Meet FileLocal - Seattle's New Portal for License Renewal and B & O Tax Reporting

Important Note: Filelocal has changed it’s sign up process, so the screenshots will look different than what you see below. This will still give you a general idea. I hope to update soon! ~ January 16, 2019

Grab some coffee (maybe wine), a few deep breaths, perhaps a friend ... and get ready to set up your FileLocal account.

Estimated Time: 10 - 25 minutes

Frustration Factor: 4 out of 10

Cost: Free

Recommended Timeframe: November or December

If you're self-employed in Seattle, the city requires three things of you:

• Get a city business license, when you start

• Renew city business license, annually

• Make a report of Gross Sales, annually*

If you make over $100K, then there's a fourth requirement: paying B & O taxes.

*For most. Some businesses are required to report quarterly.

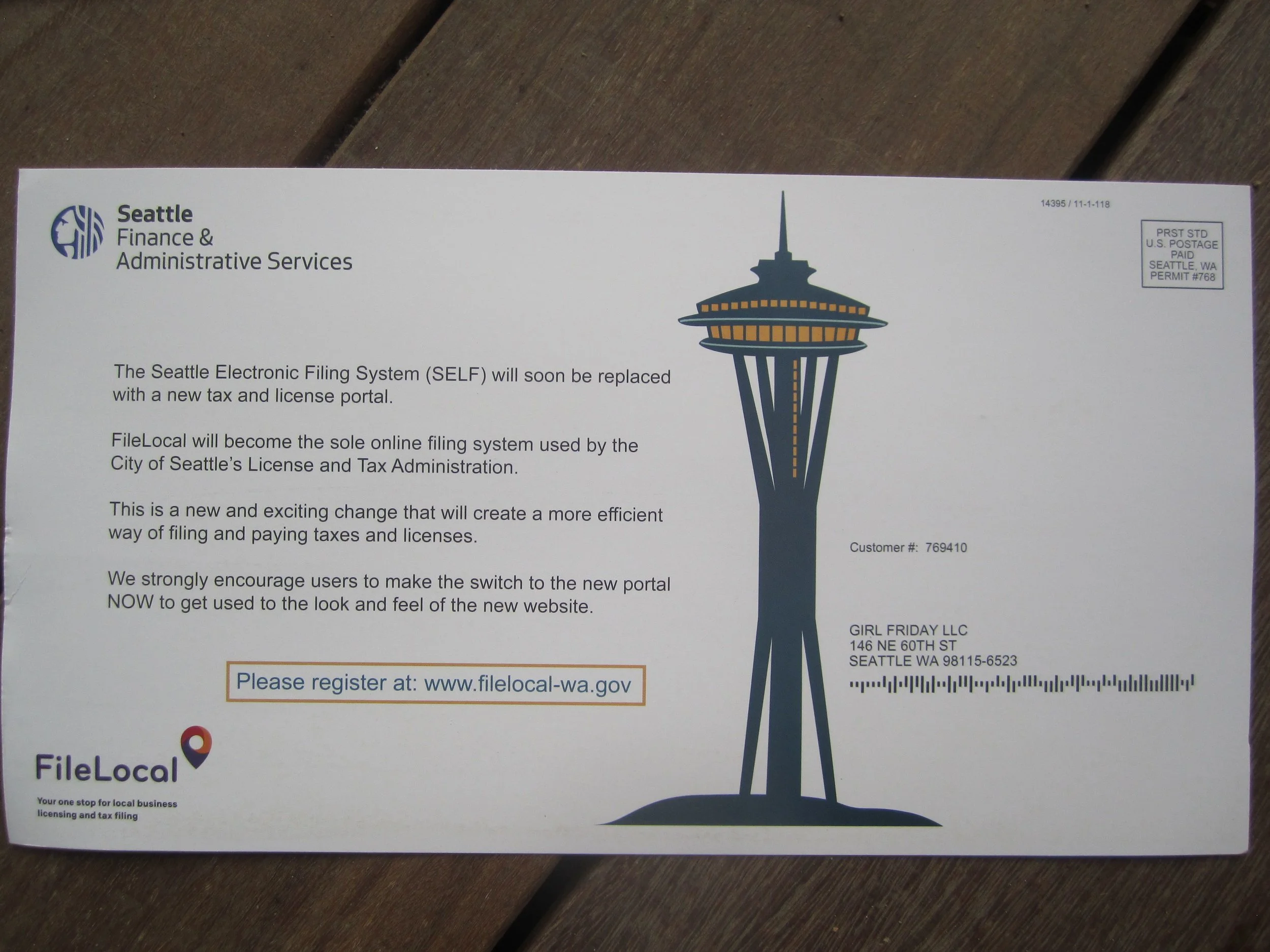

In the past, Seattle used a portal called SELF. It's now switching over to FileLocal.

The city's encouraging us to set up our FileLocal account sooner than later ... and I can sure see why! I just ran through it this morning, hit a snag, and had to find a ton of information! Not to worry, I've got you covered. :)

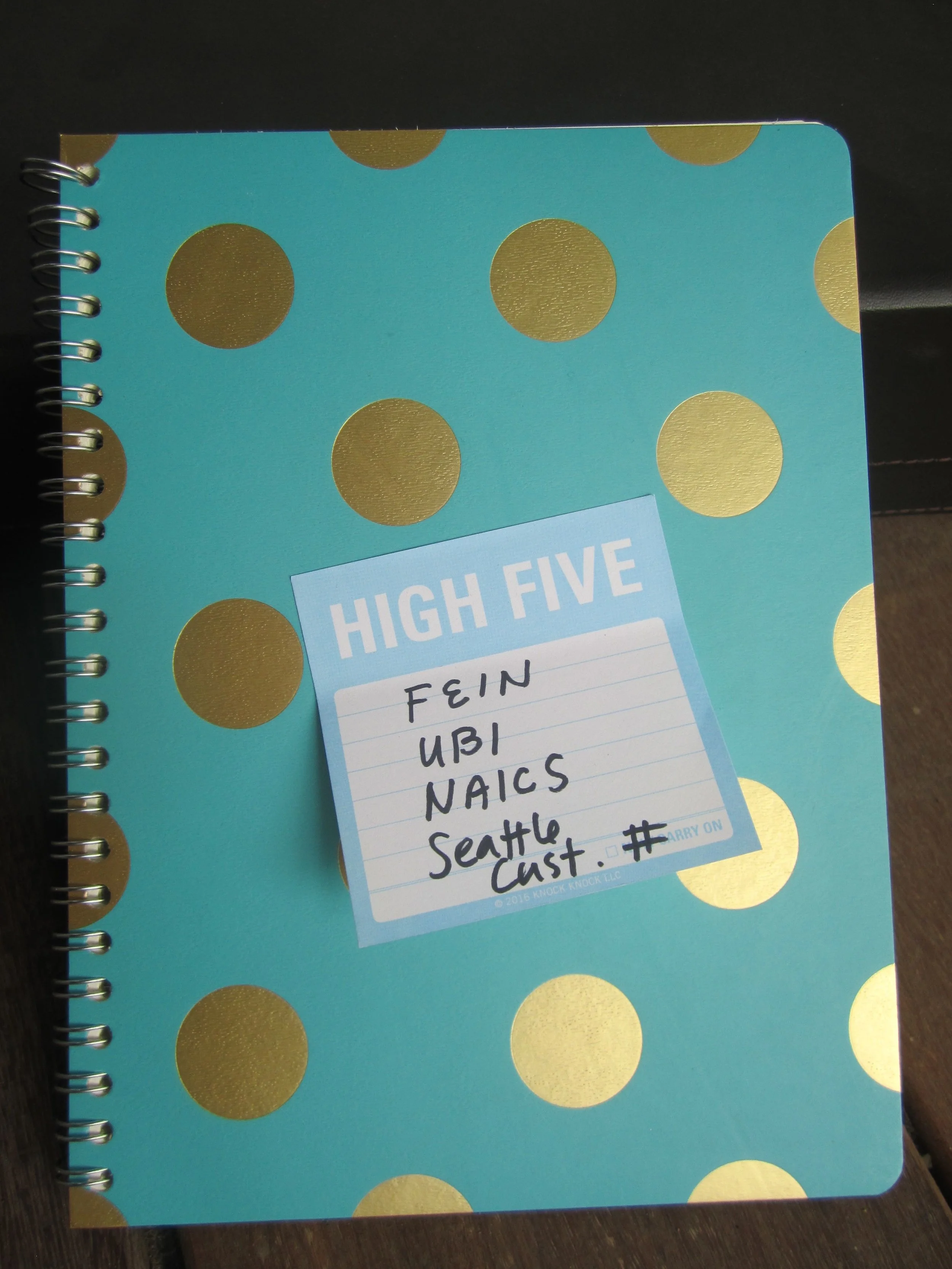

FileLocal asks for ALL of your business numbers. You can either find these things as you go, or look them up ahead of time. It definitely took me a little rummaging... This list might vary in order from the application. ProTip: If you haven't already, write all your numbers in one special notebook.

The List in Brief (details below):

1. Federal Tax Number

2. UBI - 16 digit version

3. NAICS code

4. Seattle Customer Number

1. Federal Tax Number. If you are a sole prop or a single-member LLC, you might be using your SSN for this. This is totally fine for the IRS. However, this form requires you to have an EIN! (Or FEIN.) So, if you don't have one already, you'll need to get one. It's easy, free, and only takes 10 minutes. Here's the link: Get EIN on IRS.gov. Or, go to IRS.gov and search for EIN. Heads up, this web service is only available during the daytime.

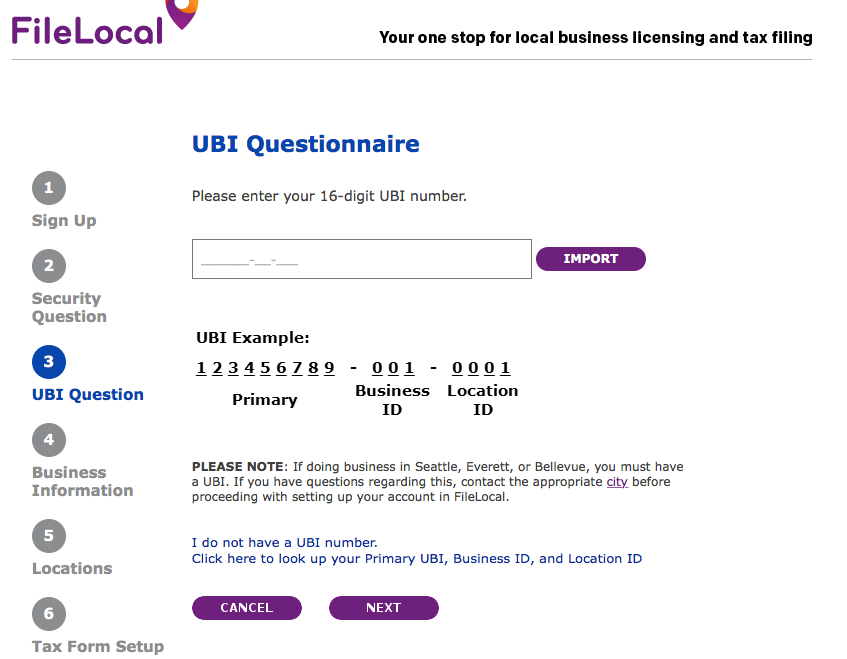

2. UBI - 16 digit version. This is your WA state business number + some codes. (UBI stands for Unified Business Identifier.) Usually, we only use 9 digits. It's in the form ###-###-###. The 16 digit version asks you to add two numbers at the end. Your Business ID and Location ID. If you only have one office, then it's easy. Business ID is 001, and Location ID is 0001.

So, your number will look like ### ### ### 001 0001. Screenshot below.

To find your UBI, you can: look on your LLC certificate (if you have one), look on your WA state business license, or look on your city license. OR, you can search for your business at the DOR lookup.

3. NAICS code. This is a code assigned to your business by the state. It's used for statistical purposes only. The easiest way to find it is to use the DOR lookup. Once the search results come up, select your business, view your profile, and the code will be listed there. The other option is to select one that matches your business ... using the dropdown menu on the FileLocal form.

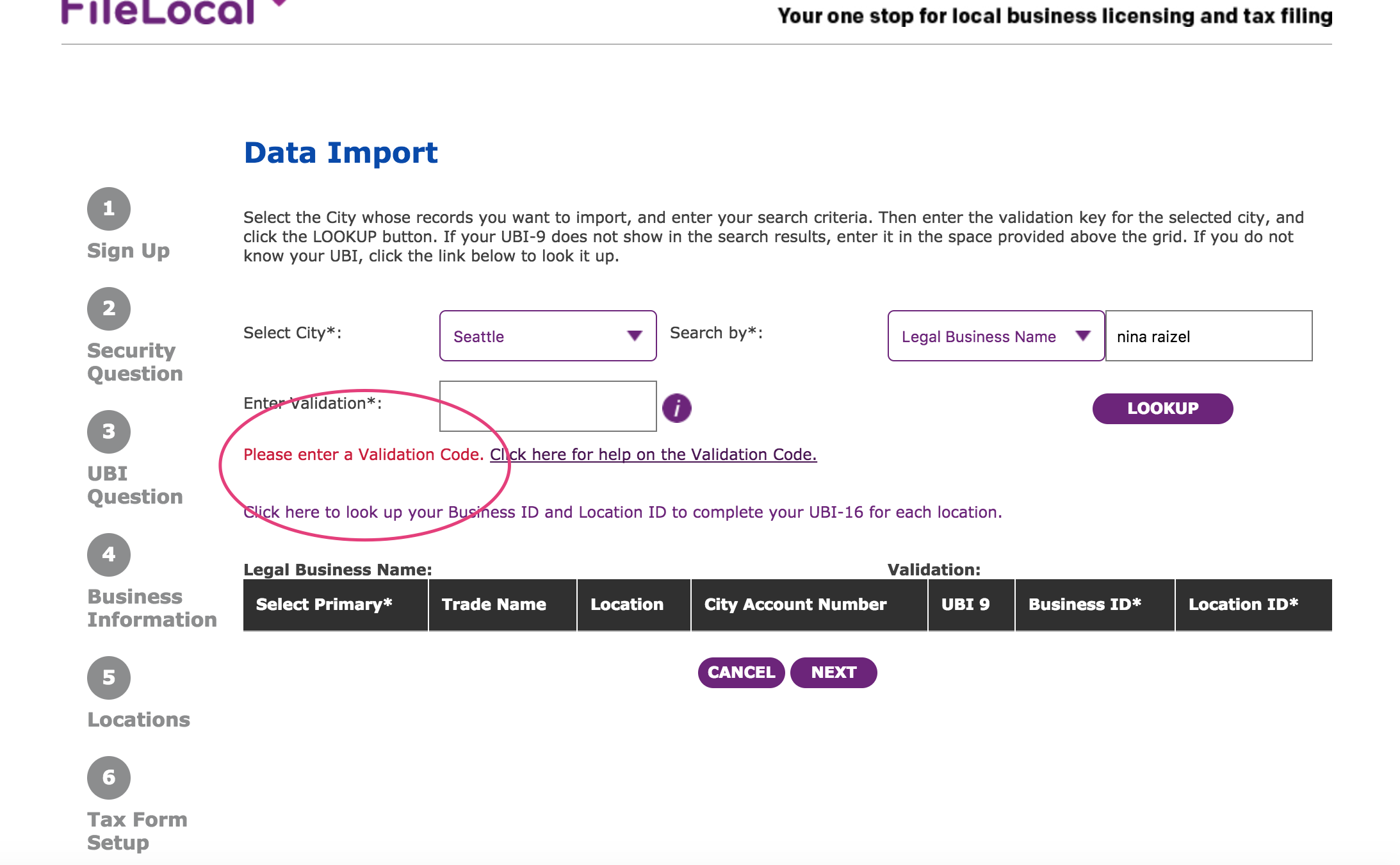

4. Seattle Customer Number. Early in the application it asks for "City Account Number". It wants the Seattle Customer Number that's been assigned to you. It also comes up if you want to search for your UBI. On that screen, it asks for your Validation or Verification number. (I can't remember which.) Your Seattle Customer Number is the ticket there.

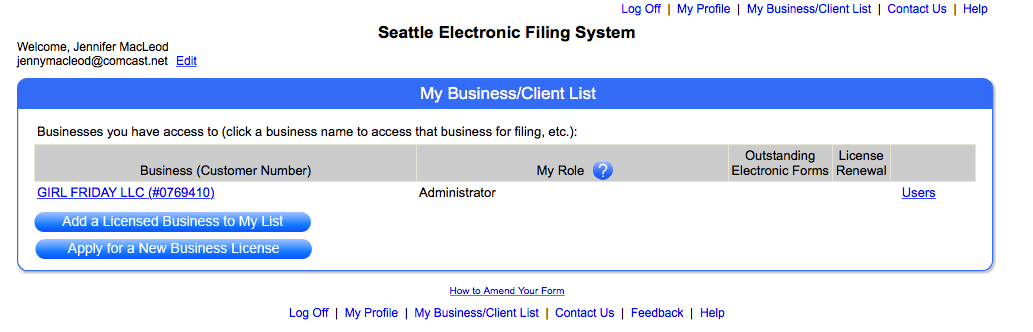

To find your Seattle Customer Number, look on your city business license, or sign into the SELF Portal, and look at your list of businesses. It's listed next to the name of your business.

Summary

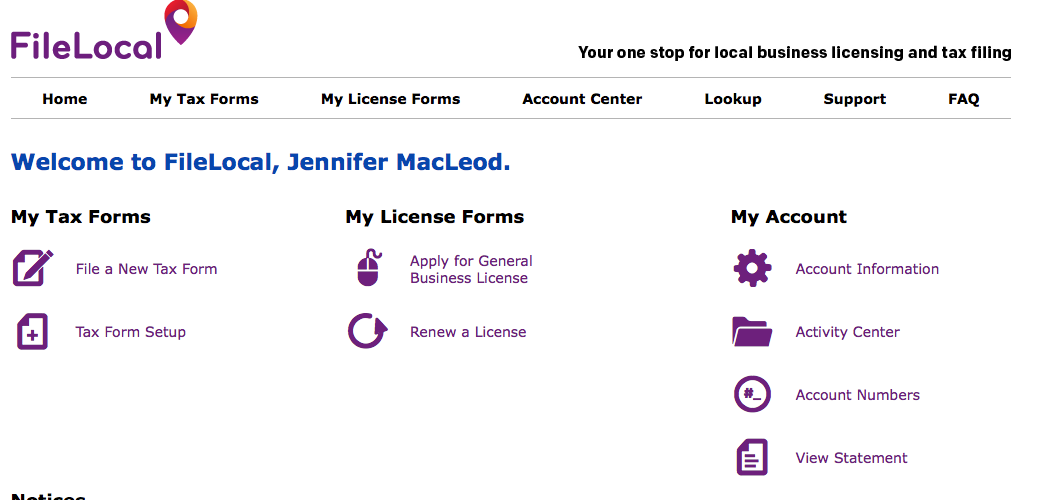

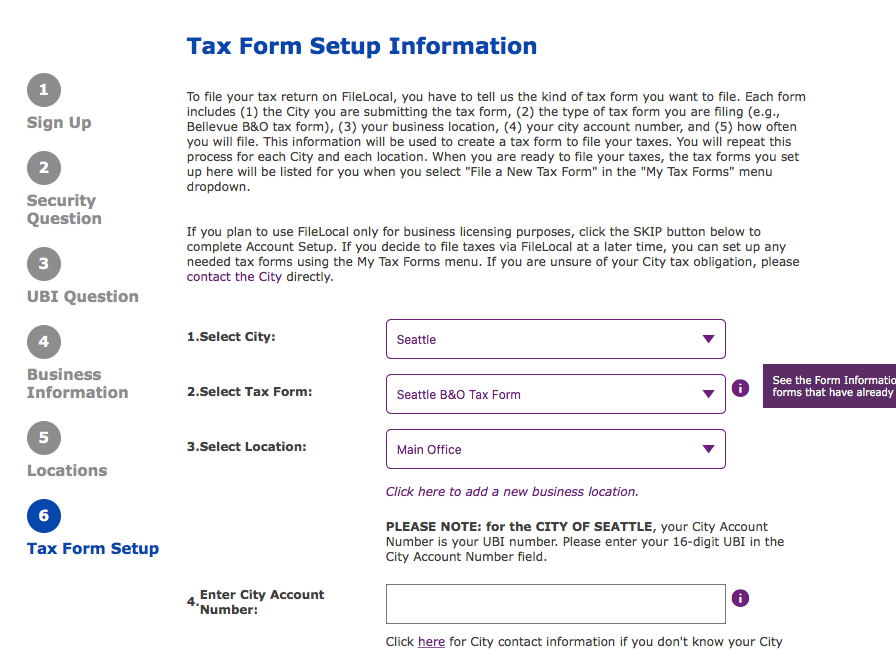

In this process, you provide your basic contact information, then all of your government numbers (so it can link up to those accounts) ... then at the end ... the whole point is to add the Tax Forms you'll be filing. For now, this is only the "Seattle B & O Tax form". Screenshot below.

The SNAG I Hit + Getting Help

On one of the last screens, it said that my UBI didn't match my business location! I called the Help number listed on the FileLocal site. They directed me to the city of Seattle. It turns out, the city had my incorrect UBI! These things happen, I suppose.

The guy helping me was super, super nice. He fixed it and the FileLocal site worked immediately.

Help Numbers:

Seattle: 206.684.8484

FileLocal: 877-693-4435

Now, for some pictures + notes:

Out with the Old - Seattle SELF Portal

In with the New - the FileLocal Dashboard. (You won't see this screen until the very end.)

A few Screenshots along the application

This one shows the 16 digit UBI. Also NOTE: the circles on the left side refer to the screen you're on ... not the content on the right.

You can either import your WA business data, or put it in manually. If you IMPORT it, it will ask you for a validation number. This is your 6 digit city customer number.

If you're a PLLC, it looks like you'll have to choose LLC - Single Member.

At the end, they're asking you which Tax Forms you want to file through their portal. The one you want is "Seattle B & O Tax Form".

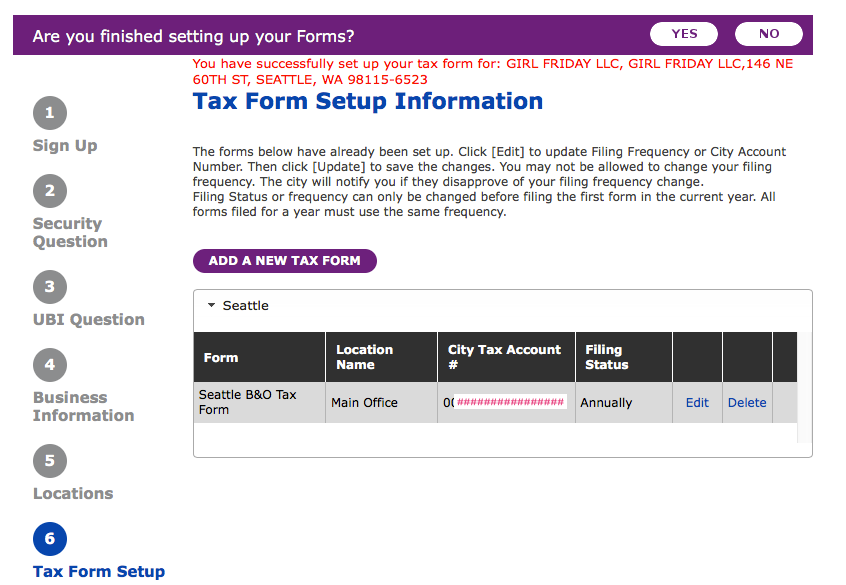

Haha...when you're all done, it congratulates you in red ... as if it's an error message! Reroute your brain to the word, 'successfully'. Cheers and head out to Ladywell's or have bubble bath. (Maybe Try the amazing Bath Bombs with Braddington Soaps!)

Bravo!

: ) Jenny Girl Friday

P.S. Please share freely with your friends who are self-employed!