Ways to Say NO ... Including MAYBE (Probably No).

This blog post will grow!

For now, here are some great ways to say NO … including MAYBE (Probably No).

Basic No-s

No thank you, I’m going to pass on this.

Thank you for inquiring … I’m going to pass.

Hmmm… I think I need to pass on this.

Oh bummer, I’m actually phasing out that service … so I have to say no.

I’m not currently set up / prepared / ready for that type of project, so need to say no.

No thanks.

Thanks, but no thanks.

I’ve got to say no for now, but thanks for asking.

I’d rather not, but thanks for asking.

I appreciate you asking. I need to say No at this time.

Oh shoot, that’s a hard no.

Oh sorry, that won’t work for me.

I need to RSVP no for this event.

I wish there were 2 of me, in that case I would say yes!

I need to bow out this time.

Sorry, no. Nat at this time.

I’m otherwise engaged, sorry!

Ooh, it’s not likely I can make that work. I’ll let you know if anything changes.

I’m sorry, I’m all booked up that week/month.

I’m booked up until the end of the year.

Oh shoot, I’m already committed that ___[evening/week/etc.]____.

I’d love to, but my plate is totally full right now!

I’m honored that you asked! Currently, I’m at capacity, so have to say no. If I had a clone, I would totally do it.

What you need is beyond my wheelhouse / my scope / my expertise…sorry, I need to say no.

Sounds tempting, but I need to pass.

If you asked me __ month/years ago … I would have said yes! But now, I’m doing something different, and have to say no.

Thank you for asking. I’m not able to take this project on right now.

I wish I could make this work right now, but need to pass.

Oh man, it’s just not possible for me to take that on right now.

Helpful No-s

My business has changed, and I no longer offer that service. Here’s a referral … or All the best with your search.

What you need is beyond my wheelhouse / my scope / my expertise…and I want you to get what you need and deserve. So, I need to say no.

Sorry no, I can’t do that. But here’s what I can do….

Ask Me Later

Oh wow, that’s a cool opportunity. At this time, I need to say no / pass. Please ask me again in the future!

Maybe someday I can say yes. For now, I need to say no.

I need to say no for now, maybe another time?

I’m at capacity, and currently not booking any future work. Feel free to check back with me in __ months.

I need to bow out this round.

Thank you for thinking of me, I need to pass this round.

Oh bummer, I’m just not able to fit that in currently. Feel free to check back with me later.

Can I take a rain check?

Maybe (Probably No)

Hmm. Let me think on that, and I’ll get back to you.

I’ll check my calendar later – when I get home / during my office hour – and will get back to you by _____.

If you don’t hear back by this date, then I’m a no.

Hmm, I’m guessing that I’m booked already. So I’ll say no for now, and if something changes, I’ll let you know!

♥

Sidekick Services / Paid Newsletter FAQs

How many newsletters will I get?

12 - 20 each year.

One, at the beginning of each month, with the important due dates, helpful links, and tools. Sometimes, you may receive an extra newsletter, if it pertains to a timely + specific topic. For instance, opportunities - like the PPP Loan, or if there are important changes with tax + licensing rules or procedures.

What will be included, specifically?

Reminders for Due Dates - for taxes, license renewal, and LLC / PLLC renewal.

Links to how-to articles, walkthroughs, or information.

Handy tools + worksheets to make biz chores easier.

AndPlanned for 2022: more tools for tending your Money Garden and being Happy at Work.

Topics cover:

IRS Taxes - Filing and Prep

Sending in Estimated Quarterly Payments to the IRS

WA State Taxes

King County Taxes

Seattle Taxes

+

Renewing PLLC / LLC

Renewing Seattle License

+ More

What does the newsletter cost?

There is a monthly fee for the newsletter. You can choose what you’d like to pay, based on your situation and how you feel. Suggested prices:

$15 - I’m new to business / on a strict budget

$20 - I want to pay the Suggested amount

$25 - I’m thriving and want to send some love back your way

$26+ (custom amount) - You have saved my life! I want to show a huge gratitude!

How many months is something due?

5 - 9 months, depending on your situation.

If you file Annually with WA State, you’ll have things due 5 - 7 months out of the year.

If you file Quarterly with WA State, you’ll have things due 7 - 9 months out of the year.

Why am I paying you monthly, if some months there is nothing due?

Three Reasons:

1 ) It’s helpful to know when nothing is due, so you can have peace of mind.

2 ) Some months you’ll be receiving a LOT of content and forms. Others are very light. Your monthly fee reflects the average value.

3) Providing regular payments, helps me to be building materials for you year-round.

Also, the months in between are a great time to rest from biz chores, to refine systems, or to work on being Happier in your job. Sometimes I will provide tools or articles related to this other work.

Is there a bonus for signing up?

Currently … there is no bonus for signing up.

If I develop one in the future, I’ll send it to all the subscribers first!

What if I no longer wish to receive Sidekick Services, but want to know about classes, workshops and other services?

I have a new Announcement List. It’s free to join. I will share about any new workshops, classes, books, and openings available for Friendly Tax/License Consults. (FYI - These announcements will go out first to Sidekick Services.)

Do I need to join the Announcement list as well?

The simple answer - No.

Why? If you are on Sidekick Services, you’ll receive all Announcements. And, you’ll receive them first! The Announcement List is a great option if you decide to leave Sidekick Services.

Is this useful if I live outside of Seattle?

Many readers have shared … that Yes! It’s still helpful if you live outside of Seattle.

For two reasons:

1 ) You get supported for IRS tax prep and filing, relevant to anyone working in the U.S.

2 ) The reminders about local taxes (city, county, state) often prompt readers to get in touch with their own local agencies to find out what is due.

Will it be different, now that we’re paying for it?

At first, not really. Eventually……….Yes!

With your support, I’m planning to up-level both the Sidekick Services and the Business Apothecary. But, it will take some time + money.

Hopefully, you will someday see:

New design of the newsletter

Additional and redesigned tax + money tools

Updated how-tos and walkthroughs

A web re-design for the Apothecary

+ More!

Why did you switch to a Paid Newsletter … when you said earlier that you wanted to keep it free?

I really, really wanted to keep it free, modeling after NPR or Wikipedia. Over time, I learned that it wasn’t sustainable. I had a few donors (thank you!), which was encouraging and so helpful. Also, it was only just enough to cover tech costs and provide a tiny bonus.

Over time, I realized the following foundational ideas:

To fully develop the newsletter and tools, and to really serve you all abundantly, I need 1 - 3 days a month for writing and design.

NPR and Wikipedia have regular fundraising campaigns. I didn’t want to start inundating you with those kinds of messages! I’m a fan of only sending need-to-know stuff to you and your inboxes.

The value of what I’m providing is designed to save you $500 - $1500 a year or more + intangibles like less stress, more peace, empowerment. And this is worth charging for.

Anyone desiring to thrive in self-employment can afford this monthly fee.

This model will be like Spotify, Hulu, G-Suite. It’s something you want or need, and it costs money.

Is this a Business Deduction for IRS taxes?

Yes! I would suggest putting this under “Supplies”.

What is Memberful?

It is the company that will process your payments, and keep the subscriber list updated. Whenever you’re changing your payment information, updating a credit card, or canceling, it will be through Memberful.

What if I want to cancel?

You can cancel any time, through Memberful. If you’re not sure how, please email me at jennygirlfriday@gmail.com, and I can do it for you. (Please allow 5 - 10 days, if you cancel through me.)

What if I want to change my monthly amount?

Stay tuned … I will find an answer and report back. And/or email me at jennygirlfriday@gmail.com, and I’ll see how to do this for you. (Please allow 5 - 10 days, if you are requesting a change through me.)

This service has been a game-changer for me. What can I do to show appreciation?

Thank you so much! I’m thrilled to hear it! All of the following are welcome: sending me a note in email, leaving a little Love in the Tip Jar, increasing your monthly fee, and/or encouraging friends to sign up. Thank you again! It’s my goal to help you THRIVE and it’s such a joy to know when things are working for you!

PPP Loan - Info + FAQs 2021

**This is an On-Going Blog Post - and will be updated as new information is discovered.**

Apply for a PPP Loan!

... as soon as you can.

Ideally this week.

Because it is 100% forgivable,

if you do a little paperwork.

The value is 2.5 x your average monthly profit.

The program was designed with you in mind

♥

Read on for FAQs ... and please let me know if you get one! ...or what happens.

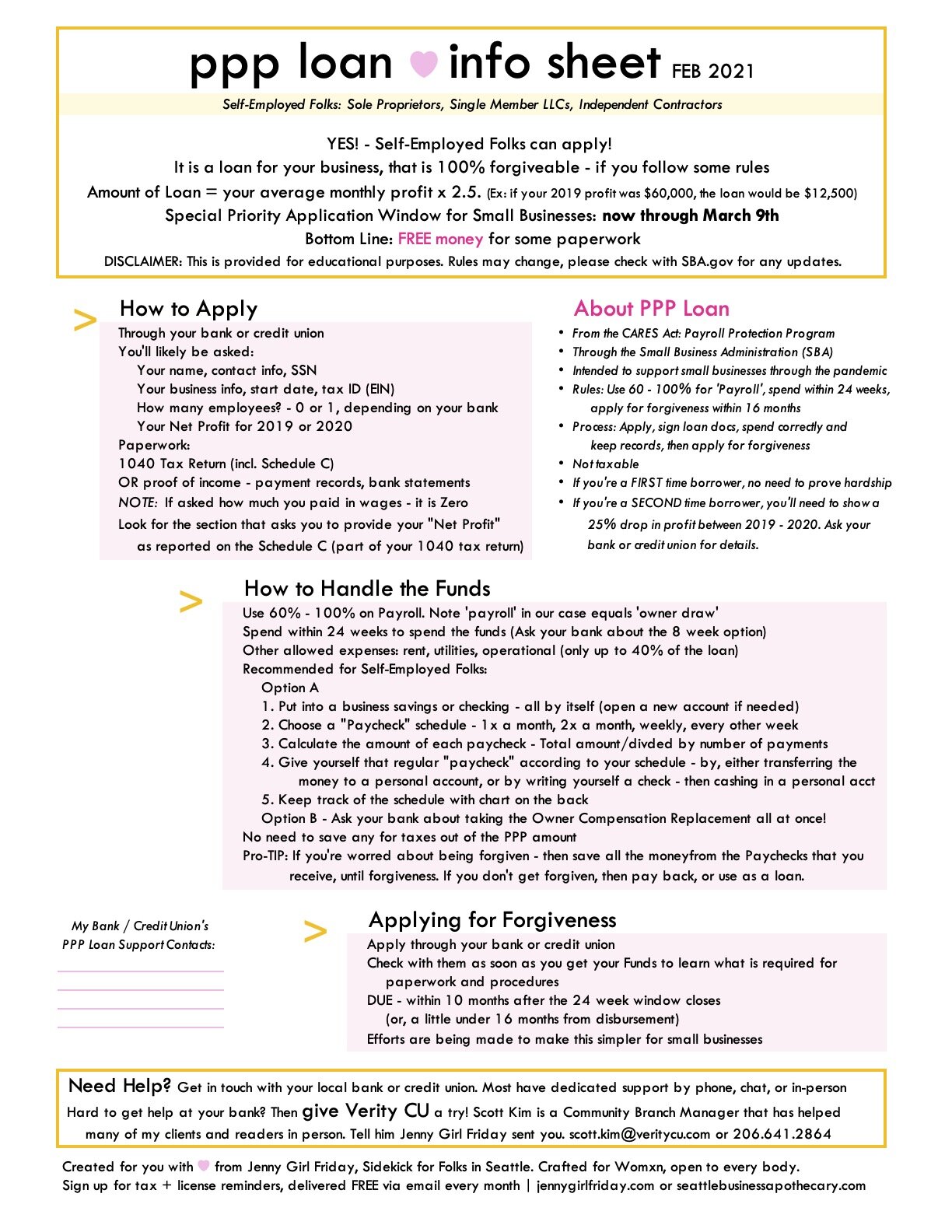

Check out this Info Sheet > > >

Includes a chart for keeping track of your Paycheck Schedule. Recommend printing back-to-back if possible. Click on either image to get the 2 page PDF.

The Basics

PPP = Paycheck Protection Program

It is part of the federal relief efforts, through the Small Business Administration.

Although we technically don't have Payroll (as a sole proprietor or single-member LLC) ... we're still invited to apply! We are still allowed to get help. For us, it's considered "owner recompensation".

> > The first step is to get in touch with your bank or credit union.

> New application deadline: May 31, 2021

> You will apply for the Funds through them.

> You'll receive the Funds.

> Then, later, you'll apply for the "Forgiveness" with the bank's help.

> When asked how many employees are in your business, some banks will instruct you to say 0 and others will ask you to say 1. Check with them! (Technically, you're the owner, not an employee. But some banks need a number 1 in there for the formula.)

> The only form you should need ... is your 1040 Tax Return from 2019 ... with your Schedule C - this will show what your business profit was. (Which equals your "payroll".) If you see request for other forms, ask the bank!

FAQs

Who can apply?

Anyone who owns a business, including self-employed folks. Even though sole proprietors and single-member LLCs don't technically have a "payroll", we are still allowed. The rules have been extended so that our profit = payroll.

What is the basic overview?

You apply through your bank ... who goes to the SBA to get the funds. Once the funds arrive, the bank may ask for more documents from you. Use the money to "pay yourself". Then, follow your bank's instructions for the Forgiveness Application. Once you pass that process, you do not have to pay it back.

What paperwork is required?

Usually, an online application through your bank. Then, submitting your 1040 Tax Form from 2019. It's possible some banks will take a Profit and Loss Statement from 2020. Then, the Forgiveness Application - I don't know what is on there, but I've read that it is simplified this round.

I tried before, but didn't get it ... is it worth it this time?

This time, more money has been allocated ... it is way more likely that you can secure the funds this time.

I work seasonally, is there anything I can do to boost my loan amount? (The formulas don’t reflect what was truly lost.)

Yes! Some banks have special steps for seasonal workers. Ask someone at your bank or credit union about this. One reader was able to apply as a seasonal work and received about $7000 instead of $4000 (with the classic application).

I have an EIDL loan ... is that an issue?

Yes and no. As far as I understand it - If you used EIDL loan to pay yourself a regular paycheck, then this will count against how much money you can get from the PPP ... but you can still get the PPP! You can use the PPP funds to pay off your EIDL loan (which is not forgiven). Also, if you used your EIDL loan for other things - like rent or business bills - you can get the full PPP loan for your "payroll". Again, ask your bank!

Hmm ... I feel like other businesses need it more than me ... wouldn't I be taking money away from them?

We all need support. If you get the PPP funds, and pay yourself, you can ensure that you'll remain a stable and secure part of our economic system and community. Plus, you can use your personal funds to support the small businesses you wish to support! And/or donate to causes you care about.

My business has been steady, so maybe I don't need it. Do you have thoughts around that?

Yes! Many people I know (including Yours Truly) have been able to continually work ... but it's been exhausting, and some of us are starting to hit a wall. If we hit a wall, then our businesses come to a total standstill - without sick pay or disability insurance. The PPP funds can allow you to throttle back a bit, if you've been working steadily. Also, keep in mind, the spirit of this is to "protect" your payroll. Who knows what will happen in the next 6 - 12 months. I, for one, could use some security moving forward.

I got the first round of PPP ... can I apply again?

Yes, you can apply again ... with some extra paperwork. You'll need to demonstrate a 25% drop in income ... for a particular month. For example, if you can show you made $4000 in February of 2019 ... then, only $3000 in Feb of 2020, that would suffice. Again, ask your bank!

I heard about the Special Window to apply, where women or minority-owned business are getting additional funds … What if I already received the PPP loan, can I get these additional funds?

Sorry, at this time, there is no retroactive pay available. Keep asking at your bank, in case this changes.

Do I have to space out the paychecks to myself? Or, can I take the money all at once?

It's possible you can take it all at once. I've been seeing the term Owner Compensation Replacement - referring to this idea. Ask you bank or credit union if this applies to you.

What is the best way to handle the funds, to get the forgiveness?

Put all of the loan funds into a separate Savings or Checking account. Open a new one if you need to. Then, choose a schedule to "Pay" yourself - by transferring your "paycheck" to a personal account. OR, write yourself a check. It's very important that the "paycheck" goes into your personal account. What we're trying to avoid, is using the PPP monies for other costs. Use the chart above to keep track.

What am I allowed to spend the money on?

You must use 60-100% of the PPP money for "payroll" costs. There are a few other approved things - benefits, rent, utilities, operational. Ask your bank.

Am I allowed to use it to pay taxes?

If you are a sole prop or single member LLC ... technically, you, as a person pay taxes (not your business). So, after you give yourself a Paycheck (into your personal account), you can send in IRS estimated taxes from those monies. Having said that, you may NOT use them for city or state taxes - those are taxes your business pays.

I work by myself, I thought Self-Employed people didn't get Paychecks or have Payroll.

You are absolutely correct! Technically, we have profit or an owner draw. Having said that, the PPP Loan is including us, and equating our "profit" with our "payroll".

What happens if it’s not forgiven?

It stays a loan with a 1% interest rate. I think you may also defer payments, but am not totally sure about that yet.

What if I’m too worried about not getting forgiven … so it makes me not want to apply, because that would be way to stressful?

Suggestion, get the loan, go through the steps of paying yourself AND save all in Personal Savings. Apply for Forgivess asap, if you get it, cool! Keep the money. If you don’t get forgiveness, then you can pay it back. It would have been a hassle, I get it …but know this, they want us to have the money to stay employed and to stimulate the economy. So, they’re trying to make it as easy as possible for us.

Want to talk to a real person about this?

Scott Kim is at Verity Credit Union ... and helped one of my clients, Dr. Annie Roepke, a resiliency expert, go through the process. He shared that he's willing to be a resource to NON-Verity Members. I'll be reaching out to him this week.

What?! Amazing!

♥ Scott Kim,

Community Branch Manager at Beacon Hill

scott.kim@veritycu.com

206.641-2864

Bottom Line

This program was created with you in mind!

It is here to support small businesses through the rocky waters of the pandemic, and post-pandemic world.

Get help! Help is available!

For a few hours of paperwork and research, you can receive 2.5x $$ what you earn in a month ... to keep for Free.

Please do let me know if works for you! I'd love to hear how many readers do this. All the best and luck to you!

Good luck to you,

Jenny Girl Friday

P.S. I work for tips! If you this article helped you in any way, please consider leaving a tip in the TIP JAR. Thanks! :)

Three Ideal Clients - Book Excerpt

Who Are Your Ideal Clients?

Who are the people you want to work with? Thinking deeply about who they are will help you figure out what they need, where to find them, and what language and design will get their attention. It will also help you decide when to accept work, and when to politely decline.

It’s hard to describe an imaginary group. To help you out, work through the following exercise.

Create three ideal clients that you would love to work with or to sell products to. Sometimes these are called avatars. Choose them so that they represent different types of clients/buyers. Really think them through; flesh them out. Name them, describe them, build a picture of them in your head.

Get three pieces of paper - one for each idea client. Draw a picture in the middle of the client, or perhaps cut an paste images. Use each page to bring your ideal clients to life! Afterwards, we’ll make some observations.

For each one, fill out the following ~

For Individuals:

Name

Age

Religion/politics

Where they live

How they dress

Family

Career

Aspirations

Hobbies

Everything you can think of

For Orgainzations / Companies

Name

Size

Services/Products

Location

Design/Look/Brand

Who they work with

Company values/causes

How long in business

Community connections

Everything you can think of

• • •

Now, look at your three clients. Let’s make some observations.

What do they have in common?

Where do they hang out?

What do they like?

What do they need that they’re not able to get?

What ideas, images, and values do they have in common with you and your business?

Use this knowledge to help you when choosing words and tone in your marketing materials, such as colors, design, and imagery. Think about them by name. For example, Would this make sense to Sally, the Florist in Ballard?

Continue to refine these three ideal clients. Carry them with you as guides.

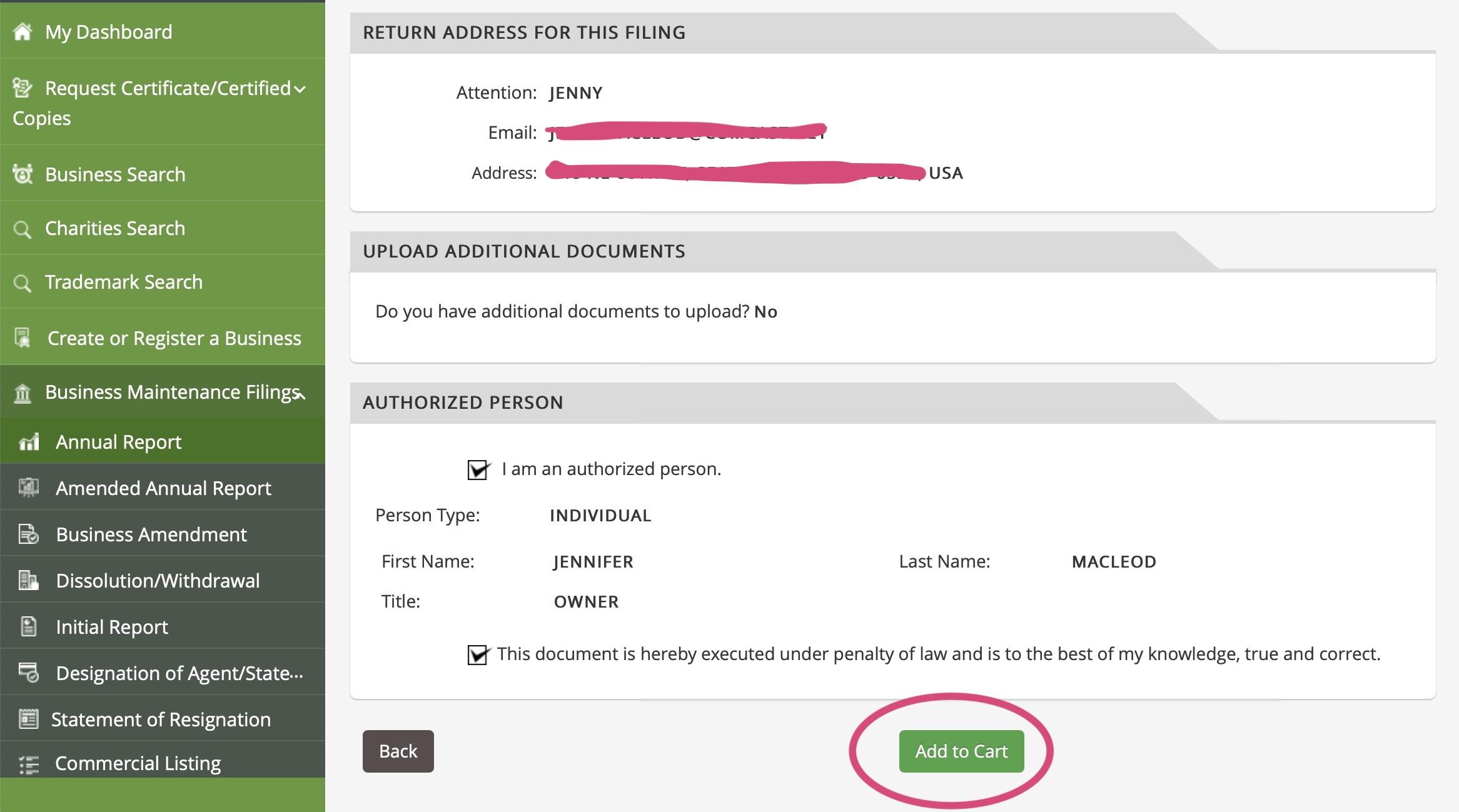

• How to Renew your LLC / PLLC (aka file annual report)

If you have an LLC or PLLC, you must ‘renew’ it each year to keep it going. Officially, it’s referred to as filing your Annual Report. It’s quick and costs about $60. It’s due on the anniversary month of when you opened it.

Some reminders

This is different than your business license. Your LLC / PLLC is a legal entity that you created. It has its own limits, responsibilities and protections. It’s separate from you (like an 18 year old child). It can only practice business if you keep it alive and it is properly licensed. To keep it alive is a legal issue (vs. financial), that’s why we’re dealing with the Secretary of State.

Basic Info to Renew / Make Annual Report

TIME: 2 - 10 minutes

COST: $60

DUE: On the anniversary month when it was formed

Frustration Factor: 4 out of 10

WEBSITE: ccfs.sos.wa.gov/#/

GOVT: Secretary of State

HELP: 360.725.0377

Summary

Set up a profile if needed. Log in. Double check that your name and address is filled in for every role (governor, registered agent, executor, etc.). Get to the end, pay $60. Mark off your Important Dates List (Annual, Quarterly). Reward yourself!

Why?

LLCs / PLLCs were originally created for groups of people coming together to do business. Each owner is actually called a Member. The annual report is saying, Yes, it’s still going. Here’s who is doing which role. With bigger groups, this matters! For a single-member LLC / PLLC, it feels a little silly because generally we serve all the roles! By making this report, we confirming that all this info is the same.

Steps - Screen shots below

1 Go to SOS.wa.gov

2 Click on CORPORATIONS in the Top Nav to open the menu

3 Find CORPS & CHARITIES FILING SYSTEM

4 Sign in ….or create a profile, then sign in when directed

5 Find ANNUAL REPORT on the Left Nav

6 Search for your Business using your UBI or Name

7 Select your name from the List

8 Confirm all your information, make changes or additions if needed

9 Review

10 Add to Cart and Pay

11 Optional - print or save the pdf for your records

12 Mark as done on your Important Dates List

13 Reward yourself!

Screenshots

Voila! All done for another year. Great job on getting another business chore finished. Having said that, I hope it was kind of fun and rewarding! Your work is still alive and kicking!

: ) Jenny Girl Friday

♥ ♥ ♥ ♥ ♥

P.S. Was this helpful? I sure hope so! If YES, please consider leaving a Tip in the Tip Jar. (Unless you’ve already given an Annual Donation.)

Have any friends with an LLC / PLLC? Forward freely!

Why tips and donations? I’m currently doing all of this work during evenings/weekends. It’s slow going to build this Apothecary on the side. With more funds, I can ‘buy’ more time each month to grow the collection faster. I’m hoping to some day earn enough so it can be a one-day-a-week job.

If NO, then send me your questions, or let me know where things are confusing. I’d love to clear it up for you and other folks! jennygirlfriday@gmail.com

• How to CALCULATE numbers for IRS taxes: pen and paper, spreadsheets, software

[Note: This is step three of the Prep for IRS Tax process. To see all the steps, click here.]

In a nutshell

You need to report some numbers related to your business AND have some evidence to back them up (receipts, bank statements, etc.). How you add up the numbers is up to you!

The numbers (eventually) get reported on the Schedule C. If you use software or a tax preparer, they will ask you questions, then put those numbers onto the Schedule C for you.

Consider using the handy worksheets below to keep track of your numbers.

Alert: This blog post may look really complicated, and I apologize for that! It's tough because every situation is different, and I'm attempting to speak to a variety of situations in one post. ♥ Please know: once you get into the material, it usually starts to make sense. Also, I invite you to email me with any questions! jennygirlfriday@gmail.com

ProTip: Print the Calculate-Basic worksheet, and just start filling in what you know. Then come back to the post for more ideas when needed.

ProTip: Get a friend to help you with this. They can read the instructions, then together, you can figure out how to proceed.

The Calculate-Basic includes everything you need for MOST situations. The Calculate-Next Level is helpful if you're planning to file using paper forms, or if you want to predict your self-employment tax amount.

Gross Sales

AKA Gross Income / Total Deposits

Important: This number NEVER includes any sales tax collected.

You need to have a total Gross Sales number, and a record to back this up. Perhaps you already have this total, or parts of it.......or perhaps you have to create it still. Here are some options.

Different Ways to Keep / Create a Gross Sales Record

If you already have this record, great! If you need to make one up for last year, read on! The basic process is:

1 Find the payment amounts

2 Make a Record

3 Find the Total

4 Format for the IRS

1 - Find the payment amounts

Here are all the places to look:

- Bank Statements - look at deposit records

- Deposit Slips

- Copies of Receipts/Invoices

- Reports from Commerce sites

- Calendar - find all appointments and mark what you got paid for each

2 - Make a Record

Ideally, include the date, purchaser name, and amount of each.

These are options for you to choose from:

- Keep a list of all payments in a notebook

- Record payments in a spreadsheet

- Print out all summary reports from websites you use, keep as your records

- Use software or an app (such as Quickbooks or Fresh Books)

3 - Find the Total

Add up all your numbers to find your Total Payments by customers. This is your Gross Sales.

Do NOT include any sales tax collected.

- Use calculator

- Put into a spreadsheet, and use formulas to add

- If using software, go to the Reports section to get the totals

4 - Format for the IRS

Did you get any 1099-MISCs or 1099-Ks for your business? These are simply proofs of payments that someone else made to your business. The numbers on these forms should already be included in your Gross Sales amount.

> If you're filing with Paper Forms, then you just report your Gross Sales, which includes the totals on these forms. You do NOT need to list out their amounts separately.

> If you're filing with software or an accountant, they will ask you for your Gross Sales in parts. So you'll need to find the subtotals for:

___1099-MISCs

___1099-Ks

___ All other payments (including barter)

___ Total of Gross Sales

Expenses

Okay, options! Here are three of my favorite. There are more options and variations. Hopefully this will give you an overall idea, and you can create something that works for you.

Note: For evidence of our business expenses, receipts from the purchase are best. The IRS will also accept bank and credit card statements.

Pen and Paper

With Receipts

1. Look at the categories of business expenses (on the Calculate-Basic sheet or the Schedule C)

2. Make piles with your receipts in each category.

3. Add up the totals for each, and fill in the chart. Perhaps write these amounts on pieces of paper to keep track, one for each category.

4. Suggested: staple each stack of receipts together.

With Bank Statements

1. Look at the categories of business expenses (on the Calculate-Basic sheet or the Schedule C)

2. Get a piece of paper for each category, label at the top.

3. Go through Bank Statements. Find each business expense. Highlight, circle, or underline it on the statement.

4. Decide which category the expense falls in. Write each expense on the corresponding piece of paper. (For example, if you see a line for "Office Max", write the amount on the paper that labeled "Office Expense".)

5. When all expenses have been recorded, add up to get the totals. Record on the Calculate-Basic worksheet by category.

Spreadsheet

1. Look at the categories of business expenses (on the Calculate-Basic sheet or the Schedule C)

2. Label a column or separate tab with each category. (Depending on how you like to work.)

3. Go through your receipts and Bank Statements. Find each business expense. Highlight, circle, or underline on the statement.

4. Decide which category the expense falls in. Add it to the column or the tab.

5. When all have been recorded, add up to get the totals. Record on the Calculate-Basic worksheet.

Quickbooks or Other Software

1. Finish inputing/uploading all expenses for 2017

2. Find the Reports page

3. Select Profit and Loss statement

4. For the time period, select Last Year

5. Look at the report. Review each category.

6. Make any adjustments.

7. Print the Profit and Loss statement. Or, record the amounts on the Calculate-Basic sheet.

Special Expenses

These get calculated in special ways, so deserve their own section.

Special Expense - Mileage

There are two ways to deduct driving expenses. For each vehicle, choose one method and stick to it each year.

Option A: Actual expense. (Less common)

With this option, you collect and report ALL costs associated with your vehicle: gas, insurance, repairs, maintenance, and tab renewals. If you use it part for personal and part for business, you need to calculate what percentage is used for business. Then take that percentage of the total costs.

So, if you use for business 30% of the time, you'd deduct 30% of all costs associated with that vehicle.

Add this expense to the Car and Truck Category.

Option B: Mileage Deduction (most common)

For every mile that you drive for business, you get to deduct a specified amount. In 2017 it was 53.5 cents per mile. With this method, you need to know your total business miles. Additionally, you're required to have a record. The easiest way is to use an app, such as MileIQ. Or, you can keep a log book.

For most forms of filing, you'll be asked for:

___ Starting Odometer reading, on January 1

___ Ending Odometer reading, on December 31

___ Grand Total of All Miles

___ Total of Personal Miles

___ Total of all Commuting Miles (driving to and from an office)

___ Total of all Business Miles

To Claim the Expense:

If using Paper Forms

A. Calculate Total Business Miles x 0.535 =____________.

B. Add this to your Car and Truck Total

If using Software or Working with a Tax Pro

A. Have all of your Mileage Totals Handy

B. Do NOT include in Car and Truck expense

C. Provide information when asked, and they will calculate and deduct

Special Expense - Home Office

If you have a home office that meets certain requirements, then you can make a deduction. There's a Regular Method (that's complicated) to do this, and a Simplified Method. I will only speak to the Simplified Method. To learn more, go to IRS.gov, or ask your accountant.

A. Decide if you meet the requirements: the space is ONLY used for business, and it is your principle work space.

B. Measure the Square Footage.

C. Multiply Square Footage by $5=_____________

D. If using Paper Forms, claim this expense on the Schedule C on Line 30. (It is in a separate place than other expenses.) Also, consider researching or asking someone about Schedule A. I have yet to learn about this.

E. If using software or working with a tax pro, input when prompted.

♥ If this is your first year..........hang in there........and just try your best! If you find out in the future that you did something wrong, or forgot some major deductions, don't worry, you can amend tax returns from previous years.

Actually, that goes for everybody. Just try your best. Take things one step at a time. Do what you can. Reach out for help: from a friend or colleague, email me, meet with a tax volunteer at the library, or your bookkeeper or accountant.

To read about options for Filing, click here.

For the next Tax Help Pop-up Shop, click here.

: ) Jenny Girl Friday

P.S. Know any other self-employed Seattleites who could use this information? Please forward freely!

P.S.2 Are you already signed up for Sidekick Services? If not, click here and join the list to receive tax + license reminders, how-tos, inspiration and more delivered to your inbox.

• IRS Taxes - Different Options for Filing, from Paper to CPAs and in between

Please note: this is an evolving blog post.

I'm hoping to do continued research on this topic! (Perhaps with your help.) What you see below is what I know currently, I'll continue to revise and refine this post over time. If you have any information, feedback, input, or questions, please get in touch! Email me at: jennygirlfriday@gmail.com.

There are several great options for filing your IRS Taxes. This year, they are due on Monday, April 15th.

When you're self-employed, there are just two additional forms that get added to your normal taxes. The Schedule C and the Schedule SE. They're not too complicated. (Schedule SE looks a bit crazy, but really, there's only a few lines that you need to do!)

If you're filing with software, online, or with an accountant, usually, they will ask you a lot of questions, and then put your info into the forms. (Coming soon....Click here to read more about the forms, and what information you'll need for each.)

Filing Options

Here's a list, from the most basic to the most formal. More details about each below.

♥ Paper Tax Forms

♥ Free Online Portals

♥ Online Portals / Software (For Purchase)

♥ Tax Preparers / Bookkeepers

♥ Accountants / CPAs

♥Paper Tax Forms

Prefer the Old Skool Way? Paper tax forms still work just great….though the new 1040 is a little more tricky. The IRS took 2 sheets……and turned them into 7 half sheets. Weird, right? Oh well, knowing you, you’ll figure these out like a pro since you’re used to figuring it out. A post coming soon showing the new 1040…In addition to those, you’ll also need to fill out the the Schedule C and Schedule SE. You can download these directly from the IRS.gov site, or find at many libraries.

Variations

• Do on your own, using the instructions

• Get a friend for moral support and a 2nd set of eyes

• Use the Walkthroughs on the Business Apothecary, by Yours Truly (coming soon)

• Get free assistance at a Library, sponsored by the AARP

• Sign up for a Tax Pop-up Shop

Pros: You can see all your numbers. It's easy to double-check the information. It feels very satisfying and transparent.

Caution: Paper forms don't prompt you...so you might miss out on certain deductions, or credits. Such as the state sales tax deduction. (I have to look into that one still!)

♥Free Online Portals

I believe there are a handful of free portals to use. Usually, these work for basic tax situations only. Some can handle self-employment taxes.

One option is the IRS Free File.

Another is H&R Block, at hrblock.com

(Know any more good ones? Please send my way!)

Variations

• Do on your own, using the instructions

• Get a friend for moral support, and a 2nd set of eyes

• Use the Walkthroughs on the Business Apothecary, by Yours Truly (coming soon) to help you prepare your numbers ahead of time.

• Sign up for a Tax Pop-up Shop to get assistance with the self-employment section

Pros: It's free! It'll know about current tax credits, deductions, etc. It will prompt you for all the information.

Caution: It can be hard to get support when you run into trouble. The graphics aren't as easy or pleasing to the eye. Sometimes, there are limits...such as you have to earn under a certain amount.

♥(For Purchase) Online Portals / Software ... like TurboTax

Have you already been doing your taxes online with TurboTax or something similar? Then adding your self-employment taxes is pretty easy! The portal will guide you through a series of questions about your business, then it will do some of the math for you, and put all of your information into the proper tax forms (that get submitted electronically).

The golden standard is: TurboTax. A major benefit is....they are the same company that created QuickBooks. So, if you've been using those, it can be really quick to upload all your data right into TurboTax!

(Know any more good ones? Please send my way!)

Variations

• Do on your own, using the instructions

• Get a friend for moral support, and a 2nd set of eyes

• Use the Walkthroughs on the Business Apothecary, by Yours Truly (coming soon) to help you prepare your numbers ahead of time

• Sign up for a Tax Pop-up Shop to get assistance with the self-employment section

Pros: It'll know about current tax credits, deductions, etc. It will prompt you for all the information. It's easy to use. Excellent help available.

Caution: Sometimes one can get lost in the process. The portals guide you through, but it's sometimes hard to go back to change things. There are often a lot of up-sells, and it's hard to know when you really need them or not.

♥Tax Preparer / Bookkeeper

Do you feel better working with someone? Is your situation fairly straightforward? Working with a tax preparer or bookkeeper can be a great option! These are folks who are trained in, and very experienced with, doing basic taxes. They are different than CPAs (Certified Public Accountants), and usually cost less. Want to know more about the difference? Click here to read more on clearskybookkeeping.com.

Options:

H&R Block offers in-office assistance with using their portal, for a fee

(Know any more good ones? Please send my way!)

Variations

• Go into an office

• Hire a consultant to come to your office

• Sign up for a Tax Pop-up Shop for preparation of very basic taxes, including self-employment

Pros: Working with a real person to lead you through the process. Get answers to questions. Preparers will prompt you for all the information. They know all the things to check for at the end. Gives you a natural deadline for your preparation part.

Caution: Different personalities (sometimes folks are not friendly), tax preparers/bookkeepers may or may not know some of the very detailed laws that apply to your situation.

♥Accountants / CPAs (Certified Public Accountant)

This is the Cadillac approach! Accountants have a degree in their field, extensive training and experience with taxes, as well as a broader view of money in our lives, financial reports, investments, retirement, etc. They're who you need if you want to do any number modeling, get advice with decisions, do long-term planning, and more.

Some accountants are also CPAs. CPAs have to answer some additional and very high standards! They must have a professional license, follow a code of conduct, and get continuing education. CPAs are a great choice if you: have a complex situation (own properties, stocks, divorce, etc.), if it feels reassuring for you to the highest level of training for doing taxes, plan to grow into an S-Corp or change to a non-profit.

They will usually provide you with a questionnaire each year during tax season and a due date.

Options:

Many CPAs are moving to a subscription model, where you pay a monthly fee each month...and you get your annual taxes prepared + support year round. Some provide a quarterly check-in/tune-up plus annual filing. Personally, I think this is a great move!

Two CPAs with subscription models (that I've just learned about!) are:

• Timber Tax, with Luke Frye and Anne Chan at timbertax.co

• Hipster Money, with Alexandra Perwin at hipstermoney.com. (Website is still being developed.)

• Penny Smart Girl, with Meka West at pennysmartgirl.com

Some Accountants/CPAs are willing to do your once-a-year annual filing, and charge one fee for that job.

• Ballard Bean Counters, with Rose Westwood at ballardbeancounters.com

(Know any more good ones? Please send my way!)

Variations

• Go into an office

• Work over the phone and online

• Hire a CPA who also handles your bookkeeping

Pros: Working with a real person to lead you through the process. Get answers to questions. They can give advice. They can often save you money by knowing all of the credits and special rules! Gives you a natural deadline for your preparation part. You can reach out for help via email or the phone.

Caution: Different personalities (sometimes folks are not friendly). It still takes work on your part to prepare for the Accountant. Sometimes the portals that accountants use can be confusing.

Heads Up ~

However you choose to file your taxes—and with whom—it'll still be up to you to have the numbers and evidence for them. That's where I've got you covered! (Coming soon - Click here for a workbook.)

A couple parting thoughts ~

*****You have the right to be treated well by whoever is helping you with filing your taxes!***** If you ever come across someone who's being severe, unfriendly, or acting like you should know this stuff........then I invite you to move on! Find someone else. You're hiring them to help you! Your job isn't to know this stuff! Your job is to do your work, then find the paperwork + numbers that they ask you to get.

+

It actually is rewarding to do taxes. :) It sounds complicated. It interrupts your schedule. It can be confusing. Also, it is evidence of all the beautiful work that you did last year! Think about all the clients and buyers who benefited from your work! Look at all you accomplished! Every number represents income or expenses that you purchased to do your work. That's pretty cool.

Here's to a rewarding tax prep time!

♥

Jenny Girl Friday

P.S. Know any other self-employed Seattleites who could use this information? Please forward freely!

P.S.2 Are you already signed up for Sidekick Services? If not, click here and join the list to receive tax + license reminders, how-tos, inspiration and more delivered to your inbox.

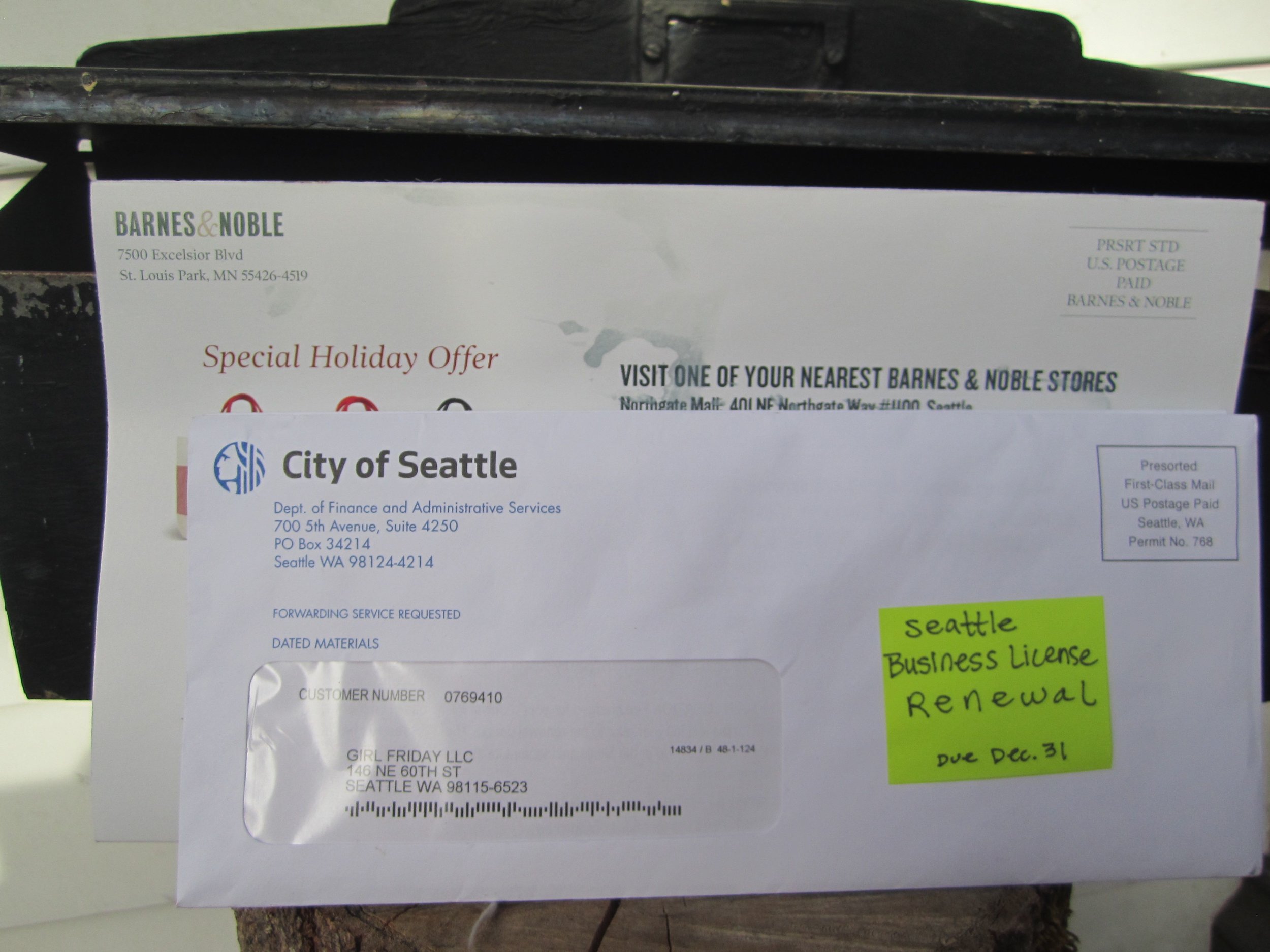

• Renew Your Seattle (City) Business License - December 31st

Your first TAX season hoop is here! Renew your Seattle business license by December 31st. Cost is $55 if you earn under $20K, or $110 if over $20K (plus fees if you renew online).

A friendly reminder ~ all self-employed folks need to have two business licenses, one from the state and one from the city.

This post is about renewing your business license with Seattle. (Its longer name is Business License Tax Certificate.) To read more about it, go to: seattle.gov/licenses/get-a-business-license. [Post coming soon about state business licenses.]

Your city business license is the one with the year printed diagonally across ... and the Seattle symbol in the corner.

Due: December 31st

Time: 5 minutes

Frustration: 5 out of 10

(on FileLocal)

Cost:

$57 if you make under $20K annually

$113 if you make over $20K

+Fees: $2 - 7 for processing credit cards

Note: There is a grace period until January 31st. After that, a late penalty applies.

you have 2 options for renewing your license.

Renew through the mail.

Hopefully, you've received a renewal form in the mail. If not, and prefer to renew this way, call the city at: 206-684-8484. Or email them at: tax@seattle.gov

Online ~ FileLocal Portal - This is the new portal.

If you've already created your account, it's pretty easy to renew your license. If you haven't set up your new account, read this article, and plan an extra 20 - 30 minutes for that step. Instructions and screenshots below for renewing your license.

Renew with FileLocal

If you need to set up your account, read this article first. Allow 20 - 30 minutes.

NOTE - The specific screens and steps might have changed a little bit. This will at least give you an idea of what to expect.

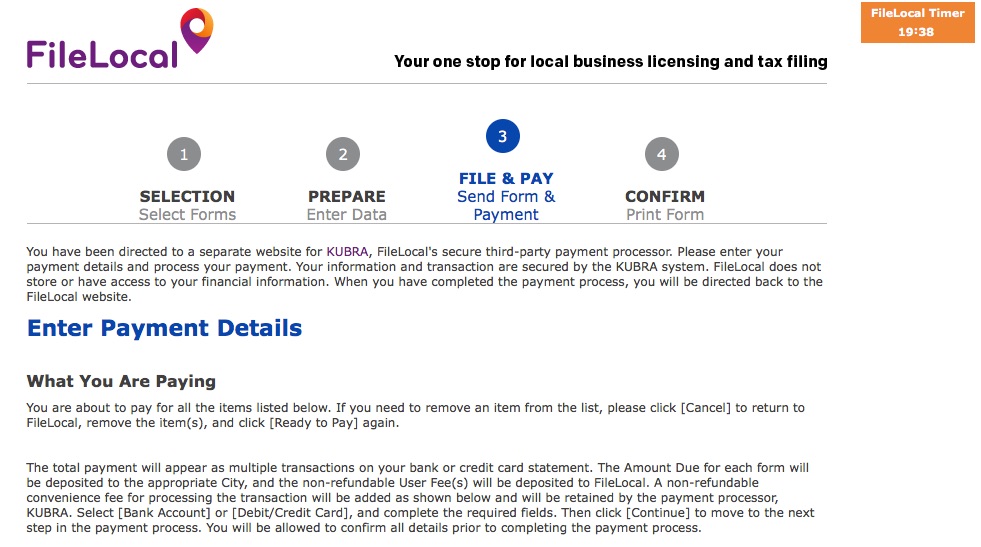

1. Sign in to FileLocal

2. Select Renew A License

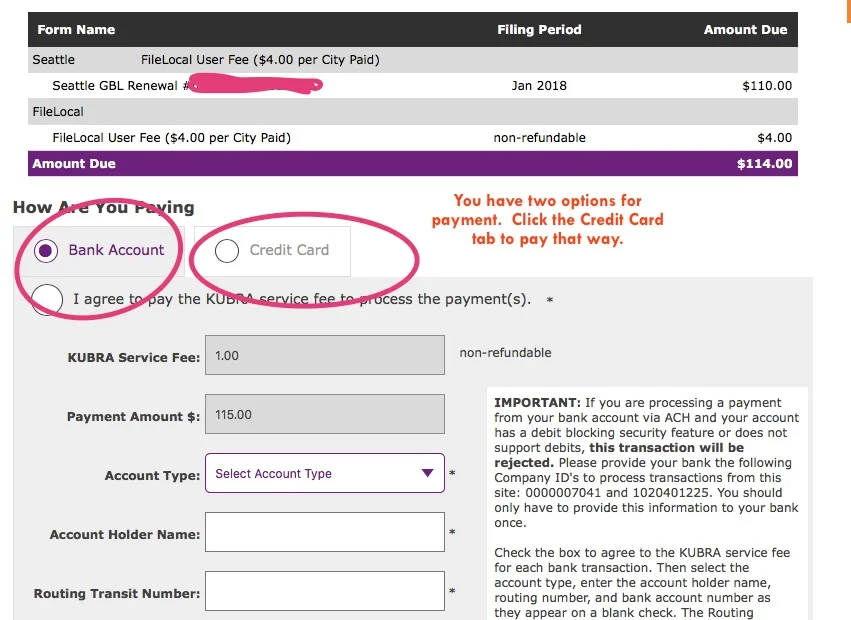

3. Now you're in the Activity Center. It should have "Renewals and Applications" set as the "TYPE" of activity, with your business information below. [If not, adjust as needed. Call FileLocal if you need help 1.877.693.4435 Select Continue.

4. Continue through screens to confirm your information. Then look for the "READY TO PAY" button.

5. Look for the HOW ARE YOU PAYING tabs. It's set on Bank Account. You can use that, or select the tab for CREDIT CARD.

6. Complete the checkout process.

7. Print a copy for your records. (It's an expense/deduction.) Or, save a pdf and put into special folder.

8. Check this off your Tax Season List!

Well Done! One more Hoop accomplished / one more thing checked off your TAX Season checklist!

♥ ♥ ♥ ♥ ♥ ♥ ♥ ♥ ♥

Are you already signed up for Sidekick Services? Get tax and license reminders delivered right to your Email Inbox, so you can stay current + feel peace of mind all year long. Did this article help you? Please share with a friend or two, or 5!

{I'm on a mission to help every self-employed woman* in Seattle get the support she needs to be awesome.}

Cheers! Jenny Girl Friday

• How to Set Up Your Business in Seattle - as an LLC / PLLC

A Bigger Splash, David Hockney • Credit below.

Setting up an LLC business doesn't take much time! ….That is, if you know what to do, what you need, and the right order of steps. Here's where I've got you covered.

(Not sure if you want an LLC? Read Sole Proprietor or LLC: Which is Best for Me?)

Below is the quick and dirty list. Detailed notes are at the bottom of the post.

If you know your business name(s), the whole process takes about one hour.

Go ahead, take the plunge!

Pro Tip: Get a journal to record all your log-ins, passwords, IDs, and various notes as you go through the process. Use in the future for all research and calls related to taxes and licensing.

1) Register your LLC / PLLC.

Through: the Washington Secretary of State

Click here to go directly to registration.

Cost: $200

Time: 10 minutes

2) Pause + wait for your UBI

You'll need your UBI to go on to the next steps. (Unified Business Identifier.) It's a lot like your social security number, in that it's a tax ID number assigned to you ... and banks and other organizations will ask for it to identify you. It'll be provided along with your LLC documents. Most often, it's in a 9 digit format. Sometimes it'll be in a 16 digit format, where there are 0s and 1s at the end, noting your "business ID" and "location ID".

3) Apply for your state business license.

Through: Washington State Business Licensing Service (BLS)

Uses MyDOR portal.

Click here to go to read more information on the BLS.WA.gov site

Cost: $19 plus $5 for each DBA

Time: 15 - 20 minutes

4) Apply for your city business license.

Through: City of Seattle Business Department

Uses the FileLocal Portal.

Click here to read more on the city’s website

Cost: $113 for standard, $56 if you plan to gross under $20K per year.

Time: 15 - 20 minutes

That's it! You're in business. …but you're not quite done. To be legal, you need to ensure that you have all of the special permits and licenses for your line of business.

5) Optional ~ Apply for an EIN

EIN stands for Employer Identification Number. It's a tax ID number assigned to businesses by the IRS. If you are a sole prop or a single-member LLC, you are allowed to use your SSN for business purposes. Having said that, banks and online forms will often required you to have an EIN. The issue is that the number formatting is different. With your social security number, it looks like 000-00-0000. With an EIN, it looks like 00-0000000.

Good news! It's easy, free, and only takes 10 minutes. Here's the link: Get EIN on IRS.gov. Or, go to IRS.gov and search for EIN. Heads up, this web service is only available during the daytime.

6) Do your due diligence.

At the state level, check the List of Licenses

This is a list by trade, with links to relevant licensing agencies.

Here's the list of Endorsements required by some businesses.

Or, call the BLS: 1-800-451-7985

And, at the city level, check the Regulatory Endorsements page.

Or, call the City of Seattle: 206.684.2489

Another nice tool is the WA Business Hub. It's created to walk anyone through the setting up a business. There's a TON on there.

7) Celebrate!

* * Please note: The intent of this post is to get you started! And, to provide you with the required framework for every business. Your field may require additional permitting or specialty licenses not covered here. For best results, call the city or state.

Happy Working,

Jenny Girl Friday

Some Helpful Details

With the LLC Registration

Some things you'll be asked:

• the legal name of your company

• 2 alternate names

• start date - day of filing, or a specific date

(Tip: pick one that's easy to remember or has meaning for you.)

• perpetual or specific time period

Mostly, you will have to put your name and address in a million times. Because, as a single-member LLC, you are the member, the manager, the agent, and registrar. You fill all the roles.

Even though you will be a limited liability company, LLCs are handled along with the corporations.

For the State Business License

Some things you'll be asked:

• the UBI - you get this when your LLC goes through - it is your Unified Business Identifier

• what bank you'll be using

• your SSN and your partner's SSN

• description of your business: 1- 2 sentences

• trade name(s)

• which cities you'll be doing business in (you need a license for each one)

For the City Business License

Some things you'll be asked:

• the UBI - you get this when your LLC goes through - it is your Unified Business Identifier

• estimated income

• Meet FileLocal - Seattle's New Portal for License Renewal and B & O Tax Reporting

Important Note: Filelocal has changed it’s sign up process, so the screenshots will look different than what you see below. This will still give you a general idea. I hope to update soon! ~ January 16, 2019

Grab some coffee (maybe wine), a few deep breaths, perhaps a friend ... and get ready to set up your FileLocal account.

Estimated Time: 10 - 25 minutes

Frustration Factor: 4 out of 10

Cost: Free

Recommended Timeframe: November or December

If you're self-employed in Seattle, the city requires three things of you:

• Get a city business license, when you start

• Renew city business license, annually

• Make a report of Gross Sales, annually*

If you make over $100K, then there's a fourth requirement: paying B & O taxes.

*For most. Some businesses are required to report quarterly.

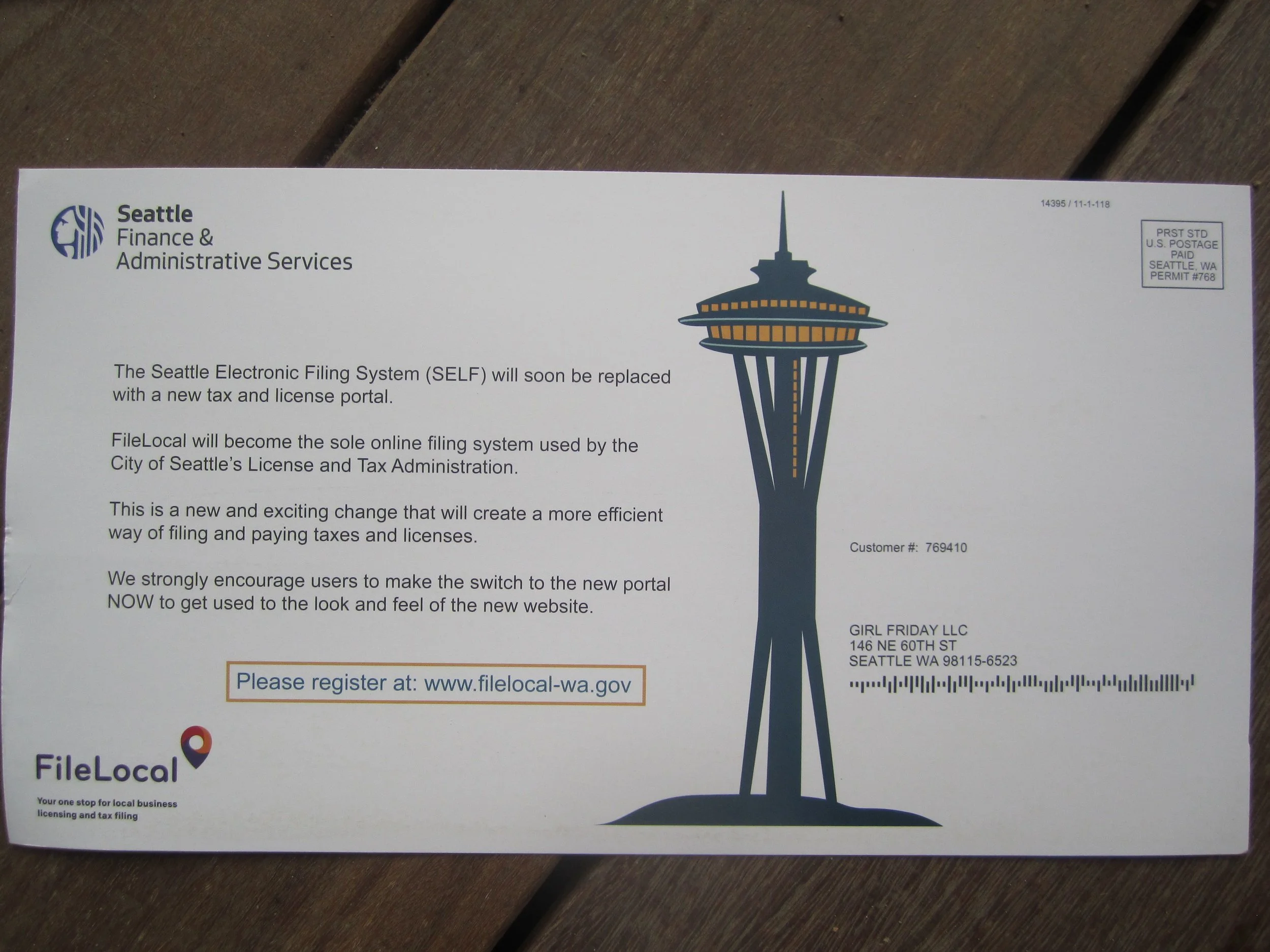

In the past, Seattle used a portal called SELF. It's now switching over to FileLocal.

The city's encouraging us to set up our FileLocal account sooner than later ... and I can sure see why! I just ran through it this morning, hit a snag, and had to find a ton of information! Not to worry, I've got you covered. :)

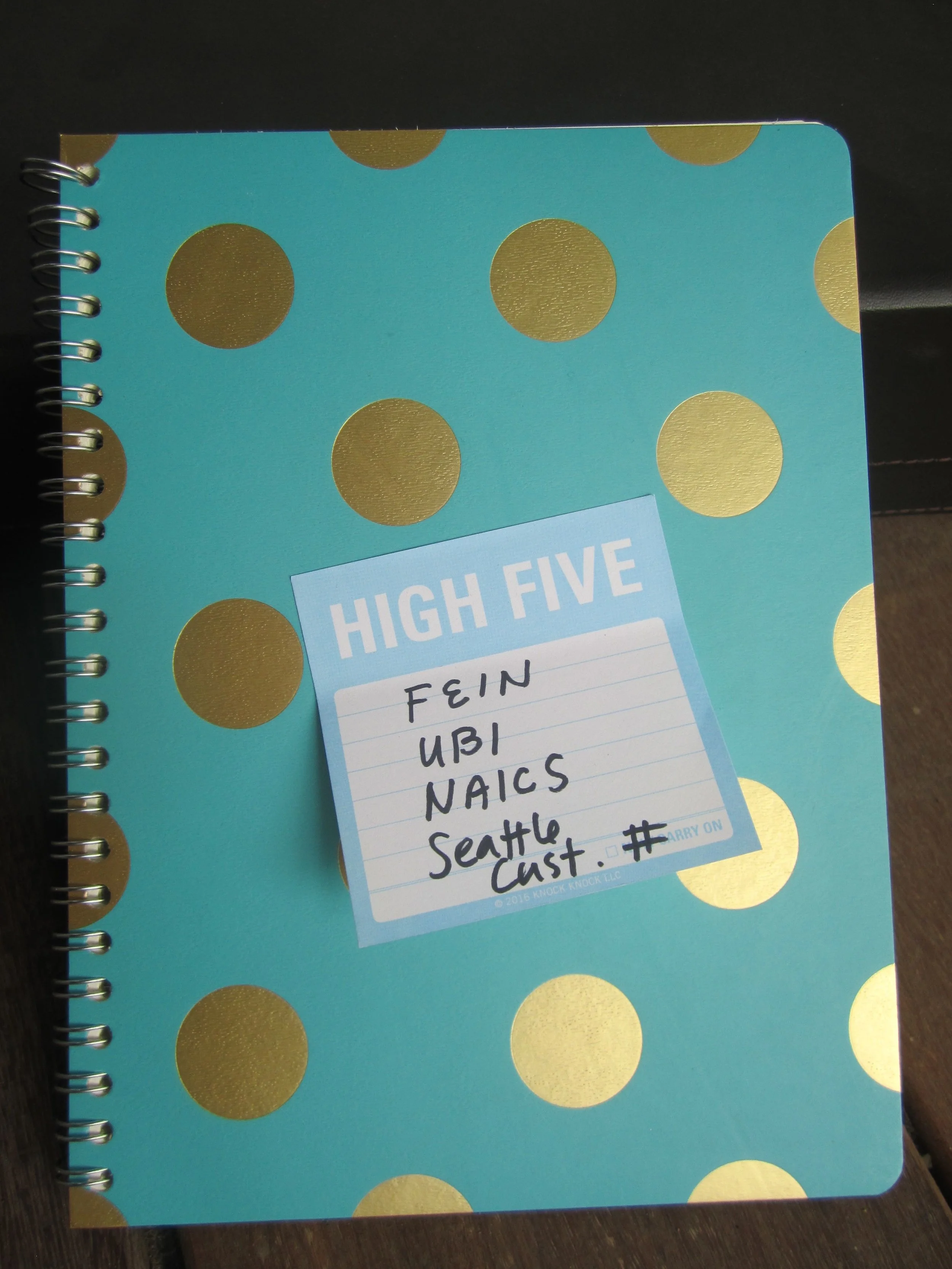

FileLocal asks for ALL of your business numbers. You can either find these things as you go, or look them up ahead of time. It definitely took me a little rummaging... This list might vary in order from the application. ProTip: If you haven't already, write all your numbers in one special notebook.

The List in Brief (details below):

1. Federal Tax Number

2. UBI - 16 digit version

3. NAICS code

4. Seattle Customer Number

1. Federal Tax Number. If you are a sole prop or a single-member LLC, you might be using your SSN for this. This is totally fine for the IRS. However, this form requires you to have an EIN! (Or FEIN.) So, if you don't have one already, you'll need to get one. It's easy, free, and only takes 10 minutes. Here's the link: Get EIN on IRS.gov. Or, go to IRS.gov and search for EIN. Heads up, this web service is only available during the daytime.

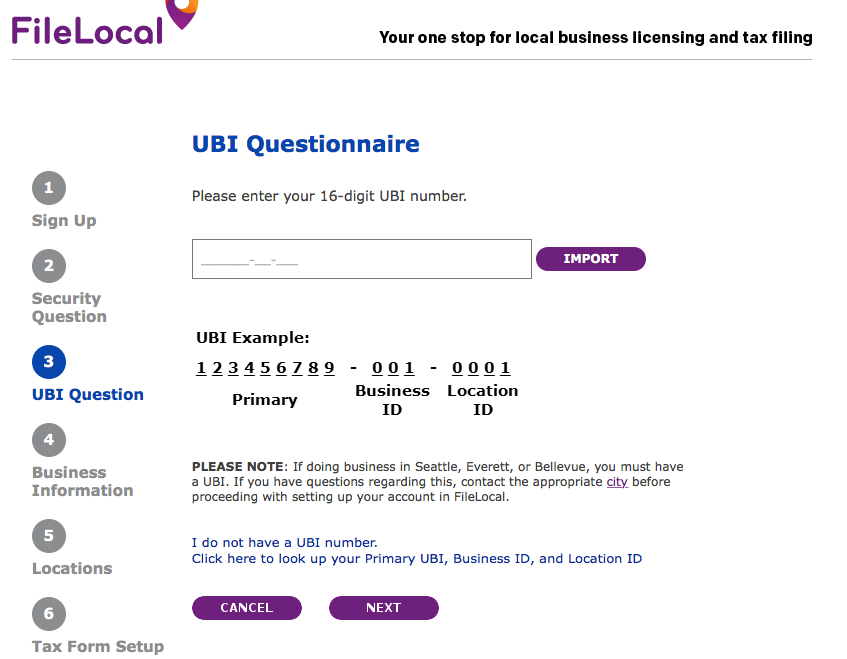

2. UBI - 16 digit version. This is your WA state business number + some codes. (UBI stands for Unified Business Identifier.) Usually, we only use 9 digits. It's in the form ###-###-###. The 16 digit version asks you to add two numbers at the end. Your Business ID and Location ID. If you only have one office, then it's easy. Business ID is 001, and Location ID is 0001.

So, your number will look like ### ### ### 001 0001. Screenshot below.

To find your UBI, you can: look on your LLC certificate (if you have one), look on your WA state business license, or look on your city license. OR, you can search for your business at the DOR lookup.

3. NAICS code. This is a code assigned to your business by the state. It's used for statistical purposes only. The easiest way to find it is to use the DOR lookup. Once the search results come up, select your business, view your profile, and the code will be listed there. The other option is to select one that matches your business ... using the dropdown menu on the FileLocal form.

4. Seattle Customer Number. Early in the application it asks for "City Account Number". It wants the Seattle Customer Number that's been assigned to you. It also comes up if you want to search for your UBI. On that screen, it asks for your Validation or Verification number. (I can't remember which.) Your Seattle Customer Number is the ticket there.

To find your Seattle Customer Number, look on your city business license, or sign into the SELF Portal, and look at your list of businesses. It's listed next to the name of your business.

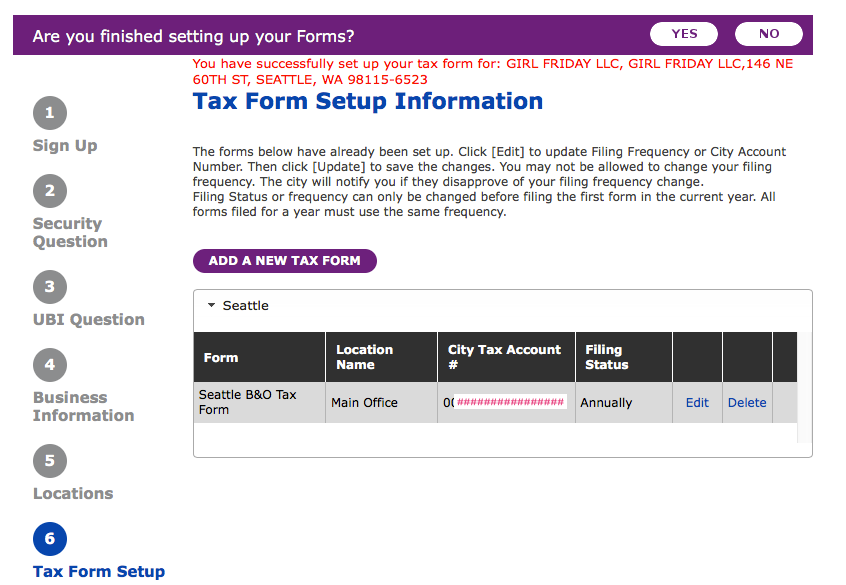

Summary

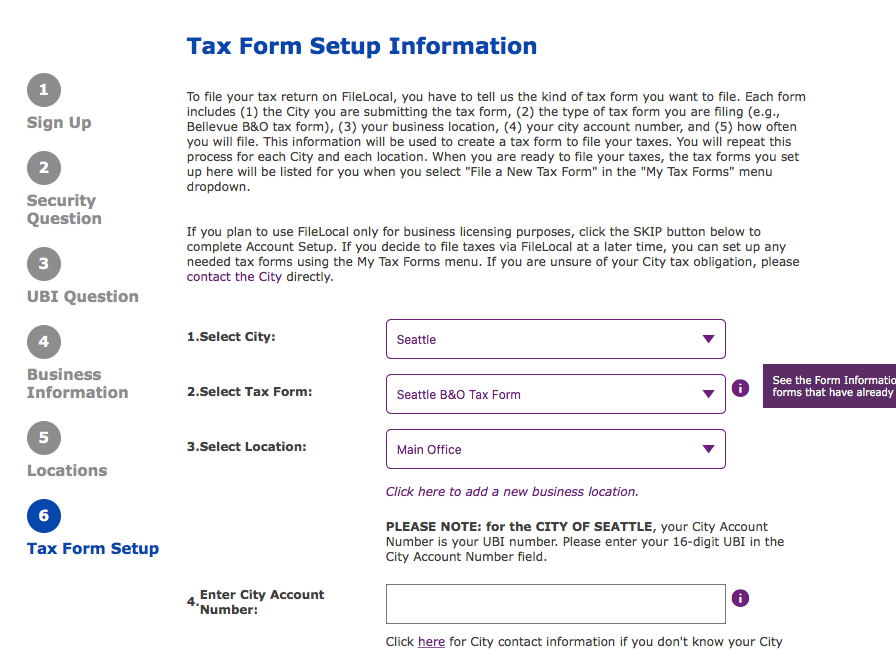

In this process, you provide your basic contact information, then all of your government numbers (so it can link up to those accounts) ... then at the end ... the whole point is to add the Tax Forms you'll be filing. For now, this is only the "Seattle B & O Tax form". Screenshot below.

The SNAG I Hit + Getting Help

On one of the last screens, it said that my UBI didn't match my business location! I called the Help number listed on the FileLocal site. They directed me to the city of Seattle. It turns out, the city had my incorrect UBI! These things happen, I suppose.

The guy helping me was super, super nice. He fixed it and the FileLocal site worked immediately.

Help Numbers:

Seattle: 206.684.8484

FileLocal: 877-693-4435

Now, for some pictures + notes:

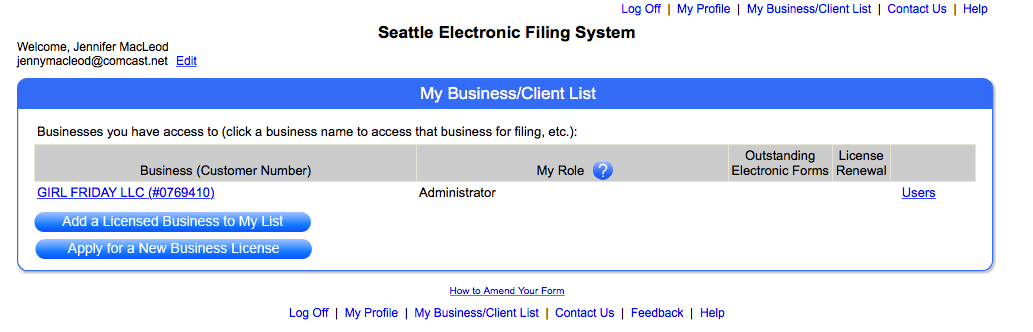

Out with the Old - Seattle SELF Portal

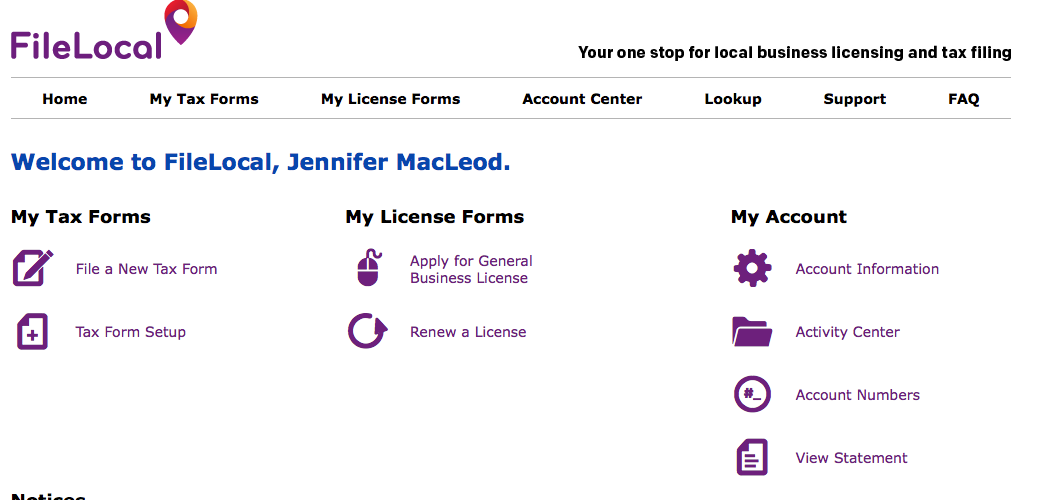

In with the New - the FileLocal Dashboard. (You won't see this screen until the very end.)

A few Screenshots along the application

This one shows the 16 digit UBI. Also NOTE: the circles on the left refer to the screens...they don't match the content on the right.

YOU CAN EITHER IMPORT YOUR WA BUSINESS DATA, OR PUT IT IN MANUALLY. IF YOU IMPORT IT, IT WILL ASK YOU FOR A VALIDATION NUMBER. THIS IS YOUR 6 DIGIT CITY CUSTOMER NUMBER.

If you're a PLLC, it looks like you'll have to choose LLC - Single Member.

At the end, they're asking you which Tax Forms you want to file through their portal. The one you want is "Seattle B & O Tax Form".

Haha...when you're all done, it congratulates you in red ... as if it's an error message! Reroute your brain to the word, 'successfully'. Cheers and head out to Ladywell's or have bubble bath. (Maybe Try the amazing Bath Bombs with Braddington Soaps!)

Bravo!

: ) Jenny Girl Friday

P.S. Please share freely with your friends who are self-employed!