Filing your BOI Report with FINCEN - a New Requirement for LLCs/PLLCs starting in 2024

UPDATE on 1.7.2025

This requirement is now paused. Here’s a quote from FINCEN:

In light of a recent federal court order, reporting companies are not currently required to file beneficial ownership information with FinCEN and are not subject to liability if they fail to do so while the order remains in force. However, reporting companies may continue to voluntarily submit beneficial ownership information reports. More information is available at https://www.fincen.gov/boi .

Check back with FINCEN, join the Sidekick Service Newsletter, or email me to stay tuned!

Here is the original blogpost, written in March 2024:

Hi there,

This is a new federal requirement - in 2024 - for anyone who has an LLC / PLLC.

Good news! It’s actually simple and quick and free.

It just looks kinda scary. (And some people in social media try to make it look scarier than it is to get your attention, and try to get money out of you.)

Short Story

You just have to log in, and provide the government with information about your LLC/PLLC and the people who own it. That’s it!

Some Details

The requirement includes filing a BOI Report. This stands for Beneficial Ownership Information. You might also see the acronym BOIR, where the R stands for Report.

If you registered your LLC/PLLC before January 1, 2024 … then you have all year to get it done! For you, it’s due by January 1, 2025

If you registered your LLC/PLLC this year, in 2024 … then you need to complete the BOIR within 90 days of registering your LLC/PLLC.

More of the Story

…Some people use LLCs to cover up criminal activity. So a branch called the Financial Crimes Enforcement Network (FINCEN) is tasked with getting info on all the LLCs/PLLCs and their owners, to verify legal activity. And look for the criminal activity.

Filing your BOIR

Get prepped:

It’s easy … you’ll just need:

The EIN for your business (or social security number if you don’t use an EIN)

A photo of your Driver’s License or Passport

The process takes 10-20 minutes. (More if you like to read, and re-read instructions!)

Links:

To File Online - Click here

For helpful walkthroughs and screenshots - Click here

ProTips

Question 16 looks a little confusing at first. They’re basically asking if your LLC/PLLC existed before January 1, 2024. If yes, they refer to it as an “Existing reporting company”. If you click Yes to this, you can skip a whole section.

There are little “Need help?” prompts throughout, with more information.

At the end, they’ll offer you a PDF of the report to download. BE SURE TO DOWNLOAD YOUR TRANSCRIPT! Currently, this is the only way to get confirmation that you filed. You’re not able to do it later….

And/or record somewhere that you finished your BOIR. Later this year, there will probably be lots of scary looking ads out there … and your system might get activated. Then, when you remember that you did this, you can feel calm and victorious.

Wishing you a quick and successful filing.

Considering getting a little reward for yourself for dealing with this pesky chore!

♡ Jenny

How to Close a Business in Seattle

DRAFT FORM

Time to close up shop?

I’ve got you covered.

If this post is helpful to you, please consider leaving a Tip in the Tip Jar. Thank you!

There are two steps to this process:

Part 1 / Alert all agencies - to close the business

+

Part 2 / Do the final tax reporting.

Part One - Alert all Agencies / Closing the Business

1 - IF Relevant to you - Close your LLC/PLLC

With the Secretary of State

Referred to as filing a “Certificate of Dissolution”

Paper form - click this link for the form (if this doesn’t work, search on the SOS.wa.gov site for “close LLC”)

Online - sign into the Corps and Charities Filing System. Look on the left nav for “Dissolution/Withdrawal” link. Search for your LLC/PLLC. Select yours, then follow the instructions.

2 - Close WA State Business License

With Washington DOR (Dept. of Revenue)

Referred to as “Close my Account”

Paper Form - Business Information Change Form. Mailing info on the form.

Online - sign into MYDOR. Click “Get Started” or navigate to your “Excise Tax Account” page. Scroll down, at the bottom, you’ll find a link for “Close License Account.”

3 - Close City of Seattle Business License

With City of Seattle

Referred to as “Cancel a License”

Paper - Write a letter, include this info (Name and phone number, Customer number, Legal name of business, Date business closed). Mail to: Finance and Administrative Services, PO Box 94689, Seattle, WA, 98124-4689

Email - Send an email with the info listed above, to: tax@seattle.gov

Online - Fill out an online form. Click here. If it doesn’t work, please call: 206.684.8484

4 - IF Relevant to you - Close your Account with King County

With King County Department of Assessments

Referred to as “Close Account”

Paper Form - Fill out the Advance Tax Request Form. Click here to download. Address on the top of the form. Need more help? Call 206.296.5126 or email: personal.property@kingcounty.gov

NOTES

• Have any special permits? Or licenses? Please contact the issuers of those to find out how to cancel.

• There is NO need to notify the IRS

Part Two - Final Tax Reporting

1 - Make final report to WA State

Due within 10 days after closing your license.

Note - Some of you file ANNUALLY, some of you file QUARTERLY. You will need to make sure that all reports are complete.

Options:

• Go onto MYDOR, log into your account. Navigate to: “Manage Payments and Returns”. Find all reports that are still due - and complete these. If you need help, call 360.705.6705.

• Call the DOR and ask them to help you. 360.705.6705.

• If you use paper forms, these will likely be mailed to you. You can call the above number for assistance.

2 - Make final report to City of Seattle

DUE - Seattle will let you know. Standard due date is by April 30th of the next calendar year.

Options:

Online - Sign into FileLocal to complete your annual report

Paper - You can request paper forms by emailing tax@seattle.gov or, make the request as part of the Online Form for canceling your license.

3 - IF Relevant - Make final report to IRS

If your business had any activity - whether you had a profit or loss, you will need to report it as part of that year’s taxes. If you are a Sole Prop or Single-Member LLC, then it is reported along with your individual taxes … on the Schedule C form. See this page for info on IRS taxes.

For example, let’s say Meghan closes her music business in June of 2021. She made a small profit of $800. Meghan will need to report her business info next year, before April 2022 along with her personal taxes.

If your business had NO activity in its final calendar year, then there is NO need to report anything with the IRS next April.

NOTE

• Final report to King County was covered earlier, with the Advance Tax Request Form

• NO need to do any financial reporting to the LLC / PLLC. (That is done through your WA state business license.)

Phew! Well done. Be sure to give yourself a nice reward for finishing this chapter - whether it was a short experiment, or on-going side gig, or a major career! It’s worth marking the change, and it’s important to treat yo’self for following through all the way to the end. Need some ideas? Click here for a Reward Menu.

Sole Proprietor or LLC: Which is best for me?

When you work for yourself, you fill two roles in one. The employee and the employer. In order to do this, you have to create a business entity that essentially hires you. It feels a little like make-believe play – All I want to do is my work! – but it is necessary. The two most common options are sole proprietor and limited liability company, or LLC.

It is the first decision that you need to make, because it determines your legal status and name options. And, you’ll be asked about it right away when registering your license.

Sole Proprietor

Advantages: simplest and cheapest

Legal Name: must be your name

Disadvantage: liability – if someone sues your business, they are suing you

In this case, you and the business are considered one in the same. There’s no real structure to set up or maintain. You simply are required to have licenses and pay taxes. It is free. There are no additional obligations, and no special benefits. Except that the paperwork is the most streamlined.

There is a risk, though. If someone sues your business, they are suing you too. Meaning, if they win and you owe them money, it comes out of your personal accounts. In a worst case scenario, you’d have to sell your house or drain accounts to pay them.

You can do business under a different name, called your trade name, or DBA, Doing Business As. For example, Jane Doe’s legal business name would be Jane Doe. She could do business as, Polka Dot Consulting. She just has to register this name, so her business activity is traceable to her legal name. These only cost $5 each. When you apply for your license, you can choose 1 or more.

LLC

Advantages: protection from lawsuits, looks official

Legal Name: must include a version of LLC*

Disadvantage: it costs some money each year

In this case, the business is a company that is separate from you. It offers a layer of protection. If someone sues your company and wins, then they can take company assets (not your personal ones). In my case, this includes a small business savings account, my computer, printer, and lots of great books. The idea is that your home and personal monies are protected. Having said that, it is possible to get around that protection – depending on the case and the lawyer. If you want to know more on the subject, I suggest meeting with a small business lawyer to share more about your specific situation.

You must apply with the Secretary of State to be granted this entity. It costs about $200. And, you must renew each year on the anniversary month, for about $80.

The LLC also looks serious and cool. For people that don’t know, it helps you to look official. This can be a boon for certain types of business. You can also use DBAs. (But they may not include variations of LLC.)

Concerning the IRS – Good news!

A cool thing is that you don’t have to do anything different for the IRS! That is, if you are a single-member LLC. Because you are still a one-person business, and there’s no dividing of profit, the IRS lumps you in with Sole Proprietors. In fact, they refer to you as a “disregarded entity”. You are not regarded! You are ignored. This is great because it keeps your paperwork simple.

•

In the end, both serve different purposes. Often - people who are tight on cash, or starting before they're totally ready, or intimidated by the LLC – choose sole proprietor. For others who have the money, and/or are really committed to their vision, tend to go for the LLC! You even get a certificate with borders and a golden seal to frame.

If you have questions, please, get in touch. Click here to read a post on how to get licensed in Seattle.

Happy Working,

Jenny Girl Friday

Girl Friday LLC

DBAs:

Jenny Girl Friday

Jenny MacLeod

Girl Friday

girlFriday

*Limited Liability Company, Limited Liability Co., LLC, or L.L.C.

• How to Renew your LLC / PLLC (aka file annual report)

If you have an LLC or PLLC, you must ‘renew’ it each year to keep it going. Officially, it’s referred to as filing your Annual Report. It’s quick and costs about $60. It’s due on the anniversary month of when you opened it.

Some reminders

This is different than your business license. Your LLC / PLLC is a legal entity that you created. It has its own limits, responsibilities and protections. It’s separate from you (like an 18 year old child). It can only practice business if you keep it alive and it is properly licensed. To keep it alive is a legal issue (vs. financial), that’s why we’re dealing with the Secretary of State.

Basic Info to Renew / Make Annual Report

TIME: 2 - 10 minutes

COST: $60

DUE: On the anniversary month when it was formed

Frustration Factor: 4 out of 10

WEBSITE: ccfs.sos.wa.gov/#/

GOVT: Secretary of State

HELP: 360.725.0377

Summary

Set up a profile if needed. Log in. Double check that your name and address is filled in for every role (governor, registered agent, executor, etc.). Get to the end, pay $60. Mark off your Important Dates List (Annual, Quarterly). Reward yourself!

Why?

LLCs / PLLCs were originally created for groups of people coming together to do business. Each owner is actually called a Member. The annual report is saying, Yes, it’s still going. Here’s who is doing which role. With bigger groups, this matters! For a single-member LLC / PLLC, it feels a little silly because generally we serve all the roles! By making this report, we confirming that all this info is the same.

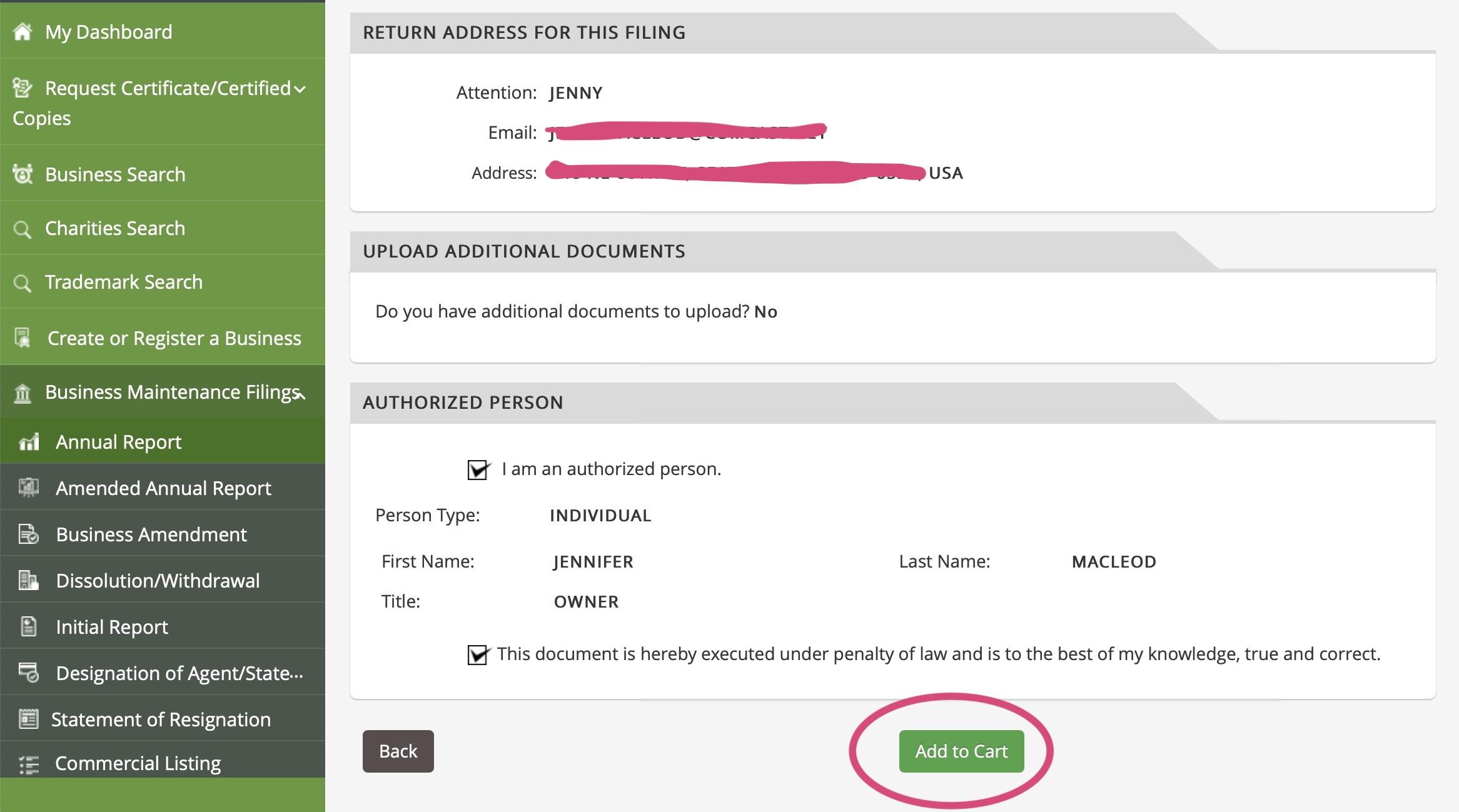

Steps - Screen shots below

1 Go to SOS.wa.gov

2 Click on CORPORATIONS in the Top Nav to open the menu

3 Find CORPS & CHARITIES FILING SYSTEM

4 Sign in ….or create a profile, then sign in when directed

5 Find ANNUAL REPORT on the Left Nav

6 Search for your Business using your UBI or Name

7 Select your name from the List

8 Confirm all your information, make changes or additions if needed

9 Review

10 Add to Cart and Pay

11 Optional - print or save the pdf for your records

12 Mark as done on your Important Dates List

13 Reward yourself!

Screenshots

Voila! All done for another year. Great job on getting another business chore finished. Having said that, I hope it was kind of fun and rewarding! Your work is still alive and kicking!

: ) Jenny Girl Friday

♥ ♥ ♥ ♥ ♥

P.S. Was this helpful? I sure hope so! If YES, please consider leaving a Tip in the Tip Jar. (Unless you’ve already given an Annual Donation.)

Have any friends with an LLC / PLLC? Forward freely!

Why tips and donations? I’m currently doing all of this work during evenings/weekends. It’s slow going to build this Apothecary on the side. With more funds, I can ‘buy’ more time each month to grow the collection faster. I’m hoping to some day earn enough so it can be a one-day-a-week job.

If NO, then send me your questions, or let me know where things are confusing. I’d love to clear it up for you and other folks! jennygirlfriday@gmail.com

• How to Set Up Your Business in Seattle - as an LLC / PLLC

A Bigger Splash, David Hockney • Credit below.

Setting up an LLC business doesn't take much time! ….That is, if you know what to do, what you need, and the right order of steps. Here's where I've got you covered.

(Not sure if you want an LLC? Read Sole Proprietor or LLC: Which is Best for Me?)

Below is the quick and dirty list. Detailed notes are at the bottom of the post.

If you know your business name(s), the whole process takes about one hour.

Go ahead, take the plunge!

Pro Tip: Get a journal to record all your log-ins, passwords, IDs, and various notes as you go through the process. Use in the future for all research and calls related to taxes and licensing.

1) Register your LLC / PLLC.

Through: the Washington Secretary of State

Click here to go directly to registration.

Cost: $200

Time: 10 minutes

2) Pause + wait for your UBI

You'll need your UBI to go on to the next steps. (Unified Business Identifier.) It's a lot like your social security number, in that it's a tax ID number assigned to you ... and banks and other organizations will ask for it to identify you. It'll be provided along with your LLC documents. Most often, it's in a 9 digit format. Sometimes it'll be in a 16 digit format, where there are 0s and 1s at the end, noting your "business ID" and "location ID".

3) Apply for your state business license.

Through: Washington State Business Licensing Service (BLS)

Uses MyDOR portal.

Click here to go to read more information on the BLS.WA.gov site

Cost: $19 plus $5 for each DBA

Time: 15 - 20 minutes

4) Apply for your city business license.

Through: City of Seattle Business Department

Uses the FileLocal Portal.

Click here to read more on the city’s website

Cost: $113 for standard, $56 if you plan to gross under $20K per year.

Time: 15 - 20 minutes

That's it! You're in business. …but you're not quite done. To be legal, you need to ensure that you have all of the special permits and licenses for your line of business.

5) Optional ~ Apply for an EIN

EIN stands for Employer Identification Number. It's a tax ID number assigned to businesses by the IRS. If you are a sole prop or a single-member LLC, you are allowed to use your SSN for business purposes. Having said that, banks and online forms will often required you to have an EIN. The issue is that the number formatting is different. With your social security number, it looks like 000-00-0000. With an EIN, it looks like 00-0000000.

Good news! It's easy, free, and only takes 10 minutes. Here's the link: Get EIN on IRS.gov. Or, go to IRS.gov and search for EIN. Heads up, this web service is only available during the daytime.

6) Do your due diligence.

At the state level, check the List of Licenses

This is a list by trade, with links to relevant licensing agencies.

Here's the list of Endorsements required by some businesses.

Or, call the BLS: 1-800-451-7985

And, at the city level, check the Regulatory Endorsements page.

Or, call the City of Seattle: 206.684.2489

Another nice tool is the WA Business Hub. It's created to walk anyone through the setting up a business. There's a TON on there.

7) Celebrate!

* * Please note: The intent of this post is to get you started! And, to provide you with the required framework for every business. Your field may require additional permitting or specialty licenses not covered here. For best results, call the city or state.

Happy Working,

Jenny Girl Friday

Some Helpful Details

With the LLC Registration

Some things you'll be asked:

• the legal name of your company

• 2 alternate names

• start date - day of filing, or a specific date

(Tip: pick one that's easy to remember or has meaning for you.)

• perpetual or specific time period

Mostly, you will have to put your name and address in a million times. Because, as a single-member LLC, you are the member, the manager, the agent, and registrar. You fill all the roles.

Even though you will be a limited liability company, LLCs are handled along with the corporations.

For the State Business License

Some things you'll be asked:

• the UBI - you get this when your LLC goes through - it is your Unified Business Identifier

• what bank you'll be using

• your SSN and your partner's SSN

• description of your business: 1- 2 sentences

• trade name(s)

• which cities you'll be doing business in (you need a license for each one)

For the City Business License

Some things you'll be asked:

• the UBI - you get this when your LLC goes through - it is your Unified Business Identifier

• estimated income