• IRS Taxes - Different Options for Filing, from Paper to CPAs and in between

Please note: this is an evolving blog post.

I'm hoping to do continued research on this topic! (Perhaps with your help.) What you see below is what I know currently, I'll continue to revise and refine this post over time. If you have any information, feedback, input, or questions, please get in touch! Email me at: jennygirlfriday@gmail.com.

There are several great options for filing your IRS Taxes. This year, they are due on Monday, April 15th.

When you're self-employed, there are just two additional forms that get added to your normal taxes. The Schedule C and the Schedule SE. They're not too complicated. (Schedule SE looks a bit crazy, but really, there's only a few lines that you need to do!)

If you're filing with software, online, or with an accountant, usually, they will ask you a lot of questions, and then put your info into the forms. (Coming soon....Click here to read more about the forms, and what information you'll need for each.)

Filing Options

Here's a list, from the most basic to the most formal. More details about each below.

♥ Paper Tax Forms

♥ Free Online Portals

♥ Online Portals / Software (For Purchase)

♥ Tax Preparers / Bookkeepers

♥ Accountants / CPAs

♥Paper Tax Forms

Prefer the Old Skool Way? Paper tax forms still work just great….though the new 1040 is a little more tricky. The IRS took 2 sheets……and turned them into 7 half sheets. Weird, right? Oh well, knowing you, you’ll figure these out like a pro since you’re used to figuring it out. A post coming soon showing the new 1040…In addition to those, you’ll also need to fill out the the Schedule C and Schedule SE. You can download these directly from the IRS.gov site, or find at many libraries.

Variations

• Do on your own, using the instructions

• Get a friend for moral support and a 2nd set of eyes

• Use the Walkthroughs on the Business Apothecary, by Yours Truly (coming soon)

• Get free assistance at a Library, sponsored by the AARP

• Sign up for a Tax Pop-up Shop

Pros: You can see all your numbers. It's easy to double-check the information. It feels very satisfying and transparent.

Caution: Paper forms don't prompt you...so you might miss out on certain deductions, or credits. Such as the state sales tax deduction. (I have to look into that one still!)

♥Free Online Portals

I believe there are a handful of free portals to use. Usually, these work for basic tax situations only. Some can handle self-employment taxes.

One option is the IRS Free File.

Another is H&R Block, at hrblock.com

(Know any more good ones? Please send my way!)

Variations

• Do on your own, using the instructions

• Get a friend for moral support, and a 2nd set of eyes

• Use the Walkthroughs on the Business Apothecary, by Yours Truly (coming soon) to help you prepare your numbers ahead of time.

• Sign up for a Tax Pop-up Shop to get assistance with the self-employment section

Pros: It's free! It'll know about current tax credits, deductions, etc. It will prompt you for all the information.

Caution: It can be hard to get support when you run into trouble. The graphics aren't as easy or pleasing to the eye. Sometimes, there are limits...such as you have to earn under a certain amount.

♥(For Purchase) Online Portals / Software ... like TurboTax

Have you already been doing your taxes online with TurboTax or something similar? Then adding your self-employment taxes is pretty easy! The portal will guide you through a series of questions about your business, then it will do some of the math for you, and put all of your information into the proper tax forms (that get submitted electronically).

The golden standard is: TurboTax. A major benefit is....they are the same company that created QuickBooks. So, if you've been using those, it can be really quick to upload all your data right into TurboTax!

(Know any more good ones? Please send my way!)

Variations

• Do on your own, using the instructions

• Get a friend for moral support, and a 2nd set of eyes

• Use the Walkthroughs on the Business Apothecary, by Yours Truly (coming soon) to help you prepare your numbers ahead of time

• Sign up for a Tax Pop-up Shop to get assistance with the self-employment section

Pros: It'll know about current tax credits, deductions, etc. It will prompt you for all the information. It's easy to use. Excellent help available.

Caution: Sometimes one can get lost in the process. The portals guide you through, but it's sometimes hard to go back to change things. There are often a lot of up-sells, and it's hard to know when you really need them or not.

♥Tax Preparer / Bookkeeper

Do you feel better working with someone? Is your situation fairly straightforward? Working with a tax preparer or bookkeeper can be a great option! These are folks who are trained in, and very experienced with, doing basic taxes. They are different than CPAs (Certified Public Accountants), and usually cost less. Want to know more about the difference? Click here to read more on clearskybookkeeping.com.

Options:

H&R Block offers in-office assistance with using their portal, for a fee

(Know any more good ones? Please send my way!)

Variations

• Go into an office

• Hire a consultant to come to your office

• Sign up for a Tax Pop-up Shop for preparation of very basic taxes, including self-employment

Pros: Working with a real person to lead you through the process. Get answers to questions. Preparers will prompt you for all the information. They know all the things to check for at the end. Gives you a natural deadline for your preparation part.

Caution: Different personalities (sometimes folks are not friendly), tax preparers/bookkeepers may or may not know some of the very detailed laws that apply to your situation.

♥Accountants / CPAs (Certified Public Accountant)

This is the Cadillac approach! Accountants have a degree in their field, extensive training and experience with taxes, as well as a broader view of money in our lives, financial reports, investments, retirement, etc. They're who you need if you want to do any number modeling, get advice with decisions, do long-term planning, and more.

Some accountants are also CPAs. CPAs have to answer some additional and very high standards! They must have a professional license, follow a code of conduct, and get continuing education. CPAs are a great choice if you: have a complex situation (own properties, stocks, divorce, etc.), if it feels reassuring for you to the highest level of training for doing taxes, plan to grow into an S-Corp or change to a non-profit.

They will usually provide you with a questionnaire each year during tax season and a due date.

Options:

Many CPAs are moving to a subscription model, where you pay a monthly fee each month...and you get your annual taxes prepared + support year round. Some provide a quarterly check-in/tune-up plus annual filing. Personally, I think this is a great move!

Two CPAs with subscription models (that I've just learned about!) are:

• Timber Tax, with Luke Frye and Anne Chan at timbertax.co

• Hipster Money, with Alexandra Perwin at hipstermoney.com. (Website is still being developed.)

• Penny Smart Girl, with Meka West at pennysmartgirl.com

Some Accountants/CPAs are willing to do your once-a-year annual filing, and charge one fee for that job.

• Ballard Bean Counters, with Rose Westwood at ballardbeancounters.com

(Know any more good ones? Please send my way!)

Variations

• Go into an office

• Work over the phone and online

• Hire a CPA who also handles your bookkeeping

Pros: Working with a real person to lead you through the process. Get answers to questions. They can give advice. They can often save you money by knowing all of the credits and special rules! Gives you a natural deadline for your preparation part. You can reach out for help via email or the phone.

Caution: Different personalities (sometimes folks are not friendly). It still takes work on your part to prepare for the Accountant. Sometimes the portals that accountants use can be confusing.

Heads Up ~

However you choose to file your taxes—and with whom—it'll still be up to you to have the numbers and evidence for them. That's where I've got you covered! (Coming soon - Click here for a workbook.)

A couple parting thoughts ~

*****You have the right to be treated well by whoever is helping you with filing your taxes!***** If you ever come across someone who's being severe, unfriendly, or acting like you should know this stuff........then I invite you to move on! Find someone else. You're hiring them to help you! Your job isn't to know this stuff! Your job is to do your work, then find the paperwork + numbers that they ask you to get.

+

It actually is rewarding to do taxes. :) It sounds complicated. It interrupts your schedule. It can be confusing. Also, it is evidence of all the beautiful work that you did last year! Think about all the clients and buyers who benefited from your work! Look at all you accomplished! Every number represents income or expenses that you purchased to do your work. That's pretty cool.

Here's to a rewarding tax prep time!

♥

Jenny Girl Friday

P.S. Know any other self-employed Seattleites who could use this information? Please forward freely!

P.S.2 Are you already signed up for Sidekick Services? If not, click here and join the list to receive tax + license reminders, how-tos, inspiration and more delivered to your inbox.

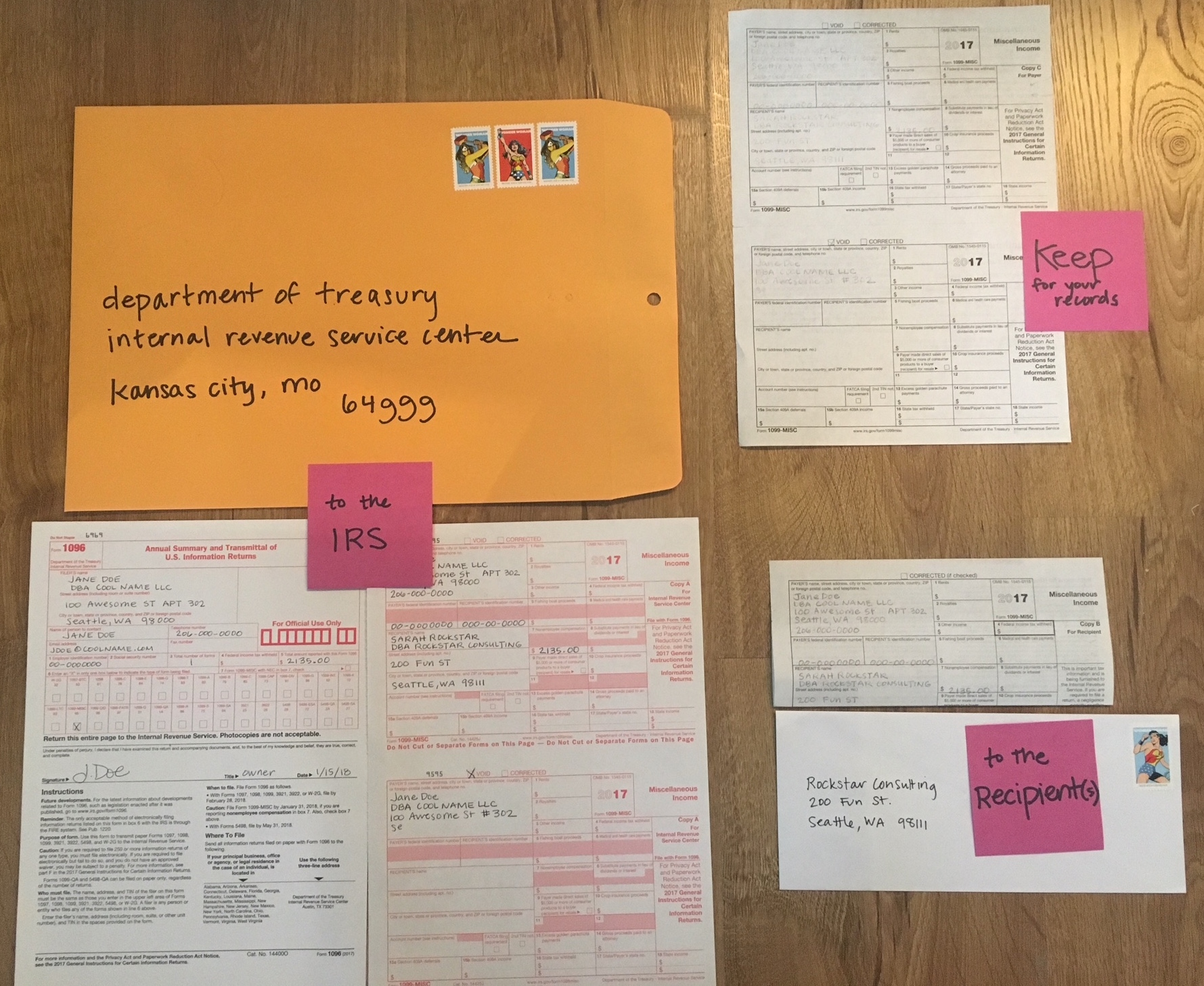

• How to Fill Out + Send 1099-MISC forms

If you paid any Independent Contractors more than $600 in one year, for service work, you need to submit a 1099-MISC form (1099 for short).....both to the Recipient and to the IRS. To read more, click here.

Time Required: 5 - 10 minutes per form (+more time if you have to collect W-9s)

Cost: About $1.50 in postage to IRS + any postage costs to mail to recipients

Due: January 31st

Frustration: 3 out of 10

Tedium Factor: 10 out of 10

Summary

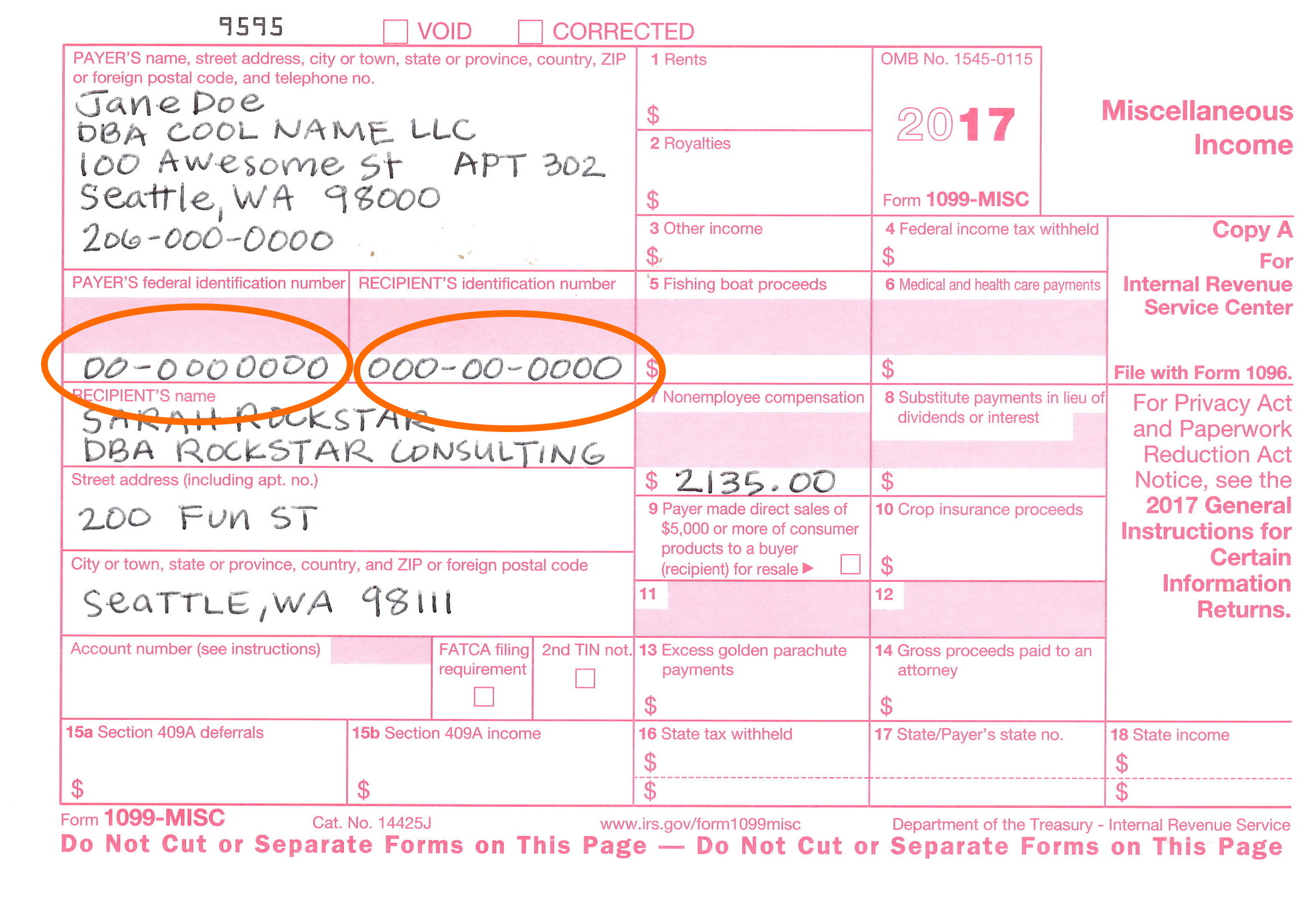

On a half sheet form, you fill in a few boxes. Your name, address, phone number, and tax ID number. Your recipients name, address, tax ID number. The amount you paid them.

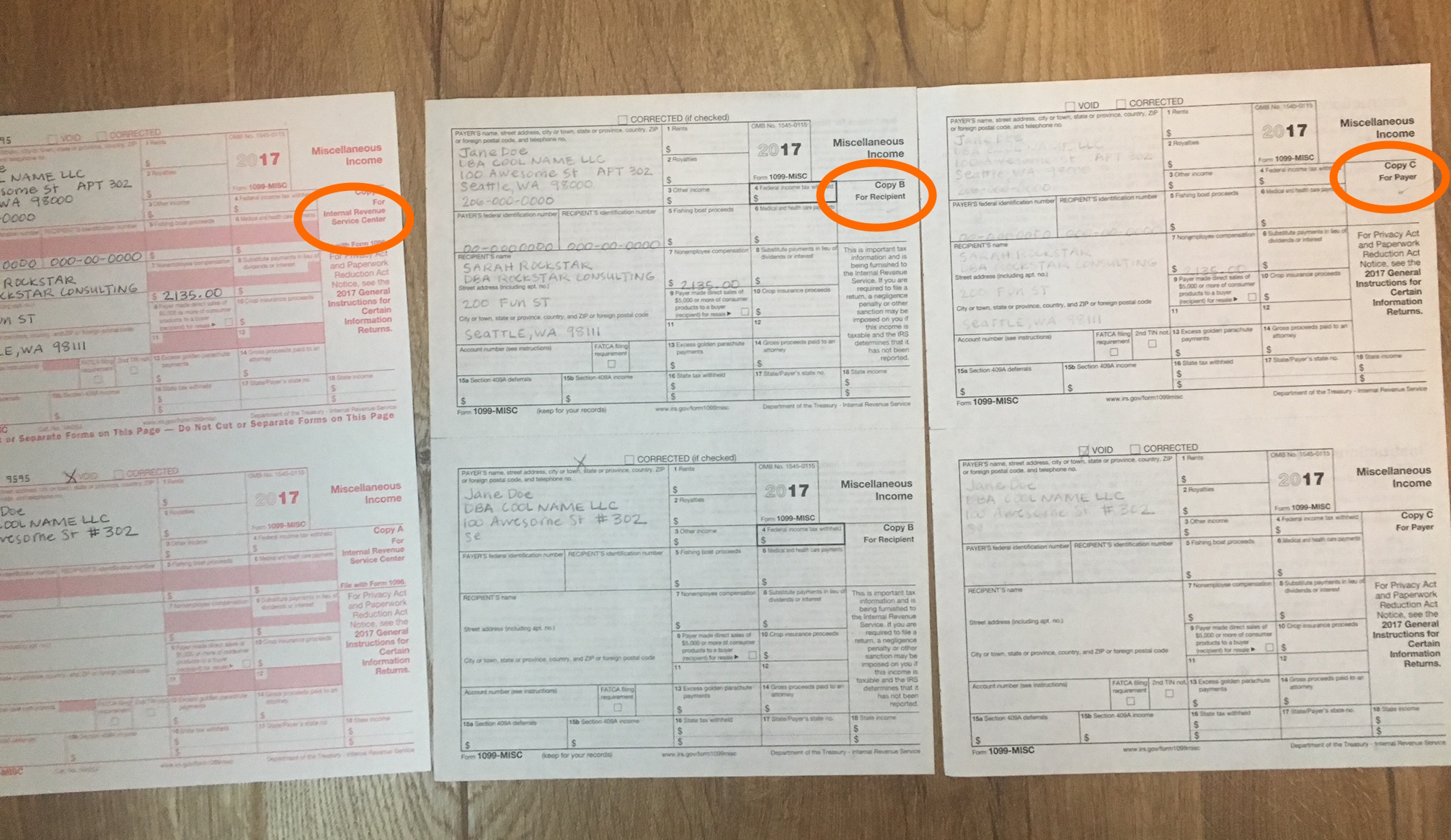

You send a copy to the recipient, to the IRS, and you keep one for yourself.

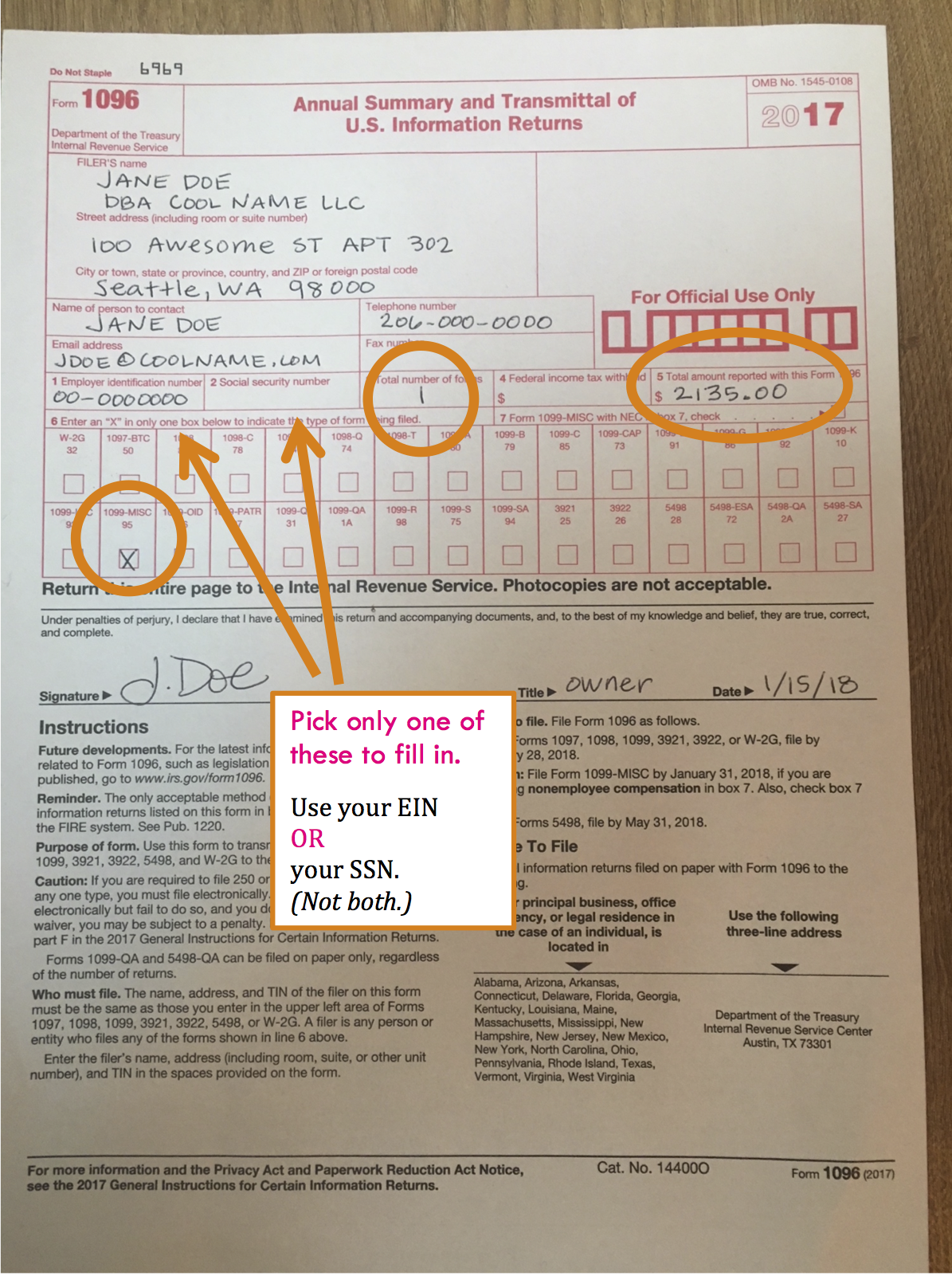

In addition, you must work with two more forms. A 1096 acts as a cover sheet when mailing 1099-MISCs to the IRS. Use W-9s to collect information from recipients. More below....

Photos with notes below. First some information.

You can choose to use paper forms or to file electronically.

Paper forms are carbon and MUST be ordered from the IRS or another source. They canNOT be printed. To ORDER forms, click here. To see a walkthrough of ordering forms, click here.

I haven't worked with e-filing yet. Some tax software systems provide this, such as TurboTax. The IRS also gives this tip, "To locate an IRS business partner who may be able to offer low-cost or even free filing of certain forms, enter "e-file for business partners" in the search box on IRS.gov."

Some accountants will also do this for you.

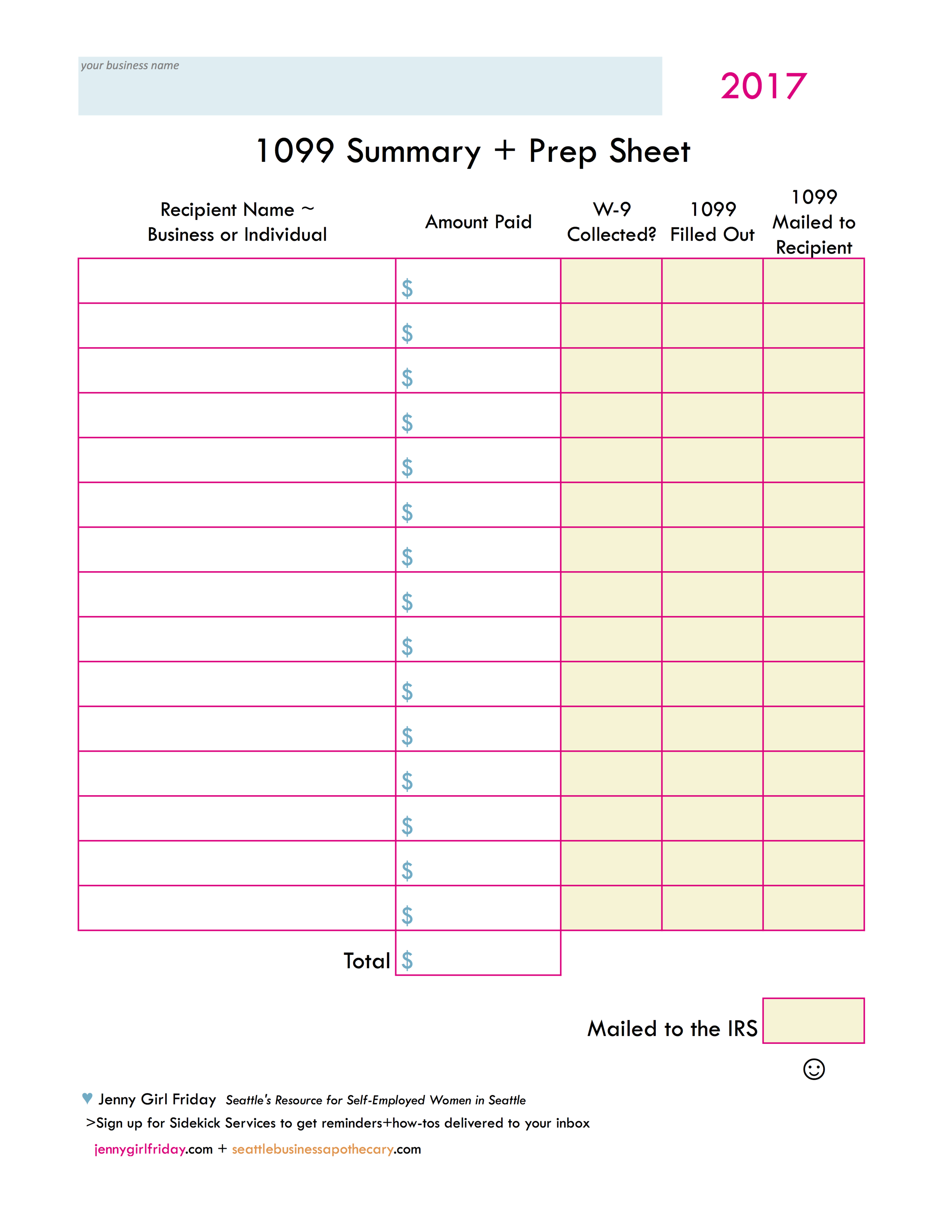

What you need~

For each recipient:

• Full legal name (of the person)

• Legal name of the business

• Address

• Tax ID Number ~ Either their SSN (social security number) or EIN (employer ID number)

• Amount you paid them ~ called "Nonemployee compensation"

If filing with paper forms:

• 1096 Form

• Large Envelope

• Postage

• Black ball point pen

Use this prep sheet to keep things straight! Click on it to get a PDF. :) This will also help when it's time to file your IRS taxes later this Spring.

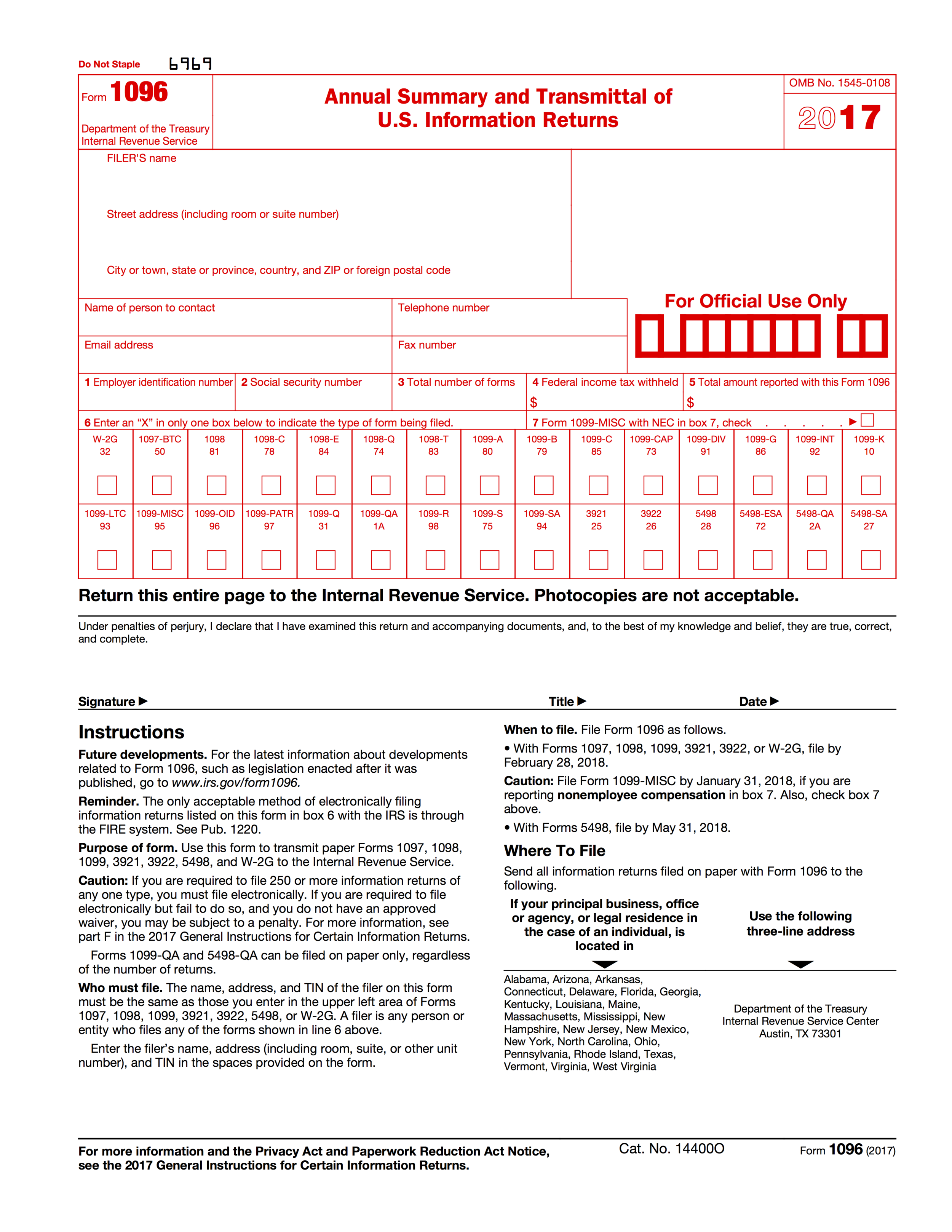

Heads Up! There are two more forms to know about! 1096 and W-9

Like the Charlie's Angels, there are actually 3 forms that you'll be working with! They always go together.

W-9 The IRS created a W-9 form to collect the required information from recipients, including their tax ID. It's a one page form with lots of pages attached. As you can imagine, tax ID numbers are sensitive information, and W-9 forms must be stored securely. You can collect W-9s on paper, or electronically. Click here to download from the IRS.gov site.

1096 This is like a cover letter. When you submit certain types of forms to the IRS, they want a 1096 as well. It's basically a summary of everything you're sending in.

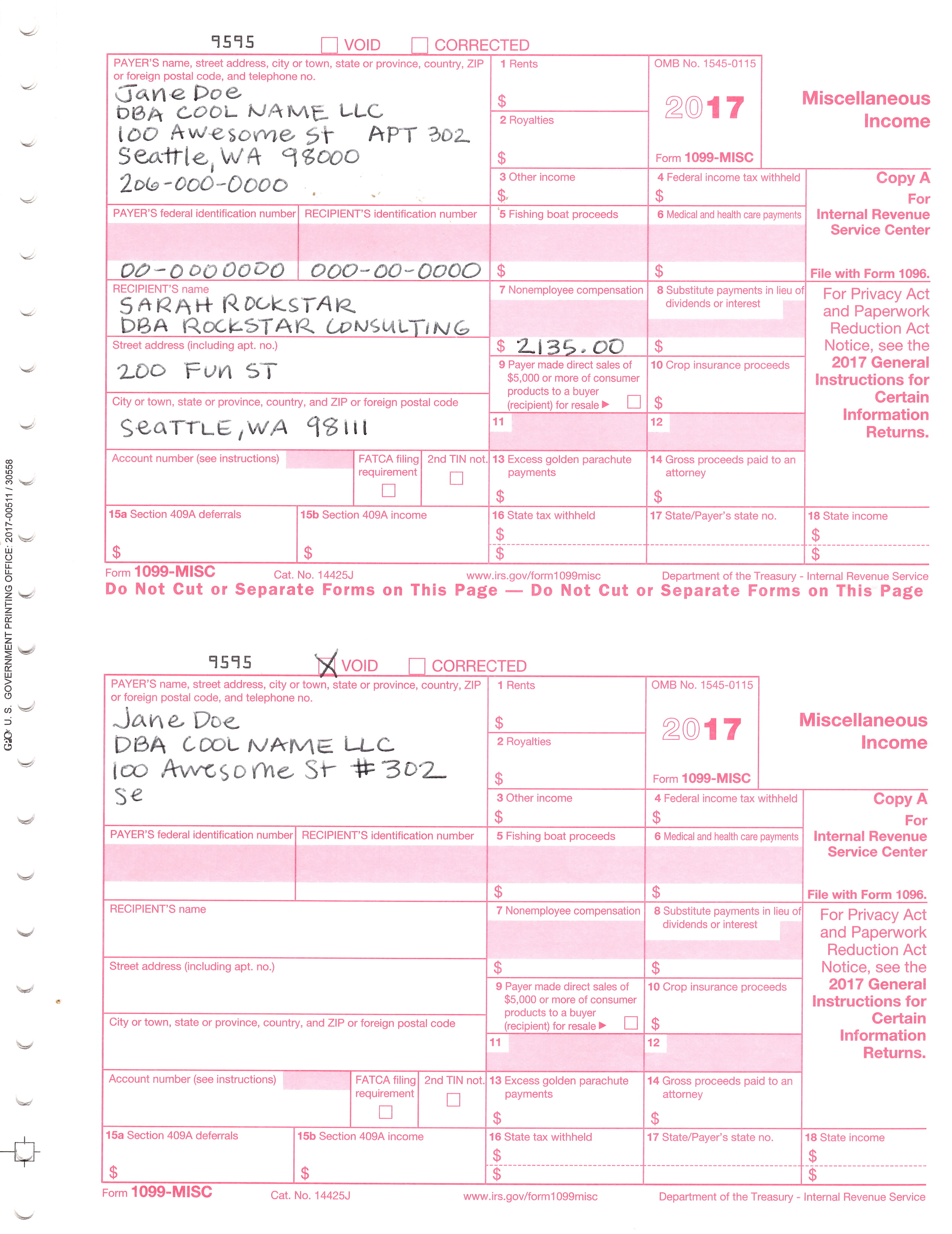

Important Things to Know When Filling Out Paper Forms!

1. Use a BLACK ball point pen, press hard!

2. Use legible, block printing

3. Do NOT add any symbols. NO dollar signs, NO apostrophes, NO number signs.

For Susie's Flowers, you'd write: Susies Flowers

For an apartment #302, write APT 302

4. Do NOT cut the 1099 form top sheet (the one you send to the IRS)

5. Write the dollars + cents for all amounts. For example, 1235.00 is correct. (1235 is NOT correct.)

> > If you happen to make any mistakes, check the VOID box at the top of the form, and start again.

Mailing Information

• Address for Washington Residents:

Department of the Treasury

Internal Revenue Service

Kansas City, MO 64999

• You must use a FLAT envelope, with no folds.

• It must be postmarked on or before January 31, 2018.

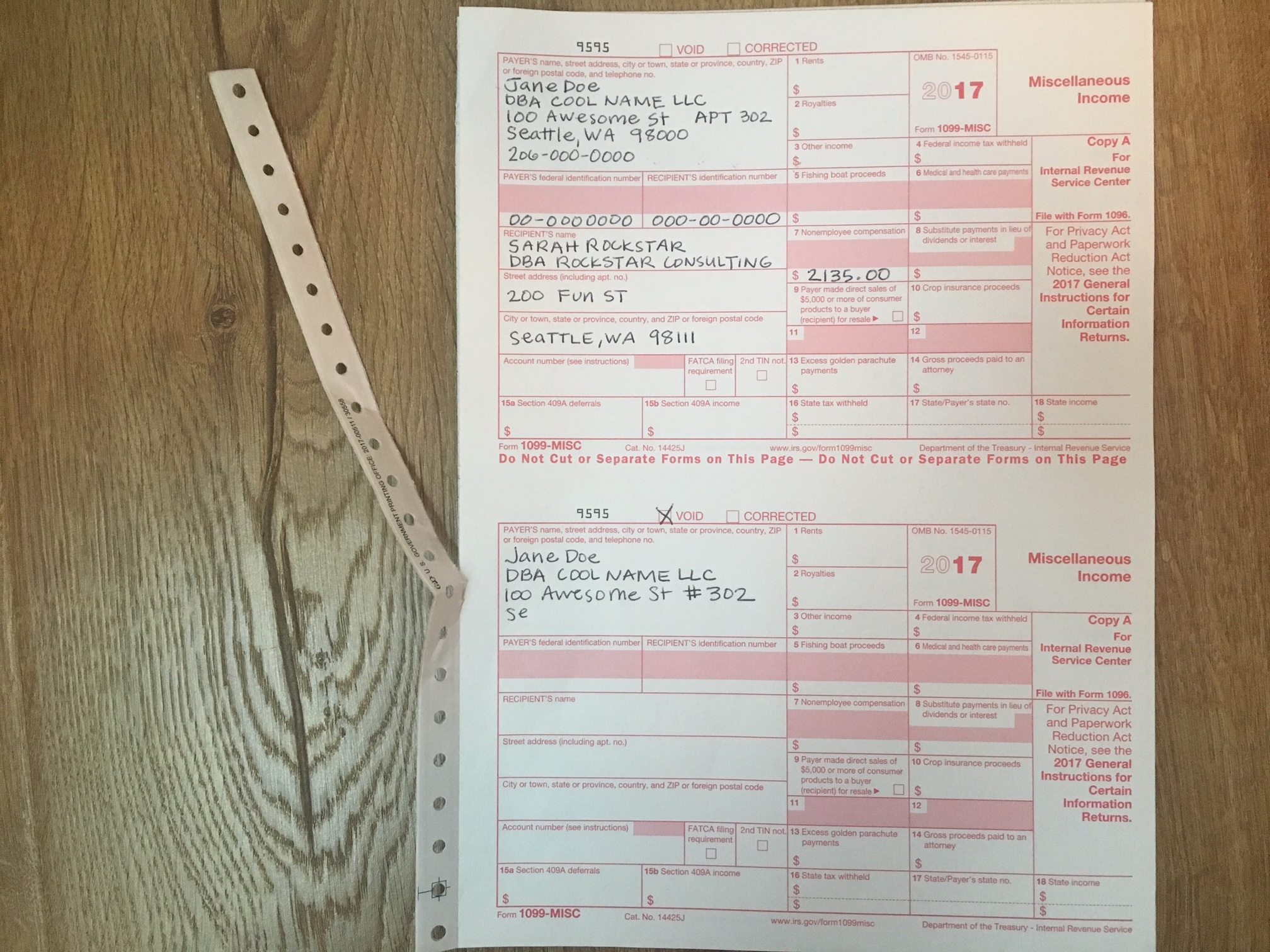

1099-MISCs Forms

Two separate forms are on each page. This shows the top sheet which is sent to the IRS. Do NOT cut this page. The pages underneath are torn in half before giving to the recipients.

Notice the names. It's important to write both the recipients full legal name AND the business's legal name.

Whenever a business is a Sole Proprietor or Single Member LLC, you may use either the SSN (social security number) OR an EIN (employer identification number).

This example shows the Payer having an EIN.

The recipient using their SSN.

On the bottom form, I made a mistake! I used a # sign. This is not allowed, so I stopped filling it out and marked the VOID box.

After they are filled out, tear the strip off and separate the forms.

Look for THREE to keep, and do the following:

1. For the IRS - send in the mail, in a flat envelope

2. For Recipient - send in the mail, may be folded

3. For Payer - keep in your tax records

Here's a look at the 1096 Form.

Moving from left to right with notes:

1. Be sure to check the box 1099-MISC.

2. Use your EIN ....OR.....your SSN. (Not both)

3. Number of forms. Put the number of filled out 1099-MISCs. There are two per page. If you filled out for 3 recipients, you'd write "3".

4. "Total amount reported with this Form" Add up the total of all dollar amounts on all forms. If I was reporting $2100 for a coach and $1400 for a designer, I would record $3500 in this box.

Finishing up!

To the IRS - one 1096 form plus the top copies of all 1099-MISCs

To the recipients - their 1099-MISC copy

For your records - full page copies

Well done! Bravo! Even though the contents of this are straightforward, it can feel so taxing because it takes a lot of care and attention, yet it is boring. In addition, just the thought of the IRS can be triggering or get the adrenaline going. ♥ If you can, find a time to relax a bit. Perhaps a bath, a trip to Ladywell's, a long walk, even a short walk around the block.

Also, remember to check off of your Cheat Sheet / Sticker Chart!

Cheers!

: ) Jenny Girl Friday

P.S. Sign up for Sidekick Services to get these delivered right to your inbox! (Posting on social media is random....)

• How to Order 1099-MISC Forms (free!)

Not sure if you need 1099-MISC forms? Read about them here.

When: Order in Nov or Dec

Forms Due: January 31

Estimated Time: 3 minutes

Cost: Free

Frustration Factor: 1 out of 10

If you plan to use paper 1099-MISC forms (1099s for short), you'll need to order them from IRS.gov. It's not possible to simply print them off ... because they are carbon forms.

Here are the steps. There are screenshots are below.

1. Go to IRS.gov

2. Select "Forms & Publications" ~ Top right side

3. Select "Order Forms and Pubs" ~ Left side

4. Select "Online Ordering for Information Returns and Employer Returns"

5. Scroll Down to see chart of forms

6. Notice there are two empty boxes for each form ~ one is for 2017 forms, the other is for 2018 forms

7. Keep scrolling until you see 1099-MISC

8. Put the desired number of forms that you need in the left box, for 2017 forms

9. Put a number 1 next to the Instructions

10. Scroll down to the bottom and select "Add to Cart"

11. Follow the checkout process

The first picture starts on the "Order Forms and Pubs" page.

The Chart of Forms - The actual chart is longer than what's shown here.

The beginning of the checkout process.

To read about 1099s + w-9s, click here. (Coming soon.)

Need help filling out your 1099s? Click here. (Coming soon.)

Great job staying on top of things for tax season!

♥ Jenny Girl Friday

Would you like to receive friendly reminders for tax season ... delivered right to your inbox? Sign up for Sidekick Services! Asking for a small annual donation.