For Service Providers ~ How to Make Your Annual Report to the City of Seattle (for B&O Taxes)

Good News! For MOST people, this hoop is easy and free.

(If you earned under $100K.)

If your business is strictly service-oriented...and NON-retail, it's pretty easy to make your report to the city and to the state.

If you are a retail business, or a combination of service + retail, click here to read a different walkthrough. To learn more about Service vs. Retail Services, click here.

Due: April 30th

Time Required: 5 - 30 minutes

Frustration Factor: 6 out of 10

Cost/Taxes Due: If you earned under $100K, then you will NOT pay any taxes. To read about tax rates for over $100K with Seattle, click here.

Type of Tax: B&O (business and occupation)

Summary of the Task

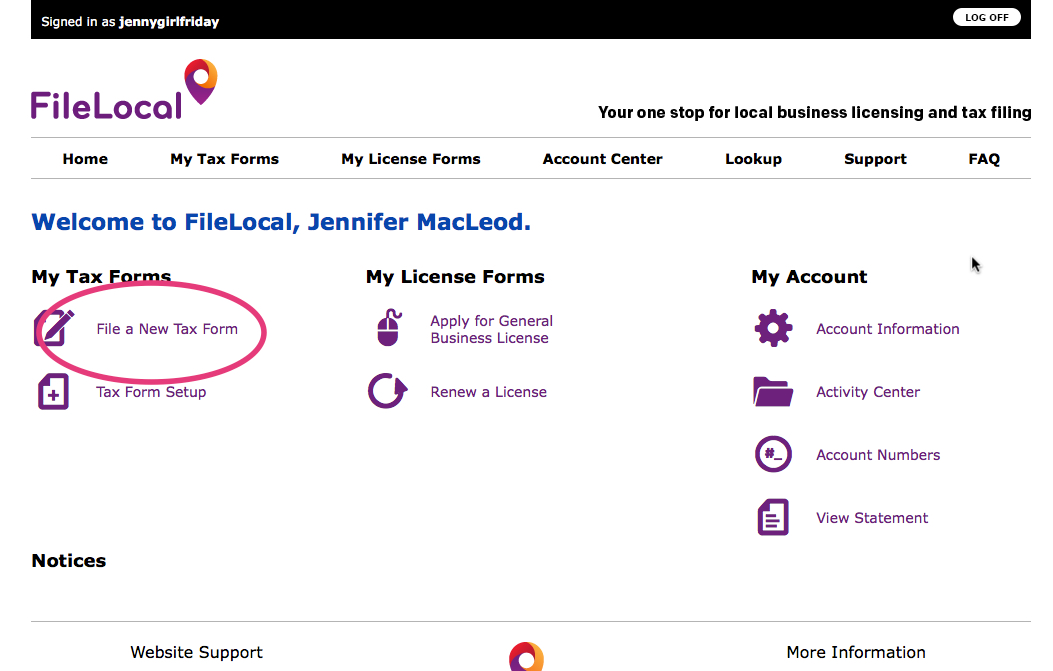

1. Log in

2. Find the ONE correct box the portal

3. A worksheet pops out with a few questions

3. Then, enter your total gross sales in 2 places. And Inside-of-Seattle gross sales in one place.

4. Click next until you're done

Here's what you'll need to get ready:

• Gross Sales—The total amount of money you collected from your work. (That's it, no need to figure out deductions yet.) Can also referred to as Gross Service Receipts.

• If Applicable—The total amount of money you earned INSIDE Seattle. (Versus other cities.)

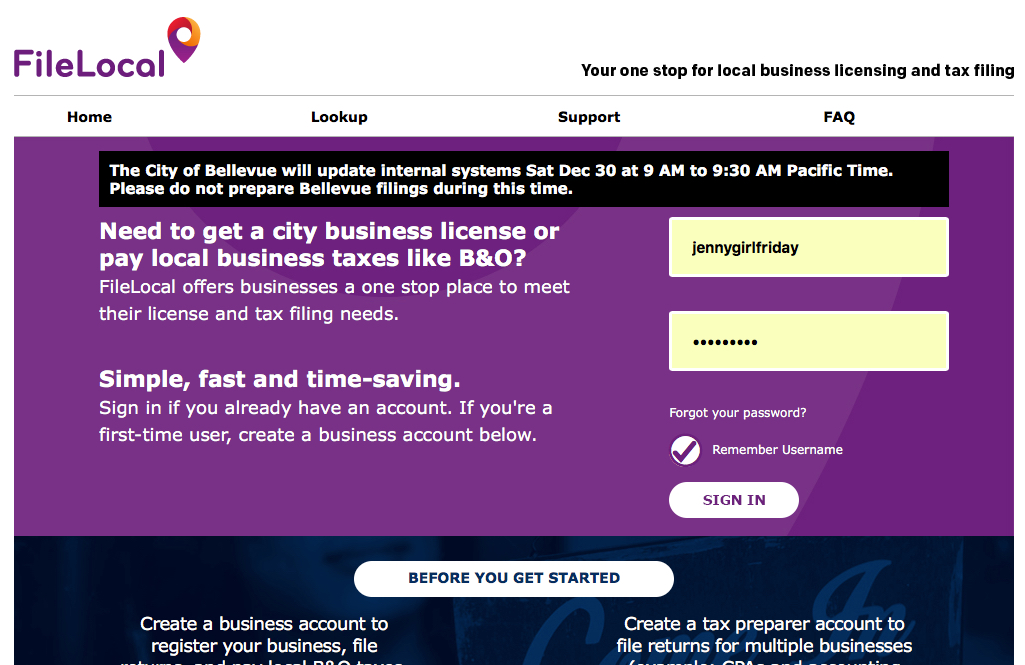

• Log In + password to either FileLocal.

Note: If you don't have a FileLocal account, you'll need to set one up. It takes some time to create this account, because FileLocal wants all of your numbers (UBI, EIN, etc. Click here to learn more.)

Recommendation + Note

♥ If you get stuck, call the city directly at: 206.684.8484. Have your UBI handy. (Your state business ID.)

♥ Ask a friend to sit next to you the first time, to be a 2nd set of eyes.

Here we go!

Click here to go to FileLocal.

For ANNUAL filers (most or all of you) ... we select December of the desired year.

Troubleshooting Note

If there are No tax forms in the dropdown menu, you’ll need to do another little process…….you’ll have to Add Tax Forms to your profile. (A walkthrough is coming.) Meanwhile, scroll to the bottom of this post for the basic steps.

After you answer these questions, the worksheet will expand. Note: you are NOT an employee; you're the owner.

On this screen, you need to enter your Gross Sales (or Gross Service Receipts):

- Total Worldwide - Lines 1 and 8

- Total Seattle - Line 7

If you did all your work in Seattle, these should be the same.

If you worked in different cities, I suggest calling the city to walk you through this part. 206.684.8484

Here's the same worksheet with some numbers filled in. Enter the amounts in lines 1 and 7. The worksheet will populate with more numbers.

Line 12 says, "Seattle Taxable Receipts". This should match the amount of total sales for your business that happened in Seattle.

(Little note: I apologize if these notes sound confusing. I found this form to be surprisingly non-intuitive compared to past forms, and am still trying to wrap my own head around it. Remember, if you get stuck, call the city!)

After you hit "continue" it takes you back to the screen you were on.

Where the pink lines are, it shows my Total Sales ......and then the tax due. (If I were to owe tax.) Your tax due will be ZERO if you earned less than $100k. (For some reason, it still shows you what you would’ve paid if you earned over $100K, but you can see in the grey boxes that you owe $0.)

Review, and if things look good, hit Next.

When everything looks good, hit File Now. The newest version of FileLocal actually has you confirm 4 times. Only two are shown here.

Note ~ The first two times I hit Yes, I got an error screen! I waited a few days, tried again....I logged in, all my numbers were still there, and then it worked! Who knows why.

Here's what the confirmation page looks like, plus you'll get an email confirmation.

Troubleshooting Note: If the “Seattle B&O Tax” form is missing from your drop down

1 - Go to the Home Page

2 - Select “Tax Form Setup”

3 - Select “Add New Tax Form”

Complete the screen……

4 - Under forms, choose “Seattle B&O Tax”

5 - For your city account#, use your 9 digit UBI + 0010001

6 - For filing status, choose Annual

7 - Once complete, go back to the home screen to start again.

Well done! One important hoop is over. Reporting your gross sales is a great moment ... you get to see all of the business you accomplished over the last year.

: ) Jenny Girl Friday

P.S. I’m working for TIPS! If this was helpful, please consider leaving something in the Tip Jar.