Accountants + Tax Help for Therapists

Hey there,

Here’s a list of Accountants and Financial folks especially collected for therapists. Most of these names come from Bethany Bylsma of the famed + super fun Therapy Godmothers. Friends of mine, offering all types of support for therapists setting up, or running, a private practice.

Also, hey, would you like to learn more about IRS taxes - either to file yourself. Or, to help you work with an accountant in a more empowered way? Check out Taxes + Snaxes, with Yours Truly as a Guest Presenter. Online or in-person workshops (in Seattle).

:) Jenny

Heard

Offering wholistic services - with accounting and bookkeeping combined

joinheard.com/pricing

MaClean Wealth

Retirement and Income Planning

macleanwealthplanning.com/team

TLDR

Extra support for new therapists

tldraccounting.com/accounting-for-therapists/

Nth Degree CPAS

Taxes and help with cash flow

nthdegreecpas.com/

+

Wise Mind Financial

Money Coaching, by a trained therapist

wisemindfinancial.com

How to Prep for IRS Taxes - All at Once

This is for anyone who needs to prep for IRS taxes all at once! Perhaps you “put it off until the last minute”. No problem! You’re safe here. Or, perhaps you just like doing all at once, and scheduled a day for it. Cool! There are many ways to approach taxes, and they’re all just fine. Read more about Tax Prep Styles to define yours. If you wish to break it up over multiple days, click here.

Okay, here we go.

Overview of the process

Collect stuff.

Find your numbers - wherever they are.

Add up in categories.

Put into a worksheet. Provided.

Then you’re ready to file!

Store your work in one place.

Bonus - Reward yourself.

1

Warm Up / Prep your space

Turn off email. Get some nice music, clear off the table. Use the worksheet to find everything that you might need. Get some favorite food or snacks.

2

Collect everything you can find

Use the worksheet as a guide.

3a.

Find your Gross Sales

This is the amount of total payments you received from clients / customers.

Ways to find this amount:

If you have tracking software, like Quickbooks or something specific to your practice (like Simple Practice for therapists), then get an Annual Report for the tax year.

If you’ve used one bank account for all deposits, simply look at the December statement and find the Year-to-Date deposits.

If you’ve used a spreadsheet, then highlight all the cells of income, then notice the Total.

If you have an income record, look there.

If none of the above, go to the next step.

Important Note! If you received 1099-NECs and/or 1099-Ks for some of your income, you will need to have all of those available.

3b.

Make an Income Record

• Have an income record? Print it out.

• If you have software, print a list of all income.

• If you’ve used a bank account/s …search transactions from Jan. 1 - Dec. 31 of last year, and then filter for Credits Only. Download and print.

• Need to make one? Use your calendar to make a list of all appointments or sales. Write the amounts earned next to each one. You can do this on paper or make a spreadsheet.

• Have invoices? Print them out, staple together as your record.

3c.

Expenses by category

Find all evidence of purchases for your business. Could be ~

paper receipts

online receipts

bank statements

credit card statements

utility bills

It doesn’t matter how you paid for the purchases, all of them can be deducted. (If you’re a sole proprietor or single member LLC.)

Now, we want to add them up by category. Use the sheet you already printed to see the categories. For more info on what expenses go where, click on this worksheet.

Have software?

quickbooks - print the P and L for last year

other software - print P and L for last year, or print all expenses then categorize

OR You can add up these amounts using ~

pen and paper

excel spreadsheet - type in date/amount/vendor by category

excel spreadsheet - download all expenses then, then categorize and sum

Email me if you’d like to use my spreadsheet. Please allow 3 - 5 business days.

Important Note - It doesn’t matter how you add them up! As long as you have subtotals for each category. And evidence for each expense.

3d.

Special case expenses - mileage and office

Did you drive for your business? Most any place that you drove, except to an office, can be deducted. There are two ways to claim this expense - actual cost of vehicle or mileage. I will only cover the Mileage Method here.

Mileage

What you need to find

total miles for the vehicle for the whole year

total miles for business use

total miles for personal use

If you have these figures, your accountant or tax software will do the rest.

Ways to find mileage

Used an app? Log in to find your report for last year.

Have a record, great!

Calculate miles - look at your calendar, make a list of dates/locations and use Mapquest or other site to calculate the mileage of your trips.

For total miles, do your best to guess your odometer reading for last January 1. Perhaps look at oil change records. For the ending mileage do the same. (In the future, make a note to yourself to write down your Odometer miles each January 1st.)

Office

There are two ways to claim this expense. I will only cover the Simplified Office expense here. Calculate the square footage of your office.

The accountant or tax software will know what to do.

3e.

Payments You Already Sent In

This is majorly important!!!!

These are the Estimated Quarterly Tax Payments you sent in, if you did. Only you can provide this info. Find the dates and amounts when you sent these in. Otherwise, you will not get credit for them!

Not sure? Look through all of your records, your bank statements, email. And/or call the IRS.

4

Check the worksheet

Look over the worksheet at everything you’ve collected. Try and think if anything is missing. Did you have any more business expenses? Any accounts you forgot to check? Find anything missing and add them. At some point, decide to be done!

5

Plan when to file

Doing this today? If not today, choose a day and put on your calendar. Not sure how to file? Read this post.

6a

Store everything

Keep these things out: Worksheet with all your figures AND any 1099-MISCs.

Gather all of your receipts, statements, calculations, notes. Print out and put into a box, or envelope. Label with the Tax Year.

6b

Reward yourself!

Phew, that was a lot of work. Be nice to yourself this evening. Maybe order take-out or go out. Maybe a bath or binge watch some shows. Maybe online shop for something you’ve wanted. Just be sure to be nice to yourself AND get a reward…or put one on your calendar asap. Here’s a menu if you’re not sure what you need.

♥ ♥ ♥ ♥ ♥

Was this helpful? If yes, please considering leaving a Tip in the Tip Jar …. and/or forwarding to a friend. Thanks so much!

: ) Jenny Girl Friday.

Sole Proprietor or LLC: Which is best for me?

When you work for yourself, you fill two roles in one. The employee and the employer. In order to do this, you have to create a business entity that essentially hires you. It feels a little like make-believe play – All I want to do is my work! – but it is necessary. The two most common options are sole proprietor and limited liability company, or LLC.

It is the first decision that you need to make, because it determines your legal status and name options. And, you’ll be asked about it right away when registering your license.

Sole Proprietor

Advantages: simplest and cheapest

Legal Name: must be your name

Disadvantage: liability – if someone sues your business, they are suing you

In this case, you and the business are considered one in the same. There’s no real structure to set up or maintain. You simply are required to have licenses and pay taxes. It is free. There are no additional obligations, and no special benefits. Except that the paperwork is the most streamlined.

There is a risk, though. If someone sues your business, they are suing you too. Meaning, if they win and you owe them money, it comes out of your personal accounts. In a worst case scenario, you’d have to sell your house or drain accounts to pay them.

You can do business under a different name, called your trade name, or DBA, Doing Business As. For example, Jane Doe’s legal business name would be Jane Doe. She could do business as, Polka Dot Consulting. She just has to register this name, so her business activity is traceable to her legal name. These only cost $5 each. When you apply for your license, you can choose 1 or more.

LLC

Advantages: protection from lawsuits, looks official

Legal Name: must include a version of LLC*

Disadvantage: it costs some money each year

In this case, the business is a company that is separate from you. It offers a layer of protection. If someone sues your company and wins, then they can take company assets (not your personal ones). In my case, this includes a small business savings account, my computer, printer, and lots of great books. The idea is that your home and personal monies are protected. Having said that, it is possible to get around that protection – depending on the case and the lawyer. If you want to know more on the subject, I suggest meeting with a small business lawyer to share more about your specific situation.

You must apply with the Secretary of State to be granted this entity. It costs about $200. And, you must renew each year on the anniversary month, for about $80.

The LLC also looks serious and cool. For people that don’t know, it helps you to look official. This can be a boon for certain types of business. You can also use DBAs. (But they may not include variations of LLC.)

Concerning the IRS – Good news!

A cool thing is that you don’t have to do anything different for the IRS! That is, if you are a single-member LLC. Because you are still a one-person business, and there’s no dividing of profit, the IRS lumps you in with Sole Proprietors. In fact, they refer to you as a “disregarded entity”. You are not regarded! You are ignored. This is great because it keeps your paperwork simple.

•

In the end, both serve different purposes. Often - people who are tight on cash, or starting before they're totally ready, or intimidated by the LLC – choose sole proprietor. For others who have the money, and/or are really committed to their vision, tend to go for the LLC! You even get a certificate with borders and a golden seal to frame.

If you have questions, please, get in touch. Click here to read a post on how to get licensed in Seattle.

Happy Working,

Jenny Girl Friday

Girl Friday LLC

DBAs:

Jenny Girl Friday

Jenny MacLeod

Girl Friday

girlFriday

*Limited Liability Company, Limited Liability Co., LLC, or L.L.C.

What's Your Tax Prep Style?

Dear Readers, this is an evolving blog post. I’d love to get your feedback on which terms / descriptions work or don’t work for you!

Work with your nature.

This is one of my favorite guiding principles. And it's more important than ever when it comes to chores or anything that feels tedious, new, overwhelming.

What style fits you? ....when it comes to working on IRS tax prep?

(Nicknames are works in progress.)

♥ The truth?: I ignore it until the last minute, then scramble and get it all done. (Phoenix)

♥ I like to start as early as possible. In fact, I already have! I work steadily until the job is done finished. (Early bird)

♥ I do best breaking up a task. I prefer to work over several sessions. (Marathoner)

♥ I like to do the job all at once, on a planned day. (Personal work party)

♥ None of these fit exactly/I'm a mixture. (4 Leaf Clover)

The idea: choose your style. Name it. Claim it. Plan for it. Be at peace with it. Below are a few ideas for each style.

P.S. If you're new to this, I suggest reading the Marathoner description as well as your style.

♥

Phoenix

Do your thing! No reason to fix something that works. When the time comes, find this email and these tools to offer some help: All-at-once Prep + CalculateBasic. If needed, here's an article if you get stuck somewhere. Perhaps, mark off a day or two around 4/12, 4/13, 4/14 to do the work. Lastly, if you can, clear your calendar on 4/15 or 4/16 to take a break, go to the spa or drive out of town to reward yourself and recover. (I'm keeping this short, because your mind is busy with other things right now. You'll get to this later.)

♥

Early Bird

This message to you might be too late because you're probably finished. In case I caught you in time, here's an article that outlines the whole process. And a worksheet to capture all your numbers: CalculateBasic. You'd probably like to fill out this second sheet as well: Calculate Next Level. Before you get too far, please be sure to choose a reward for yourself. Set aside some money for it and plan whatever time it takes. Yes, you start early because it's your nature, there's an urge to. That's cool. Still, let's reinforce and reward that nature! We want to keep you happy in your job. If you feel a bit guilty, then it's probably the right amount.

Oh, and here's an article on filing options. As you know, it feels so good to get the appointment for the actual filing on the calendar, whether it's meeting your accountant, filing yourself online, etc. Heads up, there are a few changes this year! A new 1040 and a few new rules. I'll be sharing about that soon. I'm just mentioning it so you plan in a little extra time. If you'd like to dive into research now, here are the 1040 Instructions, start on page 6.

♥

Marathoner

Slow and steady wins the race! And, "Life ain't a track meet, it's a marathon." Ice Cube. You know that working slowly over time means less impact on your life, the pain can be spread out. If you've done this before, you've probably got a system already. If you're new / as a reminder to experienced folks: plan several work periods over the next 4 - 6 weeks. Prep time really ranges from 2 hours to 12 or more. Just take your best guess and plan in the time. You can pick a regular day + time, like "Fridays from 1 - 3pm", or choose a time block like "1 hour" to fit into your weekly schedule.

One option is for you to follow along with the Sidekick Service Tax Prep series coming out soon. I've broken the process into 6-7 steps, and will send an email about each one...so you can follow along with me. If you'd like to space it out yourself, take a look at this article, with worksheets for each step. Or, look at this All-at-Once Prep Sheet to plan your own sessions. I also suggest choose a little treat for each work session and a big Reward for when you're all finished.

♥

Work-Party Girl

You like to get in the zone; to give this task your whole attention, all at once. Like gearing up for party or 5K, you want to collect all your tools and resources, create the space, and get it done, and done well, and then shut the door and be finished. Tips for you (if you're new/need reminders): schedule three days on your calendar: 1- Personal Tax Work Party, 2- Time OFF to recover/reward yourself, 3 - Follow-up Tasks.

Create a space in your house to collect all of the things you'll need. Tax documents coming in the mail, bank statements, receipts, etc. Perhaps print out this sheet Collect Stuff. You can use it to slowly collect items prior to your Party day, or, do it first thing that morning. Consider getting a friend to hang out with you. Oh, and if you're the cook in your house, arrange for someone else to handle meals or to go out for dinner. Be sure to have a breakfast and lunch you love, plus snacks on hand. On that day, I suggest printing out these two sheets: All-at-once Prep + CalculateBasic. Here's an article if you run into questions.

♥

Four Leaf Clover

Perhaps none of these fit, you're a combination, or you're new to this and just don't know. Or, maybe you're a rebel and as soon as someone tries to type you, you don't like it! That's cool. I get that we're a spectrum and not everyone fits into boxes. A few ideas. First, find a way to name your own style. Think about what's true, even if you're different/changing all the time. The reason? It's empowering to claim what we do naturally and then we've got a strategy to stick to.

Next translate your style into some logistics. Do you want to plan ahead, wait until inspired, ignore? Three Options for you. 1) read through the tips for the other styles, and whatever sounds good/calming/easy, then do that. 2) Plan to follow along with the Sidekick Service emails over the next 6 weeks. If it sounds good, do the work suggested for each. Then, if you want to jump off at any point, please do! 3) Look at this All-at-Once Prep sheet. Or skim this article. Then ask yourself this, Now that I see all the work involved, how do I want to tackle it?

Once you discover your name + system, I'd sure love to hear about it. Please email me at jennygirlfriday@gmail.com

I'm excited to hear what you think of these Styles + Tips!

• How to CALCULATE numbers for IRS taxes: pen and paper, spreadsheets, software

[Note: This is step three of the Prep for IRS Tax process. To see all the steps, click here.]

In a nutshell

You need to report some numbers related to your business AND have some evidence to back them up (receipts, bank statements, etc.). How you add up the numbers is up to you!

The numbers (eventually) get reported on the Schedule C. If you use software or a tax preparer, they will ask you questions, then put those numbers onto the Schedule C for you.

Consider using the handy worksheets below to keep track of your numbers.

Alert: This blog post may look really complicated, and I apologize for that! It's tough because every situation is different, and I'm attempting to speak to a variety of situations in one post. ♥ Please know: once you get into the material, it usually starts to make sense. Also, I invite you to email me with any questions! jennygirlfriday@gmail.com

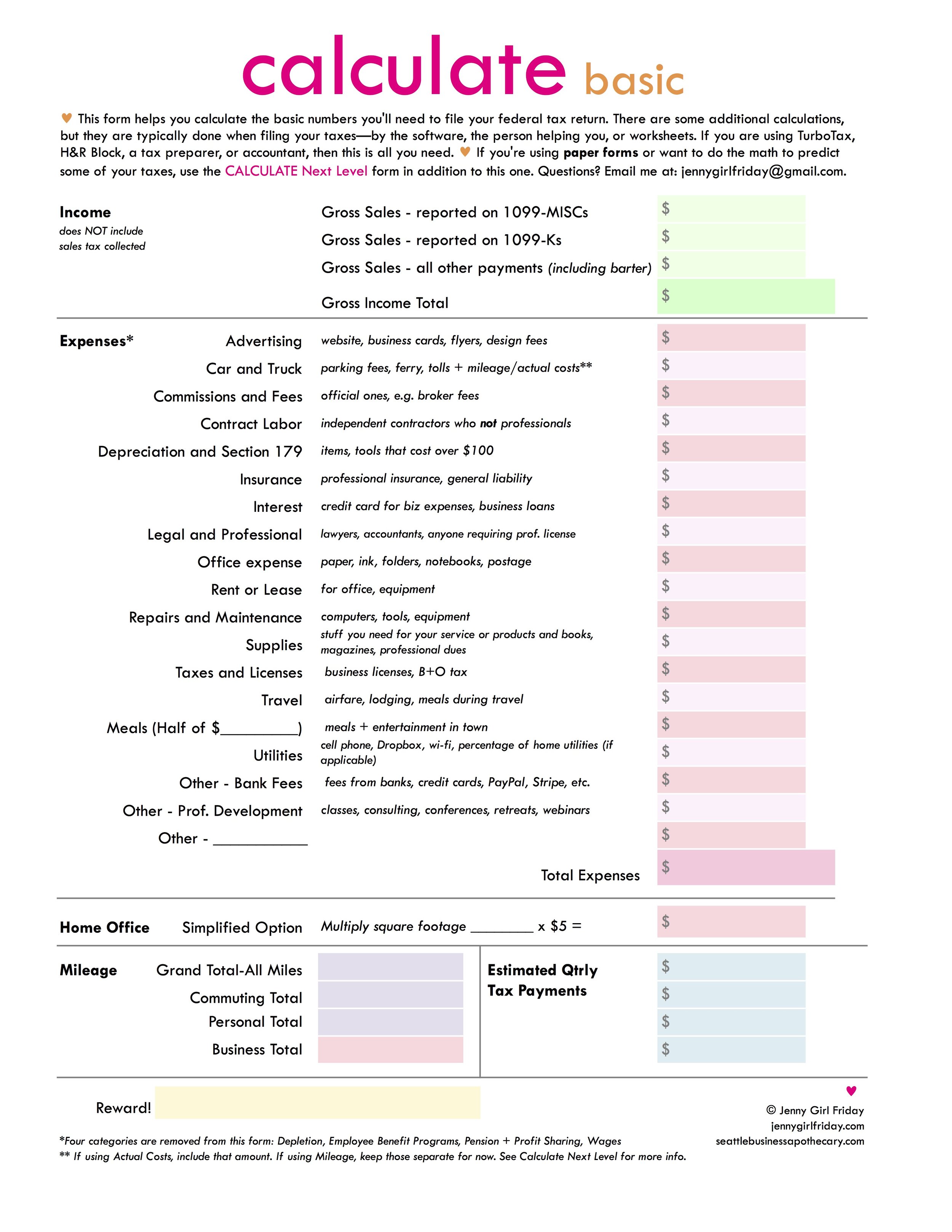

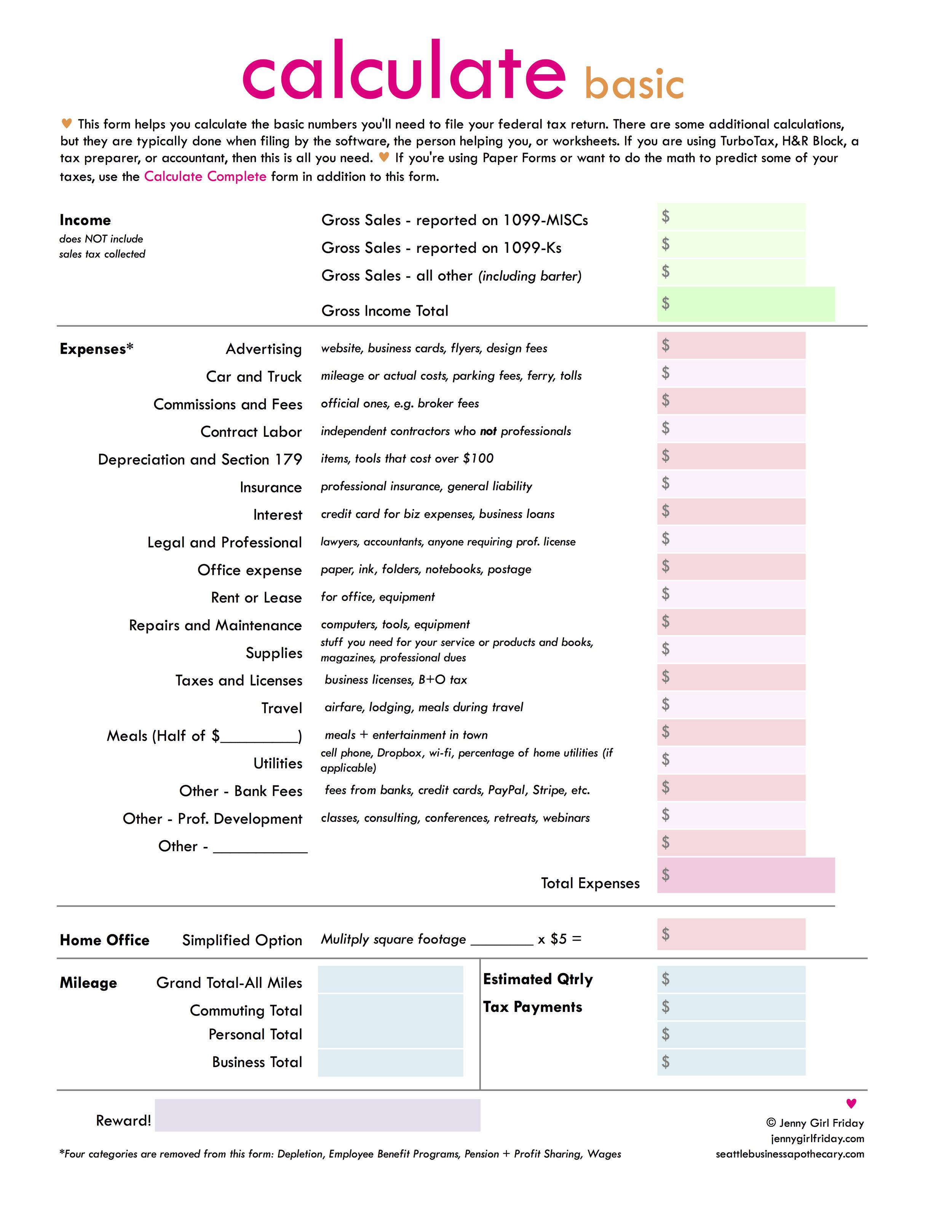

ProTip: Print the Calculate-Basic worksheet, and just start filling in what you know. Then come back to the post for more ideas when needed.

ProTip: Get a friend to help you with this. They can read the instructions, then together, you can figure out how to proceed.

The Calculate-Basic includes everything you need for MOST situations. The Calculate-Next Level is helpful if you're planning to file using paper forms, or if you want to predict your self-employment tax amount.

Gross Sales

AKA Gross Income / Total Deposits

Important: This number NEVER includes any sales tax collected.

You need to have a total Gross Sales number, and a record to back this up. Perhaps you already have this total, or parts of it.......or perhaps you have to create it still. Here are some options.

Different Ways to Keep / Create a Gross Sales Record

If you already have this record, great! If you need to make one up for last year, read on! The basic process is:

1 Find the payment amounts

2 Make a Record

3 Find the Total

4 Format for the IRS

1 - Find the payment amounts

Here are all the places to look:

- Bank Statements - look at deposit records

- Deposit Slips

- Copies of Receipts/Invoices

- Reports from Commerce sites

- Calendar - find all appointments and mark what you got paid for each

2 - Make a Record

Ideally, include the date, purchaser name, and amount of each.

These are options for you to choose from:

- Keep a list of all payments in a notebook

- Record payments in a spreadsheet

- Print out all summary reports from websites you use, keep as your records

- Use software or an app (such as Quickbooks or Fresh Books)

3 - Find the Total

Add up all your numbers to find your Total Payments by customers. This is your Gross Sales.

Do NOT include any sales tax collected.

- Use calculator

- Put into a spreadsheet, and use formulas to add

- If using software, go to the Reports section to get the totals

4 - Format for the IRS

Did you get any 1099-MISCs or 1099-Ks for your business? These are simply proofs of payments that someone else made to your business. The numbers on these forms should already be included in your Gross Sales amount.

> If you're filing with Paper Forms, then you just report your Gross Sales, which includes the totals on these forms. You do NOT need to list out their amounts separately.

> If you're filing with software or an accountant, they will ask you for your Gross Sales in parts. So you'll need to find the subtotals for:

___1099-MISCs

___1099-Ks

___ All other payments (including barter)

___ Total of Gross Sales

Expenses

Okay, options! Here are three of my favorite. There are more options and variations. Hopefully this will give you an overall idea, and you can create something that works for you.

Note: For evidence of our business expenses, receipts from the purchase are best. The IRS will also accept bank and credit card statements.

Pen and Paper

With Receipts

1. Look at the categories of business expenses (on the Calculate-Basic sheet or the Schedule C)

2. Make piles with your receipts in each category.

3. Add up the totals for each, and fill in the chart. Perhaps write these amounts on pieces of paper to keep track, one for each category.

4. Suggested: staple each stack of receipts together.

With Bank Statements

1. Look at the categories of business expenses (on the Calculate-Basic sheet or the Schedule C)

2. Get a piece of paper for each category, label at the top.

3. Go through Bank Statements. Find each business expense. Highlight, circle, or underline it on the statement.

4. Decide which category the expense falls in. Write each expense on the corresponding piece of paper. (For example, if you see a line for "Office Max", write the amount on the paper that labeled "Office Expense".)

5. When all expenses have been recorded, add up to get the totals. Record on the Calculate-Basic worksheet by category.

Spreadsheet

1. Look at the categories of business expenses (on the Calculate-Basic sheet or the Schedule C)

2. Label a column or separate tab with each category. (Depending on how you like to work.)

3. Go through your receipts and Bank Statements. Find each business expense. Highlight, circle, or underline on the statement.

4. Decide which category the expense falls in. Add it to the column or the tab.

5. When all have been recorded, add up to get the totals. Record on the Calculate-Basic worksheet.

Quickbooks or Other Software

1. Finish inputing/uploading all expenses for 2017

2. Find the Reports page

3. Select Profit and Loss statement

4. For the time period, select Last Year

5. Look at the report. Review each category.

6. Make any adjustments.

7. Print the Profit and Loss statement. Or, record the amounts on the Calculate-Basic sheet.

Special Expenses

These get calculated in special ways, so deserve their own section.

Special Expense - Mileage

There are two ways to deduct driving expenses. For each vehicle, choose one method and stick to it each year.

Option A: Actual expense. (Less common)

With this option, you collect and report ALL costs associated with your vehicle: gas, insurance, repairs, maintenance, and tab renewals. If you use it part for personal and part for business, you need to calculate what percentage is used for business. Then take that percentage of the total costs.

So, if you use for business 30% of the time, you'd deduct 30% of all costs associated with that vehicle.

Add this expense to the Car and Truck Category.

Option B: Mileage Deduction (most common)

For every mile that you drive for business, you get to deduct a specified amount. In 2017 it was 53.5 cents per mile. With this method, you need to know your total business miles. Additionally, you're required to have a record. The easiest way is to use an app, such as MileIQ. Or, you can keep a log book.

For most forms of filing, you'll be asked for:

___ Starting Odometer reading, on January 1

___ Ending Odometer reading, on December 31

___ Grand Total of All Miles

___ Total of Personal Miles

___ Total of all Commuting Miles (driving to and from an office)

___ Total of all Business Miles

To Claim the Expense:

If using Paper Forms

A. Calculate Total Business Miles x 0.535 =____________.

B. Add this to your Car and Truck Total

If using Software or Working with a Tax Pro

A. Have all of your Mileage Totals Handy

B. Do NOT include in Car and Truck expense

C. Provide information when asked, and they will calculate and deduct

Special Expense - Home Office

If you have a home office that meets certain requirements, then you can make a deduction. There's a Regular Method (that's complicated) to do this, and a Simplified Method. I will only speak to the Simplified Method. To learn more, go to IRS.gov, or ask your accountant.

A. Decide if you meet the requirements: the space is ONLY used for business, and it is your principle work space.

B. Measure the Square Footage.

C. Multiply Square Footage by $5=_____________

D. If using Paper Forms, claim this expense on the Schedule C on Line 30. (It is in a separate place than other expenses.) Also, consider researching or asking someone about Schedule A. I have yet to learn about this.

E. If using software or working with a tax pro, input when prompted.

♥ If this is your first year..........hang in there........and just try your best! If you find out in the future that you did something wrong, or forgot some major deductions, don't worry, you can amend tax returns from previous years.

Actually, that goes for everybody. Just try your best. Take things one step at a time. Do what you can. Reach out for help: from a friend or colleague, email me, meet with a tax volunteer at the library, or your bookkeeper or accountant.

To read about options for Filing, click here.

For the next Tax Help Pop-up Shop, click here.

: ) Jenny Girl Friday

P.S. Know any other self-employed Seattleites who could use this information? Please forward freely!

P.S.2 Are you already signed up for Sidekick Services? If not, click here and join the list to receive tax + license reminders, how-tos, inspiration and more delivered to your inbox.

• How-To Prep for IRS Taxes (Includes fun + rewards!)

Prepping for taxes is a lot like planning a big party or fancy dinner. (Okay, maybe a little bit different.)

It's possible to do it all at once.........or to break it up over time. There are pros and cons to each!

Doing it all at once

....is more efficient, you get really in the zone, and sometimes adrenaline fuels quicker working. If this sounds good to you, click here.

Breaking up over time

....means the effort is less intense, you have time to catch important details, you can rest in between.

Either way, it's helpful to know early how you're going to file, so that you can line up any help, or make appointments. (For example, if you're planning to go to H&R Block, you'll need to find their open hours. If you're hoping to work with an accountant, they'll have their own deadlines for you, earlier than April 17th!) Click here to read more about options for filing.

Overview

I've broken up the process into several steps, which can be spread over days/weeks, or done all at once. More details about each step below. Please keep in mind: as a project manager client once explained to me.......when you break things into many steps, each step looks easier, but then, you have a lot of steps! Don't let this discourage you. Just find a way to start, and, in theory, each step should feel easy and quick, and you'll build momentum.

0. Review REWARDS Menu (optional + recommended)

1. WARM UP

2. COLLECT stuff (coming next)

3. CALCULATE some numbers - Basic + Next Level

4. CHECK + find any missing pieces

5. FILE / SUBMIT along with your IRS taxes - File-paper, File-online, File-tax pro

6. STORE tax forms and back up document

7. Optional: Reward + Reflect

It can look like a lot! And feel like a pain! It can also be very rewarding, and I'm determined to help you build in some fun.

Warming Up

Warming up ... okay, so you don't have to, but it will make things more pleasant.

It's like stretching before playing soccer, or better yet, like a cocktail + appetizer before dinner!

As part of our Tax Prep, Warming Up includes picking a due date, your option for filing, considering your way of working, putting time on the calendar, and most importantly...........finding ways to make it fun and picking rewards!

Click on the image to get a downloadable PDF.

You might notice that I often refer to inviting a friend to join you for some of this work. I'm not kidding about this! If you make an appointment with a friend, you're more likely to do the work (not put it off), it's way more more fun, it can go faster, and they can help you figure out anything confusing. Most often, friends are happy to lend a hand in exchange for dinner, a bottle of wine, a candle, or just some sincere thanks.

Do you have someone who could keep you company with this?

Collect Stuff

AKA.....Treasure Hunt Time!!!!!!

I love this step. Can you tell? Here's why. Every receipt you find for business expenses is like finding $$$$$! Depending on your specific tax scenario...for each receipt, you'll be saving 20 - 30% of what that receipt is worth.

For example, if you bought a few books for your business, and the cost totaled $80...then you'll pay $16 - $24 less in taxes.

With this step, we're just collecting stuff. No adding, no smoothing receipts, just find it.

ProTip: create a spot somewhere to put all these things, or perhaps a very pretty basket, or decorated office box.

Heads up: it's very helpful to print a lot of records, so you may have to stock up on some ink. (I like to use remanufactured ink to save money.)

Click on the image to get a downloadable PDF.

Calculate

So.........you don't pay too much!

>>> If you know what to do, or would like to just figure it out as you go, print the Calculate-Basic sheet and start filling in numbers.

Why we're doing this

Before we talk about the numbers we need, let's review why we have to do all this work. Basically, it's so that you don't pay too many taxes! The IRS taxes you on your Income. When you are a sole proprietor or single-member LLC, the profit from your business is considered your income.

If you were to only report your total payments (gross sales), you'd have to pay taxes on that entire amount...even though you likely had to spend money on running the business. That wouldn't be fair. Thank goodness, we don't have to do that! Instead, we report our profit, and we're taxed on that. In order to report our profit....we required to report several numbers, as a sort of proof. Here's more on that....

The Basic Numbers + Formula

To find our profit, we report the following numbers + formula:

Gross Sales

- Expenses

= Profit

Two of those numbers (gross sales and expenses) are made up from several other numbers, and have to be reported in the right way. The IRS created the form Schedule C for sole proprietors and single-member LLCs. The worksheets I created are simplified versions of the Schedule C.

Gross Sales, may include:

- totals from 1099-MISC, given to you

- totals from 1099-K, given to you

- totals from all other payments, including barter

Expenses, may nclude:

- totals by category of business expenses

- total business miles

- square footage of home office

The Calculate Step

In this step, the idea is to find these numbers. It's possible you have them already if you've been keeping records, or using a program such as QuickBooks.

[Even if you have these totals, it's great that you've collected your receipts and bank statements, because these are part of the evidence that you need to keep for several years—7, I think?—in case you get audited. (Btw, good news, less than 1% of people get audited.)]

If you still need to calculate your totals, and would like some guidance, click here to read more about this. There are several ways to do this! Just a few include: pen and paper, spreadsheets, and software. Find what works best for you, and consider getting a friend to help.

Check

Congrats! You've finished the CALCULATE step, often the longest one. By any chance, did you discover that you were missing some things? Or did you have new questions as a result of your work?

That's super normal! That's what the Check + Find is about: finding missing things, getting answers, and double-checking your math. This step is optional. It's offered for those of you who like to be very thorough before filing.

This checklist prompts you to check the math you've done so far (income subtotals, expense totals, mileage).

+

There's space to list questions and things to find. Use it to keep track of your progress.

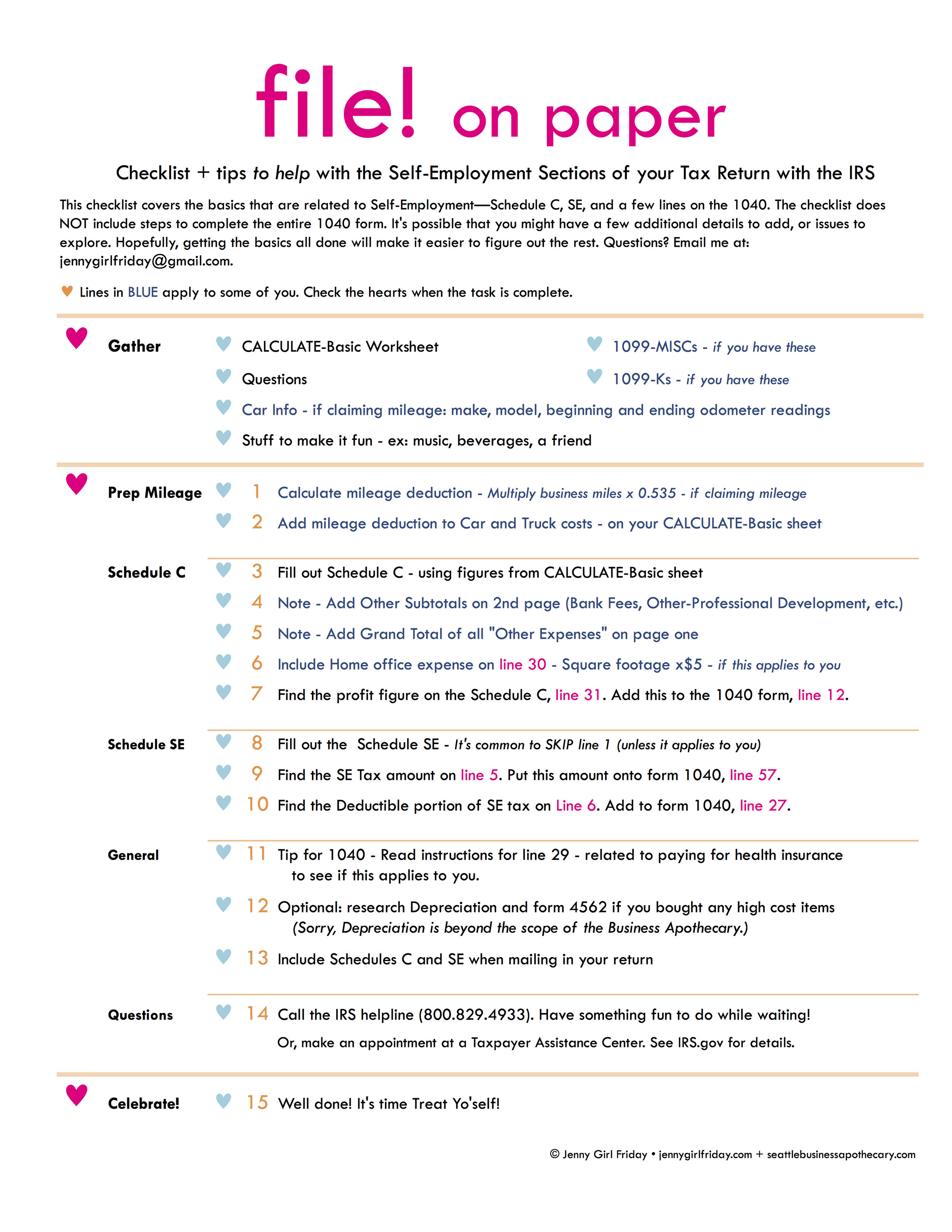

File!

It's finally here, the big moment.

Well, actually, with all your amazing prep work, this part is likely to go rather quickly. :)

There are slightly different actions to take, depending on which way you're filing. The worksheets to the left work for:

• Filing Online - TurboTax, H&R Block, TaxAct, etc.

• Working with a Tax Pro - Accountant, CPA, preparer, volunteer

Each checklist covers the basics that are related to Self-Employment—Schedule C, SE, and a few lines on the 1040. The checklists do NOT include steps to complete the entire 1040 form.

It's possible that you might have a few additional details to add, or issues to explore. Hopefully, getting the basics all done will make it easier to figure out the rest.

(Please note: Technically, these are not guides, they are reminders in a logical order. This blog is for tax education, and doesn't constitute tax advice.)

♥ They might look long, but don't worry too much! They only look long because I wrote out each little step separately.

♥ Remember to get a friend to keep you company, and/or make the job fun with things like favorite music, treats, a show in the background.

♥ Also, when you're finished with this step, be sure to give yourself the reward you identified! It's common to be too tired and relived to care, and to skip the reward. Please don't! You deserve it.

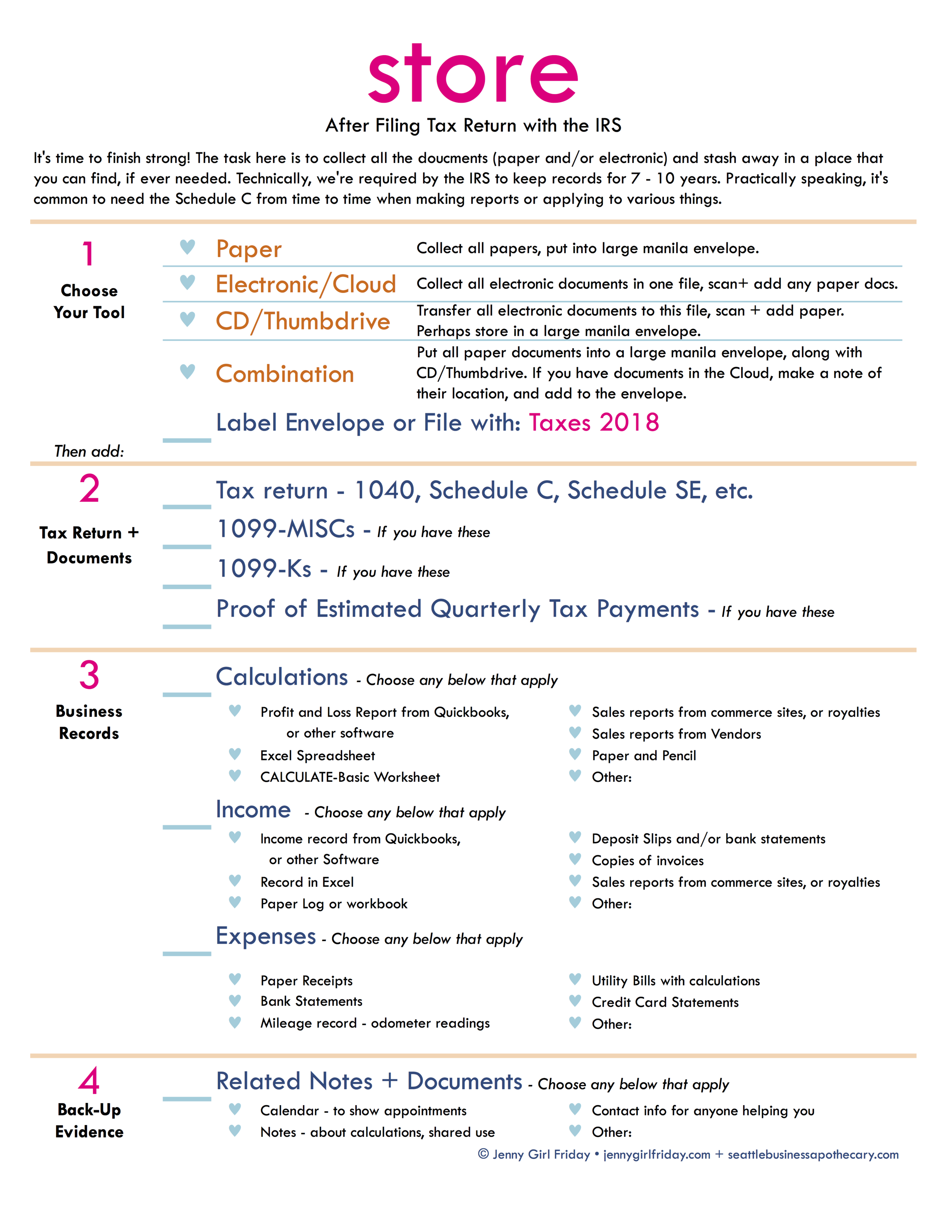

Store

Phew! You're almost done. There's just one last crucial step - to Store everything away. You might be thinking, I'm over this! I'm done! I get it, that's super reasonable....and I promise, this last step is worth it and feels really, really good.

It's your choice: you can shove papers in an envelope or file willy nilly. Or, put things in place...neatly, and methodically. Either way, you'll feel so much satisfaction, relief, and closure.

And, if ever in the future, you do need these documents, you'll be SO glad that you did this.

As usual, I invite you to add a reward for this step, even though it's not on the checklist!

Optional: Reward + Reflect

Well done! You just finished a big job. It's essential that you reward yourself. (This is part of staying in the game of self-employment.)

Hopefully, you already did this. If not, now's your second chance.

Also, right now, fresh off the job, is the BEST time to make a change or two, to make life easier next tax season, and throughout the year. Do your future self a big favor by taking just 5 - 10 minutes to reflect!

Yay! Now we're really done. :)

You got this!

♥

Jenny Girl Friday

P.S. Know any other self-employed Seattleites who could use this information? Please forward freely!

P.S.2 Are you already signed up for Sidekick Services? If not, click here and join the list to receive tax + license reminders, how-tos, inspiration and more delivered to your inbox.

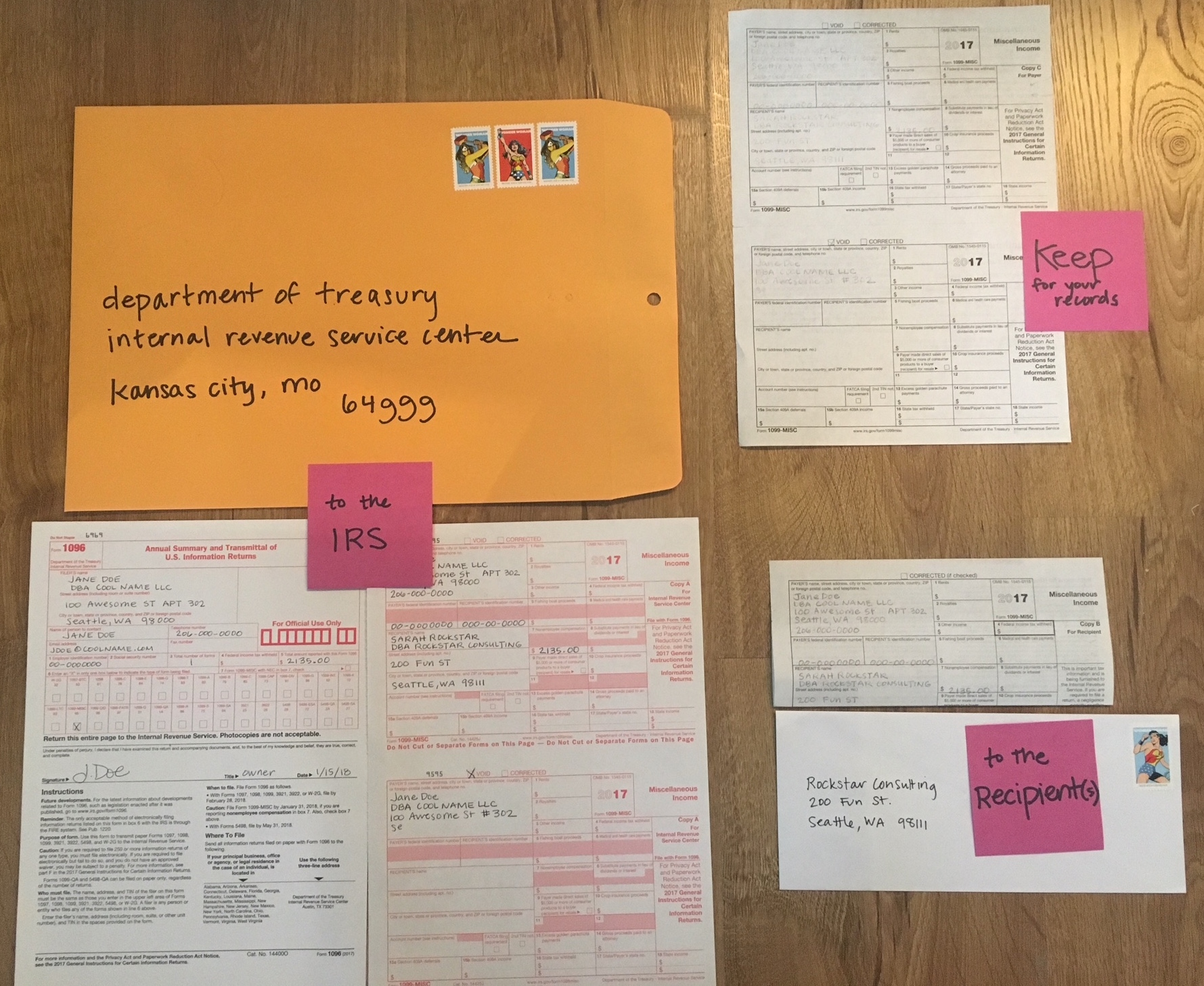

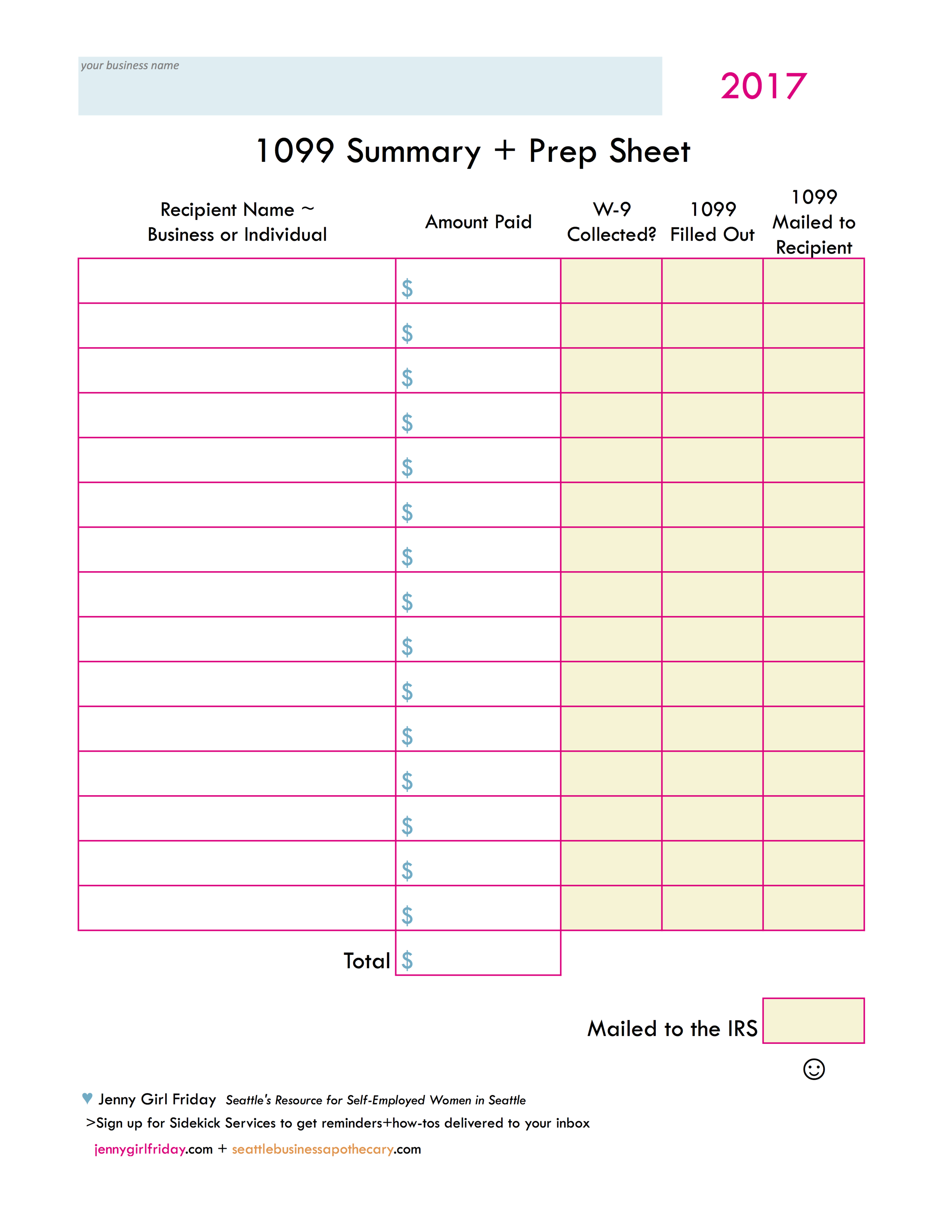

• How to Fill Out + Send 1099-MISC forms

If you paid any Independent Contractors more than $600 in one year, for service work, you need to submit a 1099-MISC form (1099 for short).....both to the Recipient and to the IRS. To read more, click here.

Time Required: 5 - 10 minutes per form (+more time if you have to collect W-9s)

Cost: About $1.50 in postage to IRS + any postage costs to mail to recipients

Due: January 31st

Frustration: 3 out of 10

Tedium Factor: 10 out of 10

Summary

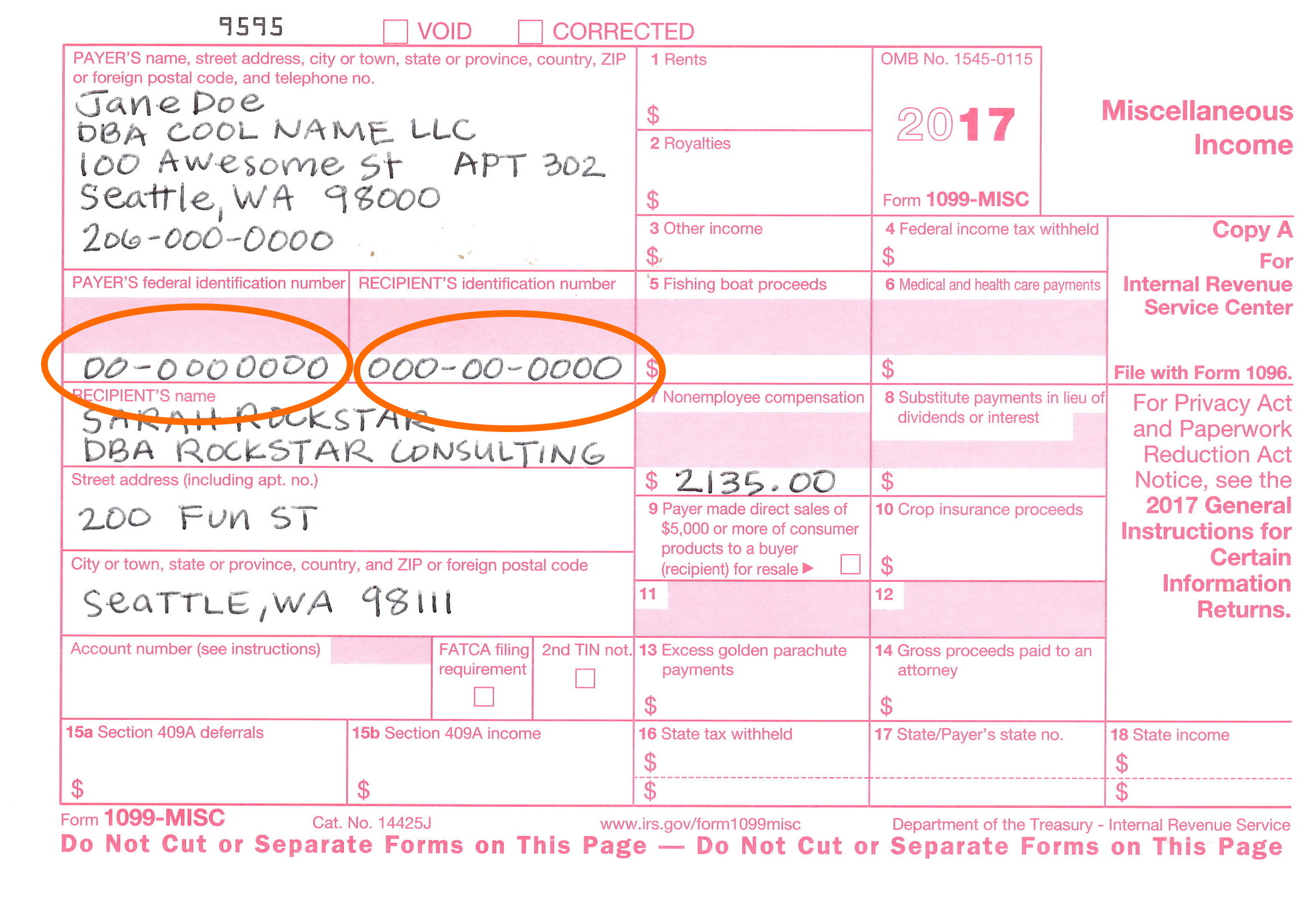

On a half sheet form, you fill in a few boxes. Your name, address, phone number, and tax ID number. Your recipients name, address, tax ID number. The amount you paid them.

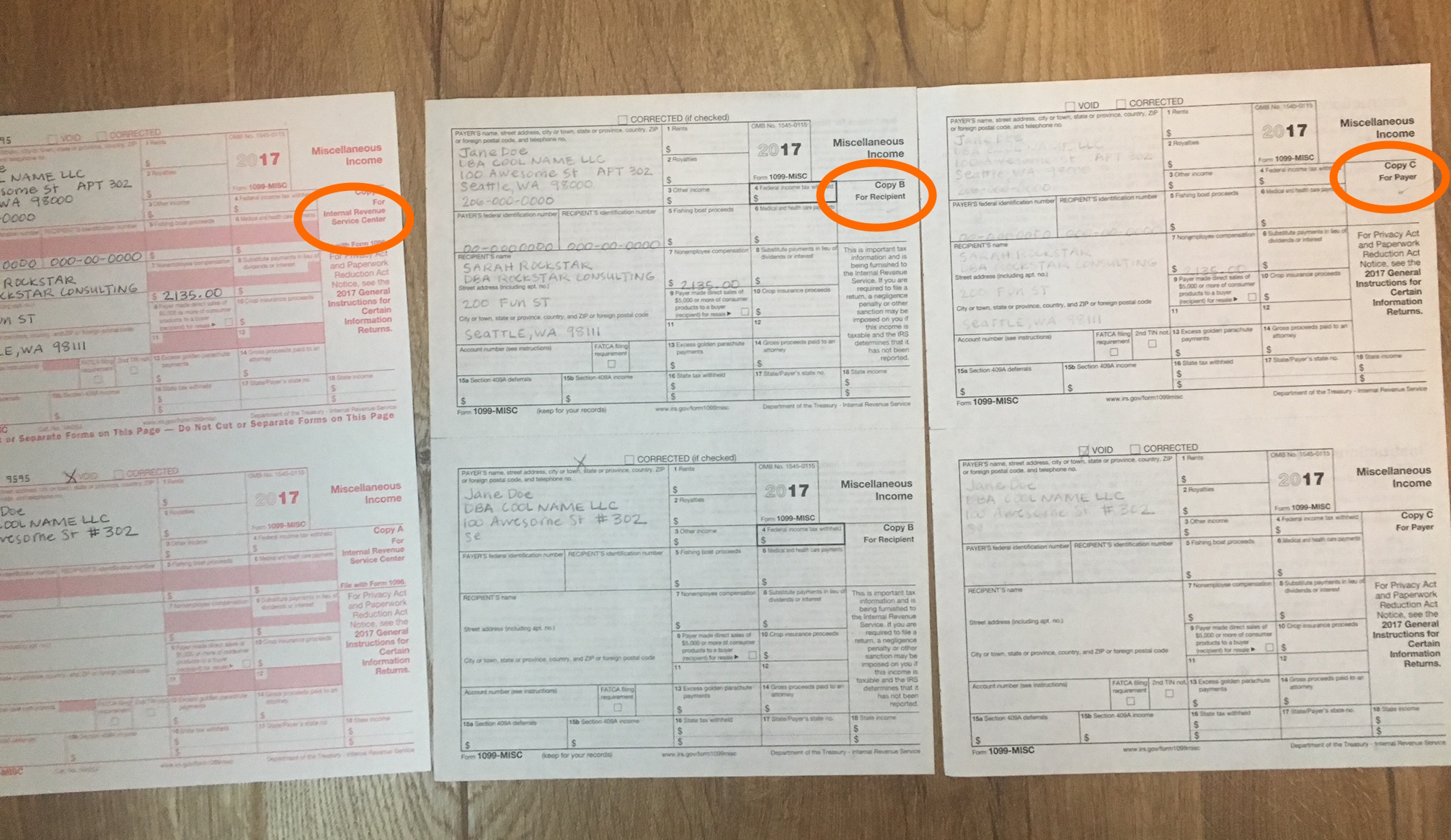

You send a copy to the recipient, to the IRS, and you keep one for yourself.

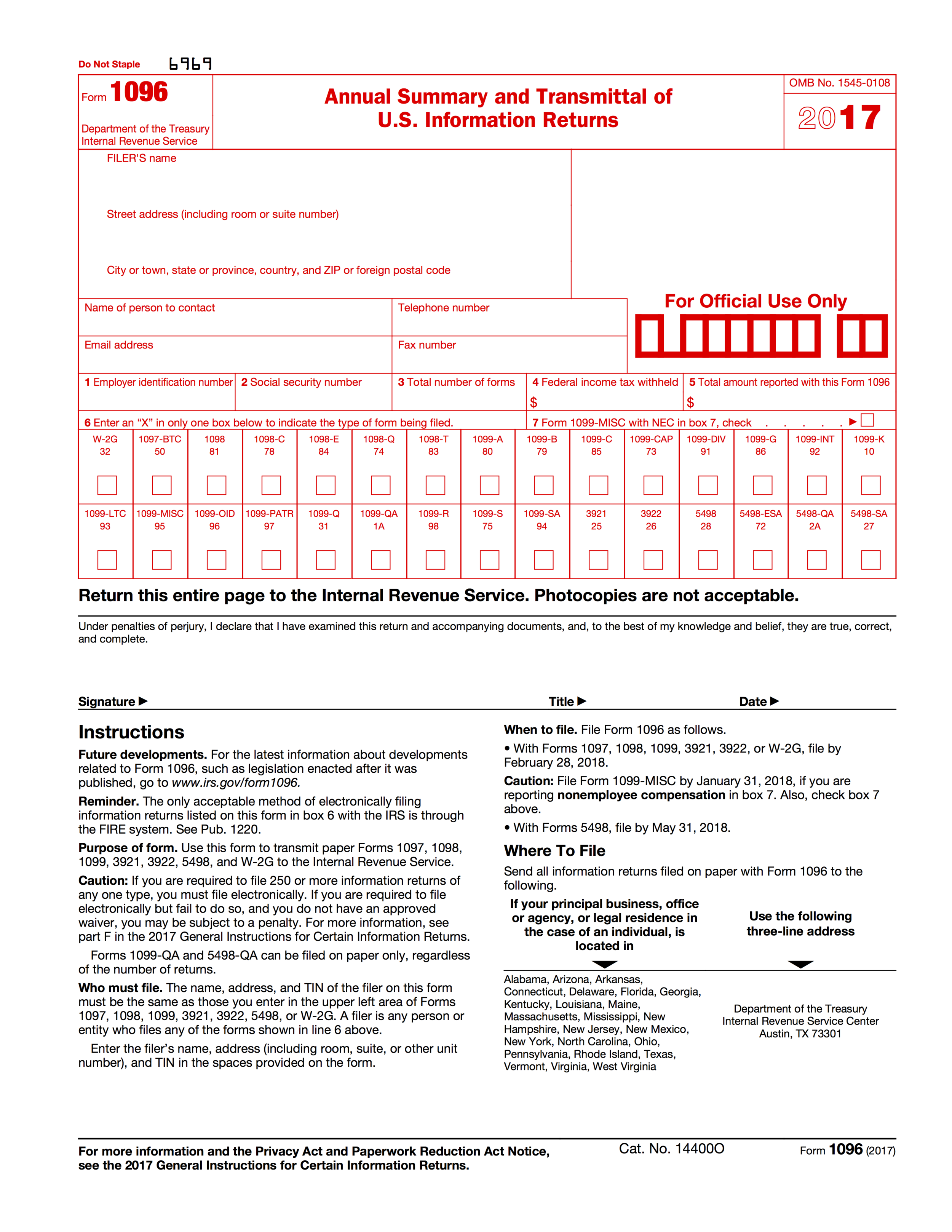

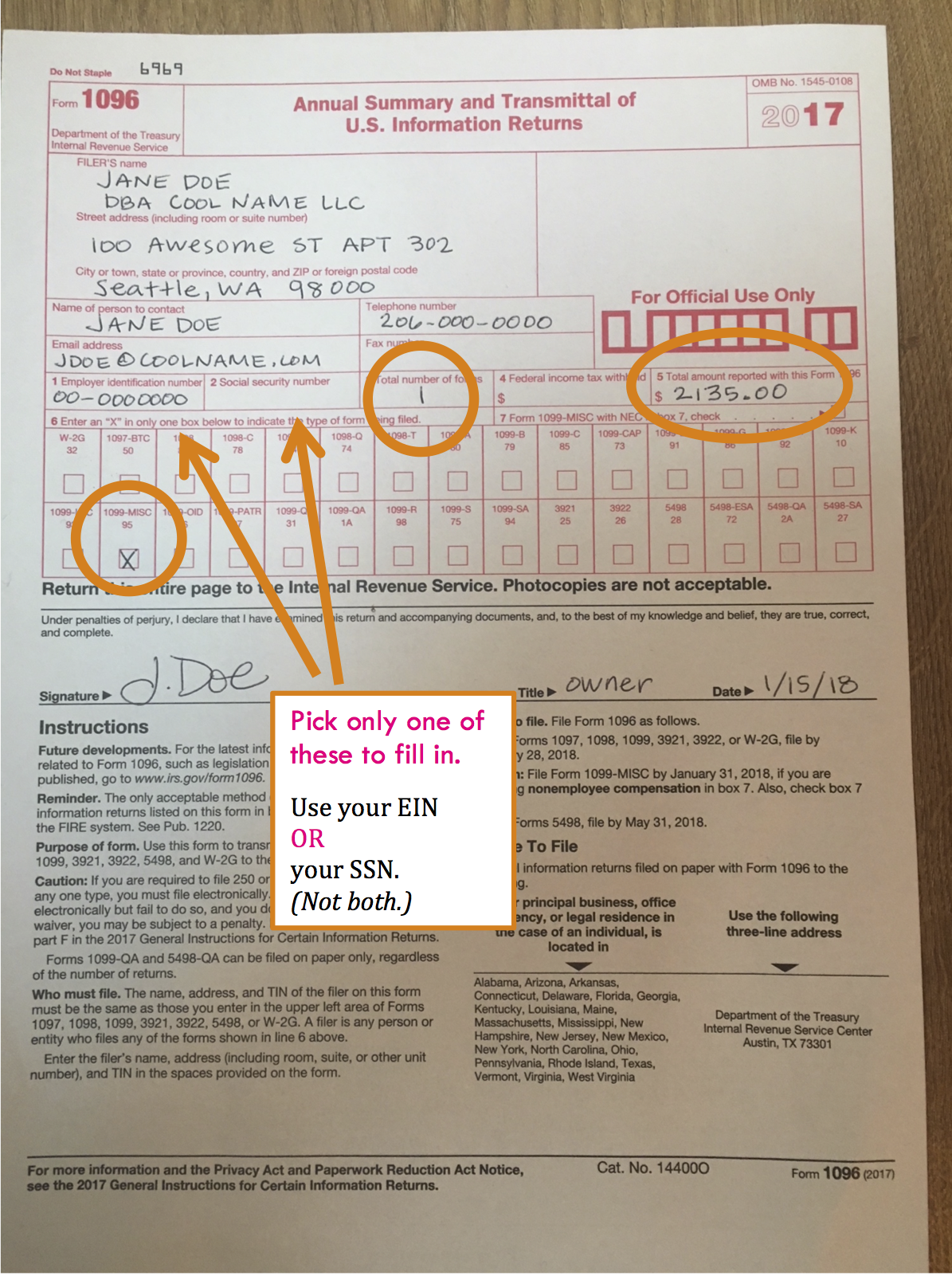

In addition, you must work with two more forms. A 1096 acts as a cover sheet when mailing 1099-MISCs to the IRS. Use W-9s to collect information from recipients. More below....

Photos with notes below. First some information.

You can choose to use paper forms or to file electronically.

Paper forms are carbon and MUST be ordered from the IRS or another source. They canNOT be printed. To ORDER forms, click here. To see a walkthrough of ordering forms, click here.

I haven't worked with e-filing yet. Some tax software systems provide this, such as TurboTax. The IRS also gives this tip, "To locate an IRS business partner who may be able to offer low-cost or even free filing of certain forms, enter "e-file for business partners" in the search box on IRS.gov."

Some accountants will also do this for you.

What you need~

For each recipient:

• Full legal name (of the person)

• Legal name of the business

• Address

• Tax ID Number ~ Either their SSN (social security number) or EIN (employer ID number)

• Amount you paid them ~ called "Nonemployee compensation"

If filing with paper forms:

• 1096 Form

• Large Envelope

• Postage

• Black ball point pen

Use this prep sheet to keep things straight! Click on it to get a PDF. :) This will also help when it's time to file your IRS taxes later this Spring.

Heads Up! There are two more forms to know about! 1096 and W-9

Like the Charlie's Angels, there are actually 3 forms that you'll be working with! They always go together.

W-9 The IRS created a W-9 form to collect the required information from recipients, including their tax ID. It's a one page form with lots of pages attached. As you can imagine, tax ID numbers are sensitive information, and W-9 forms must be stored securely. You can collect W-9s on paper, or electronically. Click here to download from the IRS.gov site.

1096 This is like a cover letter. When you submit certain types of forms to the IRS, they want a 1096 as well. It's basically a summary of everything you're sending in.

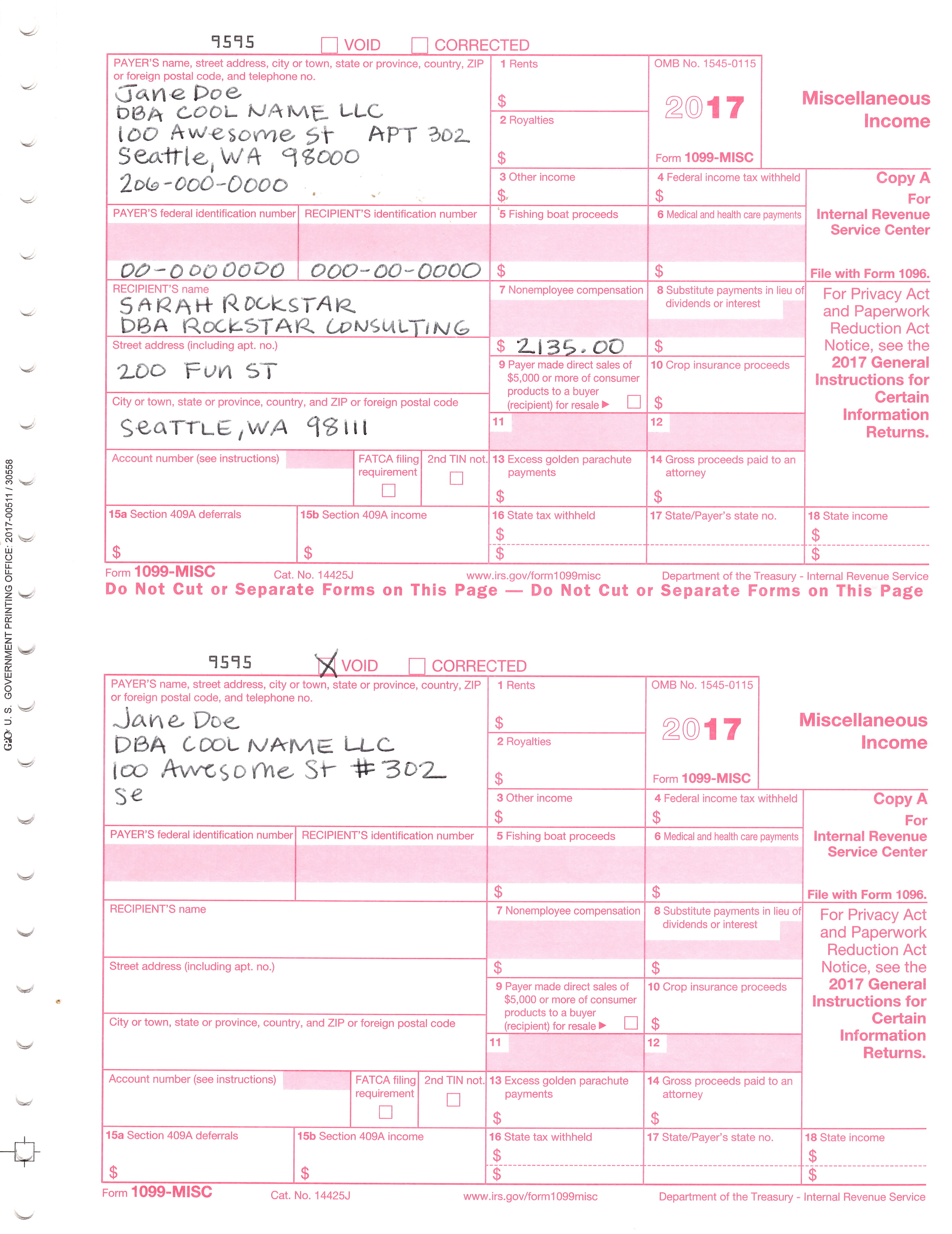

Important Things to Know When Filling Out Paper Forms!

1. Use a BLACK ball point pen, press hard!

2. Use legible, block printing

3. Do NOT add any symbols. NO dollar signs, NO apostrophes, NO number signs.

For Susie's Flowers, you'd write: Susies Flowers

For an apartment #302, write APT 302

4. Do NOT cut the 1099 form top sheet (the one you send to the IRS)

5. Write the dollars + cents for all amounts. For example, 1235.00 is correct. (1235 is NOT correct.)

> > If you happen to make any mistakes, check the VOID box at the top of the form, and start again.

Mailing Information

• Address for Washington Residents:

Department of the Treasury

Internal Revenue Service

Kansas City, MO 64999

• You must use a FLAT envelope, with no folds.

• It must be postmarked on or before January 31, 2018.

1099-MISCs Forms

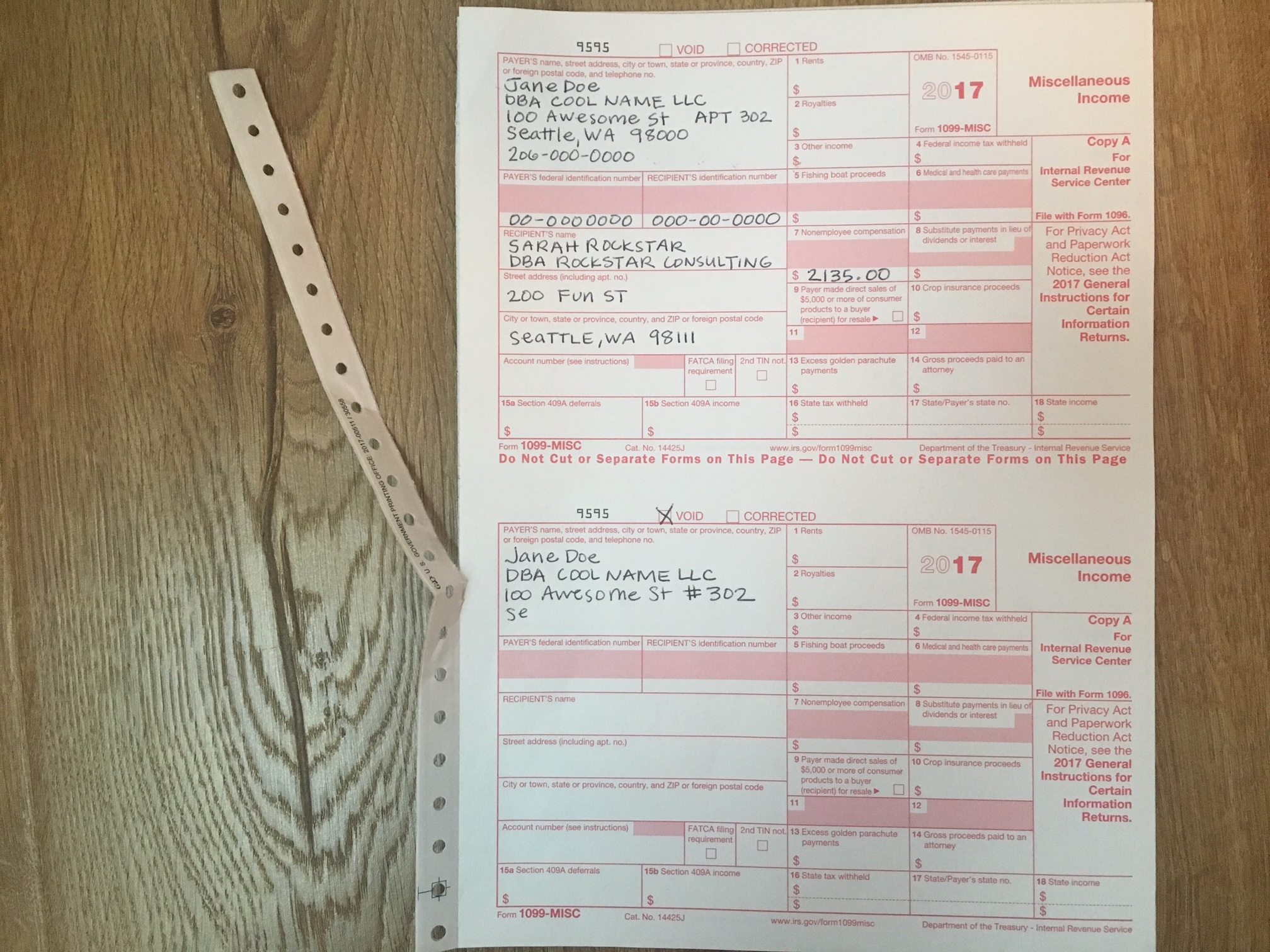

Two separate forms are on each page. This shows the top sheet which is sent to the IRS. Do NOT cut this page. The pages underneath are torn in half before giving to the recipients.

Notice the names. It's important to write both the recipients full legal name AND the business's legal name.

Whenever a business is a Sole Proprietor or Single Member LLC, you may use either the SSN (social security number) OR an EIN (employer identification number).

This example shows the Payer having an EIN.

The recipient using their SSN.

On the bottom form, I made a mistake! I used a # sign. This is not allowed, so I stopped filling it out and marked the VOID box.

After they are filled out, tear the strip off and separate the forms.

Look for THREE to keep, and do the following:

1. For the IRS - send in the mail, in a flat envelope

2. For Recipient - send in the mail, may be folded

3. For Payer - keep in your tax records

Here's a look at the 1096 Form.

Moving from left to right with notes:

1. Be sure to check the box 1099-MISC.

2. Use your EIN ....OR.....your SSN. (Not both)

3. Number of forms. Put the number of filled out 1099-MISCs. There are two per page. If you filled out for 3 recipients, you'd write "3".

4. "Total amount reported with this Form" Add up the total of all dollar amounts on all forms. If I was reporting $2100 for a coach and $1400 for a designer, I would record $3500 in this box.

Finishing up!

To the IRS - one 1096 form plus the top copies of all 1099-MISCs

To the recipients - their 1099-MISC copy

For your records - full page copies

Well done! Bravo! Even though the contents of this are straightforward, it can feel so taxing because it takes a lot of care and attention, yet it is boring. In addition, just the thought of the IRS can be triggering or get the adrenaline going. ♥ If you can, find a time to relax a bit. Perhaps a bath, a trip to Ladywell's, a long walk, even a short walk around the block.

Also, remember to check off of your Cheat Sheet / Sticker Chart!

Cheers!

: ) Jenny Girl Friday

P.S. Sign up for Sidekick Services to get these delivered right to your inbox! (Posting on social media is random....)

• Estimated Quarterly Payments to the IRS - What are they? Do I have to send them? How do I calculate payments?

What are estimated quarterly tax payments to the IRS? Why do I have to send them?

Our federal taxes are a "pay-as-you-go" system. When you're an employee, federal taxes are taken out of each check. If you are self-employed, the IRS requires that you send in tax payments throughout the year. For the smallest business, this is required 4 times. (Larger businesses may have to end in more often.)

I just had to make a report to Washington State and send in Sales Tax. Is this the same thing?

Great question and No. Every level of government wants to tax you...and it's easy and reasonable to get them confused.

Washington State - collects Sales Tax, B&O tax, and Use Tax. Some businesses report annually, some report quarterly.

The Federal Government (IRS) - collects Income and Self-Employment Tax. We file an annual report, but we're asked to send in estimated tax payments throughout the year.

This post is about tax payments to the IRS.

Do I have to send in the estimated quarterly payments (EQ$) to the IRS? What happens if I don't?

Technically speaking, YES—the letter of the law is that if a person is doing business, they must send payments in each quarter. In some cases, if you don't send in your EQ$, you'll have to pay a penalty.

The reality: I've met many self-employed folks who did not send in their EQ$ the first year, and they had no penalties, or the penalties were very low. Having said that, the IRS may choose to more vigorously enforce this rule at any time.

In some cases, if your income is low enough, it is allowable to NOT send in payments. To see if this applies to you, click here to read more (scroll down to page 24), or call the IRS at 800.829.4933

How do I calculate payments?

If you filed business taxes last year, usually your tax preparation software or accountant will provide you with a recommended amount for you to pay. It'll be based off of your earnings for the previous year.

If you are a brand new business, you'll need to calculate an amount to pay. There's a formula and worksheet below.

An important note: it's common for new businesses to grow quite a bit from year to year! Because of this, the estimate made for the quarterly payment can be too low. ProTip: Always transfer 30% of all business deposits into a savings account for taxes you may owe. (40% if you collect sales tax.) If what you're saving is more than what your EQ$ require, you can either....send in extra money for each EQ$. OR, hold the money in your account until you file your federal taxes.

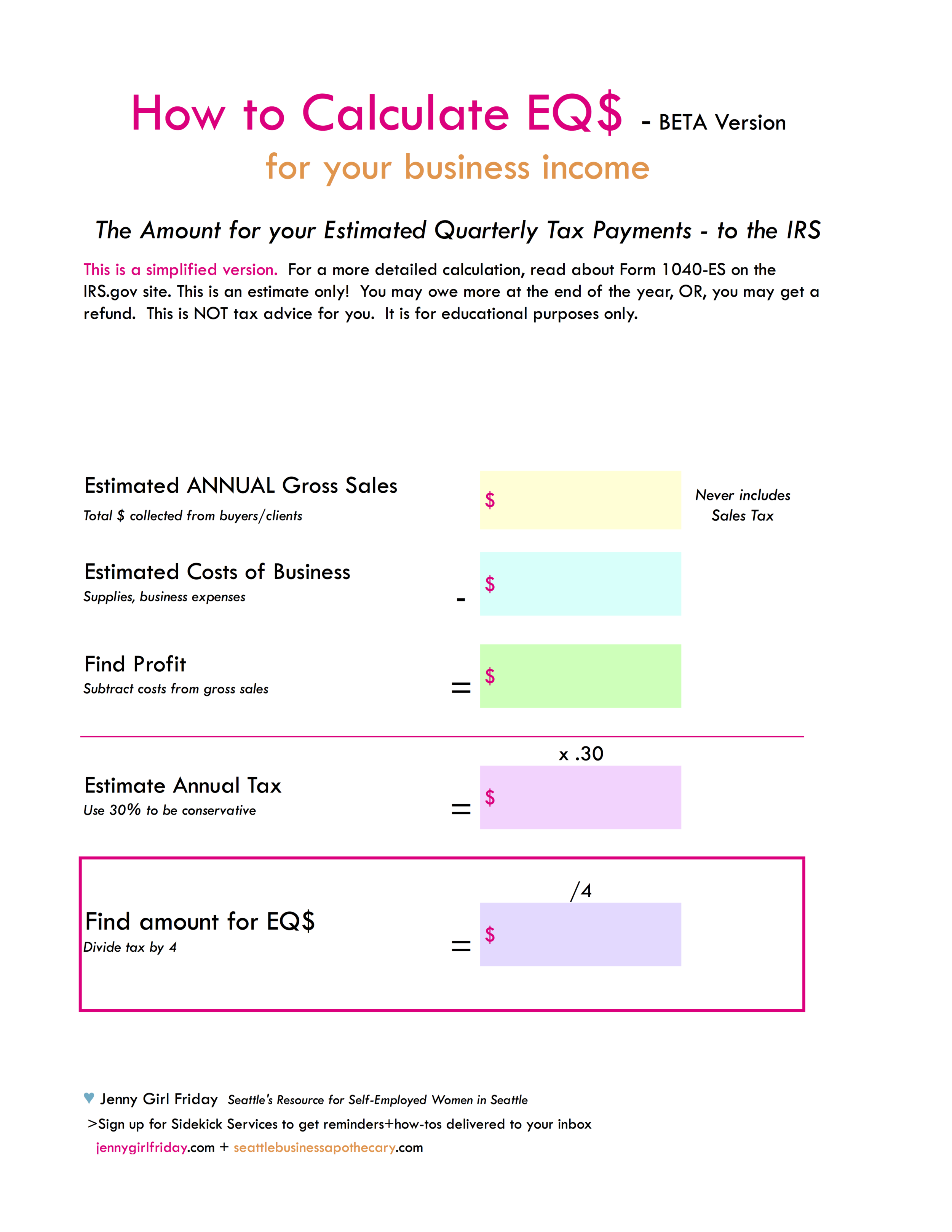

Simplified Formula for Calculating EQ$ + Worksheet

Click on the worksheet for a PDF version for download.

1. Estimate your Gross Sales - all the money you'll collect from buyers/clients. (Never include Sales tax in the amount.)

Example: $12,000

2. Estimate your costs of doing business.

Example: $3000

3. Subtract the costs of business from your Gross Sales.

Example: $12,000 - $3000

4. The answer is your Profit or Income.

Example: $9000

5. Estimate your tax owed. Multiply your profit by .30.

Example: $9000 x .3 = $2700

6. Divide tax owed by 4. This is the amount to use for your EQ$

Example: $2700 / 4 =$675

When are they due? How do I send them in?

They are due on the following dates each year. If a date falls on a weekend or holiday, the deadline is extended to the next business day.

January 15

April 15

June 15

September 15

You may submit payments electronically or through snail mail. Click here to read more on How To Submit EQ$.

ProTips + Doing Yourself a Favor

ProTip: Each year after you file taxes, print off all your Payment Vouchers. Find four envelopes and put stamps on them. Put these vouchers + envelopes in a visible place, for example, pin to a bulletin board, set on your bookshelf, or clip to your fridge.

ProTip: Add these dates to your calendar right now: Jan 1, Apr 1, Jun 1, Sep 1. Prep and send your payments on these days.

Do yourself a favor and send these payments in! If you skip these payments, it can be very tempting to spend the money from your account......leaving you high and dry next April! In addition to making your future brighter, it can feel very satisfying to mail the checks, and gives peace of mind right now.

Happy Working,

Jenny Girl Friday

Read more on the official FORM 1040-ES info sheet on the IRS.gov site.

• Make Your Life Easier! - Simple Tips for Keeping Track of License and Tax Stuff

Being self-employed includes answering to government agencies at every level: city, county, state, and federal. Sometimes it can feel a little crazy to manage all of the paperwork, dates, passwords, etc.

Here are a few tips for making your life a little easier. The theme here is to make it very convenient to collect information and documents ... so that when you need them, you know where to look. I don't know about you, but I'd rather rummage around when I need something, than spend time filing everything meticulously, just in case. (Of course, if filing calms you, then go for it!)

1. Choose a paper notebook

... that you love the look of ... and record all of your business numbers, logins, passwords in it. I also like to list any phone numbers I've needed to call, and any notes from phone conversations.

I like the paper notebook because it doesn't get lost like bits of paper, and, it can't be lost if my computer gets fried.

Numbers to be sure to add:

• UBI - Washington State Business Number

• EIN - Employer Identification Number (Not required, but recommended.)

• NAICS Code - North American Industry Classification System (Assigned to you by the state.)

• Seattle Customer Number

2. Find a box or basket

To collect all of your legal + tax paperwork. Any time you get any thing from the government: letters, licenses, updates, etc., throw them in there. Put in a easy to reach place that feels secure. Keep your notebook in there too.

3. Create an email folder to collect all messages

4. Post the Important Dates where you can see them

These refer to all of your business requirements (license renewals, tax reports, and tax payments). Put the list somewhere on the wall or refrigerator, so you can reference it from time to time.

Download Important Dates if reporting Annually with WA state.

Download Important Dates if reporting Quarterly with WA state.

Please consider leaving a Tip for any downloads. :)

Advanced ProTips

5. Record all of the important dates on your calendar.

+

6. Record time to work on these in your calendar.

Perhaps a week or two before the deadline.

7. Prep Your Estimated Quarterlies

After you file your federal taxes with the IRS, prepare four envelopes to mail in your estimated quarterly payments. Attach the payment stubs (hopefully provided by TurboTax or your accountant) and pin on a bulletin board.

Wherever you can, make this stuff fun + easy! It'll make these chores more pleasant and bring you peace of mind.

Cheers!

: ) Jenny Girl Friday