WA state expanding who needs to collect sales tax

Washington state earns most of its money from sales tax. It requires businesses that sell products to collect sales tax.

It also requires certain services to collect sales tax. Often if these services are related to physical things, e.g. painting a mural on a wall, fixing a fence.

This is called Retail Service.

Now WA is adding more industries to the Retail Service category.

Which means new types of services will need to collect + submit sales tax.

Some new examples:

Advertising services

Graphic design

Presentations, workshops

Web design

Over the years, WA is constantly adjusting who needs to collect sales tax. Some people are not aware that technically their work is considered Retail or Retail Service.

You might not know …

That these services and products also need to collect sales tax:

Photography - services and photos

Selling digital products - newsletters, digital art, webinars

Painting murals

Repairing, improving furniture or other objects

Is this feeling scary or overwhelming?

Are you thinking things like…..

Oh Sh*t! I can’t afford to pay more taxes? Why am I burdened with this? Will clients think my prices are too high? This is not fair! I already hate number, now I have to do this?

I got you!

Here are some key things to know upfront

1 - This won’t cost you any extra money. This is tax that you collect from the customer, and sent on to the state. (Though it will take a little extra time.)

2 - Once you know what to do, it’s not that hard.

3 - Not sure where to start? Just add 10% sales tax to everything for now, you can get more precise later. Set that money aside in a separate account if possible.

4 - Our customers are used to paying sales tax, so hopefully, for most people, this will not be a big deal.

5 - When it’s time to file, the phone support at the WA Department of Revenue is usually really nice, and it is their job to help you. (You can also tag me in to help with a Quickie Consult-Call )

6 - Other people not as smart as you have figured it out, you can too!

I’ll be creating more support materials and resources in the future. In the mean time, feel free to hit me up for a Quickie Consult-Call for a small fee. Or, if you’re a new client, find me in a free 20-min Zoom chat.

You got this!

Once you’ve got your system, this is just one more way to feel like a Bo$$!

xo Jenny

Accountant help with IRS taxes ~ if you're on a tight budget

“Do you any CPAs/accountants who can help me file IRS taxes? I’m a single-member LLC/PLLC on a budget….”

Or ”…I’m a Sole Proprietor on a budget.”

Hi Friends,

This is probably the #1 most common question I get via email. And it’s a little complex to answer. Short answer ~ Not really, but I can still help you!

Please read on for some context, then options for you.

Context

Great accountants cost a little money. The ones I know generally charge $900 - $3000 for filing IRS taxes, with good reason. A great accountant is easier to work with, good with people, they will answer questions, they use robust software, and can advise you on decisions. And if you’re asking for a CPA, certified public accountant, they are more spendy because they have extra certifications and answer to a higher standard.

Here’s a list of accountants I know, and a few other finance folks.

Many self employed people - do not need an accountant. If your taxes are simple, you can file directly. Filing software is excellent at prompting us for what to report.

Also….if your taxes are simple, all the accountant is doing is entering it into their software. Without any value-add! A great one will look it over. Many of the cheaper-priced accountants simply enter it into the software for you. By the time you’ve given them all the info, you could have filed your own taxes.

Reasons to get an a great accountant:

You have tricky taxes: investments, rentals, more than one home, etc.

You’re filing as an S-corp

You have employees

To help you with decisions

They lead you through the process of prepping your business info

They answer questions in a friendly way

Reasons to get an a cheaper accountant:

You like the deadline of getting all your forms + numbers to them

It gives you peace of mind, it feels more official

It’s part of your annual ritual

Options / to get accountant help on a budget

The most affordable way is to use tax software, and access the accountants / tax pros they offer!

Work with H&R Block. You can go into an H&R Block center, or get help online. I think you still enter everything into the computer, and for an extra fee, you can get a real person to help you with it.

Use TurboTax with “Live Full Service”. Or file yourself, using the Live Chat for questions.

Try Tax Slayer. Their standard package includes access to tax pros.

Friendly Reminder

No matter who you file with, you still have to do all of the prep work! It’s still on you to find all of the tax forms. And to collect all your business numbers. The “Filing” step is putting all of that info into the software. It’s the easier part…. Check out this newsletter for a few tools to help you with the prep step. If you like it, please leave a tip in the Tip Jar!

Good luck, you got this!

♡ Jenny

Book$ about Money / A short list ♡ and some guiding ideas

If you wish to see the list only, scroll down. :)

First, I wished to share some thoughts about books on money….

I love when people ask me about good books on money! And then immediately get confounded … for 2 reasons.

1 - Because most of the books I read are a bit older, and I can’t fully remember if they feel modern enough now. (I stopped reading books on this topic, once I got enough knowledge, and found my own good relationship with money.) I’m sure there are great ones out that that I just don’t know about!

2 - Most importantly, because it really depends on what you’re looking for! There are so many aspects to working with money! I can answer this best when we have a little conversation first. (In fact, feel free to hit me up for a free 20 min Zoom chat.)

The best books on money, are the ones where: you like the tone, it gives you the knowledge you’re seeking, and motivates you to make some changes! Avoid books that feel too daunting, make you feel behind, or that you’re doing something wrong. Or define a protocol that feels too strict.

Below is a list of money topics.

I list them out, to offer you as menu, in case you’re still figuring out what you want to learn.

Also, I wish to point out that … there are many ways to “be good” with money. Though in our society, women have been steered to only one corner of this skill set: budgeting, saving money, being thrifty, paying off debt. Here are more ways to be good with money, that might get you a bigger bang for the buck!: earning more, feeling worthy and empowered, building wealth, being literate with our money systems.

These are the most common topics people are asking about:

How to control or direct your spending (budgeting)

Ways to save more

How to get out of debt

Investing, growing wealth

Retirement

Adulting money skills, building some basic money literacy and know-how

Basic bookkeeping and accounting for business

I would love to get these topics on people’s radar too:

Get fired up to earn more ~ how to feel worthy

Learn what your thriving life costs, and put a price on it

How to earn more

If you work for yourself, design your rates to earn enough+, If you have an employee job, find a way to ask for more

How our money system is a bit whack, and you’re great!, but it’s still good to know how to play the game

How your taxes work, so you can factor them into plans

Feeling better about money, building a more peaceful relationship, being empowered

How to work with people in the Finance world (financial advisor, accountant, etc.)

List of Money Books

I wish I had more modern books to offer you! If you find any that you love, please let me know.

Feminism and building wealth

I haven’t read these, but this is where I’d start today

Rebel Millionaire: Get rich on your own terms

Peg Cheng

Perhaps heck out Suze Orman books

All-around Money Skills ~ Getting out of debt and building wealth

#7-Figure Net Worth: Modern Wealth Blueprint for Black Americans

by Brielle Mabrey

Your Money or Your Life: Transforming Your Relationship with Money and Achieving Financial Independence

by Joe Dominguez and Monique Tilford

This is an oldie, but goodie. Though the program is kinda strict.

Adulting Money Skills with a Narrative

I Survived Capitalism and All I Got Was This Lousy T-Shirt: Everything I Wish I Never Had to Learn About Money

by Madeline Pendleton

Charging enough if you’re self-employed

Sections of these books cover how to charge more.

If you follow this guidance, it’ll pay for the book in no time!

Unstuck: Method + Magic for Stepping Into your Worth

by Roxie Jane Hunt

How to Become Self-Employed in Seattle: A Guidebook, Companion, and Reference

by Jenny MacLeod (yours truly!)

Working with money if you’re self-employed

Accounting Made Simple: Accounting Explained in 100 Pages or Less

by Mike Piper

Profit First: Transform Your Business from a Cash-Eating Monster to a Money-Making Machine

by Mike Michalowicz

This book is overpromises (it could have been an article)…however, it’s got some great strategies around using bank accounts.

Feeling better about working with money

The Soul of Money: Transforming your Relationship with Money and Life

by Lynne Twist

Thank you for reading! I’d love to hear which books you found helpful, whether from this list, or beyond. Good luck in your journey! And way to go for building up your money skills! I think it’s one of the most beautiful, simple, radical acts as a Feminist!

♡ Jenny

Estimated Quarterly Payments (EQ$) to the IRS / Just the Basics

The WHY behind EQ$

The IRS is a Pay-as-You-Go tax system. We're required to send in 4 estimated payments throughout the year ... then, it's True Up time when we actually file our taxes. If we overpaid, we'll get a refund. If we underpaid, we'll owe more.

Good news!

Once you know what you’re doing … it only takes about 5 minutes!

It can feel really satisfying, like you’re a BOSS of your business.

It makes Filing Taxes in April a lot nicer.

A Few Quick Facts about Sending in EQ$

When we send in an EQ$, it’s simply sending in money. It’s not filing taxes. There are no numbers to report. We just send money and make sure it’s attached to our name and tax ID.

If sending by check, there’s just a small voucher. If online, just a few fields to fill out to verify your identity.

You can send payments online, or via snail mail. Click here to read more.

IMPORTANT - if sending payments online, see note below.

It's fine to use your SSN with these payments. (Even if you have an EIN.)

The Due Dates are not even! (Weird, right?)

DUE Dates

April 15

June 15

September 15

January 15

Note - When these dates fall on the weekend or holiday, they will shift to the following business day.

To Send in or Not Send In….

If total tax for the year (related to your biz profit) is $2000 or less, then the IRS says that we do NOT need to send in payments.

If total tax for the year (related to your biz profit) is $2000 or more ... we're required to send in payments.

If we send in partial payments, or none at all, we might have to pay a penalty. Usually these are a few hundred dollars or less.

How Much to Send

The IRS offers a complex way to calculate your EQ$. I offer simpler alternatives. Three different methods to choose from. Click here for the NEW worksheet with instructions.

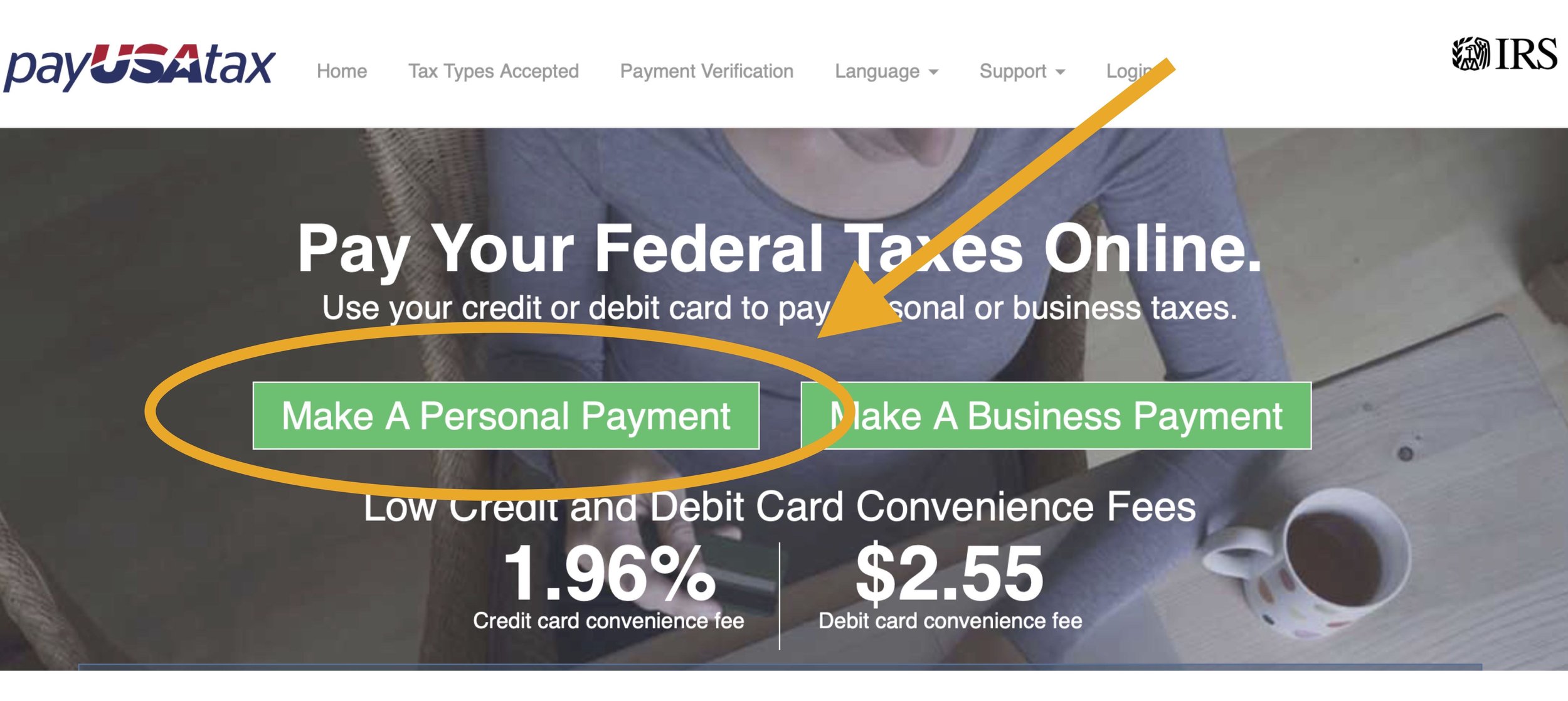

IMPORTANT NOTE / If Paying Online

IF you pay online, and use a 3rd party, be sure to choose "Personal Taxes"

Why? Because your business does NOT pay taxes, you pay personal taxes on the income you earned through your business....

Well those are all the basics on EQ$. It might feel intimidating at first … but it really gets easier over time!

Finding Your IRS Numbers - Notes and FAQs

This is a brand new post … I’ll keep adding to it throughout March 2023

Some General Notes

The IRS taxes you on profit.

To formula to finding this is: GROSS SALES - Biz EXPENSES = PROFIT

To show this work, the IRS asks us to fill out a Schedule C, a type of “Profit or Loss Form”.

The Schedule C is only 2 pages, and not that hard!

In reality, we don’t fill out the form … if we file ourselves, we’ll enter the numbers into software or a website (like TurboTax, FreeTax, H&R Block).

OR, we’ll give our numbers to our tax preparer.The Schedule C gets added to your personal IRS taxes. You don’t have to do a separate tax return. (Isn’t that great?)

Did you know … your business doesn’t pay any IRS taxes? You are paying personal taxes … on the money you earned from your business.

When you are self-employed, you’ll be paying 2 types of tax. Income tax (what you’ve been paying your whole life) and Self-Employment tax.

Business deductions, write-offs, business expenses - all mean the same thing.

What can I write-off? / What can I claim? / What is a business expense or deduction?

Almost everything you spend on your business - can be a deduction. It’s just a matter of what amount, and what category. The IRS uses the phrase, “ordinary and necessary”.

Quote from the IRS:

“To be deductible, a business expense must be both ordinary and necessary. An ordinary expense is one that is common and accepted in your industry. A necessary expense is one that is helpful and appropriate for your trade or business. An expense does not have to be indispensable to be considered necessary.”

What about something that is part for business, party for personal … like my cell phone, or my laptop?

These are referred to as Shared Use items. The basic strategy is to calculate - or decide - on what percentage is for business, and claim that amount. The default is 50/50, though you can split them other ways as well.

So, if you buy a new computer for $1800, and claim 50% for business, you would claim $900 as a business expense.

Let’s say your phone bill is split between your business, personal, and 2 other people. You could say that 25% is for business. Then take 25% of the total phone bill for the year as a deduction.

Does it matter what category I put things in?

Sorta no, sorta yes.

As long as you claim things only one time, you’re generally fine. The category doesn’t change the taxable amount. And if you’re paying the right amount of tax, you’re good.

Putting things in the reasonable categories does help though! Part of the risk factor for getting audited - is - do these expenses line up for this type of work.

What if I don’t see a category that fits?

You can either pick the closest category, that might make sense.

OR, make an “Other” category, and give it a label.

For example, I have checking account fees, for $84 a year. I could maybe put it into the “Office” category, though it’d be a stretch. So instead, I put it into “Other - Bank Fees”.

How do I handle mileage?

answer coming soon

What about a home office deduction?

Sometimes you can take a deduction for your Home Office. Additionally, you can deduct furniture and items used in your office. (Note, very often, the home office deduction doesn’t add up to that much. The simplified method generally yields a savings of $100 - $300 when all said and done.)

A – Home Office Deduction.

First, check to see if you meet the criteria:

Used exclusively for business – meaning no other activities take place there

Used on a regular basis

For the purpose of making a profit

Principle place of business

If yes, there are two methods:

Simplified Method: Calculate the square footage of your home office. Add this number when filing (with software or accountant.) Generally, you’ll get $5 per square foot as a deduction.

Actual Expenses Method: This is complex, and beyond my scope. The basic idea is that you calculate the percentage of your home that is your office. Say it’s 8%. Then, you add up all home expenses – mortgage/rent, utilities, insurance, etc. – then take 8% of those costs. I think.

B - Furniture and items

All or most things you buy for your office can be deducted – like chairs, rug, couch, artwork.

What do I do with the 1099 forms I received? What’s a 1099-NEC? And 1099-K?

1099 forms are a family of forms that track - whenever we get paid. There are different suffixes, here are some examples:

1099-INT … interest you earned from a bank or investment

1099-DIV … dividends you earned

1099-NEC … income from “Non-employee compensation”

1099-MISC … income from “Miscellaneous source”.

These are the forms you get PAYERS, and are straightforward to work with.

1099-NEC (non-employee compensation)

1099-MISC (miscellaneous)

These might come from businesses that hired you, programs you’ve contracted with, insurance companies, people you supervise. You’ll need to input all the data from these forms into the tax software, or give to your accountant. These count as part of tallying up your gross sales.

You may also get 1099-Ks, these come from payment PROCESSORS:

You might get these from Square, Stripe, Venmo, PayPal, etc. These are a little trickier, as the amount reflected in the 1099-K may overlap with other income. Be sure to get guidance on how to enter these when filing.

What if I didn’t receive a 1099 form?

Short answer: You still report the income, whether or not you received the form.

Longer answer: Ask the person/business if they sent one. Or look up on online. If they submitted one to the IRS, it can be a problem if you don’t report it. If they did NOT submit one, you’re in the clear. It’s the responsibility of the Payer to complete the form….

Accountants + Tax Help for Therapists

Hey there,

Here’s a list of Accountants and Financial folks especially collected for therapists. Most of these names come from Bethany Bylsma of the famed + super fun Therapy Godmothers. Friends of mine, offering all types of support for therapists setting up, or running, a private practice.

Also, hey, would you like to learn more about IRS taxes - either to file yourself. Or, to help you work with an accountant in a more empowered way? Check out Taxes + Snaxes, with Yours Truly as a Guest Presenter. Online or in-person workshops (in Seattle).

:) Jenny

Heard

Offering wholistic services - with accounting and bookkeeping combined

joinheard.com/pricing

MaClean Wealth

Retirement and Income Planning

macleanwealthplanning.com/team

TLDR

Extra support for new therapists

tldraccounting.com/accounting-for-therapists/

Nth Degree CPAS

Taxes and help with cash flow

nthdegreecpas.com/

+

Wise Mind Financial

Money Coaching, by a trained therapist

wisemindfinancial.com

Do you know any great Accountants or Bookkeepers?

This is a great question. Also, it is the #1 question I receive through email … so I decided to keep a full answer here for you - that I can update regularly.

Short answer - Yes! I know some amazing folks.

Longer answer - They are often booked. Below is my current list of people I know, and others recommended to me. If none of these folks work out, read some tips for searching for your own tax/money pro - at the bottom of this post.

Note: If you’re a Therapist - please see this list, specially collected for you.

/ / / / /

One last note: If you end up hiring one of these amazing folks, please consider coming back, and leaving a Tip in the Tip Jar. It took me years and hours+hours to find these good people. Thank you!

Valerie Moseley, CPA

valeriemoseleycpa.com

Available for consults: self-employed, S-corps, interesting tax situations, etc.

Limited openings for perfect-fit clients

Jocelyn Muhl, CPA

northseattleaccountant.com

Accounting services include time for questions

Available for consults, and perfect-fit clients

Kathy Coggins

cogginsaccounting.com

Kathy loves to work with S-Corps!

She has a full team to support you with other services too, like payroll, bookkeeping

Luke and Amy Weissgarber

ltwcpa.com/

Based in Bellevue, just moved up from Texas. Recommended by trusted CPA, actively looking for clients.

Julia Ensign

ensign-bookkeeping.com

Bookkeeping services for local businesses

Friendly! Offers phone call to take about working together

Patty Kelley, CPA and Katherine Griswold, MBA

portumbooks.com

Taking new clients, focus on small business. Offering full bookkeeping services, preparing documents for taxes, consulting, Quickbooks advising, and more!

Lindsey Gaughn, CPA

gaughanlindsey@gmail.com

Available for consults, bookkeeping and accounting services

Email to get in touch

Hipster Money / Alexandra Perwin, CPA

hipstermoney.com

Usually booked … sometimes available for consults, new clients who are perfect-fit

Clear Sky Money Matters / Emily Zillig

emilyzillig.com

Bookkeeping, money coaching

Sadie Frederick / Bookkeeper

sadieaccounts.com

Specializing in small Seattle nonprofit clients (also a long-time client of mine)

Justin Bourn, CPA

wzbcpa.com/team/justin-a-bourn/

A client said he’s friendly and easy to work with. Now the co-owner of this company. I hope to meet him some time.

♥

Tips for finding your own Tax/Money Pro

Keep asking everyone you know, to get a list of names 3-5 or more if possible

Try to meet at least 2-3 - for some type of initial consult. You will learn a little bit each time, and you’ll get a sense of the various communication styles. And what you like and don’t like.

Keep in mind - this is an equal power situation. You are the client, you’re an expert on your biz and your personality and work style. They are the expert of filing taxes and numbers. Be sure it feels good to talk with them and work with them.

If you want someone who will teach you things, ask them specifically if they like explaining how taxes and bookkeeping work.

For Accountants, be sure to ask if they file city and state taxes too! Many accountants do not.

Good luck with your search! … and please do let me know if you find any great people to add to this list.

Jenny Girl Friday

PPP Forgiveness Info + Tips ~ For First Time Borrowers

You got that cash … now it’s time to keep that cash!

Great news for PPP recipients in 2021. The SBA made it a lot quicker and easier to apply for Forgiveness! For my part, it took only about 10 minutes … once I found the right location on my bank’s portal. (Full disclosure, I did spend about 30 minutes doing the wrong things first….)

Important - this blog post is for you, if you are a 1st time borrower, with under $150K in a loan.

The Basic Process ...

First, the process depends on the bank. Usually, it's two steps - the bank will give preliminary approval, then send to the SBA for final approval.*

In most cases, we just need to get form 3508S - the Simplified Forgiveness Application - to the SBA ... Either the bank will ask you to fill out the form, OR, they will ask you for information and create the form.

In many cases, No supporting documents are required!

The bank will review your application. If satisfied, they submit to the SBA.

It's possible that the bank or the SBA may come back to you to ask for documentation.

Once approved, you'll be notified. And, the SBA sends the money to the bank to pay off your loan.

*It's possible you may be able to apply directly with the SBA - they have opened a Direct Forgiveness Portal just this week - though it is in the Pilot phase. Click here to see it.

This is what you’re going for … to see this sent to you:

Important Info

It is required for us to keep our paperwork for 6 years. This includes the SBA loan paperwork that grants Forgiveness. And, records to show that you used the funds for 60 - 100% for Payroll. See this blog post for more info on records and acceptable uses for the funds.

The deadline for applying for Forgiveness ... is within 16 months after you received the funding.

If you are a 2nd time borrower

You have an extra requirement - you must prove that you had a 25% reduction between 2019 and 2020 (by comparing 2 quarters).

Please talk to your bank to learn what they will need.

Things to Do

Check with your bank / credit union to see if they are open for Forgiveness Applications. In many cases, they will send you an email to invite you to apply.

Click on the link to see the Simplified Forgiveness Application (3508S) - to warm yourself up for the process. You will see that the info needed is pretty basic.

Put time on your calendar to do this work.

Tips

Reach out to any friends with a PPP at the same bank. Learn from them, or go through the process together.

Plan a large chunk of time for this - even if it's quick. It takes a mental toll, so it's nice to have space.

Have something sugary at the start of this session - glucose helps the brain.

If possible, plan a massage, or trip to Olympus, or a bath, or a walk afterward to reward yourself.

Totally intimidated? Call your bank and ask how to get help.

FAQs

What was I allowed to spend the money on? (What do I need to prove about how I used the money?)

You must use 60-100% of the PPP money for "payroll" costs to be forgiven. There are a few other approved costs - such as benefits, rent, utilities, operational - that can be used for up to 40%. Ask your bank.

Am I allowed to use it to pay taxes?

If you are a sole prop or single member LLC ... technically, you, as a person pay taxes (not your business). So, after you give yourself a Paycheck (into your personal account), you can send in IRS estimated taxes from those monies. Having said that, you may NOT use them for city or state taxes - those are taxes your business pays.

I work by myself, I thought Self-Employed people didn't get Paychecks or have Payroll.

You are absolutely correct! Technically, we have profit or an owner draw. Having said that, the PPP Loan is including us, and equating our "profit" with our "payroll".

What happens if it’s not forgiven?

It stays a loan with a 1% interest rate. I think you may also defer payments, but am not totally sure about that yet.

You got this! Wishing you an easy and quick forgiveness.

♥ Jenny Girl Friday

P.S. Are you self-employed? Be sure you’re getting Sidekick Service emails - tax + license reminders sent to your inbox monthly, with links to how-to articles and tools to make things easier and fun.

PPP Loan - Info + FAQs 2021

**This is an On-Going Blog Post - and will be updated as new information is discovered.**

Apply for a PPP Loan!

... as soon as you can.

Ideally this week.

Because it is 100% forgivable,

if you do a little paperwork.

The value is 2.5 x your average monthly profit.

The program was designed with you in mind

♥

Read on for FAQs ... and please let me know if you get one! ...or what happens.

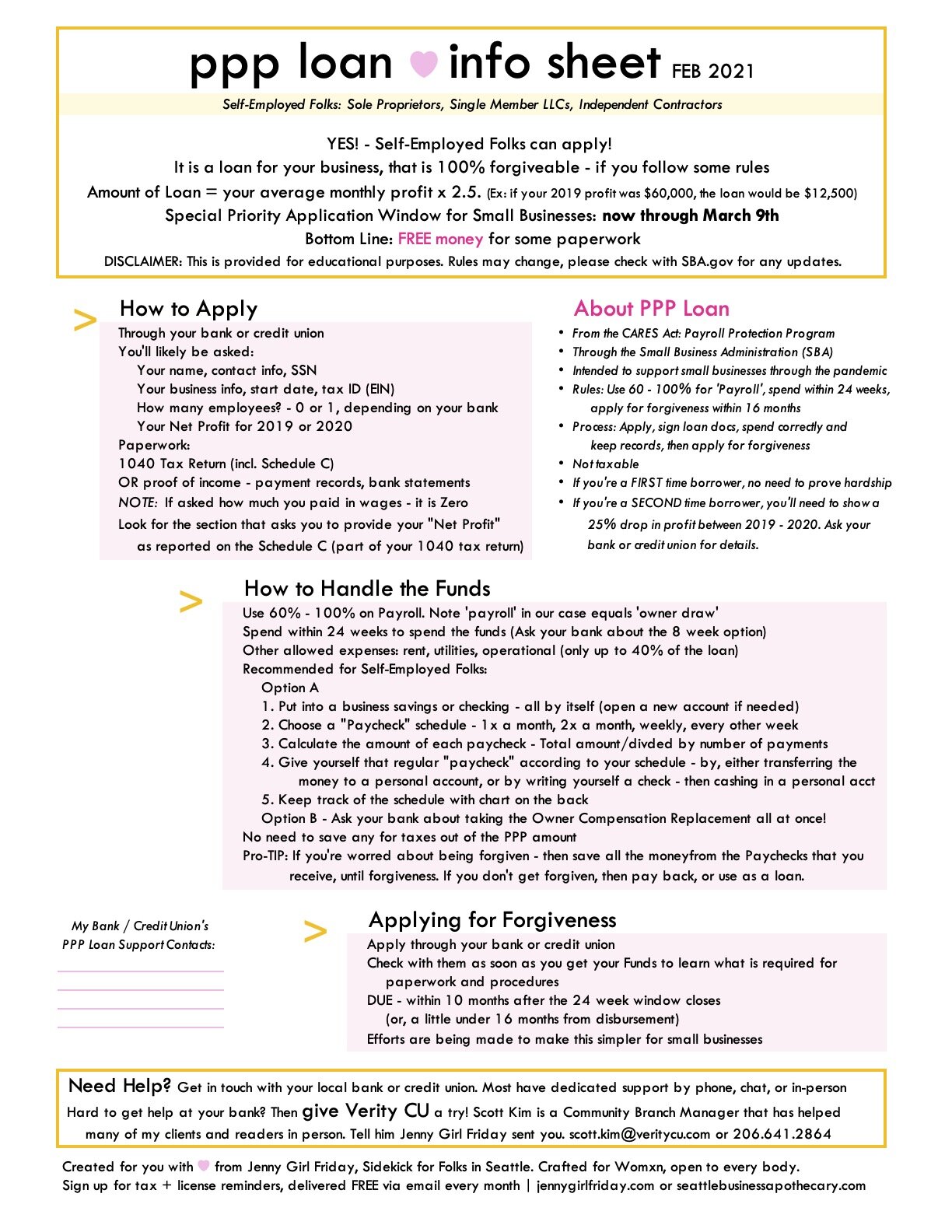

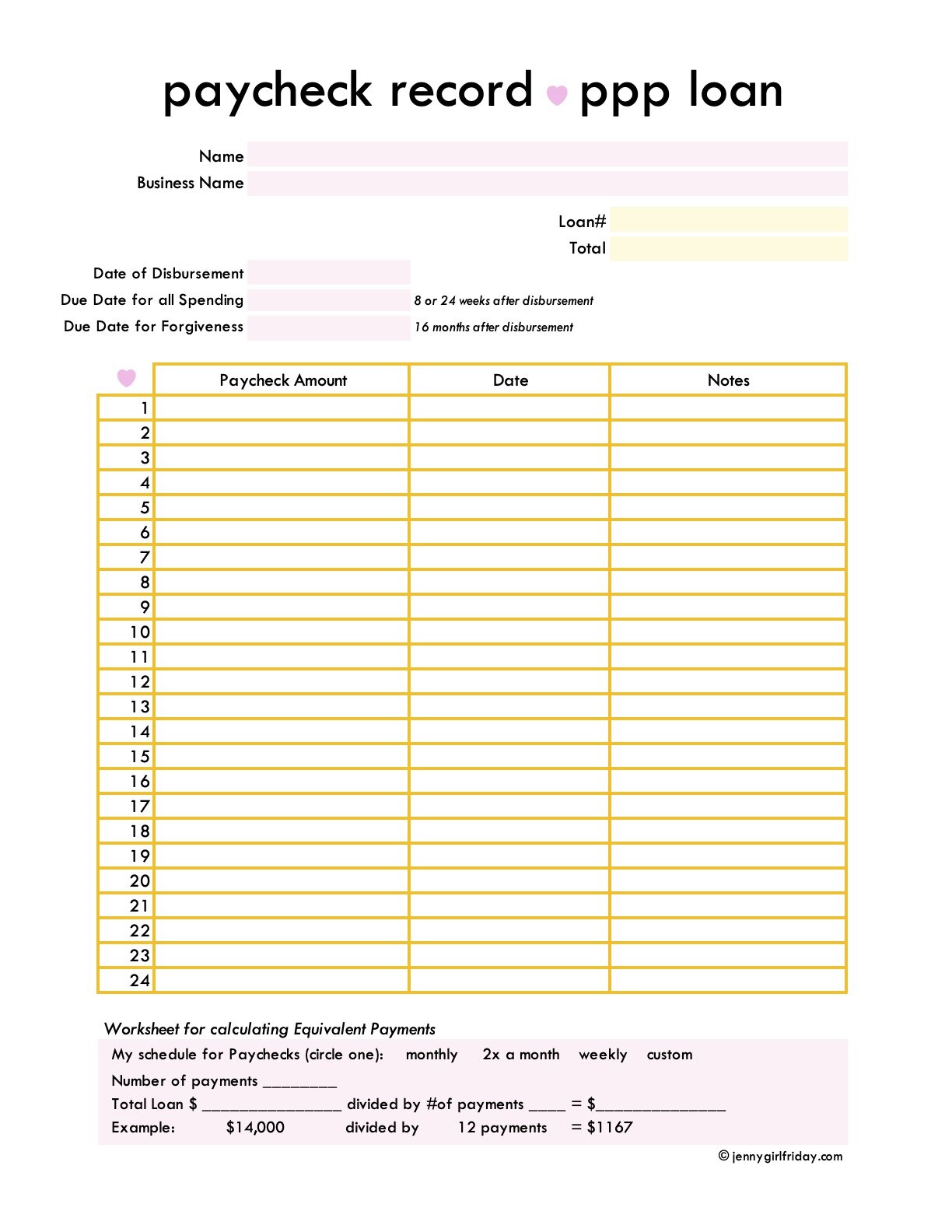

Check out this Info Sheet > > >

Includes a chart for keeping track of your Paycheck Schedule. Recommend printing back-to-back if possible. Click on either image to get the 2 page PDF.

The Basics

PPP = Paycheck Protection Program

It is part of the federal relief efforts, through the Small Business Administration.

Although we technically don't have Payroll (as a sole proprietor or single-member LLC) ... we're still invited to apply! We are still allowed to get help. For us, it's considered "owner recompensation".

> > The first step is to get in touch with your bank or credit union.

> New application deadline: May 31, 2021

> You will apply for the Funds through them.

> You'll receive the Funds.

> Then, later, you'll apply for the "Forgiveness" with the bank's help.

> When asked how many employees are in your business, some banks will instruct you to say 0 and others will ask you to say 1. Check with them! (Technically, you're the owner, not an employee. But some banks need a number 1 in there for the formula.)

> The only form you should need ... is your 1040 Tax Return from 2019 ... with your Schedule C - this will show what your business profit was. (Which equals your "payroll".) If you see request for other forms, ask the bank!

FAQs

Who can apply?

Anyone who owns a business, including self-employed folks. Even though sole proprietors and single-member LLCs don't technically have a "payroll", we are still allowed. The rules have been extended so that our profit = payroll.

What is the basic overview?

You apply through your bank ... who goes to the SBA to get the funds. Once the funds arrive, the bank may ask for more documents from you. Use the money to "pay yourself". Then, follow your bank's instructions for the Forgiveness Application. Once you pass that process, you do not have to pay it back.

What paperwork is required?

Usually, an online application through your bank. Then, submitting your 1040 Tax Form from 2019. It's possible some banks will take a Profit and Loss Statement from 2020. Then, the Forgiveness Application - I don't know what is on there, but I've read that it is simplified this round.

I tried before, but didn't get it ... is it worth it this time?

This time, more money has been allocated ... it is way more likely that you can secure the funds this time.

I work seasonally, is there anything I can do to boost my loan amount? (The formulas don’t reflect what was truly lost.)

Yes! Some banks have special steps for seasonal workers. Ask someone at your bank or credit union about this. One reader was able to apply as a seasonal work and received about $7000 instead of $4000 (with the classic application).

I have an EIDL loan ... is that an issue?

Yes and no. As far as I understand it - If you used EIDL loan to pay yourself a regular paycheck, then this will count against how much money you can get from the PPP ... but you can still get the PPP! You can use the PPP funds to pay off your EIDL loan (which is not forgiven). Also, if you used your EIDL loan for other things - like rent or business bills - you can get the full PPP loan for your "payroll". Again, ask your bank!

Hmm ... I feel like other businesses need it more than me ... wouldn't I be taking money away from them?

We all need support. If you get the PPP funds, and pay yourself, you can ensure that you'll remain a stable and secure part of our economic system and community. Plus, you can use your personal funds to support the small businesses you wish to support! And/or donate to causes you care about.

My business has been steady, so maybe I don't need it. Do you have thoughts around that?

Yes! Many people I know (including Yours Truly) have been able to continually work ... but it's been exhausting, and some of us are starting to hit a wall. If we hit a wall, then our businesses come to a total standstill - without sick pay or disability insurance. The PPP funds can allow you to throttle back a bit, if you've been working steadily. Also, keep in mind, the spirit of this is to "protect" your payroll. Who knows what will happen in the next 6 - 12 months. I, for one, could use some security moving forward.

I got the first round of PPP ... can I apply again?

Yes, you can apply again ... with some extra paperwork. You'll need to demonstrate a 25% drop in income ... for a particular month. For example, if you can show you made $4000 in February of 2019 ... then, only $3000 in Feb of 2020, that would suffice. Again, ask your bank!

I heard about the Special Window to apply, where women or minority-owned business are getting additional funds … What if I already received the PPP loan, can I get these additional funds?

Sorry, at this time, there is no retroactive pay available. Keep asking at your bank, in case this changes.

Do I have to space out the paychecks to myself? Or, can I take the money all at once?

It's possible you can take it all at once. I've been seeing the term Owner Compensation Replacement - referring to this idea. Ask you bank or credit union if this applies to you.

What is the best way to handle the funds, to get the forgiveness?

Put all of the loan funds into a separate Savings or Checking account. Open a new one if you need to. Then, choose a schedule to "Pay" yourself - by transferring your "paycheck" to a personal account. OR, write yourself a check. It's very important that the "paycheck" goes into your personal account. What we're trying to avoid, is using the PPP monies for other costs. Use the chart above to keep track.

What am I allowed to spend the money on?

You must use 60-100% of the PPP money for "payroll" costs. There are a few other approved things - benefits, rent, utilities, operational. Ask your bank.

Am I allowed to use it to pay taxes?

If you are a sole prop or single member LLC ... technically, you, as a person pay taxes (not your business). So, after you give yourself a Paycheck (into your personal account), you can send in IRS estimated taxes from those monies. Having said that, you may NOT use them for city or state taxes - those are taxes your business pays.

I work by myself, I thought Self-Employed people didn't get Paychecks or have Payroll.

You are absolutely correct! Technically, we have profit or an owner draw. Having said that, the PPP Loan is including us, and equating our "profit" with our "payroll".

What happens if it’s not forgiven?

It stays a loan with a 1% interest rate. I think you may also defer payments, but am not totally sure about that yet.

What if I’m too worried about not getting forgiven … so it makes me not want to apply, because that would be way to stressful?

Suggestion, get the loan, go through the steps of paying yourself AND save all in Personal Savings. Apply for Forgivess asap, if you get it, cool! Keep the money. If you don’t get forgiveness, then you can pay it back. It would have been a hassle, I get it …but know this, they want us to have the money to stay employed and to stimulate the economy. So, they’re trying to make it as easy as possible for us.

Want to talk to a real person about this?

Scott Kim is at Verity Credit Union ... and helped one of my clients, Dr. Annie Roepke, a resiliency expert, go through the process. He shared that he's willing to be a resource to NON-Verity Members. I'll be reaching out to him this week.

What?! Amazing!

♥ Scott Kim,

Community Branch Manager at Beacon Hill

scott.kim@veritycu.com

206.641-2864

Bottom Line

This program was created with you in mind!

It is here to support small businesses through the rocky waters of the pandemic, and post-pandemic world.

Get help! Help is available!

For a few hours of paperwork and research, you can receive 2.5x $$ what you earn in a month ... to keep for Free.

Please do let me know if works for you! I'd love to hear how many readers do this. All the best and luck to you!

Good luck to you,

Jenny Girl Friday

P.S. I work for tips! If you this article helped you in any way, please consider leaving a tip in the TIP JAR. Thanks! :)