales tax.

It also requires certain services to collect sales tax. Often if these services are related to physical things, e.g. painting a mural on a wall, fixing a fence.

This is called Retail Service.

Now WA is adding more industries to the Retail Service category.

Which means new types of services will need to collect + submit sales tax.

Some new examples:

Advertising services

Graphic design

Presentations, workshops

Web design

Over the years, WA is constantly adjusting who needs to collect sales tax. Some people are not aware that technically their work is considered Retail or Retail Service.

You might not know …

That these services and products also need to collect sales tax:

Photography - services and photos

Selling digital products - newsletters, digital art, webinars

Painting murals

Repairing, improving furniture or other objects

Is this feeling scary or overwhelming?

Are you thinking things like…..

Oh Sh*t! I can’t afford to pay more taxes? Why am I burdened with this? Will clients think my prices are too high? This is not fair! I already hate number, now I have to do this?

I got you!

Here are some key things to know upfront

1 - This won’t cost you any extra money. This is tax that you collect from the customer, and sent on to the state. (Though it will take a little extra time.)

2 - Once you know what to do, it’s not that hard.

3 - Not sure where to start? Just add 10% sales tax to everything for now, you can get more precise later. Set that money aside in a separate account if possible.

4 - Our customers are used to paying sales tax, so hopefully, for most people, this will not be a big deal.

5 - When it’s time to file, the phone support at the WA Department of Revenue is usually really nice, and it is their job to help you. (You can also tag me in to help with a Quickie Consult-Call )

6 - Other people not as smart as you have figured it out, you can too!

I’ll be creating more support materials and resources in the future. In the mean time, feel free to hit me up for a Quickie Consult-Call for a small fee. Or, if you’re a new client, find me in a free 20-min Zoom chat.

You got this!

Once you’ve got your system, this is just one more way to feel like a Bo$$!

xo Jenny

Book$ about Money / A short list ♡ and some guiding ideas

If you wish to see the list only, scroll down. :)

First, I wished to share some thoughts about books on money….

I love when people ask me about good books on money! And then immediately get confounded … for 2 reasons.

1 - Because most of the books I read are a bit older, and I can’t fully remember if they feel modern enough now. (I stopped reading books on this topic, once I got enough knowledge, and found my own good relationship with money.) I’m sure there are great ones out that that I just don’t know about!

2 - Most importantly, because it really depends on what you’re looking for! There are so many aspects to working with money! I can answer this best when we have a little conversation first. (In fact, feel free to hit me up for a free 20 min Zoom chat.)

The best books on money, are the ones where: you like the tone, it gives you the knowledge you’re seeking, and motivates you to make some changes! Avoid books that feel too daunting, make you feel behind, or that you’re doing something wrong. Or define a protocol that feels too strict.

Below is a list of money topics.

I list them out, to offer you as menu, in case you’re still figuring out what you want to learn.

Also, I wish to point out that … there are many ways to “be good” with money. Though in our society, women have been steered to only one corner of this skill set: budgeting, saving money, being thrifty, paying off debt. Here are more ways to be good with money, that might get you a bigger bang for the buck!: earning more, feeling worthy and empowered, building wealth, being literate with our money systems.

These are the most common topics people are asking about:

How to control or direct your spending (budgeting)

Ways to save more

How to get out of debt

Investing, growing wealth

Retirement

Adulting money skills, building some basic money literacy and know-how

Basic bookkeeping and accounting for business

I would love to get these topics on people’s radar too:

Get fired up to earn more ~ how to feel worthy

Learn what your thriving life costs, and put a price on it

How to earn more

If you work for yourself, design your rates to earn enough+, If you have an employee job, find a way to ask for more

How our money system is a bit whack, and you’re great!, but it’s still good to know how to play the game

How your taxes work, so you can factor them into plans

Feeling better about money, building a more peaceful relationship, being empowered

How to work with people in the Finance world (financial advisor, accountant, etc.)

List of Money Books

I wish I had more modern books to offer you! If you find any that you love, please let me know.

Feminism and building wealth

I haven’t read these, but this is where I’d start today

Rebel Millionaire: Get rich on your own terms

Peg Cheng

Perhaps heck out Suze Orman books

All-around Money Skills ~ Getting out of debt and building wealth

#7-Figure Net Worth: Modern Wealth Blueprint for Black Americans

by Brielle Mabrey

Your Money or Your Life: Transforming Your Relationship with Money and Achieving Financial Independence

by Joe Dominguez and Monique Tilford

This is an oldie, but goodie. Though the program is kinda strict.

Adulting Money Skills with a Narrative

I Survived Capitalism and All I Got Was This Lousy T-Shirt: Everything I Wish I Never Had to Learn About Money

by Madeline Pendleton

Charging enough if you’re self-employed

Sections of these books cover how to charge more.

If you follow this guidance, it’ll pay for the book in no time!

Unstuck: Method + Magic for Stepping Into your Worth

by Roxie Jane Hunt

How to Become Self-Employed in Seattle: A Guidebook, Companion, and Reference

by Jenny MacLeod (yours truly!)

Working with money if you’re self-employed

Accounting Made Simple: Accounting Explained in 100 Pages or Less

by Mike Piper

Profit First: Transform Your Business from a Cash-Eating Monster to a Money-Making Machine

by Mike Michalowicz

This book is overpromises (it could have been an article)…however, it’s got some great strategies around using bank accounts.

Feeling better about working with money

The Soul of Money: Transforming your Relationship with Money and Life

by Lynne Twist

Thank you for reading! I’d love to hear which books you found helpful, whether from this list, or beyond. Good luck in your journey! And way to go for building up your money skills! I think it’s one of the most beautiful, simple, radical acts as a Feminist!

♡ Jenny

Filing your BOI Report with FINCEN - a New Requirement for LLCs/PLLCs starting in 2024

UPDATE on 1.7.2025

This requirement is now paused. Here’s a quote from FINCEN:

In light of a recent federal court order, reporting companies are not currently required to file beneficial ownership information with FinCEN and are not subject to liability if they fail to do so while the order remains in force. However, reporting companies may continue to voluntarily submit beneficial ownership information reports. More information is available at https://www.fincen.gov/boi .

Check back with FINCEN, join the Sidekick Service Newsletter, or email me to stay tuned!

Here is the original blogpost, written in March 2024:

Hi there,

This is a new federal requirement - in 2024 - for anyone who has an LLC / PLLC.

Good news! It’s actually simple and quick and free.

It just looks kinda scary. (And some people in social media try to make it look scarier than it is to get your attention, and try to get money out of you.)

Short Story

You just have to log in, and provide the government with information about your LLC/PLLC and the people who own it. That’s it!

Some Details

The requirement includes filing a BOI Report. This stands for Beneficial Ownership Information. You might also see the acronym BOIR, where the R stands for Report.

If you registered your LLC/PLLC before January 1, 2024 … then you have all year to get it done! For you, it’s due by January 1, 2025

If you registered your LLC/PLLC this year, in 2024 … then you need to complete the BOIR within 90 days of registering your LLC/PLLC.

More of the Story

…Some people use LLCs to cover up criminal activity. So a branch called the Financial Crimes Enforcement Network (FINCEN) is tasked with getting info on all the LLCs/PLLCs and their owners, to verify legal activity. And look for the criminal activity.

Filing your BOIR

Get prepped:

It’s easy … you’ll just need:

The EIN for your business (or social security number if you don’t use an EIN)

A photo of your Driver’s License or Passport

The process takes 10-20 minutes. (More if you like to read, and re-read instructions!)

Links:

To File Online - Click here

For helpful walkthroughs and screenshots - Click here

ProTips

Question 16 looks a little confusing at first. They’re basically asking if your LLC/PLLC existed before January 1, 2024. If yes, they refer to it as an “Existing reporting company”. If you click Yes to this, you can skip a whole section.

There are little “Need help?” prompts throughout, with more information.

At the end, they’ll offer you a PDF of the report to download. BE SURE TO DOWNLOAD YOUR TRANSCRIPT! Currently, this is the only way to get confirmation that you filed. You’re not able to do it later….

And/or record somewhere that you finished your BOIR. Later this year, there will probably be lots of scary looking ads out there … and your system might get activated. Then, when you remember that you did this, you can feel calm and victorious.

Wishing you a quick and successful filing.

Considering getting a little reward for yourself for dealing with this pesky chore!

♡ Jenny

Thriving Plan for the Year Ahead

Rough Draft

Thriving takes cultivation!

And time!

And you are so worth it.

Ever feel like you're back in a hamster wheel with work? This is very common, as we try to please all our clients, families, friends...we can get stuck in a rut, so, so easily. It turns out, that loving your job, having things in balance, earning enough ... in other words, thriving, has to be cultivated. One strategy, is to set up an annual Thriving Plan.

Here's a tool for you to try out. (You might recognize it, it's revised from an earlier tool.)

Taking even 20-30 minutes to fill this out can make all the difference!

Start with the easiest boxes on the outside. Continue to fill them in to see what your priorities are for the year. Add any vacations, trips, retreats. Lastly, create your weekly schedule(s) and monthly routines - as a way to fit in all of your priorities.

Not sure what to write? Or trying to get it “perfect”. …Just guess! You can always change it later. There is great power in starting. And often, our gut-initial-instincts are what we really need/want.

First, I’ll share my example to give you an idea. Then, there are 4 different templates to choose from.

My Example

My biz year goes from Sep - Aug

Click on the image or the Option # to download.

Option 2

Year going from January - December

With 2 different weekly schedules - a and b

Option 1

Year going from January - December

With one type of weekly schedule

Option 4

Year going from September - August

With 2 type of weekly schedules

Option 3

Year going from September - August

With 1 type of weekly schedule

Wishing you some time in your schedule … to do this important work! I hope it feels fun and magical.

♡ Jenny

P.S. Want a little company or guidance with this? I’d love to help! I offer One-Time consults - and the goal is that they are game-changers. We can fill out your plan, talk through any roadblocks, highlight new desires, and whatever else you need to feel great about your job and life. Oh, and starting this year, you can bring a friend to the consult, and I can meet with both of you for the same price.

How do I know if I file ANNUALLY or QUARTERLY with WA state?

Quick Answers

Your filing schedule is assigned to you, after you register for a business license. Here are ways to find out your schedule.

Look for a letter you received from the Washington State Department of Revenue (DOR) - after you registered for your business license. It will tell you your schedule.

Call the DOR to ask them. They’re usually very friendly. It helps to have your UBI on hand, if you know where that is. (UBI is your WA state business number.) 360-705-6705

Log into your DOR account, navigate to Manage Returns, and see what it says there. If you’re on the Annual schedule, it will say that. If you’re quarterly or monthly, I believe it just shows the date that it’s due. So you can easily infer the schedule.

Some context and FAQs

Like all states, WA relies on taxes to fund programs. It collects all of these taxes through the Department of Revenue. There are two main categories. One, you’re already familiar with - sales tax. If your business provides any retail products or services, you’ll be required to collect and submit these taxes. The 2nd category is taxing businesses in a few different ways. The most common of these is Business and Occupation tax. These dollars help the state support and monitor businesses, to be safer for consumers, etc.

The state needs to collect its taxes on a regular basis. So, your filing schedule - annually, quarterly, monthly - is based on your projected taxes. If you’re going to earn a lot, and collect sales tax, then you’ll likely be put on a quarterly or monthly schedule.

If you earn less and/or are service only (no sales tax), then you’ll be put on an Annual schedule.

This is all based on your Gross Sales (all the money you collect from customers/clients … before business expenses). And, if you collect sales tax or not.

I heard that I have to send in Estimated Quarterly Tax Payments? Is this the same or different?

This is a super common question. This different. When you have a business, you must report to all levels of government: city, county, state, and the IRS. It's easy and reasonable to get them mixed up!

"Estimated quarterly tax payments" are part of paying your federal taxes to the IRS. These are estimated based off the profit your business is likely to make. They are due four times a year: Jan 15, Apr 15, Jun 15, Sep 15. Click here to read more.

If the state says that you must report quarterly, that is for state taxes, which include: B&O, sales tax, use tax. These are calculated from your actual sales.

I was assigned Quarterly payments. Ugh. Why is that? Can I change it?

Basically, the state wants to collect tax money on a regular basis. If you have a Retail business (meaning you'll be collecting sales tax) and/or if it looks like your income will be high, they will assign you to making reports quarterly.

♥ Please don't worry too much though! Once you know how to make reports to the state, it only takes a few minutes!

If you want to change it to reporting annually, in the past, the only way was to call the state in January. If your income is low enough, they'll make the change. That number is: 360-705-6705. It's possible that there are new rules, so you might try calling soon if you want to check.

You talk about Making Reports, Paying Taxes, Submitting Taxes, are these all the same thing?

Great question. They're slightly different. I like to think about things at the most basic level first. Once you have a business, you are required to Make Reports to the state. Sometimes, if you're very small, and/or do service work, then you won't owe any money. Yay! BUT, you still have to make the reports so the state knows this. This is step one of the process.

Paying taxes are when your business is actually being taxed. That's the B&O tax, and Use Tax. This is based off a percentage of your Gross Sales, and any purchases out of state. The money comes out of your pocket.

Submitting taxes is different. This is Sales Tax that you've collected from your buyers. It is tax based on their purchase. It comes from their pocket. You're simply the carrier of that money.

How can I get more info + help with this?

Lots of ways!

♥ Get help from the state DOR. They offer workshops, online tutorials, and even consulting! Click here to see more info at DOR.wa.gov.

♥ If you currently work with an accountant or bookkeeper, check with them.

♥ Get 1-on-1 help with Yours Truly. Sign up for a One-Time consult. We can work 1-on-1, or you can bring a friend to split the fee.

♥ Join me for Book$ Club! A monthly event, where self-employed folks gather to work on bookkeeping and biz chores - just like this one. In a Happy Hour setting. I provide 1-on-1 help, as time allows. And/or, you can ask other folks in the group. Like study hall, but more fun! Click to … Read More … or to Register

Estimated Quarterly Payments (EQ$) to the IRS / Just the Basics

The WHY behind EQ$

The IRS is a Pay-as-You-Go tax system. We're required to send in 4 estimated payments throughout the year ... then, it's True Up time when we actually file our taxes. If we overpaid, we'll get a refund. If we underpaid, we'll owe more.

Good news!

Once you know what you’re doing … it only takes about 5 minutes!

It can feel really satisfying, like you’re a BOSS of your business.

It makes Filing Taxes in April a lot nicer.

A Few Quick Facts about Sending in EQ$

When we send in an EQ$, it’s simply sending in money. It’s not filing taxes. There are no numbers to report. We just send money and make sure it’s attached to our name and tax ID.

If sending by check, there’s just a small voucher. If online, just a few fields to fill out to verify your identity.

You can send payments online, or via snail mail. Click here to read more.

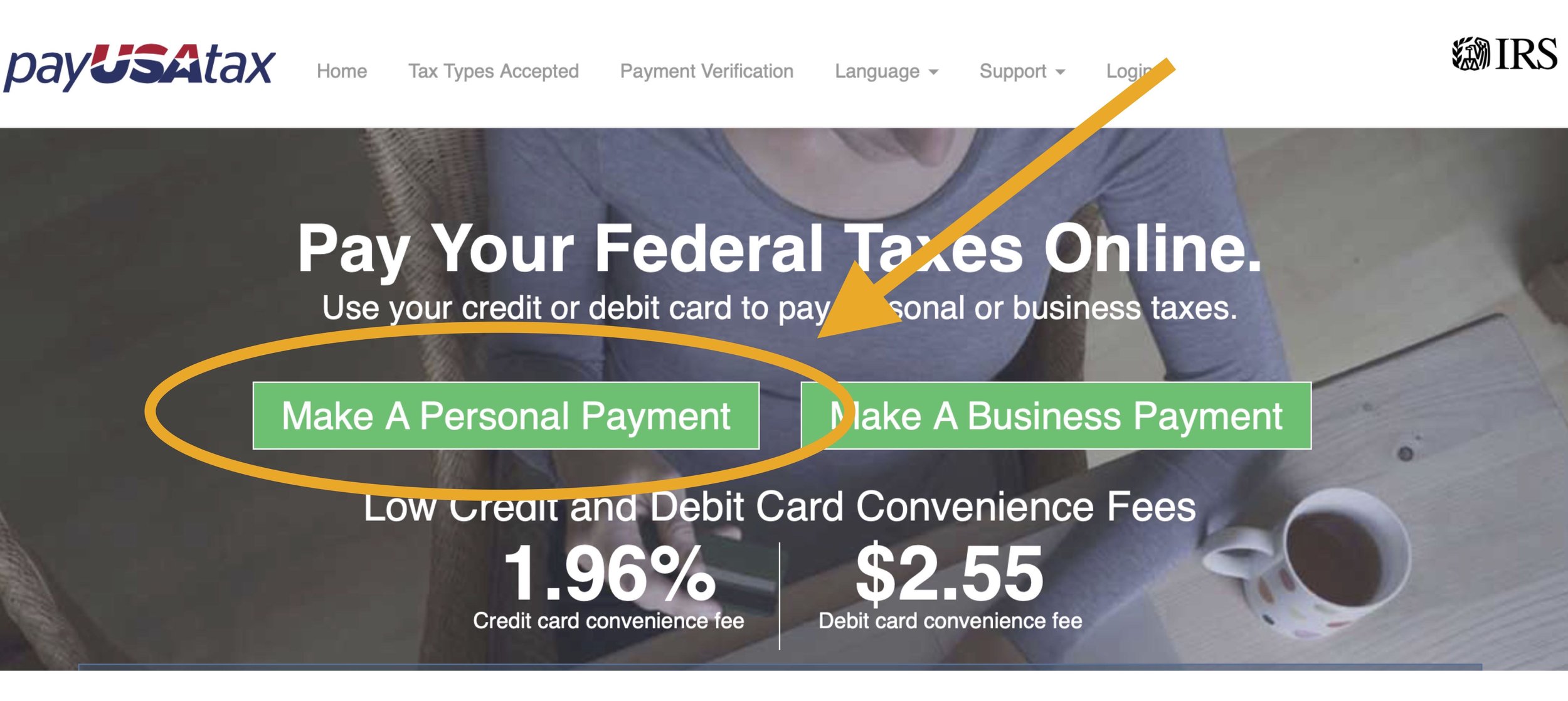

IMPORTANT - if sending payments online, see note below.

It's fine to use your SSN with these payments. (Even if you have an EIN.)

The Due Dates are not even! (Weird, right?)

DUE Dates

April 15

June 15

September 15

January 15

Note - When these dates fall on the weekend or holiday, they will shift to the following business day.

To Send in or Not Send In….

If total tax for the year (related to your biz profit) is $2000 or less, then the IRS says that we do NOT need to send in payments.

If total tax for the year (related to your biz profit) is $2000 or more ... we're required to send in payments.

If we send in partial payments, or none at all, we might have to pay a penalty. Usually these are a few hundred dollars or less.

How Much to Send

The IRS offers a complex way to calculate your EQ$. I offer simpler alternatives. Three different methods to choose from. Click here for the NEW worksheet with instructions.

IMPORTANT NOTE / If Paying Online

IF you pay online, and use a 3rd party, be sure to choose "Personal Taxes"

Why? Because your business does NOT pay taxes, you pay personal taxes on the income you earned through your business....

Well those are all the basics on EQ$. It might feel intimidating at first … but it really gets easier over time!

Finding Your IRS Numbers - Notes and FAQs

This is a brand new post … I’ll keep adding to it throughout March 2023

Some General Notes

The IRS taxes you on profit.

To formula to finding this is: GROSS SALES - Biz EXPENSES = PROFIT

To show this work, the IRS asks us to fill out a Schedule C, a type of “Profit or Loss Form”.

The Schedule C is only 2 pages, and not that hard!

In reality, we don’t fill out the form … if we file ourselves, we’ll enter the numbers into software or a website (like TurboTax, FreeTax, H&R Block).

OR, we’ll give our numbers to our tax preparer.The Schedule C gets added to your personal IRS taxes. You don’t have to do a separate tax return. (Isn’t that great?)

Did you know … your business doesn’t pay any IRS taxes? You are paying personal taxes … on the money you earned from your business.

When you are self-employed, you’ll be paying 2 types of tax. Income tax (what you’ve been paying your whole life) and Self-Employment tax.

Business deductions, write-offs, business expenses - all mean the same thing.

What can I write-off? / What can I claim? / What is a business expense or deduction?

Almost everything you spend on your business - can be a deduction. It’s just a matter of what amount, and what category. The IRS uses the phrase, “ordinary and necessary”.

Quote from the IRS:

“To be deductible, a business expense must be both ordinary and necessary. An ordinary expense is one that is common and accepted in your industry. A necessary expense is one that is helpful and appropriate for your trade or business. An expense does not have to be indispensable to be considered necessary.”

What about something that is part for business, party for personal … like my cell phone, or my laptop?

These are referred to as Shared Use items. The basic strategy is to calculate - or decide - on what percentage is for business, and claim that amount. The default is 50/50, though you can split them other ways as well.

So, if you buy a new computer for $1800, and claim 50% for business, you would claim $900 as a business expense.

Let’s say your phone bill is split between your business, personal, and 2 other people. You could say that 25% is for business. Then take 25% of the total phone bill for the year as a deduction.

Does it matter what category I put things in?

Sorta no, sorta yes.

As long as you claim things only one time, you’re generally fine. The category doesn’t change the taxable amount. And if you’re paying the right amount of tax, you’re good.

Putting things in the reasonable categories does help though! Part of the risk factor for getting audited - is - do these expenses line up for this type of work.

What if I don’t see a category that fits?

You can either pick the closest category, that might make sense.

OR, make an “Other” category, and give it a label.

For example, I have checking account fees, for $84 a year. I could maybe put it into the “Office” category, though it’d be a stretch. So instead, I put it into “Other - Bank Fees”.

How do I handle mileage?

answer coming soon

What about a home office deduction?

Sometimes you can take a deduction for your Home Office. Additionally, you can deduct furniture and items used in your office. (Note, very often, the home office deduction doesn’t add up to that much. The simplified method generally yields a savings of $100 - $300 when all said and done.)

A – Home Office Deduction.

First, check to see if you meet the criteria:

Used exclusively for business – meaning no other activities take place there

Used on a regular basis

For the purpose of making a profit

Principle place of business

If yes, there are two methods:

Simplified Method: Calculate the square footage of your home office. Add this number when filing (with software or accountant.) Generally, you’ll get $5 per square foot as a deduction.

Actual Expenses Method: This is complex, and beyond my scope. The basic idea is that you calculate the percentage of your home that is your office. Say it’s 8%. Then, you add up all home expenses – mortgage/rent, utilities, insurance, etc. – then take 8% of those costs. I think.

B - Furniture and items

All or most things you buy for your office can be deducted – like chairs, rug, couch, artwork.

What do I do with the 1099 forms I received? What’s a 1099-NEC? And 1099-K?

1099 forms are a family of forms that track - whenever we get paid. There are different suffixes, here are some examples:

1099-INT … interest you earned from a bank or investment

1099-DIV … dividends you earned

1099-NEC … income from “Non-employee compensation”

1099-MISC … income from “Miscellaneous source”.

These are the forms you get PAYERS, and are straightforward to work with.

1099-NEC (non-employee compensation)

1099-MISC (miscellaneous)

These might come from businesses that hired you, programs you’ve contracted with, insurance companies, people you supervise. You’ll need to input all the data from these forms into the tax software, or give to your accountant. These count as part of tallying up your gross sales.

You may also get 1099-Ks, these come from payment PROCESSORS:

You might get these from Square, Stripe, Venmo, PayPal, etc. These are a little trickier, as the amount reflected in the 1099-K may overlap with other income. Be sure to get guidance on how to enter these when filing.

What if I didn’t receive a 1099 form?

Short answer: You still report the income, whether or not you received the form.

Longer answer: Ask the person/business if they sent one. Or look up on online. If they submitted one to the IRS, it can be a problem if you don’t report it. If they did NOT submit one, you’re in the clear. It’s the responsibility of the Payer to complete the form….

How to do a Retreat / Worksheets V.2

ROUGH DRAFT

I'm a huge fan of retreats!

Especially in the summer.

Yes, it's true ... it can feel super difficult to find the time, space, and money. And yes, it's true, it can feel indulgent. And bring up weird/uncomfortable feelings. (I feel guilty. Am I allowed to do this? Why am I so tired? Why am I sad, when this is supposed to be fun?)

Also, retreats pay off - both for you, to feel better. And for your business.

Also, you are worth it.

You are the talent, you need support.

You are the leader of your business, you need space for inspiration and setting the next direction.

You are the manager of your talent, you need strategies to stay in alignment with your vision.

We spend most of our time during the year meeting other people's needs.

This is the time of year to tune into your needs.

And then, to adjust the business to make it a more ideal job for you AND to offer more value for your clients/customers.

I believe it's essential to both you as a person, and the success of your business!

(Also, you can write-off the cost / it's a business deduction.)

♥

Interested in setting one up for yourself?

Check out these worksheets below. They are all in BETA form.

Read this one first - How to Do a Personal/Professional Retreat

Then program Options:

Taking Stock

Rest / Fill the Reserves

Intuition

Inspiration

New Skill

Focused Work

Debrief/Reflect on a specific experience or chapter.

Ways to Say NO ... Including MAYBE (Probably No).

This blog post will grow!

For now, here are some great ways to say NO … including MAYBE (Probably No).

Basic No-s

No thank you, I’m going to pass on this.

Thank you for inquiring … I’m going to pass.

Hmmm… I think I need to pass on this.

Oh bummer, I’m actually phasing out that service … so I have to say no.

I’m not currently set up / prepared / ready for that type of project, so need to say no.

No thanks.

Thanks, but no thanks.

I’ve got to say no for now, but thanks for asking.

I’d rather not, but thanks for asking.

I appreciate you asking. I need to say No at this time.

Oh shoot, that’s a hard no.

Oh sorry, that won’t work for me.

I need to RSVP no for this event.

I wish there were 2 of me, in that case I would say yes!

I need to bow out this time.

Sorry, no. Nat at this time.

I’m otherwise engaged, sorry!

Ooh, it’s not likely I can make that work. I’ll let you know if anything changes.

I’m sorry, I’m all booked up that week/month.

I’m booked up until the end of the year.

Oh shoot, I’m already committed that ___[evening/week/etc.]____.

I’d love to, but my plate is totally full right now!

I’m honored that you asked! Currently, I’m at capacity, so have to say no. If I had a clone, I would totally do it.

What you need is beyond my wheelhouse / my scope / my expertise…sorry, I need to say no.

Sounds tempting, but I need to pass.

If you asked me __ month/years ago … I would have said yes! But now, I’m doing something different, and have to say no.

Thank you for asking. I’m not able to take this project on right now.

I wish I could make this work right now, but need to pass.

Oh man, it’s just not possible for me to take that on right now.

Helpful No-s

My business has changed, and I no longer offer that service. Here’s a referral … or All the best with your search.

What you need is beyond my wheelhouse / my scope / my expertise…and I want you to get what you need and deserve. So, I need to say no.

Sorry no, I can’t do that. But here’s what I can do….

Ask Me Later

Oh wow, that’s a cool opportunity. At this time, I need to say no / pass. Please ask me again in the future!

Maybe someday I can say yes. For now, I need to say no.

I need to say no for now, maybe another time?

I’m at capacity, and currently not booking any future work. Feel free to check back with me in __ months.

I need to bow out this round.

Thank you for thinking of me, I need to pass this round.

Oh bummer, I’m just not able to fit that in currently. Feel free to check back with me later.

Can I take a rain check?

Maybe (Probably No)

Hmm. Let me think on that, and I’ll get back to you.

I’ll check my calendar later – when I get home / during my office hour – and will get back to you by _____.

If you don’t hear back by this date, then I’m a no.

Hmm, I’m guessing that I’m booked already. So I’ll say no for now, and if something changes, I’ll let you know!

♥

Do you know any great Accountants or Bookkeepers?

This is a great question. Also, it is the #1 question I receive through email … so I decided to keep a full answer here for you - that I can update regularly.

Short answer - Yes! I know some amazing folks.

Longer answer - They are often booked. Below is my current list of people I know, and others recommended to me. If none of these folks work out, read some tips for searching for your own tax/money pro - at the bottom of this post.

Note: If you’re a Therapist - please see this list, specially collected for you.

/ / / / /

One last note: If you end up hiring one of these amazing folks, please consider coming back, and leaving a Tip in the Tip Jar. It took me years and hours+hours to find these good people. Thank you!

Valerie Moseley, CPA

valeriemoseleycpa.com

Available for consults: self-employed, S-corps, interesting tax situations, etc.

Limited openings for perfect-fit clients

Jocelyn Muhl, CPA

northseattleaccountant.com

Accounting services include time for questions

Available for consults, and perfect-fit clients

Kathy Coggins

cogginsaccounting.com

Kathy loves to work with S-Corps!

She has a full team to support you with other services too, like payroll, bookkeeping

Luke and Amy Weissgarber

ltwcpa.com/

Based in Bellevue, just moved up from Texas. Recommended by trusted CPA, actively looking for clients.

Julia Ensign

ensign-bookkeeping.com

Bookkeeping services for local businesses

Friendly! Offers phone call to take about working together

Patty Kelley, CPA and Katherine Griswold, MBA

portumbooks.com

Taking new clients, focus on small business. Offering full bookkeeping services, preparing documents for taxes, consulting, Quickbooks advising, and more!

Lindsey Gaughn, CPA

gaughanlindsey@gmail.com

Available for consults, bookkeeping and accounting services

Email to get in touch

Hipster Money / Alexandra Perwin, CPA

hipstermoney.com

Usually booked … sometimes available for consults, new clients who are perfect-fit

Clear Sky Money Matters / Emily Zillig

emilyzillig.com

Bookkeeping, money coaching

Sadie Frederick / Bookkeeper

sadieaccounts.com

Specializing in small Seattle nonprofit clients (also a long-time client of mine)

Justin Bourn, CPA

wzbcpa.com/team/justin-a-bourn/

A client said he’s friendly and easy to work with. Now the co-owner of this company. I hope to meet him some time.

♥

Tips for finding your own Tax/Money Pro

Keep asking everyone you know, to get a list of names 3-5 or more if possible

Try to meet at least 2-3 - for some type of initial consult. You will learn a little bit each time, and you’ll get a sense of the various communication styles. And what you like and don’t like.

Keep in mind - this is an equal power situation. You are the client, you’re an expert on your biz and your personality and work style. They are the expert of filing taxes and numbers. Be sure it feels good to talk with them and work with them.

If you want someone who will teach you things, ask them specifically if they like explaining how taxes and bookkeeping work.

For Accountants, be sure to ask if they file city and state taxes too! Many accountants do not.

Good luck with your search! … and please do let me know if you find any great people to add to this list.

Jenny Girl Friday

Weekly Staff Support / Check-in Meeting (For being happier at work)

Here’s my latest tool and practice for being happier at work: Weekly Staff Support Check-in Meetings.

In a nutshell

The idea is to look at the week ahead, and to ask myself, What support do I need to get everything done, and feel great?

Context and Guiding Ideas

It’s easy to move through the days and weeks, working constantly, to complete all of the things on our to-do list. Showing up for clients, finishing projects, handle business chores, etc. We are often driven by due dates. And many of us do whatever it takes to fulfill those commitments. We use the tools of: fit-stuff-in, dig-deep, work-until-it’s-done.

That’s cool, and gets results. …though, after a while, it can be very wearing on the mind, body, and spirit.

Here’s what we forget - how to give ourselves support to get through these big lists of work. Support can range from: getting tools we need, creating more time and space, gatekeeping small things out, taking things off the calendar, fuel or nourishment, ideal working conditions, encouragement, company … the list goes on. It’s whatever you need to get things done (and not be depleted).

Enter the Weekly Staff Support Check-in Meeting

You invite your two selves, the Boss You and the Talent You, hence the “meeting” part.

Talent You can write out all of the things on your plate. And then shares (with the Boss You): here’s how I’m feeling, here’s what I need, here’s what I wish. Then, the Boss You can make some decisions and provide support. After all Boss You wants to keep the Talent in the business!

Here’s how to use it

1 - Write some notes in the calendar section. Perhaps put in critical meetings, periods for working, breaks.

2 - Fill in the 2nd row - looking at tasks on your mind or list. Perhaps assign some to the calendar above.

3 - Make some observations. What do you notice - thoughts, feelings?

4 - Drill down - What’s a theme? What energy is needed? What support do I need? Perhaps add - how you want to feel at the end of the week?

5 - With all of that in mind, define some specific staff support. And then, make plans to give it to yourself.

The Quickie Version

At the beginning of your work week ……. let your eyes glaze over your calendar and to-do list.

Then, ask, “What’s one thing I can do or give myself to move through the week, get things done, and feel great?”

Channel the idea that you want to be the best boss in the world.

Give it a whirl, and let me know what you think!

: ) Jenny Girl Friday

PPP Forgiveness Info + Tips ~ For First Time Borrowers

You got that cash … now it’s time to keep that cash!

Great news for PPP recipients in 2021. The SBA made it a lot quicker and easier to apply for Forgiveness! For my part, it took only about 10 minutes … once I found the right location on my bank’s portal. (Full disclosure, I did spend about 30 minutes doing the wrong things first….)

Important - this blog post is for you, if you are a 1st time borrower, with under $150K in a loan.

The Basic Process ...

First, the process depends on the bank. Usually, it's two steps - the bank will give preliminary approval, then send to the SBA for final approval.*

In most cases, we just need to get form 3508S - the Simplified Forgiveness Application - to the SBA ... Either the bank will ask you to fill out the form, OR, they will ask you for information and create the form.

In many cases, No supporting documents are required!

The bank will review your application. If satisfied, they submit to the SBA.

It's possible that the bank or the SBA may come back to you to ask for documentation.

Once approved, you'll be notified. And, the SBA sends the money to the bank to pay off your loan.

*It's possible you may be able to apply directly with the SBA - they have opened a Direct Forgiveness Portal just this week - though it is in the Pilot phase. Click here to see it.

This is what you’re going for … to see this sent to you:

Important Info

It is required for us to keep our paperwork for 6 years. This includes the SBA loan paperwork that grants Forgiveness. And, records to show that you used the funds for 60 - 100% for Payroll. See this blog post for more info on records and acceptable uses for the funds.

The deadline for applying for Forgiveness ... is within 16 months after you received the funding.

If you are a 2nd time borrower

You have an extra requirement - you must prove that you had a 25% reduction between 2019 and 2020 (by comparing 2 quarters).

Please talk to your bank to learn what they will need.

Things to Do

Check with your bank / credit union to see if they are open for Forgiveness Applications. In many cases, they will send you an email to invite you to apply.

Click on the link to see the Simplified Forgiveness Application (3508S) - to warm yourself up for the process. You will see that the info needed is pretty basic.

Put time on your calendar to do this work.

Tips

Reach out to any friends with a PPP at the same bank. Learn from them, or go through the process together.

Plan a large chunk of time for this - even if it's quick. It takes a mental toll, so it's nice to have space.

Have something sugary at the start of this session - glucose helps the brain.

If possible, plan a massage, or trip to Olympus, or a bath, or a walk afterward to reward yourself.

Totally intimidated? Call your bank and ask how to get help.

FAQs

What was I allowed to spend the money on? (What do I need to prove about how I used the money?)

You must use 60-100% of the PPP money for "payroll" costs to be forgiven. There are a few other approved costs - such as benefits, rent, utilities, operational - that can be used for up to 40%. Ask your bank.

Am I allowed to use it to pay taxes?

If you are a sole prop or single member LLC ... technically, you, as a person pay taxes (not your business). So, after you give yourself a Paycheck (into your personal account), you can send in IRS estimated taxes from those monies. Having said that, you may NOT use them for city or state taxes - those are taxes your business pays.

I work by myself, I thought Self-Employed people didn't get Paychecks or have Payroll.

You are absolutely correct! Technically, we have profit or an owner draw. Having said that, the PPP Loan is including us, and equating our "profit" with our "payroll".

What happens if it’s not forgiven?

It stays a loan with a 1% interest rate. I think you may also defer payments, but am not totally sure about that yet.

You got this! Wishing you an easy and quick forgiveness.

♥ Jenny Girl Friday

P.S. Are you self-employed? Be sure you’re getting Sidekick Service emails - tax + license reminders sent to your inbox monthly, with links to how-to articles and tools to make things easier and fun.

King County Taxes - FAQs

What does the County tax us on? How much are the taxes?

The county taxes us on property:

1 - real estate (land and buildings)

2 - "personal property" (equipment)

If your business owns any land or buildings, please contact them directly.

For "personal property", totaling OVER $7500, we pay about 1% in taxes. (We owe nothing if the value is under $7500.)

Do I have to report to King County?

Technically speaking, ALL businesses must register with King County and make a report every year. Realistically speaking, many micro and small businesses do not know about the County, and are not registered, and it has not been a problem (so far). One similar situation is the Speed Limit. Many people drive over the speed limit, but never get a ticket—especially if you're over by only 2-5 mph. I cannot give any advice about what to do, but want to give you some context so you can make your own decision!

What counts as "personal property"?

"Personal property" is a funny term. It sounds like the opposite of business! But it IS the term for equipment and supplies that you use to do business. Like: desk, shelves, computer, printer, art equipment, and even office supplies. Think of it like this: it's property that we can pick up and carry, on our person.

How do I register with the county?

Someday, I'll have a blog post on this...for now.......)

There is a form to fill out, either on paper or as an interactive PDF.

To find it~

1

Go to the eListing page

2

Look on the LEFT side Navigation

3

Click the "Report New Business" button

4

It will download a Word document

5

It asks you to list "Owned Business Assets" ~ these are all the physical things your business owns (furniture, tools, computer) that do NOT get consumed.

6

Notice, right underneath the the "Owned Business Assets" subtitle, there's a small box where you need to list "Supplies Monthly Cost". This is for things like paper and ink, things you use up.

7

Send in form—either through email or snail mail.

Call the County with any questions! 206-296-5126

What happens after I register?

The county will add you to their system, and will most likely send you an email. Then, the following calendar year, you report any additional equipment the business has acquired, and/or any increases in supplies.

IF the total exceeds $7500, the business will be taxed about about 1%.

IF there's NO CHANGE, then we're still required to send in a report saying so.

How do I make a report to King County?

Go the eListing on the King County page.

If you need help, you can reach the County by phone or email. Don't be shy, it's their job! Here's a quote from the website:

"DID YOU KNOW?The assessor's staff is available to assist you in any way we can. If you have question or concerns, please feel free to call us at 206-296-5126."

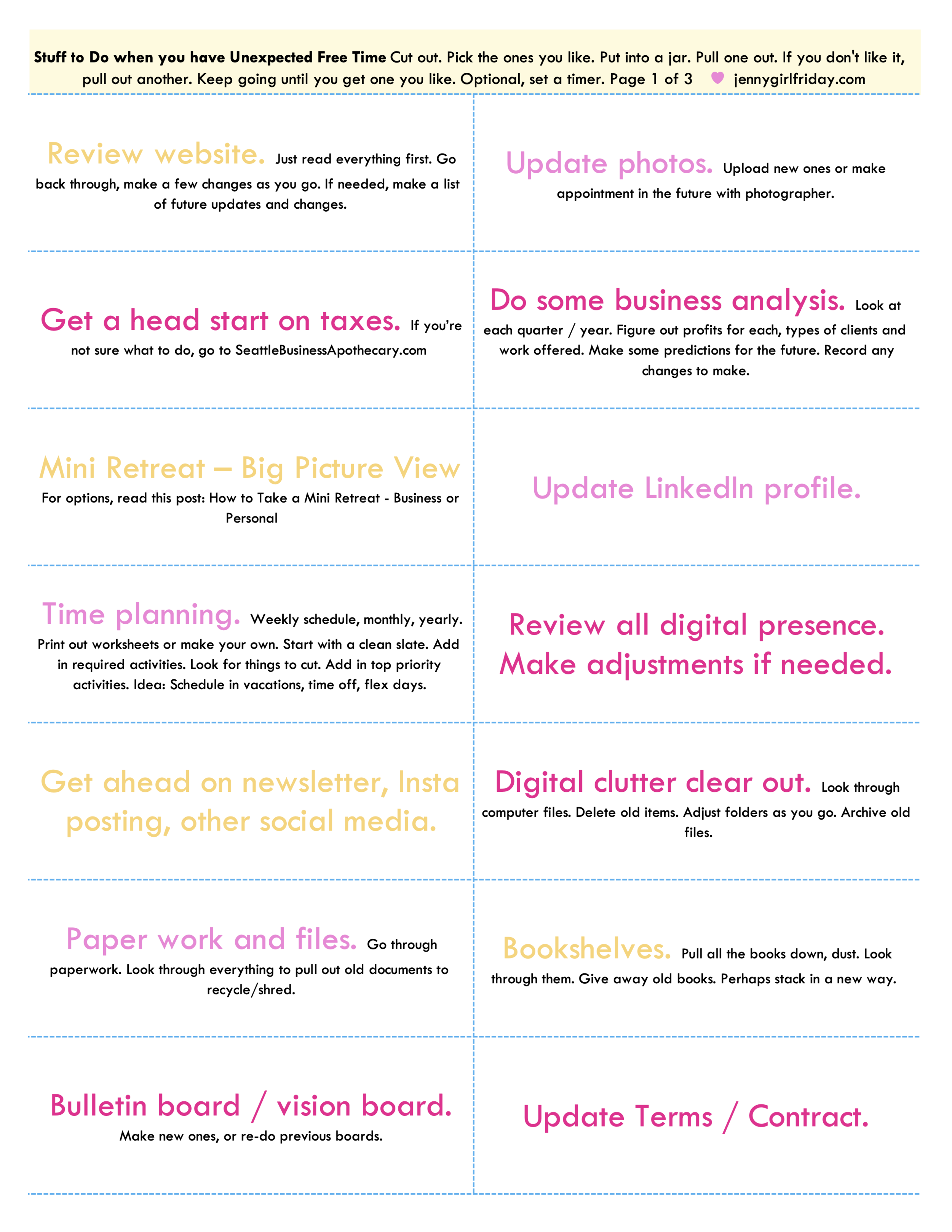

43 Ways to Work On Your Business - When you have Unexpected Free Time

ROUGH DRAFT - inspired by the Coronavirus.

Have some unexpected Free Time? Want to get something done on your business, but not sure what to do? No problem! Read on to see a Master List of ways to work on your business, plus some strategies below.

Why do I need a list you ask? Because…once you sit down to ponder the free time, and what to do, it’s easy to draw a blank or get distracted. Next challenge, once you do start thinking, it can be overwhelming. “I need to update my website, order business cards, work on bookkeeping…which one do I do?”. This brings up one of our biggest enemies, Decision Fatigue,…we don’t know which to choose, so we go back to Facebook, email, or wondering around aimlessly. All of those are fine, except when we’re trying to make progress on something.

Free time is your opportunity to work on things that are Important but not critical. These important tasks are the keys to making your future life easier.

Below is a big list. First, here are my suggestions for working with it.

Jar

Print out the PDF version of the list. Cut out the options. Throw away the ones you don’t like. Put the ones you like in a jar. When you have free time, pull out a slip of paper. If it sounds helpful, doable in the moment, get to work. Don’t like it? Pull out another. Keep repeating until you do.

Top Ten List

Pick ten of these tasks. Put on a list. Each time you have some unexpected time, look at the list. Pick the easiest one.

Two-DO List

Look at the list. Pick two tasks. Write somewhere visible. On post-its on computer, on calendar, on your fridge. Whenever you’ve got time, work on one of them. When you have time again, work on the other. Repeat.

Roll some Dice

Use an online dice roller. Or, find 3 - 5 dice. Roll one die to determine how may dice to roll. Now, roll the dice, pick the item on the list with that number. Do that task. Don’t like it? Go again. Still don’t like it? Look over the list and pick one.

Current Master List - A work in progress.

1 - Review your website.

Just read everything first. Go back through, make a few changes as you go. If needed, make a list of future updates and changes.

2 - Update pictures.

Upload new ones, or make appointment in the future with photographer.

3 - Get a head start on taxes.

If you’re not sure what to do, read this post: How to Prep for IRS Taxes

4 - Do some business analysis.

Look at each quarter / year. Figure out profits for each, types of clients and work offered. Make some predictions for the future. Record any changes to make.

5 - Mini Retreat – Big Picture View

For options, read this post: How to do a Mini Retreat - Business or Personal

6 - Time planning – weekly schedule, monthly, year.

Print out worksheets or make your own. (Click for Weekly Flow, Year -at-a-Glance.) Start with a clean slate. Add in required activities. Look for things to cut. Add in top priority activities.

7 - Update LinkedIn profile.

8 - Review all digital presence.

Make adjustments if needed.

9 - Get ahead on newsletter, Insta posting, other social media.

10 - Digital clutter clear out.

Look through computer files. Delete old items. Adjust folders as you go. Archive old files.

11 - Paper work and files.

Go through paperwork. Look through everything to pull out old documents to recycle/shred.

12 - Bookshelves.

Pull all the books down, dust. Look through them. Give away old books. Perhaps stack in a new way.

13 - Bulletin board / vision board.

Make a new one, or re-do current ones and start a new one.

14 - Visual Reminders

Make posters for the office or fridge – with whatever you need to be reminded of – routines, goals, plans, schedule.

15 - Self-care plan review.

What are you currently doing for self-care? What do you wish to add? Anything to cut? What’s your budget? Make adjustments and add activities into your schedule.

16 - 3 Ideal Clients

Check out this post - Three Ideal Clients - Book Excerpt

17 - Review policies.

Adjust or add.

18 - Update Terms / Contract.

19 - Look at prices and adjust.

Perhaps add new fees, e.g. travel, late fee, reschedule, rush work.

20 - Development new offering or class.

21 - Brainstorm new marketing materials.

22 - Create Pinterest board.

For inspiration/ communication with designer, or to draw from yourself.

23 - Research people to hire / network with.

24 - Organize photos and imagery for marketing.

Update labels, perhaps put in one folder.

25 - Collect a copy of all your materials and put in one place.

For example, all ads or brochures, business cards – put in a notebook. Or all of your handouts, print and put in a folder / notebook.

26 - Take inventory of supplies.

Reorganize supplies. Label.

27 - Make a bingo card of goals. - See below.

Pick 5 categories. Write in the spaces under the BINGO. Under each, fill in tasks or accomplishments. Give yourself rewards when you get a line or blackout. I used this for marketing my book after it was written. It’s still on my fridge!

28 - Get all tax + legal info in one place.

Online and in print form.

29 - Research swag you might want to make.

30 - Research boutiques, galleries.

31 - Research events in the area for small business / community / your field.

Make a calendar of when they happen.

32 - Research events you might want to sponsor.

33 - Research charities / causes to give money or time to.

34 - Reach out to old friends and contacts just to say hi.

Only if this feels legit and you want to, with no direct business agenda.

35 - Follow up with people you’ve talked about collaborating with.

36 - Create a class or workshop to offer for profit, or as a volunteer.

37 - Do a numbers review, by month.

Check out these worksheets: Service Providers, No Sales Tax; Services Providers, with Sales Tax; Product Makers (Retail/Combo).

38 - Make a list of Household Bills

This can be useful when making your own Salary goals. Click here for a worksheet.

39 - Give yourself a Reward.

Because you deserve it. Click to see a menu.

40 - Find some books to read, related to your work.

Consider going to the bookstore to be able to browse in person.

41 - Research a vacation or work trip.

Put it on your calendar.

42 - Do some math to give yourself a raise!

Update on website and materials.

43 - Send an email or thank you card to a role model or someone who inspired you.

Okay, that’s the big list. You don’t need to do all these things! It’s just a menu. Use one of the strategies above to make your own plan. Either the Jar, Top Ten, Two-DO list, or Roll the Dice.

♥

Please, let us know how it goes! Share any stories or suggestions in the comments below.

Cheers,

Jenny

Click on the image to get a downloadable pdf.

Here’s the Bingo Card I made after publishing my book. It helped me stay on track and celebrate successes!

Three Ideal Clients - Book Excerpt

Who Are Your Ideal Clients?

Who are the people you want to work with? Thinking deeply about who they are will help you figure out what they need, where to find them, and what language and design will get their attention. It will also help you decide when to accept work, and when to politely decline.

It’s hard to describe an imaginary group. To help you out, work through the following exercise.

Create three ideal clients that you would love to work with or to sell products to. Sometimes these are called avatars. Choose them so that they represent different types of clients/buyers. Really think them through; flesh them out. Name them, describe them, build a picture of them in your head.

Get three pieces of paper - one for each idea client. Draw a picture in the middle of the client, or perhaps cut an paste images. Use each page to bring your ideal clients to life! Afterwards, we’ll make some observations.

For each one, fill out the following ~

For Individuals:

Name

Age

Religion/politics

Where they live

How they dress

Family

Career

Aspirations

Hobbies

Everything you can think of

For Orgainzations / Companies

Name

Size

Services/Products

Location

Design/Look/Brand

Who they work with

Company values/causes

How long in business

Community connections

Everything you can think of

• • •

Now, look at your three clients. Let’s make some observations.

What do they have in common?

Where do they hang out?

What do they like?

What do they need that they’re not able to get?

What ideas, images, and values do they have in common with you and your business?

Use this knowledge to help you when choosing words and tone in your marketing materials, such as colors, design, and imagery. Think about them by name. For example, Would this make sense to Sally, the Florist in Ballard?

Continue to refine these three ideal clients. Carry them with you as guides.

How to Prep for IRS Taxes - All at Once

This is for anyone who needs to prep for IRS taxes all at once! Perhaps you “put it off until the last minute”. No problem! You’re safe here. Or, perhaps you just like doing all at once, and scheduled a day for it. Cool! There are many ways to approach taxes, and they’re all just fine. Read more about Tax Prep Styles to define yours. If you wish to break it up over multiple days, click here.

Okay, here we go.

Overview of the process

Collect stuff.

Find your numbers - wherever they are.

Add up in categories.

Put into a worksheet. Provided.

Then you’re ready to file!

Store your work in one place.

Bonus - Reward yourself.

1

Warm Up / Prep your space

Turn off email. Get some nice music, clear off the table. Use the worksheet to find everything that you might need. Get some favorite food or snacks.

2

Collect everything you can find

Use the worksheet as a guide.

3a.

Find your Gross Sales

This is the amount of total payments you received from clients / customers.

Ways to find this amount:

If you have tracking software, like Quickbooks or something specific to your practice (like Simple Practice for therapists), then get an Annual Report for the tax year.

If you’ve used one bank account for all deposits, simply look at the December statement and find the Year-to-Date deposits.

If you’ve used a spreadsheet, then highlight all the cells of income, then notice the Total.

If you have an income record, look there.

If none of the above, go to the next step.

Important Note! If you received 1099-NECs and/or 1099-Ks for some of your income, you will need to have all of those available.

3b.

Make an Income Record

• Have an income record? Print it out.

• If you have software, print a list of all income.

• If you’ve used a bank account/s …search transactions from Jan. 1 - Dec. 31 of last year, and then filter for Credits Only. Download and print.

• Need to make one? Use your calendar to make a list of all appointments or sales. Write the amounts earned next to each one. You can do this on paper or make a spreadsheet.

• Have invoices? Print them out, staple together as your record.

3c.

Expenses by category

Find all evidence of purchases for your business. Could be ~

paper receipts

online receipts

bank statements

credit card statements

utility bills

It doesn’t matter how you paid for the purchases, all of them can be deducted. (If you’re a sole proprietor or single member LLC.)

Now, we want to add them up by category. Use the sheet you already printed to see the categories. For more info on what expenses go where, click on this worksheet.

Have software?

quickbooks - print the P and L for last year

other software - print P and L for last year, or print all expenses then categorize

OR You can add up these amounts using ~

pen and paper

excel spreadsheet - type in date/amount/vendor by category

excel spreadsheet - download all expenses then, then categorize and sum

Email me if you’d like to use my spreadsheet. Please allow 3 - 5 business days.

Important Note - It doesn’t matter how you add them up! As long as you have subtotals for each category. And evidence for each expense.

3d.

Special case expenses - mileage and office

Did you drive for your business? Most any place that you drove, except to an office, can be deducted. There are two ways to claim this expense - actual cost of vehicle or mileage. I will only cover the Mileage Method here.

Mileage

What you need to find

total miles for the vehicle for the whole year

total miles for business use

total miles for personal use

If you have these figures, your accountant or tax software will do the rest.

Ways to find mileage

Used an app? Log in to find your report for last year.

Have a record, great!

Calculate miles - look at your calendar, make a list of dates/locations and use Mapquest or other site to calculate the mileage of your trips.

For total miles, do your best to guess your odometer reading for last January 1. Perhaps look at oil change records. For the ending mileage do the same. (In the future, make a note to yourself to write down your Odometer miles each January 1st.)

Office

There are two ways to claim this expense. I will only cover the Simplified Office expense here. Calculate the square footage of your office.

The accountant or tax software will know what to do.

3e.

Payments You Already Sent In

This is majorly important!!!!

These are the Estimated Quarterly Tax Payments you sent in, if you did. Only you can provide this info. Find the dates and amounts when you sent these in. Otherwise, you will not get credit for them!

Not sure? Look through all of your records, your bank statements, email. And/or call the IRS.

4

Check the worksheet

Look over the worksheet at everything you’ve collected. Try and think if anything is missing. Did you have any more business expenses? Any accounts you forgot to check? Find anything missing and add them. At some point, decide to be done!

5

Plan when to file

Doing this today? If not today, choose a day and put on your calendar. Not sure how to file? Read this post.

6a

Store everything

Keep these things out: Worksheet with all your figures AND any 1099-MISCs.

Gather all of your receipts, statements, calculations, notes. Print out and put into a box, or envelope. Label with the Tax Year.

6b

Reward yourself!

Phew, that was a lot of work. Be nice to yourself this evening. Maybe order take-out or go out. Maybe a bath or binge watch some shows. Maybe online shop for something you’ve wanted. Just be sure to be nice to yourself AND get a reward…or put one on your calendar asap. Here’s a menu if you’re not sure what you need.

♥ ♥ ♥ ♥ ♥

Was this helpful? If yes, please considering leaving a Tip in the Tip Jar …. and/or forwarding to a friend. Thanks so much!

: ) Jenny Girl Friday.

What's Your Tax Prep Style?

Dear Readers, this is an evolving blog post. I’d love to get your feedback on which terms / descriptions work or don’t work for you!

Work with your nature.

This is one of my favorite guiding principles. And it's more important than ever when it comes to chores or anything that feels tedious, new, overwhelming.

What style fits you? ....when it comes to working on IRS tax prep?

(Nicknames are works in progress.)

♥ The truth?: I ignore it until the last minute, then scramble and get it all done. (Phoenix)

♥ I like to start as early as possible. In fact, I already have! I work steadily until the job is done finished. (Early bird)

♥ I do best breaking up a task. I prefer to work over several sessions. (Marathoner)

♥ I like to do the job all at once, on a planned day. (Personal work party)

♥ None of these fit exactly/I'm a mixture. (4 Leaf Clover)

The idea: choose your style. Name it. Claim it. Plan for it. Be at peace with it. Below are a few ideas for each style.

P.S. If you're new to this, I suggest reading the Marathoner description as well as your style.

♥

Phoenix

Do your thing! No reason to fix something that works. When the time comes, find this email and these tools to offer some help: All-at-once Prep + CalculateBasic. If needed, here's an article if you get stuck somewhere. Perhaps, mark off a day or two around 4/12, 4/13, 4/14 to do the work. Lastly, if you can, clear your calendar on 4/15 or 4/16 to take a break, go to the spa or drive out of town to reward yourself and recover. (I'm keeping this short, because your mind is busy with other things right now. You'll get to this later.)

♥

Early Bird

This message to you might be too late because you're probably finished. In case I caught you in time, here's an article that outlines the whole process. And a worksheet to capture all your numbers: CalculateBasic. You'd probably like to fill out this second sheet as well: Calculate Next Level. Before you get too far, please be sure to choose a reward for yourself. Set aside some money for it and plan whatever time it takes. Yes, you start early because it's your nature, there's an urge to. That's cool. Still, let's reinforce and reward that nature! We want to keep you happy in your job. If you feel a bit guilty, then it's probably the right amount.

Oh, and here's an article on filing options. As you know, it feels so good to get the appointment for the actual filing on the calendar, whether it's meeting your accountant, filing yourself online, etc. Heads up, there are a few changes this year! A new 1040 and a few new rules. I'll be sharing about that soon. I'm just mentioning it so you plan in a little extra time. If you'd like to dive into research now, here are the 1040 Instructions, start on page 6.

♥

Marathoner

Slow and steady wins the race! And, "Life ain't a track meet, it's a marathon." Ice Cube. You know that working slowly over time means less impact on your life, the pain can be spread out. If you've done this before, you've probably got a system already. If you're new / as a reminder to experienced folks: plan several work periods over the next 4 - 6 weeks. Prep time really ranges from 2 hours to 12 or more. Just take your best guess and plan in the time. You can pick a regular day + time, like "Fridays from 1 - 3pm", or choose a time block like "1 hour" to fit into your weekly schedule.

One option is for you to follow along with the Sidekick Service Tax Prep series coming out soon. I've broken the process into 6-7 steps, and will send an email about each one...so you can follow along with me. If you'd like to space it out yourself, take a look at this article, with worksheets for each step. Or, look at this All-at-Once Prep Sheet to plan your own sessions. I also suggest choose a little treat for each work session and a big Reward for when you're all finished.

♥

Work-Party Girl

You like to get in the zone; to give this task your whole attention, all at once. Like gearing up for party or 5K, you want to collect all your tools and resources, create the space, and get it done, and done well, and then shut the door and be finished. Tips for you (if you're new/need reminders): schedule three days on your calendar: 1- Personal Tax Work Party, 2- Time OFF to recover/reward yourself, 3 - Follow-up Tasks.

Create a space in your house to collect all of the things you'll need. Tax documents coming in the mail, bank statements, receipts, etc. Perhaps print out this sheet Collect Stuff. You can use it to slowly collect items prior to your Party day, or, do it first thing that morning. Consider getting a friend to hang out with you. Oh, and if you're the cook in your house, arrange for someone else to handle meals or to go out for dinner. Be sure to have a breakfast and lunch you love, plus snacks on hand. On that day, I suggest printing out these two sheets: All-at-once Prep + CalculateBasic. Here's an article if you run into questions.

♥

Four Leaf Clover

Perhaps none of these fit, you're a combination, or you're new to this and just don't know. Or, maybe you're a rebel and as soon as someone tries to type you, you don't like it! That's cool. I get that we're a spectrum and not everyone fits into boxes. A few ideas. First, find a way to name your own style. Think about what's true, even if you're different/changing all the time. The reason? It's empowering to claim what we do naturally and then we've got a strategy to stick to.

Next translate your style into some logistics. Do you want to plan ahead, wait until inspired, ignore? Three Options for you. 1) read through the tips for the other styles, and whatever sounds good/calming/easy, then do that. 2) Plan to follow along with the Sidekick Service emails over the next 6 weeks. If it sounds good, do the work suggested for each. Then, if you want to jump off at any point, please do! 3) Look at this All-at-Once Prep sheet. Or skim this article. Then ask yourself this, Now that I see all the work involved, how do I want to tackle it?

Once you discover your name + system, I'd sure love to hear about it. Please email me at jennygirlfriday@gmail.com

I'm excited to hear what you think of these Styles + Tips!

• How to Renew your LLC / PLLC (aka file annual report)

If you have an LLC or PLLC, you must ‘renew’ it each year to keep it going. Officially, it’s referred to as filing your Annual Report. It’s quick and costs about $60. It’s due on the anniversary month of when you opened it.

Some reminders

This is different than your business license. Your LLC / PLLC is a legal entity that you created. It has its own limits, responsibilities and protections. It’s separate from you (like an 18 year old child). It can only practice business if you keep it alive and it is properly licensed. To keep it alive is a legal issue (vs. financial), that’s why we’re dealing with the Secretary of State.

Basic Info to Renew / Make Annual Report

TIME: 2 - 10 minutes

COST: $60

DUE: On the anniversary month when it was formed

Frustration Factor: 4 out of 10

WEBSITE: ccfs.sos.wa.gov/#/

GOVT: Secretary of State

HELP: 360.725.0377

Summary

Set up a profile if needed. Log in. Double check that your name and address is filled in for every role (governor, registered agent, executor, etc.). Get to the end, pay $60. Mark off your Important Dates List (Annual, Quarterly). Reward yourself!

Why?

LLCs / PLLCs were originally created for groups of people coming together to do business. Each owner is actually called a Member. The annual report is saying, Yes, it’s still going. Here’s who is doing which role. With bigger groups, this matters! For a single-member LLC / PLLC, it feels a little silly because generally we serve all the roles! By making this report, we confirming that all this info is the same.

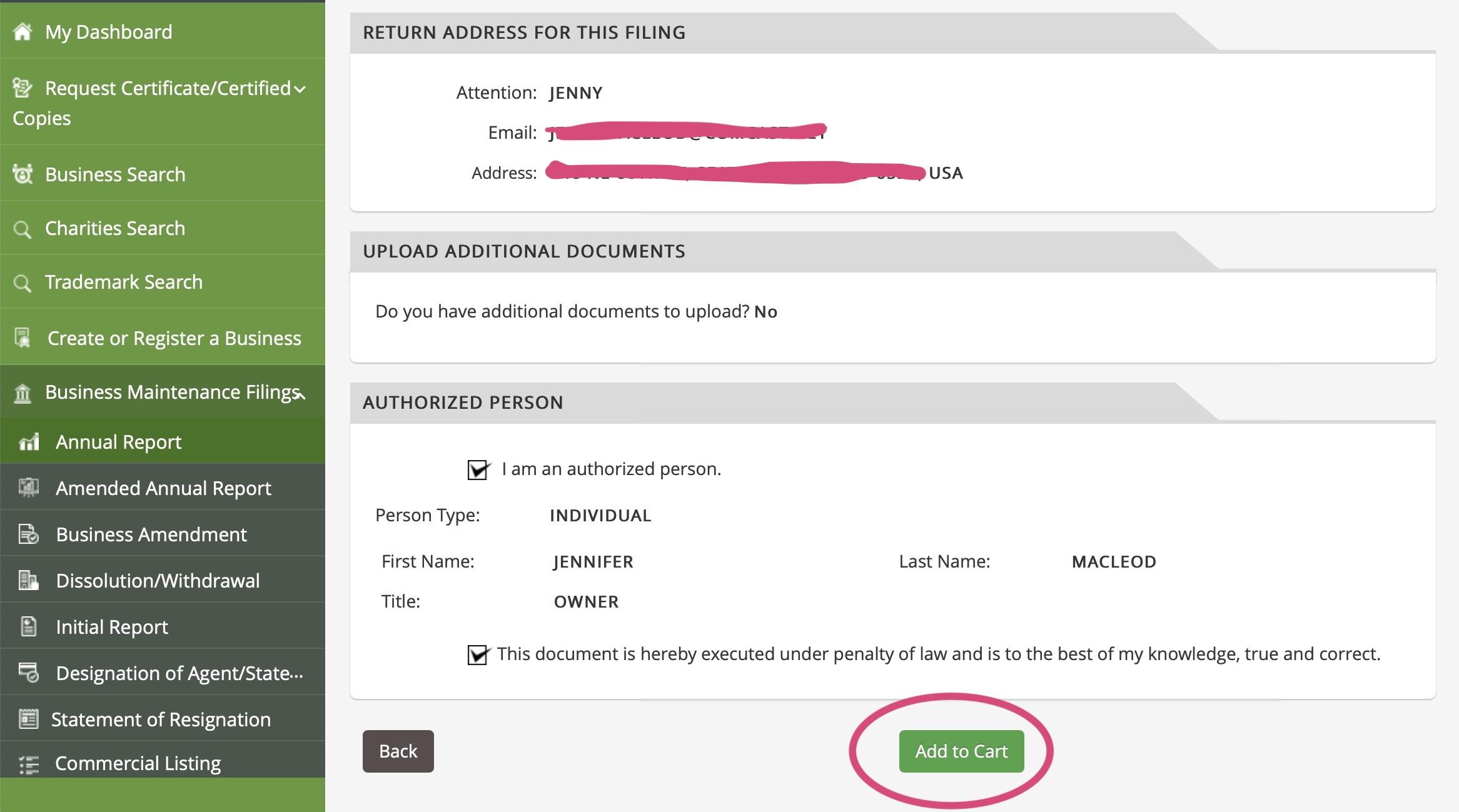

Steps - Screen shots below

1 Go to SOS.wa.gov

2 Click on CORPORATIONS in the Top Nav to open the menu

3 Find CORPS & CHARITIES FILING SYSTEM

4 Sign in ….or create a profile, then sign in when directed

5 Find ANNUAL REPORT on the Left Nav

6 Search for your Business using your UBI or Name

7 Select your name from the List

8 Confirm all your information, make changes or additions if needed

9 Review

10 Add to Cart and Pay

11 Optional - print or save the pdf for your records

12 Mark as done on your Important Dates List

13 Reward yourself!

Screenshots

Voila! All done for another year. Great job on getting another business chore finished. Having said that, I hope it was kind of fun and rewarding! Your work is still alive and kicking!

: ) Jenny Girl Friday

♥ ♥ ♥ ♥ ♥

P.S. Was this helpful? I sure hope so! If YES, please consider leaving a Tip in the Tip Jar. (Unless you’ve already given an Annual Donation.)

Have any friends with an LLC / PLLC? Forward freely!

Why tips and donations? I’m currently doing all of this work during evenings/weekends. It’s slow going to build this Apothecary on the side. With more funds, I can ‘buy’ more time each month to grow the collection faster. I’m hoping to some day earn enough so it can be a one-day-a-week job.