How to file B&O Taxes with Seattle

Service Providers - click here

Retail or Combo Business (service + retail) - click here

For Service Providers ~ How to Make Your Annual Report to the City of Seattle (for B&O Taxes)

Good News! For MOST people, this hoop is easy and free.

(If you earned under $100K.)

If your business is strictly service-oriented...and NON-retail, it's pretty easy to make your report to the city and to the state.

If you are a retail business, or a combination of service + retail, click here to read a different walkthrough. To learn more about Service vs. Retail Services, click here.

Due: April 30th

Time Required: 5 - 30 minutes

Frustration Factor: 6 out of 10

Cost/Taxes Due: If you earned under $100K, then you will NOT pay any taxes. To read about tax rates for over $100K with Seattle, click here.

Type of Tax: B&O (business and occupation)

Summary of the Task

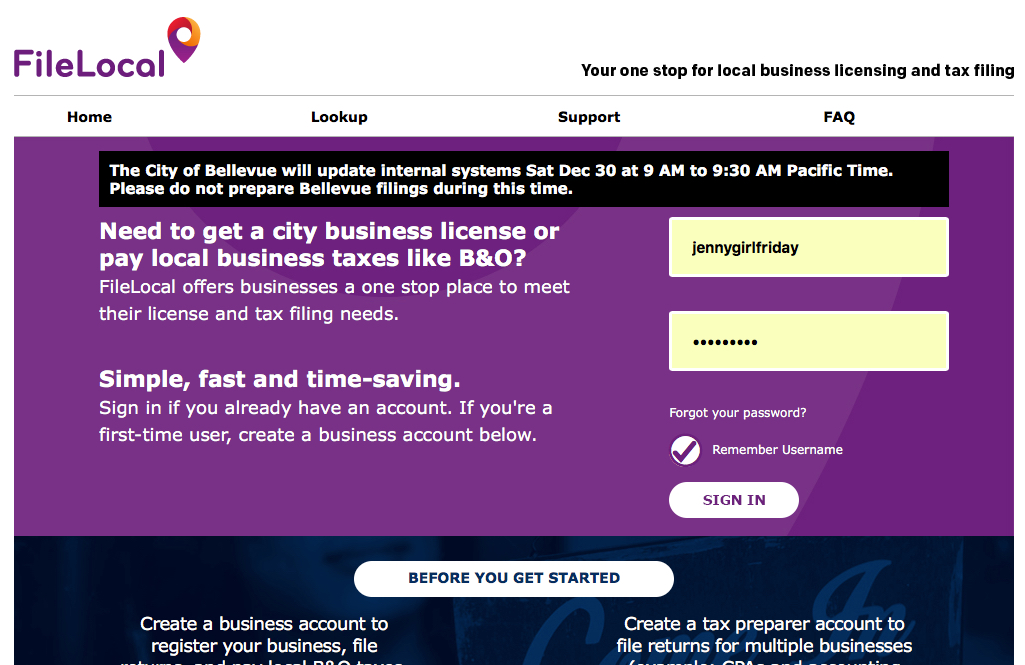

1. Log in

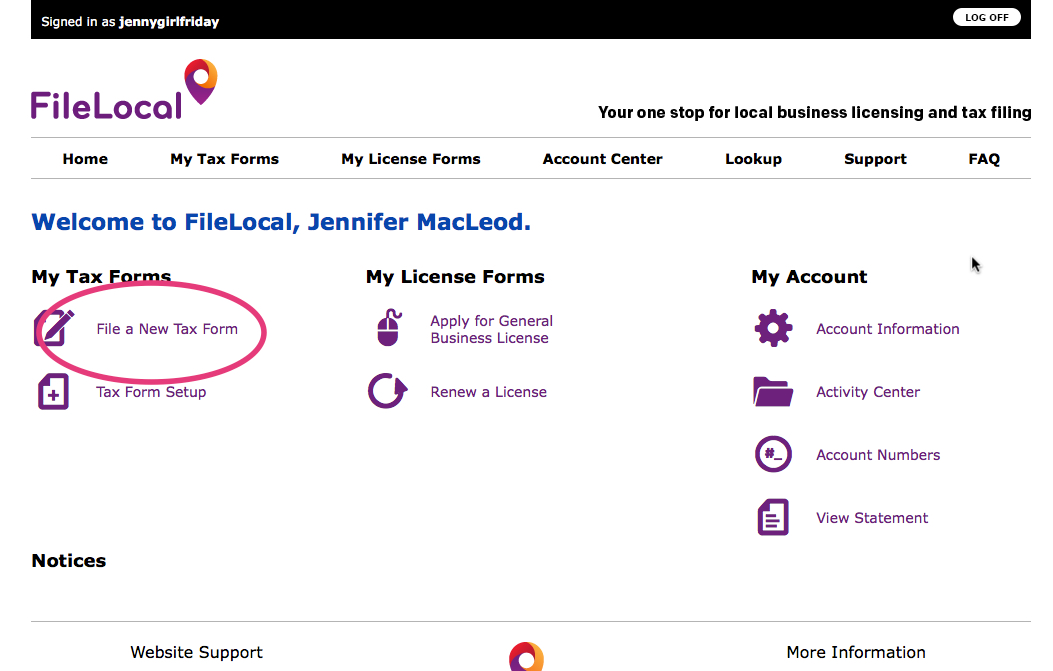

2. Find the ONE correct box the portal

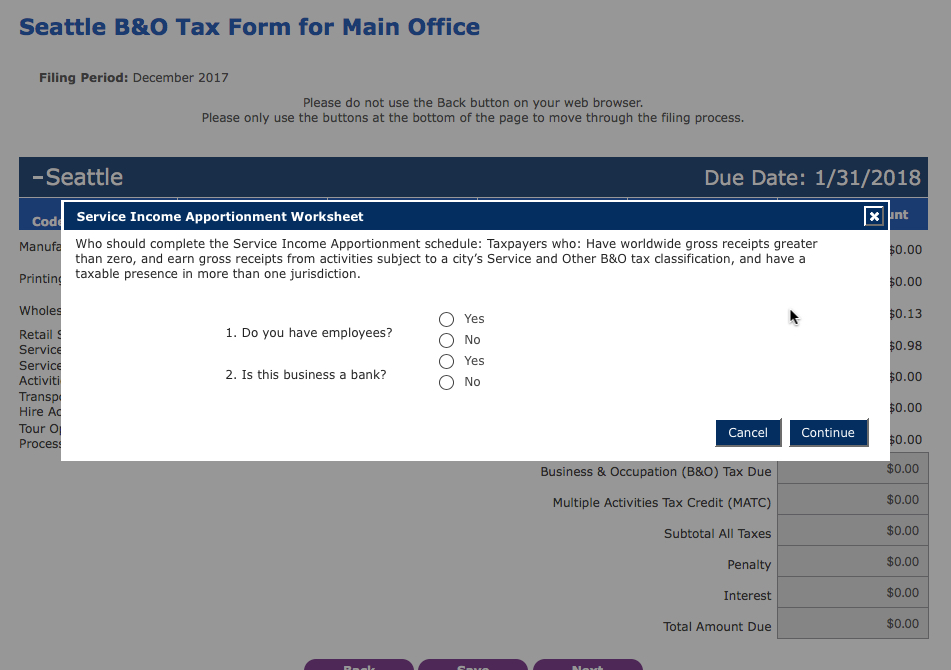

3. A worksheet pops out with a few questions

3. Then, enter your total gross sales in 2 places. And Inside-of-Seattle gross sales in one place.

4. Click next until you're done

Here's what you'll need to get ready:

• Gross Sales—The total amount of money you collected from your work. (That's it, no need to figure out deductions yet.) Can also referred to as Gross Service Receipts.

• If Applicable—The total amount of money you earned INSIDE Seattle. (Versus other cities.)

• Log In + password to either FileLocal.

Note: If you don't have a FileLocal account, you'll need to set one up. It takes some time to create this account, because FileLocal wants all of your numbers (UBI, EIN, etc. Click here to learn more.)

Recommendation + Note

♥ If you get stuck, call the city directly at: 206.684.8484. Have your UBI handy. (Your state business ID.)

♥ Ask a friend to sit next to you the first time, to be a 2nd set of eyes.

Here we go!

Click here to go to FileLocal.

For ANNUAL filers (most or all of you) ... we select December of the desired year.

Troubleshooting Note

If there are No tax forms in the dropdown menu, you’ll need to do another little process…….you’ll have to Add Tax Forms to your profile. (A walkthrough is coming.) Meanwhile, scroll to the bottom of this post for the basic steps.

After you answer these questions, the worksheet will expand. Note: you are NOT an employee; you're the owner.

On this screen, you need to enter your Gross Sales (or Gross Service Receipts):

- Total Worldwide - Lines 1 and 8

- Total Seattle - Line 7

If you did all your work in Seattle, these should be the same.

If you worked in different cities, I suggest calling the city to walk you through this part. 206.684.8484

Here's the same worksheet with some numbers filled in. Enter the amounts in lines 1 and 7. The worksheet will populate with more numbers.

Line 12 says, "Seattle Taxable Receipts". This should match the amount of total sales for your business that happened in Seattle.

(Little note: I apologize if these notes sound confusing. I found this form to be surprisingly non-intuitive compared to past forms, and am still trying to wrap my own head around it. Remember, if you get stuck, call the city!)

After you hit "continue" it takes you back to the screen you were on.

Where the pink lines are, it shows my Total Sales ......and then the tax due. (If I were to owe tax.) Your tax due will be ZERO if you earned less than $100k. (For some reason, it still shows you what you would’ve paid if you earned over $100K, but you can see in the grey boxes that you owe $0.)

Review, and if things look good, hit Next.

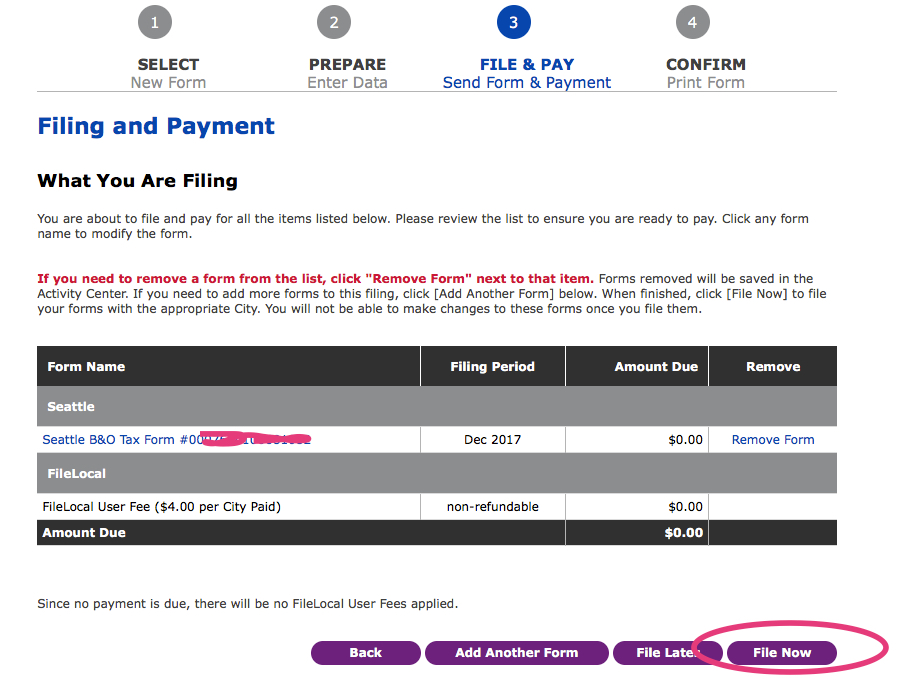

When everything looks good, hit File Now. The newest version of FileLocal actually has you confirm 4 times. Only two are shown here.

Note ~ The first two times I hit Yes, I got an error screen! I waited a few days, tried again....I logged in, all my numbers were still there, and then it worked! Who knows why.

Here's what the confirmation page looks like, plus you'll get an email confirmation.

Troubleshooting Note: If the “Seattle B&O Tax” form is missing from your drop down

1 - Go to the Home Page

2 - Select “Tax Form Setup”

3 - Select “Add New Tax Form”

Complete the screen……

4 - Under forms, choose “Seattle B&O Tax”

5 - For your city account#, use your 9 digit UBI + 0010001

6 - For filing status, choose Annual

7 - Once complete, go back to the home screen to start again.

Well done! One important hoop is over. Reporting your gross sales is a great moment ... you get to see all of the business you accomplished over the last year.

: ) Jenny Girl Friday

P.S. I’m working for TIPS! If this was helpful, please consider leaving something in the Tip Jar.

For Retail + Combo Businesses ~ How To Make Your Annual Report To The City Of Seattle (For B&O Taxes)

Hello + Note from January 9, 2019: Last year, the city started using a new portal called FileLocal. You’ll need to set up a user account there in order to make this report. Click here to read more.

Does your work include: retail, retail-service, wholesale, manufacturing, or royalties. Or a combination?

Then this post is for you!

If your business is NON-retail SERVICE only, click here to see a different walkthrough.

Due: April 30

Time Required: 2 - 8 minutes to file

Frustration Factor: 6 out of 10.

Cost/Taxes Due: If you earned under $100K (gross sales), then you will not pay any taxes to Seattle. To read about tax rates for over $100K with Seattle, click here.

Type of Tax: B&O (business and occupation)

With: City of Seattle

Use: FileLocal-wa.gov.

If you need help, call the city at: 206.684.8484

Summary

1. Log in to FileLocal-wa.gov

2. Find that business categories that apply to you: retail, wholesale, service, printing, manufacturing

3. Fill in total sales for each category

4. Hit next until the end, confirm

5. If you earned over $100K in total gross sales, complete the payment screens

One Note: The state collects sales tax for Seattle. So if you have to submit sales tax, you'll do that through the WA state DOR, Department of Revenue.

Some Screenshots below.

How to Prepare - If You are NEW to This :)

Reporting to Seattle is very similar to reporting to the WA state DOR. I recommend preparing for both at once. Everyone's situation is a little different, so it's hard to give estimates or exact instructions.

Here's what I recommend:

1. Schedule some prep time on your calendar in the next week

2. Schedule a 20 - 40 minute block for tax filing, during the weekday, with a plan to call the city if needed (they will walk you through this). This is includes buffer time.

3. Print out the the Ready, Set, File - Seattle! worksheet.

4. During your prep time, fill out as many numbers as you can on the back side of the worksheet.

5. On your scheduled day, give it a try. If you have to call the city, be prepared to wait...have something fun to do while on hold.

Okay, let’s get started.

Head to FileLocal and sign in.

The directions say to choose the last month of the period you're filing for.

With Annual Reports, choose December of the last year.

It took a few seconds for these drop down menus to work. Choose "Seattle B&O tax form" and your Main branch. (Or whatever you named it.)

Fill in each box relevant to your business.

The total sales in each category, NOT including any sales tax that you collected.

This is a second view of the same screen. Note, this symbol means a (confusing) worksheet is about to pop up.

It includes boxes for Royalties and NON-Retail Services

Some questions. Note: you are NOT an employee. You are the business owner.

Royalty information~ enter in the box circled in Green.

Non-Retail Services, enter Gross Sales in three places

1. Line 1 and 8 - for Worldwide Gross Service Receipts. (Worldwide!!!)

2. Line 7 for Seattle Service Receipts

If you did all your work in Seattle, these should be the same.

Notice, the form will fill in some numbers for you.....

A shot after this screen is filled in. You can only change the numbers in White.

This example shows gross sales + taxes in three categories.

Note, no tax is due............because this person earned under $100K.

Eventually, this screen pops up as a confirmation. Hurray! Success!!!!!

FYI - the first 3 times I tried, I got this error message. I waited a few days, and tried again and it worked! One good thing........FileLocal had kept all my numbers, so I just had to move through all the screens.

Well done! Phew! One thing about reporting to the city is that it forces us to know our total sales number. I find that kind of rewarding, how about you?

One more hoop of tax season is all done. Be sure to give yourself a little or even medium reward! Perhaps some Theo's chocolate, some yummy juice from HeartBeet, or a trip to Ladywell's.

: ) Jenny Girl Friday

P.S. Did this help you? Pretty please share with any friends, or post on Facebook. I think self-employed folks are keeping the soul in Seattle. I want to make the chores of business easier, so you all can keep being awesome.

P.S. 2 Are you signed up for Sidekick Services via email? Get reminders and links to how-tos delivered right to your email inbox. :)