Accountant help with IRS taxes ~ if you're on a tight budget

“Do you any CPAs/accountants who can help me file IRS taxes? I’m a single-member LLC/PLLC on a budget….”

Or ”…I’m a Sole Proprietor on a budget.”

Hi Friends,

This is probably the #1 most common question I get via email. And it’s a little complex to answer. Short answer ~ Not really, but I can still help you!

Please read on for some context, then options for you.

Context

Great accountants cost a little money. The ones I know generally charge $900 - $3000 for filing IRS taxes, with good reason. A great accountant is easier to work with, good with people, they will answer questions, they use robust software, and can advise you on decisions. And if you’re asking for a CPA, certified public accountant, they are more spendy because they have extra certifications and answer to a higher standard.

Here’s a list of accountants I know, and a few other finance folks.

Many self employed people - do not need an accountant. If your taxes are simple, you can file directly. Filing software is excellent at prompting us for what to report.

Also….if your taxes are simple, all the accountant is doing is entering it into their software. Without any value-add! A great one will look it over. Many of the cheaper-priced accountants simply enter it into the software for you. By the time you’ve given them all the info, you could have filed your own taxes.

Reasons to get an a great accountant:

You have tricky taxes: investments, rentals, more than one home, etc.

You’re filing as an S-corp

You have employees

To help you with decisions

They lead you through the process of prepping your business info

They answer questions in a friendly way

Reasons to get an a cheaper accountant:

You like the deadline of getting all your forms + numbers to them

It gives you peace of mind, it feels more official

It’s part of your annual ritual

Options / to get accountant help on a budget

The most affordable way is to use tax software, and access the accountants / tax pros they offer!

Work with H&R Block. You can go into an H&R Block center, or get help online. I think you still enter everything into the computer, and for an extra fee, you can get a real person to help you with it.

Use TurboTax with “Live Full Service”. Or file yourself, using the Live Chat for questions.

Try Tax Slayer. Their standard package includes access to tax pros.

Friendly Reminder

No matter who you file with, you still have to do all of the prep work! It’s still on you to find all of the tax forms. And to collect all your business numbers. The “Filing” step is putting all of that info into the software. It’s the easier part…. Check out this newsletter for a few tools to help you with the prep step. If you like it, please leave a tip in the Tip Jar!

Good luck, you got this!

♡ Jenny

Do you know any great Accountants or Bookkeepers?

This is a great question. Also, it is the #1 question I receive through email … so I decided to keep a full answer here for you - that I can update regularly.

Short answer - Yes! I know some amazing folks.

Longer answer - They are often booked. Below is my current list of people I know, and others recommended to me. If none of these folks work out, read some tips for searching for your own tax/money pro - at the bottom of this post.

Note: If you’re a Therapist - please see this list, specially collected for you.

/ / / / /

One last note: If you end up hiring one of these amazing folks, please consider coming back, and leaving a Tip in the Tip Jar. It took me years and hours+hours to find these good people. Thank you!

Valerie Moseley, CPA

valeriemoseleycpa.com

Available for consults: self-employed, S-corps, interesting tax situations, etc.

Limited openings for perfect-fit clients

Jocelyn Muhl, CPA

northseattleaccountant.com

Accounting services include time for questions

Available for consults, and perfect-fit clients

Kathy Coggins

cogginsaccounting.com

Kathy loves to work with S-Corps!

She has a full team to support you with other services too, like payroll, bookkeeping

Luke and Amy Weissgarber

ltwcpa.com/

Based in Bellevue, just moved up from Texas. Recommended by trusted CPA, actively looking for clients.

Julia Ensign

ensign-bookkeeping.com

Bookkeeping services for local businesses

Friendly! Offers phone call to take about working together

Patty Kelley, CPA and Katherine Griswold, MBA

portumbooks.com

Taking new clients, focus on small business. Offering full bookkeeping services, preparing documents for taxes, consulting, Quickbooks advising, and more!

Lindsey Gaughn, CPA

gaughanlindsey@gmail.com

Available for consults, bookkeeping and accounting services

Email to get in touch

Hipster Money / Alexandra Perwin, CPA

hipstermoney.com

Usually booked … sometimes available for consults, new clients who are perfect-fit

Clear Sky Money Matters / Emily Zillig

emilyzillig.com

Bookkeeping, money coaching

Sadie Frederick / Bookkeeper

sadieaccounts.com

Specializing in small Seattle nonprofit clients (also a long-time client of mine)

Justin Bourn, CPA

wzbcpa.com/team/justin-a-bourn/

A client said he’s friendly and easy to work with. Now the co-owner of this company. I hope to meet him some time.

♥

Tips for finding your own Tax/Money Pro

Keep asking everyone you know, to get a list of names 3-5 or more if possible

Try to meet at least 2-3 - for some type of initial consult. You will learn a little bit each time, and you’ll get a sense of the various communication styles. And what you like and don’t like.

Keep in mind - this is an equal power situation. You are the client, you’re an expert on your biz and your personality and work style. They are the expert of filing taxes and numbers. Be sure it feels good to talk with them and work with them.

If you want someone who will teach you things, ask them specifically if they like explaining how taxes and bookkeeping work.

For Accountants, be sure to ask if they file city and state taxes too! Many accountants do not.

Good luck with your search! … and please do let me know if you find any great people to add to this list.

Jenny Girl Friday

King County Taxes - FAQs

What does the County tax us on? How much are the taxes?

The county taxes us on property:

1 - real estate (land and buildings)

2 - "personal property" (equipment)

If your business owns any land or buildings, please contact them directly.

For "personal property", totaling OVER $7500, we pay about 1% in taxes. (We owe nothing if the value is under $7500.)

Do I have to report to King County?

Technically speaking, ALL businesses must register with King County and make a report every year. Realistically speaking, many micro and small businesses do not know about the County, and are not registered, and it has not been a problem (so far). One similar situation is the Speed Limit. Many people drive over the speed limit, but never get a ticket—especially if you're over by only 2-5 mph. I cannot give any advice about what to do, but want to give you some context so you can make your own decision!

What counts as "personal property"?

"Personal property" is a funny term. It sounds like the opposite of business! But it IS the term for equipment and supplies that you use to do business. Like: desk, shelves, computer, printer, art equipment, and even office supplies. Think of it like this: it's property that we can pick up and carry, on our person.

How do I register with the county?

Someday, I'll have a blog post on this...for now.......)

There is a form to fill out, either on paper or as an interactive PDF.

To find it~

1

Go to the eListing page

2

Look on the LEFT side Navigation

3

Click the "Report New Business" button

4

It will download a Word document

5

It asks you to list "Owned Business Assets" ~ these are all the physical things your business owns (furniture, tools, computer) that do NOT get consumed.

6

Notice, right underneath the the "Owned Business Assets" subtitle, there's a small box where you need to list "Supplies Monthly Cost". This is for things like paper and ink, things you use up.

7

Send in form—either through email or snail mail.

Call the County with any questions! 206-296-5126

What happens after I register?

The county will add you to their system, and will most likely send you an email. Then, the following calendar year, you report any additional equipment the business has acquired, and/or any increases in supplies.

IF the total exceeds $7500, the business will be taxed about about 1%.

IF there's NO CHANGE, then we're still required to send in a report saying so.

How do I make a report to King County?

Go the eListing on the King County page.

If you need help, you can reach the County by phone or email. Don't be shy, it's their job! Here's a quote from the website:

"DID YOU KNOW?The assessor's staff is available to assist you in any way we can. If you have question or concerns, please feel free to call us at 206-296-5126."

43 Ways to Work On Your Business - When you have Unexpected Free Time

ROUGH DRAFT - inspired by the Coronavirus.

Have some unexpected Free Time? Want to get something done on your business, but not sure what to do? No problem! Read on to see a Master List of ways to work on your business, plus some strategies below.

Why do I need a list you ask? Because…once you sit down to ponder the free time, and what to do, it’s easy to draw a blank or get distracted. Next challenge, once you do start thinking, it can be overwhelming. “I need to update my website, order business cards, work on bookkeeping…which one do I do?”. This brings up one of our biggest enemies, Decision Fatigue,…we don’t know which to choose, so we go back to Facebook, email, or wondering around aimlessly. All of those are fine, except when we’re trying to make progress on something.

Free time is your opportunity to work on things that are Important but not critical. These important tasks are the keys to making your future life easier.

Below is a big list. First, here are my suggestions for working with it.

Jar

Print out the PDF version of the list. Cut out the options. Throw away the ones you don’t like. Put the ones you like in a jar. When you have free time, pull out a slip of paper. If it sounds helpful, doable in the moment, get to work. Don’t like it? Pull out another. Keep repeating until you do.

Top Ten List

Pick ten of these tasks. Put on a list. Each time you have some unexpected time, look at the list. Pick the easiest one.

Two-DO List

Look at the list. Pick two tasks. Write somewhere visible. On post-its on computer, on calendar, on your fridge. Whenever you’ve got time, work on one of them. When you have time again, work on the other. Repeat.

Roll some Dice

Use an online dice roller. Or, find 3 - 5 dice. Roll one die to determine how may dice to roll. Now, roll the dice, pick the item on the list with that number. Do that task. Don’t like it? Go again. Still don’t like it? Look over the list and pick one.

Current Master List - A work in progress.

1 - Review your website.

Just read everything first. Go back through, make a few changes as you go. If needed, make a list of future updates and changes.

2 - Update pictures.

Upload new ones, or make appointment in the future with photographer.

3 - Get a head start on taxes.

If you’re not sure what to do, read this post: How to Prep for IRS Taxes

4 - Do some business analysis.

Look at each quarter / year. Figure out profits for each, types of clients and work offered. Make some predictions for the future. Record any changes to make.

5 - Mini Retreat – Big Picture View

For options, read this post: How to do a Mini Retreat - Business or Personal

6 - Time planning – weekly schedule, monthly, year.

Print out worksheets or make your own. (Click for Weekly Flow, Year -at-a-Glance.) Start with a clean slate. Add in required activities. Look for things to cut. Add in top priority activities.

7 - Update LinkedIn profile.

8 - Review all digital presence.

Make adjustments if needed.

9 - Get ahead on newsletter, Insta posting, other social media.

10 - Digital clutter clear out.

Look through computer files. Delete old items. Adjust folders as you go. Archive old files.

11 - Paper work and files.

Go through paperwork. Look through everything to pull out old documents to recycle/shred.

12 - Bookshelves.

Pull all the books down, dust. Look through them. Give away old books. Perhaps stack in a new way.

13 - Bulletin board / vision board.

Make a new one, or re-do current ones and start a new one.

14 - Visual Reminders

Make posters for the office or fridge – with whatever you need to be reminded of – routines, goals, plans, schedule.

15 - Self-care plan review.

What are you currently doing for self-care? What do you wish to add? Anything to cut? What’s your budget? Make adjustments and add activities into your schedule.

16 - 3 Ideal Clients

Check out this post - Three Ideal Clients - Book Excerpt

17 - Review policies.

Adjust or add.

18 - Update Terms / Contract.

19 - Look at prices and adjust.

Perhaps add new fees, e.g. travel, late fee, reschedule, rush work.

20 - Development new offering or class.

21 - Brainstorm new marketing materials.

22 - Create Pinterest board.

For inspiration/ communication with designer, or to draw from yourself.

23 - Research people to hire / network with.

24 - Organize photos and imagery for marketing.

Update labels, perhaps put in one folder.

25 - Collect a copy of all your materials and put in one place.

For example, all ads or brochures, business cards – put in a notebook. Or all of your handouts, print and put in a folder / notebook.

26 - Take inventory of supplies.

Reorganize supplies. Label.

27 - Make a bingo card of goals. - See below.

Pick 5 categories. Write in the spaces under the BINGO. Under each, fill in tasks or accomplishments. Give yourself rewards when you get a line or blackout. I used this for marketing my book after it was written. It’s still on my fridge!

28 - Get all tax + legal info in one place.

Online and in print form.

29 - Research swag you might want to make.

30 - Research boutiques, galleries.

31 - Research events in the area for small business / community / your field.

Make a calendar of when they happen.

32 - Research events you might want to sponsor.

33 - Research charities / causes to give money or time to.

34 - Reach out to old friends and contacts just to say hi.

Only if this feels legit and you want to, with no direct business agenda.

35 - Follow up with people you’ve talked about collaborating with.

36 - Create a class or workshop to offer for profit, or as a volunteer.

37 - Do a numbers review, by month.

Check out these worksheets: Service Providers, No Sales Tax; Services Providers, with Sales Tax; Product Makers (Retail/Combo).

38 - Make a list of Household Bills

This can be useful when making your own Salary goals. Click here for a worksheet.

39 - Give yourself a Reward.

Because you deserve it. Click to see a menu.

40 - Find some books to read, related to your work.

Consider going to the bookstore to be able to browse in person.

41 - Research a vacation or work trip.

Put it on your calendar.

42 - Do some math to give yourself a raise!

Update on website and materials.

43 - Send an email or thank you card to a role model or someone who inspired you.

Okay, that’s the big list. You don’t need to do all these things! It’s just a menu. Use one of the strategies above to make your own plan. Either the Jar, Top Ten, Two-DO list, or Roll the Dice.

♥

Please, let us know how it goes! Share any stories or suggestions in the comments below.

Cheers,

Jenny

Click on the image to get a downloadable pdf.

Here’s the Bingo Card I made after publishing my book. It helped me stay on track and celebrate successes!

How to Prep for IRS Taxes - All at Once

This is for anyone who needs to prep for IRS taxes all at once! Perhaps you “put it off until the last minute”. No problem! You’re safe here. Or, perhaps you just like doing all at once, and scheduled a day for it. Cool! There are many ways to approach taxes, and they’re all just fine. Read more about Tax Prep Styles to define yours. If you wish to break it up over multiple days, click here.

Okay, here we go.

Overview of the process

Collect stuff.

Find your numbers - wherever they are.

Add up in categories.

Put into a worksheet. Provided.

Then you’re ready to file!

Store your work in one place.

Bonus - Reward yourself.

1

Warm Up / Prep your space

Turn off email. Get some nice music, clear off the table. Use the worksheet to find everything that you might need. Get some favorite food or snacks.

2

Collect everything you can find

Use the worksheet as a guide.

3a.

Find your Gross Sales

This is the amount of total payments you received from clients / customers.

Ways to find this amount:

If you have tracking software, like Quickbooks or something specific to your practice (like Simple Practice for therapists), then get an Annual Report for the tax year.

If you’ve used one bank account for all deposits, simply look at the December statement and find the Year-to-Date deposits.

If you’ve used a spreadsheet, then highlight all the cells of income, then notice the Total.

If you have an income record, look there.

If none of the above, go to the next step.

Important Note! If you received 1099-NECs and/or 1099-Ks for some of your income, you will need to have all of those available.

3b.

Make an Income Record

• Have an income record? Print it out.

• If you have software, print a list of all income.

• If you’ve used a bank account/s …search transactions from Jan. 1 - Dec. 31 of last year, and then filter for Credits Only. Download and print.

• Need to make one? Use your calendar to make a list of all appointments or sales. Write the amounts earned next to each one. You can do this on paper or make a spreadsheet.

• Have invoices? Print them out, staple together as your record.

3c.

Expenses by category

Find all evidence of purchases for your business. Could be ~

paper receipts

online receipts

bank statements

credit card statements

utility bills

It doesn’t matter how you paid for the purchases, all of them can be deducted. (If you’re a sole proprietor or single member LLC.)

Now, we want to add them up by category. Use the sheet you already printed to see the categories. For more info on what expenses go where, click on this worksheet.

Have software?

quickbooks - print the P and L for last year

other software - print P and L for last year, or print all expenses then categorize

OR You can add up these amounts using ~

pen and paper

excel spreadsheet - type in date/amount/vendor by category

excel spreadsheet - download all expenses then, then categorize and sum

Email me if you’d like to use my spreadsheet. Please allow 3 - 5 business days.

Important Note - It doesn’t matter how you add them up! As long as you have subtotals for each category. And evidence for each expense.

3d.

Special case expenses - mileage and office

Did you drive for your business? Most any place that you drove, except to an office, can be deducted. There are two ways to claim this expense - actual cost of vehicle or mileage. I will only cover the Mileage Method here.

Mileage

What you need to find

total miles for the vehicle for the whole year

total miles for business use

total miles for personal use

If you have these figures, your accountant or tax software will do the rest.

Ways to find mileage

Used an app? Log in to find your report for last year.

Have a record, great!

Calculate miles - look at your calendar, make a list of dates/locations and use Mapquest or other site to calculate the mileage of your trips.

For total miles, do your best to guess your odometer reading for last January 1. Perhaps look at oil change records. For the ending mileage do the same. (In the future, make a note to yourself to write down your Odometer miles each January 1st.)

Office

There are two ways to claim this expense. I will only cover the Simplified Office expense here. Calculate the square footage of your office.

The accountant or tax software will know what to do.

3e.

Payments You Already Sent In

This is majorly important!!!!

These are the Estimated Quarterly Tax Payments you sent in, if you did. Only you can provide this info. Find the dates and amounts when you sent these in. Otherwise, you will not get credit for them!

Not sure? Look through all of your records, your bank statements, email. And/or call the IRS.

4

Check the worksheet

Look over the worksheet at everything you’ve collected. Try and think if anything is missing. Did you have any more business expenses? Any accounts you forgot to check? Find anything missing and add them. At some point, decide to be done!

5

Plan when to file

Doing this today? If not today, choose a day and put on your calendar. Not sure how to file? Read this post.

6a

Store everything

Keep these things out: Worksheet with all your figures AND any 1099-MISCs.

Gather all of your receipts, statements, calculations, notes. Print out and put into a box, or envelope. Label with the Tax Year.

6b

Reward yourself!

Phew, that was a lot of work. Be nice to yourself this evening. Maybe order take-out or go out. Maybe a bath or binge watch some shows. Maybe online shop for something you’ve wanted. Just be sure to be nice to yourself AND get a reward…or put one on your calendar asap. Here’s a menu if you’re not sure what you need.

♥ ♥ ♥ ♥ ♥

Was this helpful? If yes, please considering leaving a Tip in the Tip Jar …. and/or forwarding to a friend. Thanks so much!

: ) Jenny Girl Friday.

What's Your Tax Prep Style?

Dear Readers, this is an evolving blog post. I’d love to get your feedback on which terms / descriptions work or don’t work for you!

Work with your nature.

This is one of my favorite guiding principles. And it's more important than ever when it comes to chores or anything that feels tedious, new, overwhelming.

What style fits you? ....when it comes to working on IRS tax prep?

(Nicknames are works in progress.)

♥ The truth?: I ignore it until the last minute, then scramble and get it all done. (Phoenix)

♥ I like to start as early as possible. In fact, I already have! I work steadily until the job is done finished. (Early bird)

♥ I do best breaking up a task. I prefer to work over several sessions. (Marathoner)

♥ I like to do the job all at once, on a planned day. (Personal work party)

♥ None of these fit exactly/I'm a mixture. (4 Leaf Clover)

The idea: choose your style. Name it. Claim it. Plan for it. Be at peace with it. Below are a few ideas for each style.

P.S. If you're new to this, I suggest reading the Marathoner description as well as your style.

♥

Phoenix

Do your thing! No reason to fix something that works. When the time comes, find this email and these tools to offer some help: All-at-once Prep + CalculateBasic. If needed, here's an article if you get stuck somewhere. Perhaps, mark off a day or two around 4/12, 4/13, 4/14 to do the work. Lastly, if you can, clear your calendar on 4/15 or 4/16 to take a break, go to the spa or drive out of town to reward yourself and recover. (I'm keeping this short, because your mind is busy with other things right now. You'll get to this later.)

♥

Early Bird

This message to you might be too late because you're probably finished. In case I caught you in time, here's an article that outlines the whole process. And a worksheet to capture all your numbers: CalculateBasic. You'd probably like to fill out this second sheet as well: Calculate Next Level. Before you get too far, please be sure to choose a reward for yourself. Set aside some money for it and plan whatever time it takes. Yes, you start early because it's your nature, there's an urge to. That's cool. Still, let's reinforce and reward that nature! We want to keep you happy in your job. If you feel a bit guilty, then it's probably the right amount.

Oh, and here's an article on filing options. As you know, it feels so good to get the appointment for the actual filing on the calendar, whether it's meeting your accountant, filing yourself online, etc. Heads up, there are a few changes this year! A new 1040 and a few new rules. I'll be sharing about that soon. I'm just mentioning it so you plan in a little extra time. If you'd like to dive into research now, here are the 1040 Instructions, start on page 6.

♥

Marathoner

Slow and steady wins the race! And, "Life ain't a track meet, it's a marathon." Ice Cube. You know that working slowly over time means less impact on your life, the pain can be spread out. If you've done this before, you've probably got a system already. If you're new / as a reminder to experienced folks: plan several work periods over the next 4 - 6 weeks. Prep time really ranges from 2 hours to 12 or more. Just take your best guess and plan in the time. You can pick a regular day + time, like "Fridays from 1 - 3pm", or choose a time block like "1 hour" to fit into your weekly schedule.

One option is for you to follow along with the Sidekick Service Tax Prep series coming out soon. I've broken the process into 6-7 steps, and will send an email about each one...so you can follow along with me. If you'd like to space it out yourself, take a look at this article, with worksheets for each step. Or, look at this All-at-Once Prep Sheet to plan your own sessions. I also suggest choose a little treat for each work session and a big Reward for when you're all finished.

♥

Work-Party Girl

You like to get in the zone; to give this task your whole attention, all at once. Like gearing up for party or 5K, you want to collect all your tools and resources, create the space, and get it done, and done well, and then shut the door and be finished. Tips for you (if you're new/need reminders): schedule three days on your calendar: 1- Personal Tax Work Party, 2- Time OFF to recover/reward yourself, 3 - Follow-up Tasks.

Create a space in your house to collect all of the things you'll need. Tax documents coming in the mail, bank statements, receipts, etc. Perhaps print out this sheet Collect Stuff. You can use it to slowly collect items prior to your Party day, or, do it first thing that morning. Consider getting a friend to hang out with you. Oh, and if you're the cook in your house, arrange for someone else to handle meals or to go out for dinner. Be sure to have a breakfast and lunch you love, plus snacks on hand. On that day, I suggest printing out these two sheets: All-at-once Prep + CalculateBasic. Here's an article if you run into questions.

♥

Four Leaf Clover

Perhaps none of these fit, you're a combination, or you're new to this and just don't know. Or, maybe you're a rebel and as soon as someone tries to type you, you don't like it! That's cool. I get that we're a spectrum and not everyone fits into boxes. A few ideas. First, find a way to name your own style. Think about what's true, even if you're different/changing all the time. The reason? It's empowering to claim what we do naturally and then we've got a strategy to stick to.

Next translate your style into some logistics. Do you want to plan ahead, wait until inspired, ignore? Three Options for you. 1) read through the tips for the other styles, and whatever sounds good/calming/easy, then do that. 2) Plan to follow along with the Sidekick Service emails over the next 6 weeks. If it sounds good, do the work suggested for each. Then, if you want to jump off at any point, please do! 3) Look at this All-at-Once Prep sheet. Or skim this article. Then ask yourself this, Now that I see all the work involved, how do I want to tackle it?

Once you discover your name + system, I'd sure love to hear about it. Please email me at jennygirlfriday@gmail.com

I'm excited to hear what you think of these Styles + Tips!

• How-To Prep for IRS Taxes (Includes fun + rewards!)

Prepping for taxes is a lot like planning a big party or fancy dinner. (Okay, maybe a little bit different.)

It's possible to do it all at once.........or to break it up over time. There are pros and cons to each!

Doing it all at once

....is more efficient, you get really in the zone, and sometimes adrenaline fuels quicker working. If this sounds good to you, click here.

Breaking up over time

....means the effort is less intense, you have time to catch important details, you can rest in between.

Either way, it's helpful to know early how you're going to file, so that you can line up any help, or make appointments. (For example, if you're planning to go to H&R Block, you'll need to find their open hours. If you're hoping to work with an accountant, they'll have their own deadlines for you, earlier than April 17th!) Click here to read more about options for filing.

Overview

I've broken up the process into several steps, which can be spread over days/weeks, or done all at once. More details about each step below. Please keep in mind: as a project manager client once explained to me.......when you break things into many steps, each step looks easier, but then, you have a lot of steps! Don't let this discourage you. Just find a way to start, and, in theory, each step should feel easy and quick, and you'll build momentum.

0. Review REWARDS Menu (optional + recommended)

1. WARM UP

2. COLLECT stuff (coming next)

3. CALCULATE some numbers - Basic + Next Level

4. CHECK + find any missing pieces

5. FILE / SUBMIT along with your IRS taxes - File-paper, File-online, File-tax pro

6. STORE tax forms and back up document

7. Optional: Reward + Reflect

It can look like a lot! And feel like a pain! It can also be very rewarding, and I'm determined to help you build in some fun.

Warming Up

Warming up ... okay, so you don't have to, but it will make things more pleasant.

It's like stretching before playing soccer, or better yet, like a cocktail + appetizer before dinner!

As part of our Tax Prep, Warming Up includes picking a due date, your option for filing, considering your way of working, putting time on the calendar, and most importantly...........finding ways to make it fun and picking rewards!

Click on the image to get a downloadable PDF.

You might notice that I often refer to inviting a friend to join you for some of this work. I'm not kidding about this! If you make an appointment with a friend, you're more likely to do the work (not put it off), it's way more more fun, it can go faster, and they can help you figure out anything confusing. Most often, friends are happy to lend a hand in exchange for dinner, a bottle of wine, a candle, or just some sincere thanks.

Do you have someone who could keep you company with this?

Collect Stuff

AKA.....Treasure Hunt Time!!!!!!

I love this step. Can you tell? Here's why. Every receipt you find for business expenses is like finding $$$$$! Depending on your specific tax scenario...for each receipt, you'll be saving 20 - 30% of what that receipt is worth.

For example, if you bought a few books for your business, and the cost totaled $80...then you'll pay $16 - $24 less in taxes.

With this step, we're just collecting stuff. No adding, no smoothing receipts, just find it.

ProTip: create a spot somewhere to put all these things, or perhaps a very pretty basket, or decorated office box.

Heads up: it's very helpful to print a lot of records, so you may have to stock up on some ink. (I like to use remanufactured ink to save money.)

Click on the image to get a downloadable PDF.

Calculate

So.........you don't pay too much!

>>> If you know what to do, or would like to just figure it out as you go, print the Calculate-Basic sheet and start filling in numbers.

Why we're doing this

Before we talk about the numbers we need, let's review why we have to do all this work. Basically, it's so that you don't pay too many taxes! The IRS taxes you on your Income. When you are a sole proprietor or single-member LLC, the profit from your business is considered your income.

If you were to only report your total payments (gross sales), you'd have to pay taxes on that entire amount...even though you likely had to spend money on running the business. That wouldn't be fair. Thank goodness, we don't have to do that! Instead, we report our profit, and we're taxed on that. In order to report our profit....we required to report several numbers, as a sort of proof. Here's more on that....

The Basic Numbers + Formula

To find our profit, we report the following numbers + formula:

Gross Sales

- Expenses

= Profit

Two of those numbers (gross sales and expenses) are made up from several other numbers, and have to be reported in the right way. The IRS created the form Schedule C for sole proprietors and single-member LLCs. The worksheets I created are simplified versions of the Schedule C.

Gross Sales, may include:

- totals from 1099-MISC, given to you

- totals from 1099-K, given to you

- totals from all other payments, including barter

Expenses, may nclude:

- totals by category of business expenses

- total business miles

- square footage of home office

The Calculate Step

In this step, the idea is to find these numbers. It's possible you have them already if you've been keeping records, or using a program such as QuickBooks.

[Even if you have these totals, it's great that you've collected your receipts and bank statements, because these are part of the evidence that you need to keep for several years—7, I think?—in case you get audited. (Btw, good news, less than 1% of people get audited.)]

If you still need to calculate your totals, and would like some guidance, click here to read more about this. There are several ways to do this! Just a few include: pen and paper, spreadsheets, and software. Find what works best for you, and consider getting a friend to help.

Check

Congrats! You've finished the CALCULATE step, often the longest one. By any chance, did you discover that you were missing some things? Or did you have new questions as a result of your work?

That's super normal! That's what the Check + Find is about: finding missing things, getting answers, and double-checking your math. This step is optional. It's offered for those of you who like to be very thorough before filing.

This checklist prompts you to check the math you've done so far (income subtotals, expense totals, mileage).

+

There's space to list questions and things to find. Use it to keep track of your progress.

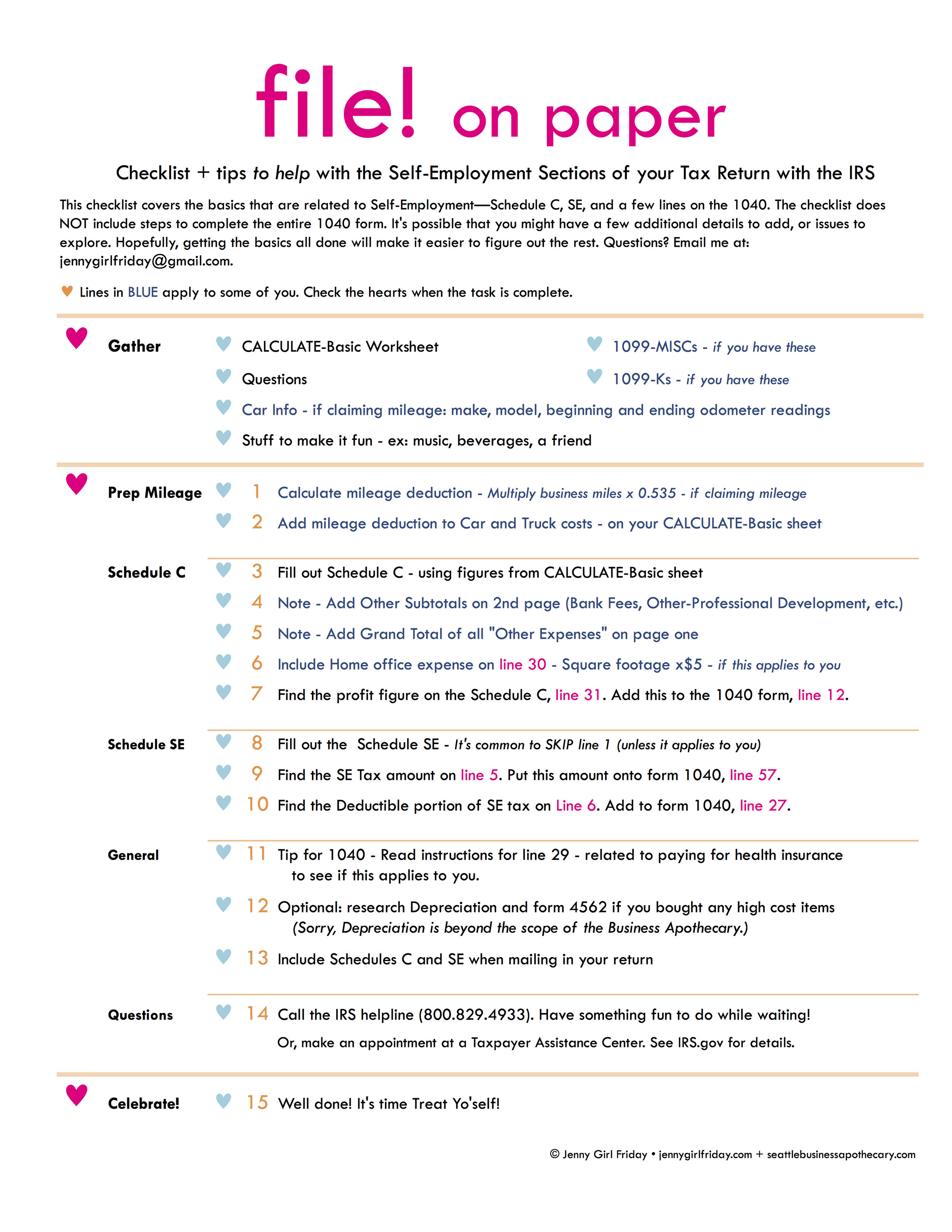

File!

It's finally here, the big moment.

Well, actually, with all your amazing prep work, this part is likely to go rather quickly. :)

There are slightly different actions to take, depending on which way you're filing. The worksheets to the left work for:

• Filing Online - TurboTax, H&R Block, TaxAct, etc.

• Working with a Tax Pro - Accountant, CPA, preparer, volunteer

Each checklist covers the basics that are related to Self-Employment—Schedule C, SE, and a few lines on the 1040. The checklists do NOT include steps to complete the entire 1040 form.

It's possible that you might have a few additional details to add, or issues to explore. Hopefully, getting the basics all done will make it easier to figure out the rest.

(Please note: Technically, these are not guides, they are reminders in a logical order. This blog is for tax education, and doesn't constitute tax advice.)

♥ They might look long, but don't worry too much! They only look long because I wrote out each little step separately.

♥ Remember to get a friend to keep you company, and/or make the job fun with things like favorite music, treats, a show in the background.

♥ Also, when you're finished with this step, be sure to give yourself the reward you identified! It's common to be too tired and relived to care, and to skip the reward. Please don't! You deserve it.

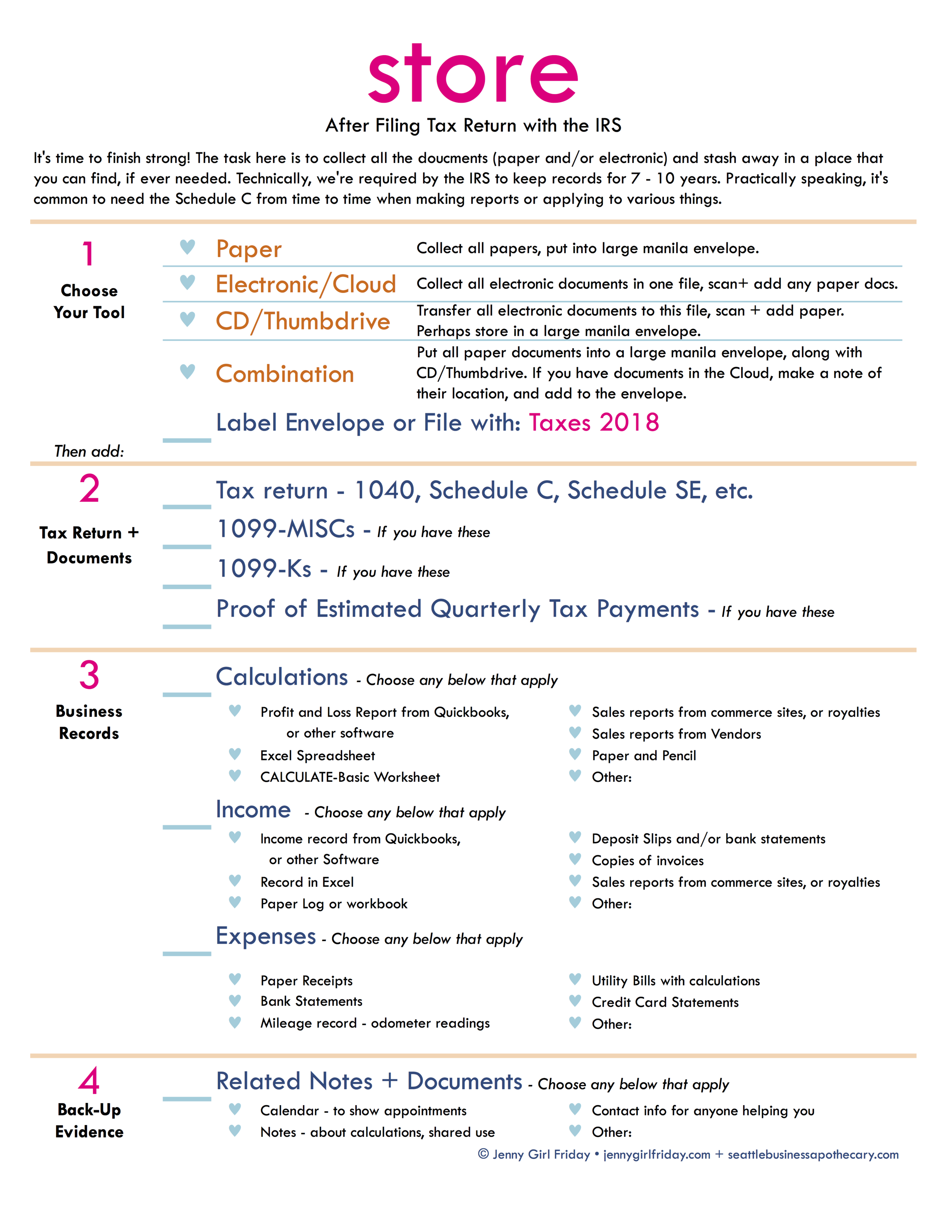

Store

Phew! You're almost done. There's just one last crucial step - to Store everything away. You might be thinking, I'm over this! I'm done! I get it, that's super reasonable....and I promise, this last step is worth it and feels really, really good.

It's your choice: you can shove papers in an envelope or file willy nilly. Or, put things in place...neatly, and methodically. Either way, you'll feel so much satisfaction, relief, and closure.

And, if ever in the future, you do need these documents, you'll be SO glad that you did this.

As usual, I invite you to add a reward for this step, even though it's not on the checklist!

Optional: Reward + Reflect

Well done! You just finished a big job. It's essential that you reward yourself. (This is part of staying in the game of self-employment.)

Hopefully, you already did this. If not, now's your second chance.

Also, right now, fresh off the job, is the BEST time to make a change or two, to make life easier next tax season, and throughout the year. Do your future self a big favor by taking just 5 - 10 minutes to reflect!

Yay! Now we're really done. :)

You got this!

♥

Jenny Girl Friday

P.S. Know any other self-employed Seattleites who could use this information? Please forward freely!

P.S.2 Are you already signed up for Sidekick Services? If not, click here and join the list to receive tax + license reminders, how-tos, inspiration and more delivered to your inbox.

• Rewards Are Important + Rewards Menu

It is SO important to give ourselves rewards...and on a regular basis. For chores, celebrations, or just because. (They are essential for tax season.)

Who would run a 5K if we didn't get some swag at the end? Who would keep playing video games without achievements and level-ups? They keep us motivated, feeling satisfied, and happy. They are an important part of self-management.

Strangely, one of the biggest reasons we forget to reward ourselves is that we're often too tired after a big push to decide! The solution? Decide ahead of time what kind of rewards you like to get. It's good habit to assign specific rewards to specific tasks, and, to have a general list, for when you need one on-the-go.

Make up your own, or print the one below. Fill it out, and hang up somewhere visible.

Click on the image to get a downloadable PDF. You can also find this menu along with other helpful tools on the Tools For Download page.

: ) Jenny Girl Friday

P.S. Did this help you? Please share freely with friends. I think self-employed folks are keeping the soul in Seattle. I want to make the chores of business easier, so you all can keep being awesome.

P.S. 2 Are you signed up for Sidekick Services via email? Get reminders and links to how-tos delivered right to your email inbox. :)

• For Retail + Combo Businesses ~ How To Make Your Annual Report To The City Of Seattle (For B&O Taxes)

Hello + Note from July 2, 2018: The state has a new portal, which looks a little different. I'm hoping to add screenshots of the new one sometime soon. Meanwhile, this post will still give you a good idea of the process. Thanks for your patience!

Does your work include: retail, retail-service, wholesale, manufacturing, or royalties. Or a combination?

Then this post is for you!

If your business is NON-retail SERVICE only, click here to see a different walkthrough.

Due: April 30

Time Required: 2 - 8 minutes to file

Frustration Factor: If you use the SELF Portal, 3 out of 10. If you use the FileLocal, 6 out of 10.

Cost/Taxes Due: If you earned under $100K (gross sales), then you will not pay any taxes to Seattle. To read about tax rates for over $100K with Seattle, click here.

Type of Tax: B&O (business and occupation)

With: City of Seattle

Use: Seattle SELF Portal (Recommended).........or FileLocal-wa.gov.

If you need help, call the city at: 206.684.8484

Summary

1. Log in to Seattle SELF Portal or FileLocal-wa.gov

2. Find that business categories that apply to you: retail, wholesale, service, printing, manufacturing

3. Fill in total sales for each category

4. Hit next until the end, confirm

5. If you earned over $100K in total gross sales, complete the payment screens

One Note: The state collects sales tax for Seattle. So if you have to submit sales tax, you'll do that through the WA state DOR, Department of Revenue.

Some Screenshots below.

How to Prepare - If You are NEW to This :)

Reporting to Seattle is very similar to reporting to the WA state DOR. I recommend preparing for both at once. Everyone's situation is a little different, so it's hard to give estimates or exact instructions.

Here's what I recommend:

1. Schedule some prep time on your calendar in the next week

2. Schedule a 20 - 40 minute block for tax filing, during the weekday, with a plan to call the city if needed (they will walk you through this). This is includes buffer time.

3. Print out the Ready, Set, File - Seattle!

4. During your prep time, fill out as many numbers as you can on the worksheet

5. On your scheduled day, give it a try. If you have to call the city, be prepared to wait...have something fun to do while on hold.

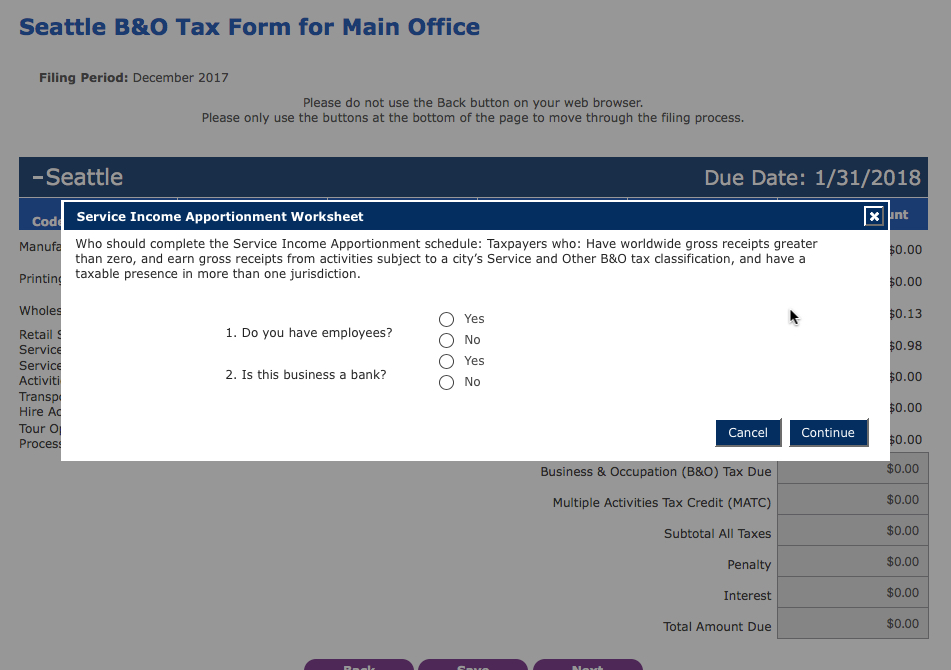

The directions say to choose the last month of the period you're filing for.

With Annual Reports, choose December of the last year.

It took a few seconds for these drop down menus to work. Choose "Seattle B&O tax form" and your Main branch. (Or whatever you named it.)

Fill in each box relevant to your business.

The total sales in each category, NOT including any sales tax that you collected.

This is a second view of the same screen. Note, this symbol means a (confusing) worksheet is about to pop up.

It includes boxes for Royalties and NON-Retail Services

Some questions. Note: you are NOT an employee. You are the business owner.

Royalty information~ enter in the box circled in Orange.

Non-Retail Services, enter in two places.

1. Line 1 for Worldwide Gross Service Receipts. (Worldwide!!!)

2. Line 7 for Seattle Service Receipts

If you did all your work in Seattle, these should be the same.

Notice, the form will fill in some numbers for you.....

A shot after this screen is filled in. You can only change the numbers in White.

This example shows gross sales + taxes in three categories.

Note, no tax is due............because this person earned under $100K.

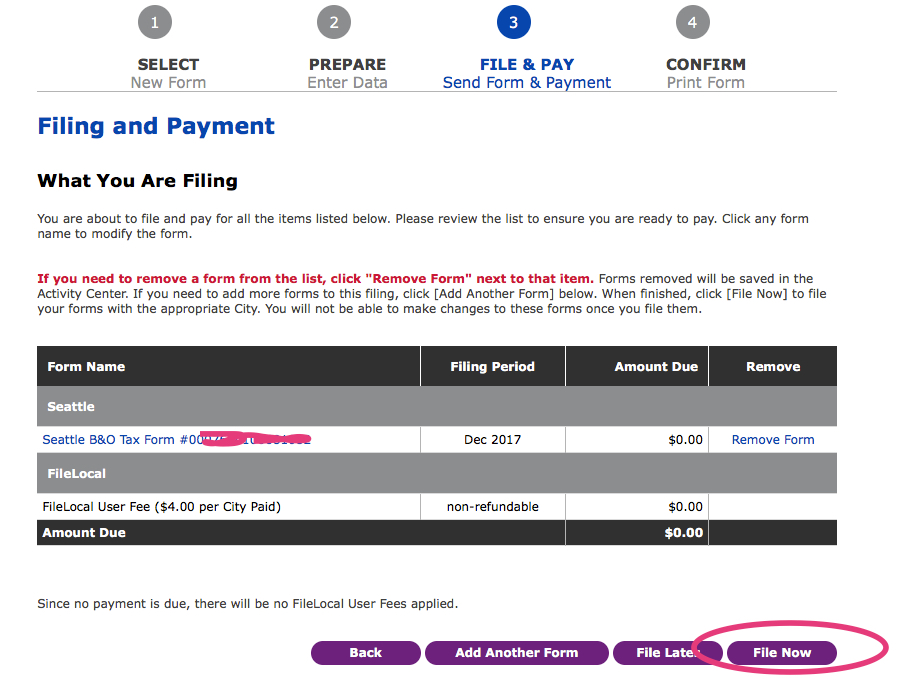

Eventually, this screen pops up as a confirmation. Hurray! Success!!!!!

FYI - the first 3 times I tried, I got this error message. I waited a few days, and tried again and it worked! One good thing........FileLocal had kept all my numbers, so I just had to move through all the screens.

Well done! Phew! One thing about reporting to the city is that it forces us to know our total sales number. I find that kind of rewarding, how about you?

One more hoop of tax season is all done. Be sure to give yourself a little or even medium reward! Perhaps some Theo's chocolate, some yummy juice from HeartBeet, or a trip to Ladywell's.

: ) Jenny Girl Friday

P.S. Did this help you? Pretty please share with any friends, or post on Facebook. I think self-employed folks are keeping the soul in Seattle. I want to make the chores of business easier, so you all can keep being awesome.

P.S. 2 Are you signed up for Sidekick Services via email? Get reminders and links to how-tos delivered right to your email inbox. :)

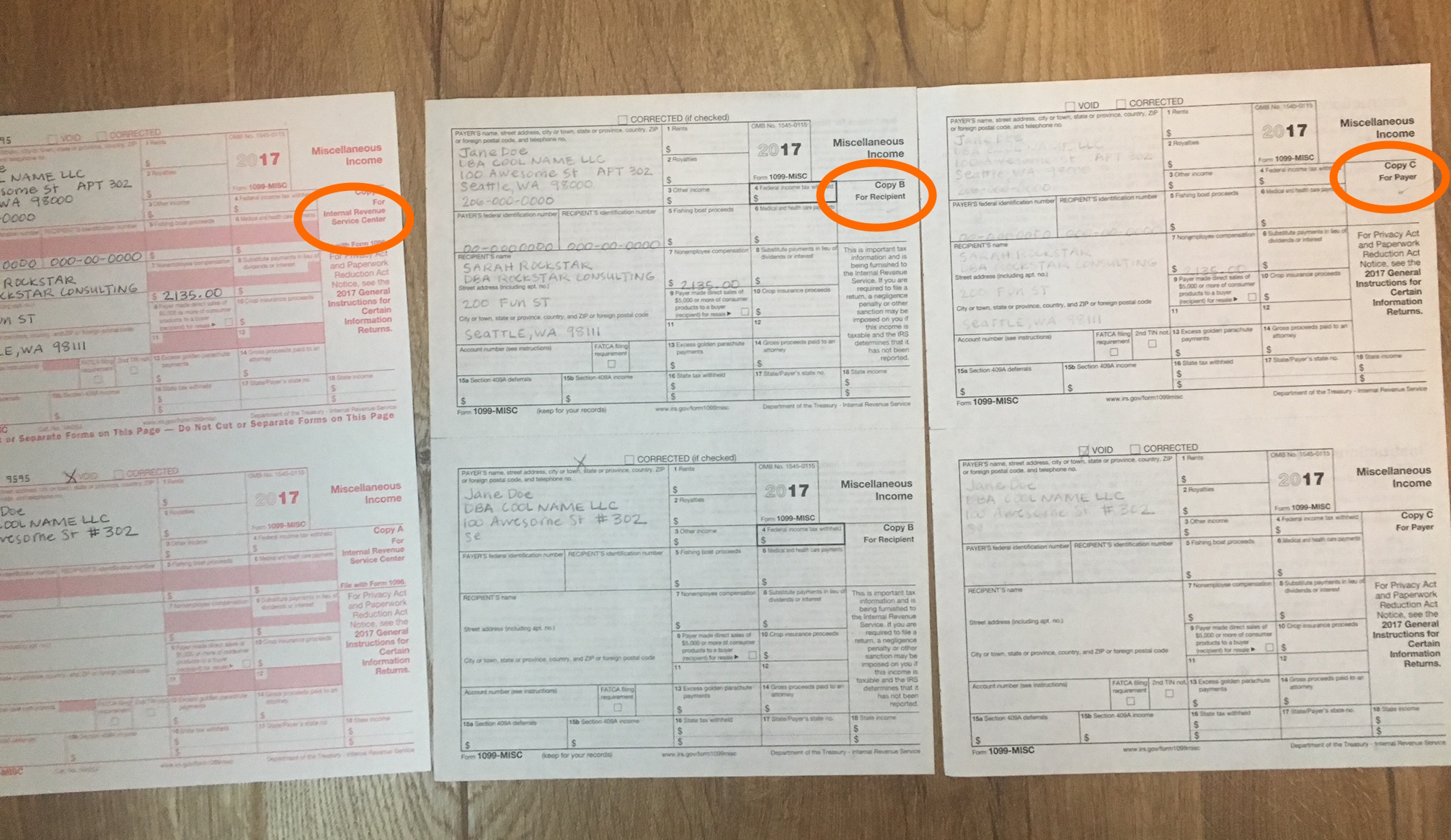

• How to Fill Out + Send 1099-MISC forms

If you paid any Independent Contractors more than $600 in one year, for service work, you need to submit a 1099-MISC form (1099 for short).....both to the Recipient and to the IRS. To read more, click here.

Time Required: 5 - 10 minutes per form (+more time if you have to collect W-9s)

Cost: About $1.50 in postage to IRS + any postage costs to mail to recipients

Due: January 31st

Frustration: 3 out of 10

Tedium Factor: 10 out of 10

Summary

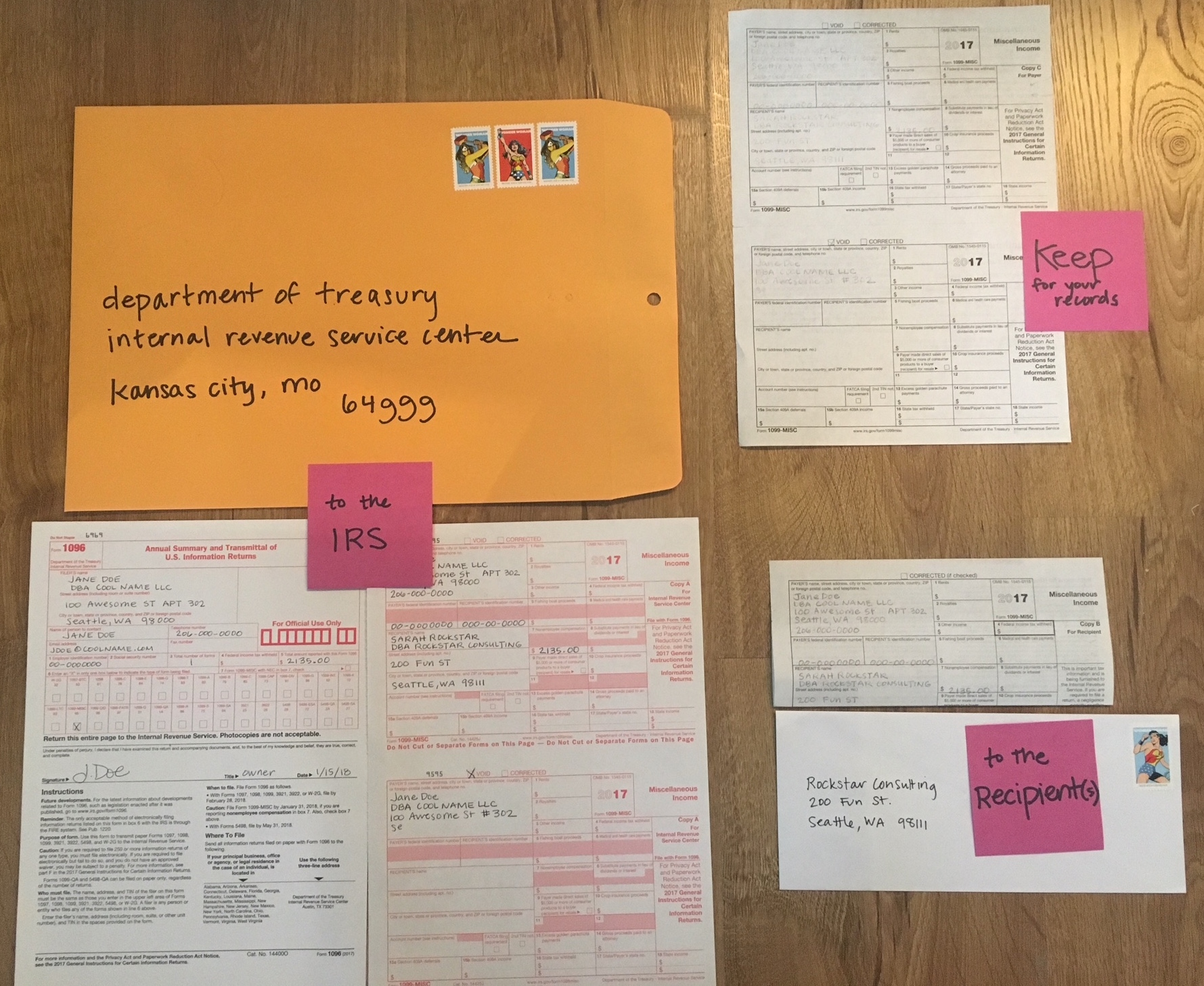

On a half sheet form, you fill in a few boxes. Your name, address, phone number, and tax ID number. Your recipients name, address, tax ID number. The amount you paid them.

You send a copy to the recipient, to the IRS, and you keep one for yourself.

In addition, you must work with two more forms. A 1096 acts as a cover sheet when mailing 1099-MISCs to the IRS. Use W-9s to collect information from recipients. More below....

Photos with notes below. First some information.

You can choose to use paper forms or to file electronically.

Paper forms are carbon and MUST be ordered from the IRS or another source. They canNOT be printed. To ORDER forms, click here. To see a walkthrough of ordering forms, click here.

I haven't worked with e-filing yet. Some tax software systems provide this, such as TurboTax. The IRS also gives this tip, "To locate an IRS business partner who may be able to offer low-cost or even free filing of certain forms, enter "e-file for business partners" in the search box on IRS.gov."

Some accountants will also do this for you.

What you need~

For each recipient:

• Full legal name (of the person)

• Legal name of the business

• Address

• Tax ID Number ~ Either their SSN (social security number) or EIN (employer ID number)

• Amount you paid them ~ called "Nonemployee compensation"

If filing with paper forms:

• 1096 Form

• Large Envelope

• Postage

• Black ball point pen

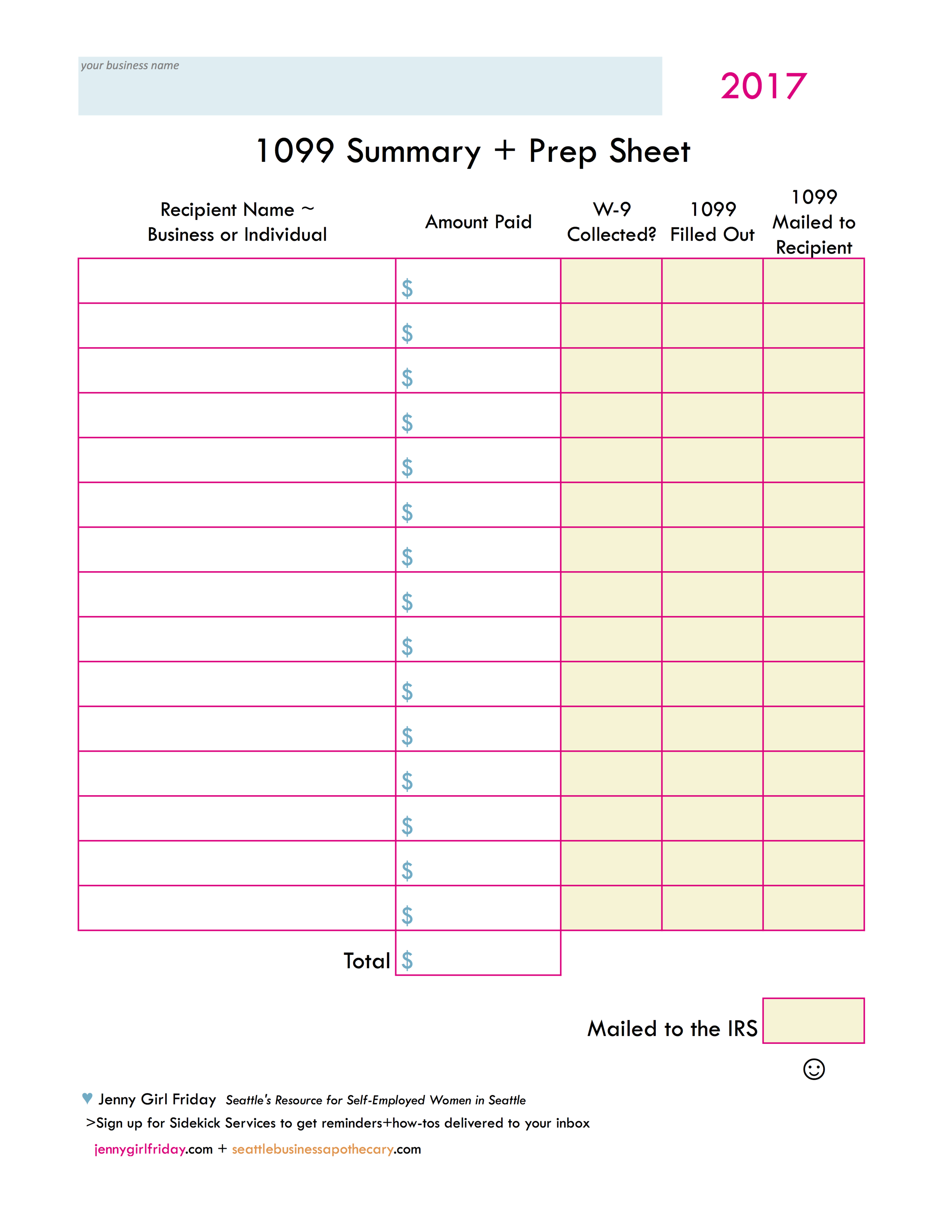

Use this prep sheet to keep things straight! Click on it to get a PDF. :) This will also help when it's time to file your IRS taxes later this Spring.

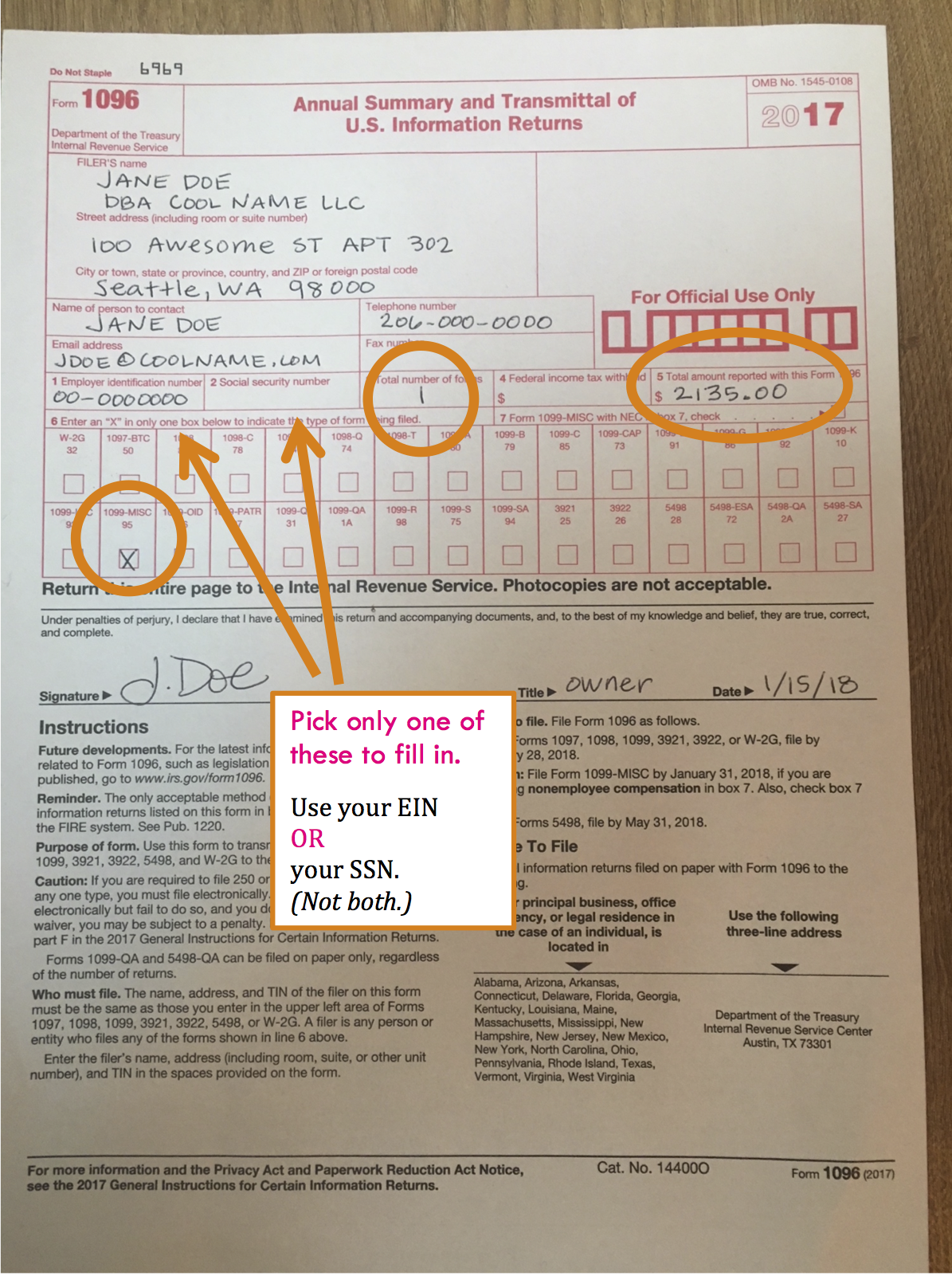

Heads Up! There are two more forms to know about! 1096 and W-9

Like the Charlie's Angels, there are actually 3 forms that you'll be working with! They always go together.

W-9 The IRS created a W-9 form to collect the required information from recipients, including their tax ID. It's a one page form with lots of pages attached. As you can imagine, tax ID numbers are sensitive information, and W-9 forms must be stored securely. You can collect W-9s on paper, or electronically. Click here to download from the IRS.gov site.

1096 This is like a cover letter. When you submit certain types of forms to the IRS, they want a 1096 as well. It's basically a summary of everything you're sending in.

Important Things to Know When Filling Out Paper Forms!

1. Use a BLACK ball point pen, press hard!

2. Use legible, block printing

3. Do NOT add any symbols. NO dollar signs, NO apostrophes, NO number signs.

For Susie's Flowers, you'd write: Susies Flowers

For an apartment #302, write APT 302

4. Do NOT cut the 1099 form top sheet (the one you send to the IRS)

5. Write the dollars + cents for all amounts. For example, 1235.00 is correct. (1235 is NOT correct.)

> > If you happen to make any mistakes, check the VOID box at the top of the form, and start again.

Mailing Information

• Address for Washington Residents:

Department of the Treasury

Internal Revenue Service

Kansas City, MO 64999

• You must use a FLAT envelope, with no folds.

• It must be postmarked on or before January 31, 2018.

1099-MISCs Forms

Two separate forms are on each page. This shows the top sheet which is sent to the IRS. Do NOT cut this page. The pages underneath are torn in half before giving to the recipients.

Notice the names. It's important to write both the recipients full legal name AND the business's legal name.

Whenever a business is a Sole Proprietor or Single Member LLC, you may use either the SSN (social security number) OR an EIN (employer identification number).

This example shows the Payer having an EIN.

The recipient using their SSN.

On the bottom form, I made a mistake! I used a # sign. This is not allowed, so I stopped filling it out and marked the VOID box.

After they are filled out, tear the strip off and separate the forms.

Look for THREE to keep, and do the following:

1. For the IRS - send in the mail, in a flat envelope

2. For Recipient - send in the mail, may be folded

3. For Payer - keep in your tax records

Here's a look at the 1096 Form.

Moving from left to right with notes:

1. Be sure to check the box 1099-MISC.

2. Use your EIN ....OR.....your SSN. (Not both)

3. Number of forms. Put the number of filled out 1099-MISCs. There are two per page. If you filled out for 3 recipients, you'd write "3".

4. "Total amount reported with this Form" Add up the total of all dollar amounts on all forms. If I was reporting $2100 for a coach and $1400 for a designer, I would record $3500 in this box.

Finishing up!

To the IRS - one 1096 form plus the top copies of all 1099-MISCs

To the recipients - their 1099-MISC copy

For your records - full page copies

Well done! Bravo! Even though the contents of this are straightforward, it can feel so taxing because it takes a lot of care and attention, yet it is boring. In addition, just the thought of the IRS can be triggering or get the adrenaline going. ♥ If you can, find a time to relax a bit. Perhaps a bath, a trip to Ladywell's, a long walk, even a short walk around the block.

Also, remember to check off of your Cheat Sheet / Sticker Chart!

Cheers!

: ) Jenny Girl Friday

P.S. Sign up for Sidekick Services to get these delivered right to your inbox! (Posting on social media is random....)

• Estimated Quarterly Payments to the IRS - What are they? Do I have to send them? How do I calculate payments?

What are estimated quarterly tax payments to the IRS? Why do I have to send them?

Our federal taxes are a "pay-as-you-go" system. When you're an employee, federal taxes are taken out of each check. If you are self-employed, the IRS requires that you send in tax payments throughout the year. For the smallest business, this is required 4 times. (Larger businesses may have to end in more often.)

I just had to make a report to Washington State and send in Sales Tax. Is this the same thing?

Great question and No. Every level of government wants to tax you...and it's easy and reasonable to get them confused.

Washington State - collects Sales Tax, B&O tax, and Use Tax. Some businesses report annually, some report quarterly.

The Federal Government (IRS) - collects Income and Self-Employment Tax. We file an annual report, but we're asked to send in estimated tax payments throughout the year.

This post is about tax payments to the IRS.

Do I have to send in the estimated quarterly payments (EQ$) to the IRS? What happens if I don't?

Technically speaking, YES—the letter of the law is that if a person is doing business, they must send payments in each quarter. In some cases, if you don't send in your EQ$, you'll have to pay a penalty.

The reality: I've met many self-employed folks who did not send in their EQ$ the first year, and they had no penalties, or the penalties were very low. Having said that, the IRS may choose to more vigorously enforce this rule at any time.

In some cases, if your income is low enough, it is allowable to NOT send in payments. To see if this applies to you, click here to read more (scroll down to page 24), or call the IRS at 800.829.4933

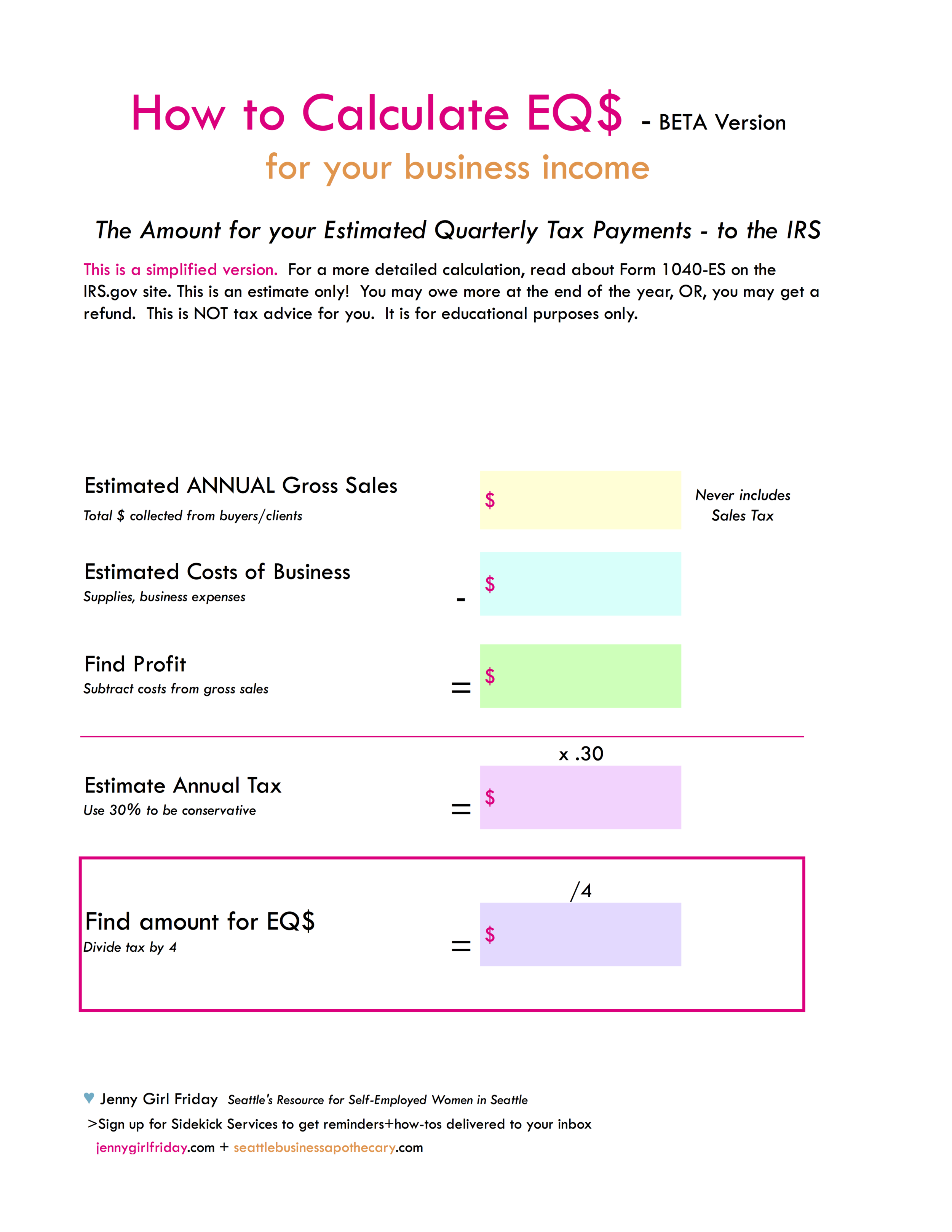

How do I calculate payments?

If you filed business taxes last year, usually your tax preparation software or accountant will provide you with a recommended amount for you to pay. It'll be based off of your earnings for the previous year.

If you are a brand new business, you'll need to calculate an amount to pay. There's a formula and worksheet below.

An important note: it's common for new businesses to grow quite a bit from year to year! Because of this, the estimate made for the quarterly payment can be too low. ProTip: Always transfer 30% of all business deposits into a savings account for taxes you may owe. (40% if you collect sales tax.) If what you're saving is more than what your EQ$ require, you can either....send in extra money for each EQ$. OR, hold the money in your account until you file your federal taxes.

Simplified Formula for Calculating EQ$ + Worksheet

Click on the worksheet for a PDF version for download.

1. Estimate your Gross Sales - all the money you'll collect from buyers/clients. (Never include Sales tax in the amount.)

Example: $12,000

2. Estimate your costs of doing business.

Example: $3000

3. Subtract the costs of business from your Gross Sales.

Example: $12,000 - $3000

4. The answer is your Profit or Income.

Example: $9000

5. Estimate your tax owed. Multiply your profit by .30.

Example: $9000 x .3 = $2700

6. Divide tax owed by 4. This is the amount to use for your EQ$

Example: $2700 / 4 =$675

When are they due? How do I send them in?

They are due on the following dates each year. If a date falls on a weekend or holiday, the deadline is extended to the next business day.

January 15

April 15

June 15

September 15

You may submit payments electronically or through snail mail. Click here to read more on How To Submit EQ$.

ProTips + Doing Yourself a Favor

ProTip: Each year after you file taxes, print off all your Payment Vouchers. Find four envelopes and put stamps on them. Put these vouchers + envelopes in a visible place, for example, pin to a bulletin board, set on your bookshelf, or clip to your fridge.

ProTip: Add these dates to your calendar right now: Jan 1, Apr 1, Jun 1, Sep 1. Prep and send your payments on these days.

Do yourself a favor and send these payments in! If you skip these payments, it can be very tempting to spend the money from your account......leaving you high and dry next April! In addition to making your future brighter, it can feel very satisfying to mail the checks, and gives peace of mind right now.

Happy Working,

Jenny Girl Friday

Read more on the official FORM 1040-ES info sheet on the IRS.gov site.

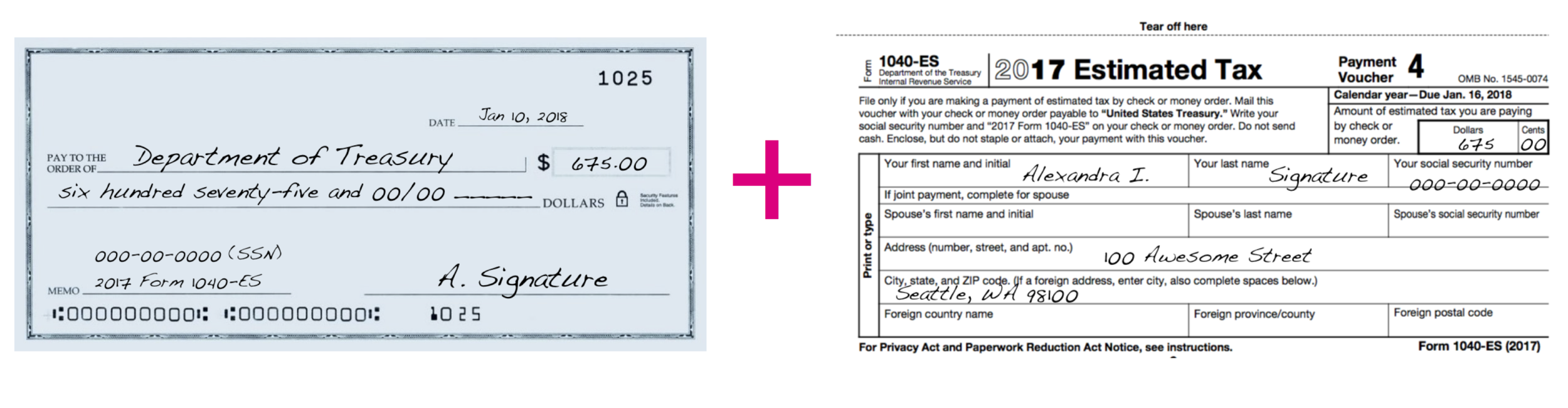

• How to Send in Your Estimated Quarterly Tax Payment (EQ$) to the IRS

Most of us are required to send in part of our federal taxes each quarter to the IRS. These are referred to as estimated quarterly tax payments (EQ$).

There are two main things you need to know to send in your EQ$.

• How much money to send.

• How to submit payments.

This post covers how to submit the payments. Click here to read more about EQ$ and how to calculate the amount.

The Due Dates for EQ$

To download original calendar, click here. Thank you to scrappystickyinkymess.wordpress.com.

January 15

April 15

June 15

September 15

Note: These are NOT due every three months. The time in between varies.

Also, if the due date falls on a weekend or holiday, it is shifted to the nearest business day.

Payment Options

> You may pay electronically. Click here to go to the Payment Page on the IRS.gov site. In most cases, there is an additional fee. There are several options: credit card, direct pay from your bank account, wiring, and more.

> Or, send checks through snail mail.

What You Need for Mailing in Checks

1. A Payment Voucher, also called, Form 1040-ES

2. Envelope

3. Check

4. Your SSN (social security number)

How to Get a Payment Voucher

If this is your first year doing business:

• Download from the IRS.gov site.

Click here to go to the Form 1040-ES page. Scroll to the bottom to get the vouchers.

If you've been in business for 1+ years:

• Tax Software programs will often generate these for you after you file your taxes.

• Accountants will often provide them

• IRS - sometimes they will send these to you in the mail

• IRS.gov - download from the website, scroll to the bottom to get the vouchers.

Steps to Take if You are Submitting Electronically

1. Calculate the amount to send in

2. Go to the IRS.gov payment site

3. Follow instructions to make payment

4. Print any receipts and file with all of your business documents

IMPORTANT - Be sure to select “PERSONAL Taxes” when asked. DO NOT select “business taxes.” This will send you to a confusing portal. “Business Taxes” are for places like Mighty-O, Starbucks, etc. You are paying “PERSONAL” taxes that you earned through your sole prop / LLC business.

Steps to Take if You are Submitting through Snail Mail

1. Calculate the amount to send in

2. Fill out the Form 1040-ES (payment voucher)

3. Write the check

4. Write on the Memo line of your check:

- your SSN

- "Form 1040-ES" and the year you're submitting tax for (See note below.)

5. Put in an envelope. Address to:

Internal Revenue Service

P.O. Box 510000

San Francisco, CA 94151-5100

6. Be sure it is postmarked by the Due Date.

7. Make a copy of your check OR make a note of the check# and amount paid. Put in your file of business documents.

What Year to Write on Your Check

Look at your payment voucher to know what year to write on your check. Generally, the estimated quarterly payment we're sending in is for the previous quarter. So....

Parting Thought

Do whatever you can! Sending any amount...at any time, is way better than skipping this step.

You can help yourself by marking these dates on your calendar: Jan 1, Apr 1, Jun 1, Sep 1....and taking 15 minutes to send these payments. If you're not sure how much, get a friend to help or just take a guess. You'll thank yourself next April, and can have more peace of mind in the meantime.

Happy Working,

Jenny Girl Friday