Estimated Quarterly Payments (EQ$) to the IRS / Just the Basics

The WHY behind EQ$

The IRS is a Pay-as-You-Go tax system. We're required to send in 4 estimated payments throughout the year ... then, it's True Up time when we actually file our taxes. If we overpaid, we'll get a refund. If we underpaid, we'll owe more.

Good news!

Once you know what you’re doing … it only takes about 5 minutes!

It can feel really satisfying, like you’re a BOSS of your business.

It makes Filing Taxes in April a lot nicer.

A Few Quick Facts about Sending in EQ$

When we send in an EQ$, it’s simply sending in money. It’s not filing taxes. There are no numbers to report. We just send money and make sure it’s attached to our name and tax ID.

If sending by check, there’s just a small voucher. If online, just a few fields to fill out to verify your identity.

You can send payments online, or via snail mail. Click here to read more.

IMPORTANT - if sending payments online, see note below.

It's fine to use your SSN with these payments. (Even if you have an EIN.)

The Due Dates are not even! (Weird, right?)

DUE Dates

April 15

June 15

September 15

January 15

Note - When these dates fall on the weekend or holiday, they will shift to the following business day.

To Send in or Not Send In….

If total tax for the year (related to your biz profit) is $2000 or less, then the IRS says that we do NOT need to send in payments.

If total tax for the year (related to your biz profit) is $2000 or more ... we're required to send in payments.

If we send in partial payments, or none at all, we might have to pay a penalty. Usually these are a few hundred dollars or less.

How Much to Send

The IRS offers a complex way to calculate your EQ$. I offer simpler alternatives. Three different methods to choose from. Click here for the NEW worksheet with instructions.

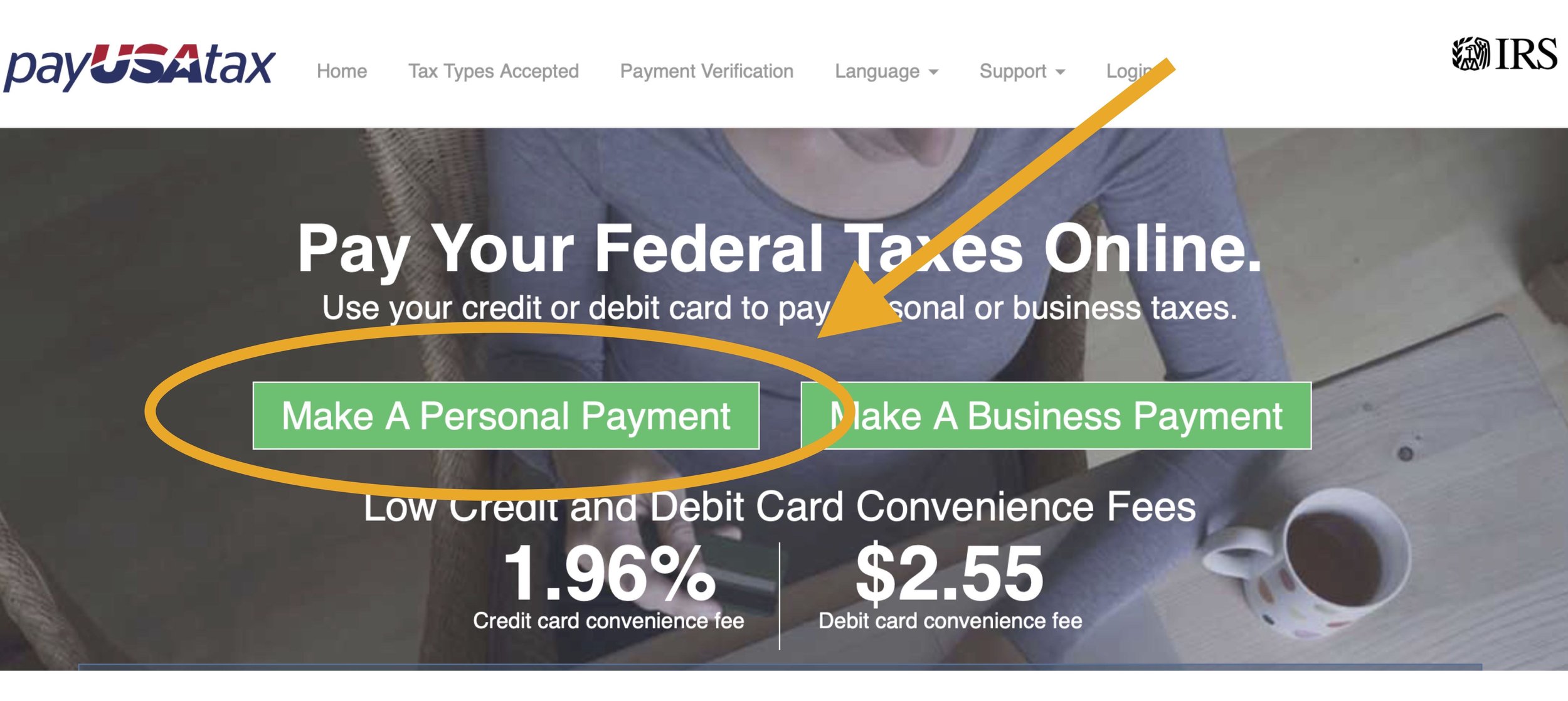

IMPORTANT NOTE / If Paying Online

IF you pay online, and use a 3rd party, be sure to choose "Personal Taxes"

Why? Because your business does NOT pay taxes, you pay personal taxes on the income you earned through your business....

Well those are all the basics on EQ$. It might feel intimidating at first … but it really gets easier over time!

• Estimated Quarterly Payments to the IRS - What are they? Do I have to send them? How do I calculate payments?

What are estimated quarterly tax payments to the IRS? Why do I have to send them?

Our federal taxes are a "pay-as-you-go" system. When you're an employee, federal taxes are taken out of each check. If you are self-employed, the IRS requires that you send in tax payments throughout the year. For the smallest business, this is required 4 times. (Larger businesses may have to end in more often.)

I just had to make a report to Washington State and send in Sales Tax. Is this the same thing?

Great question and No. Every level of government wants to tax you...and it's easy and reasonable to get them confused.

Washington State - collects Sales Tax, B&O tax, and Use Tax. Some businesses report annually, some report quarterly.

The Federal Government (IRS) - collects Income and Self-Employment Tax. We file an annual report, but we're asked to send in estimated tax payments throughout the year.

This post is about tax payments to the IRS.

Do I have to send in the estimated quarterly payments (EQ$) to the IRS? What happens if I don't?

Technically speaking, YES—the letter of the law is that if a person is doing business, they must send payments in each quarter. In some cases, if you don't send in your EQ$, you'll have to pay a penalty.

The reality: I've met many self-employed folks who did not send in their EQ$ the first year, and they had no penalties, or the penalties were very low. Having said that, the IRS may choose to more vigorously enforce this rule at any time.

In some cases, if your income is low enough, it is allowable to NOT send in payments. To see if this applies to you, click here to read more (scroll down to page 24), or call the IRS at 800.829.4933

How do I calculate payments?

If you filed business taxes last year, usually your tax preparation software or accountant will provide you with a recommended amount for you to pay. It'll be based off of your earnings for the previous year.

If you are a brand new business, you'll need to calculate an amount to pay. There's a formula and worksheet below.

An important note: it's common for new businesses to grow quite a bit from year to year! Because of this, the estimate made for the quarterly payment can be too low. ProTip: Always transfer 30% of all business deposits into a savings account for taxes you may owe. (40% if you collect sales tax.) If what you're saving is more than what your EQ$ require, you can either....send in extra money for each EQ$. OR, hold the money in your account until you file your federal taxes.

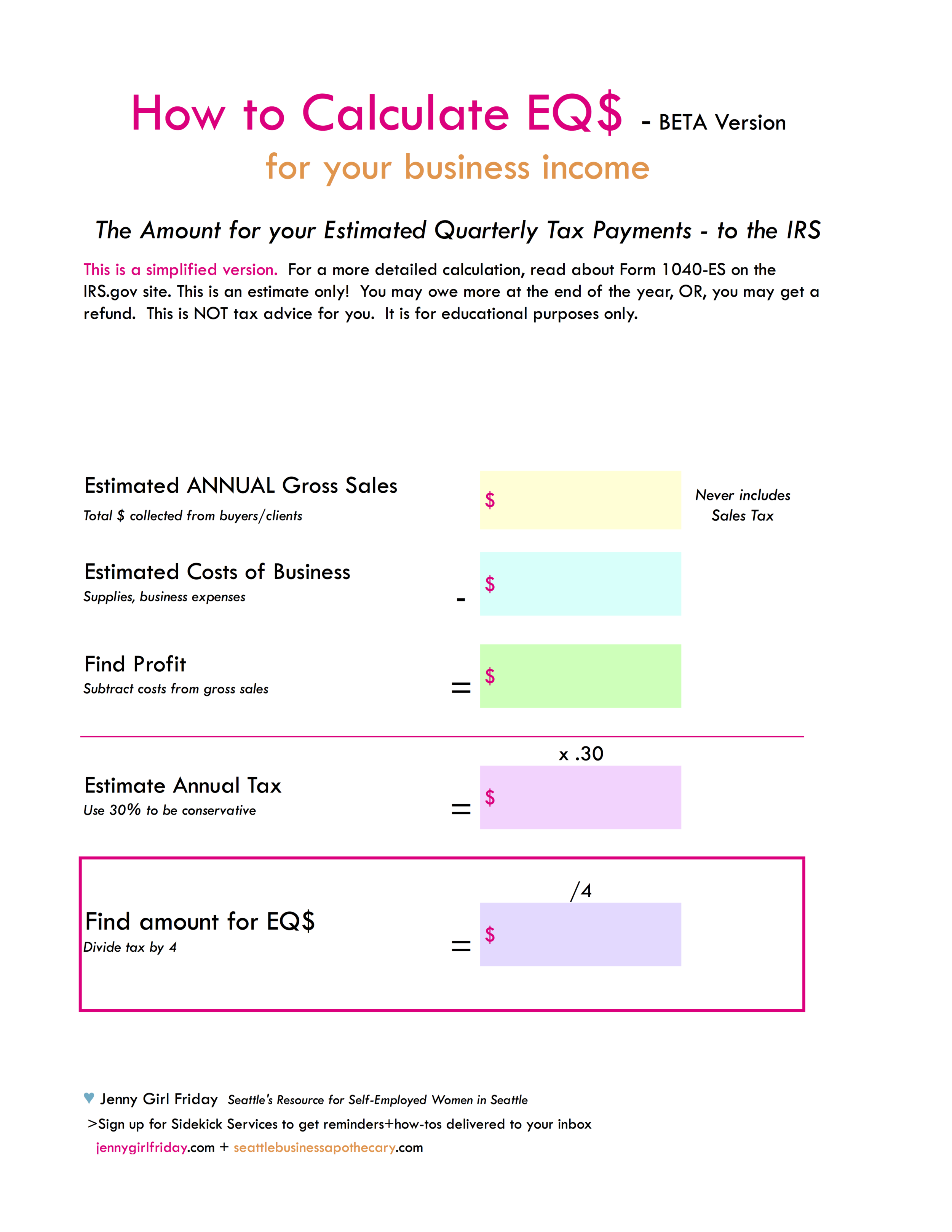

Simplified Formula for Calculating EQ$ + Worksheet

Click on the worksheet for a PDF version for download.

1. Estimate your Gross Sales - all the money you'll collect from buyers/clients. (Never include Sales tax in the amount.)

Example: $12,000

2. Estimate your costs of doing business.

Example: $3000

3. Subtract the costs of business from your Gross Sales.

Example: $12,000 - $3000

4. The answer is your Profit or Income.

Example: $9000

5. Estimate your tax owed. Multiply your profit by .30.

Example: $9000 x .3 = $2700

6. Divide tax owed by 4. This is the amount to use for your EQ$

Example: $2700 / 4 =$675

When are they due? How do I send them in?

They are due on the following dates each year. If a date falls on a weekend or holiday, the deadline is extended to the next business day.

January 15

April 15

June 15

September 15

You may submit payments electronically or through snail mail. Click here to read more on How To Submit EQ$.

ProTips + Doing Yourself a Favor

ProTip: Each year after you file taxes, print off all your Payment Vouchers. Find four envelopes and put stamps on them. Put these vouchers + envelopes in a visible place, for example, pin to a bulletin board, set on your bookshelf, or clip to your fridge.

ProTip: Add these dates to your calendar right now: Jan 1, Apr 1, Jun 1, Sep 1. Prep and send your payments on these days.

Do yourself a favor and send these payments in! If you skip these payments, it can be very tempting to spend the money from your account......leaving you high and dry next April! In addition to making your future brighter, it can feel very satisfying to mail the checks, and gives peace of mind right now.

Happy Working,

Jenny Girl Friday

Read more on the official FORM 1040-ES info sheet on the IRS.gov site.

• How to Send in Your Estimated Quarterly Tax Payment (EQ$) to the IRS

Most of us are required to send in part of our federal taxes each quarter to the IRS. These are referred to as estimated quarterly tax payments (EQ$).

There are two main things you need to know to send in your EQ$.

• How much money to send.

• How to submit payments.

This post covers how to submit the payments. Click here to read more about EQ$ and how to calculate the amount.

The Due Dates for EQ$

To download original calendar, click here. Thank you to scrappystickyinkymess.wordpress.com.

January 15

April 15

June 15

September 15

Note: These are NOT due every three months. The time in between varies.

Also, if the due date falls on a weekend or holiday, it is shifted to the nearest business day.

Payment Options

> You may pay electronically. Click here to go to the Payment Page on the IRS.gov site. In most cases, there is an additional fee. There are several options: credit card, direct pay from your bank account, wiring, and more.

> Or, send checks through snail mail.

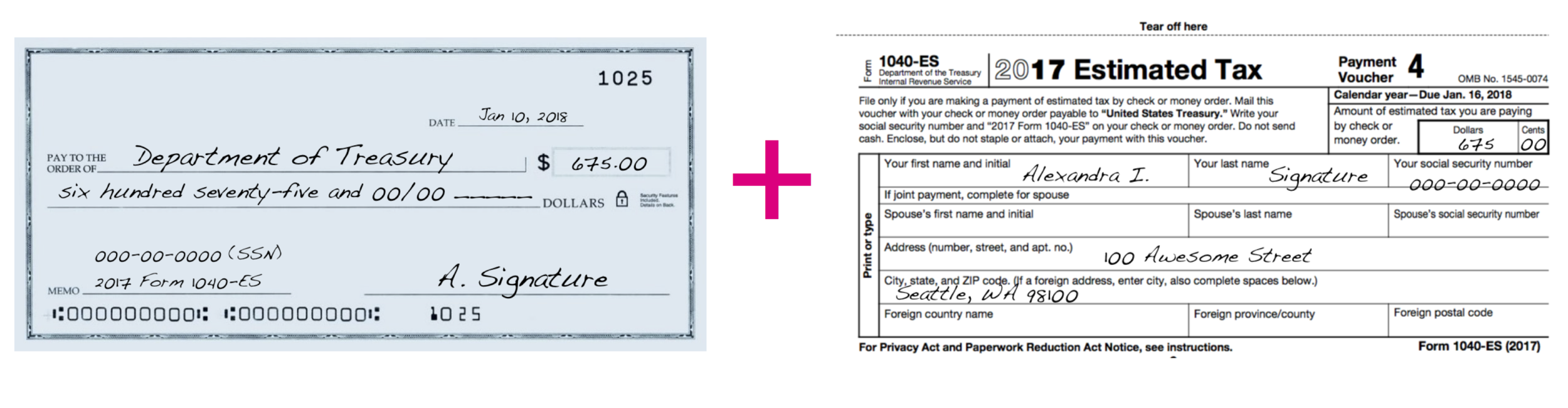

What You Need for Mailing in Checks

1. A Payment Voucher, also called, Form 1040-ES

2. Envelope

3. Check

4. Your SSN (social security number)

How to Get a Payment Voucher

If this is your first year doing business:

• Download from the IRS.gov site.

Click here to go to the Form 1040-ES page. Scroll to the bottom to get the vouchers.

If you've been in business for 1+ years:

• Tax Software programs will often generate these for you after you file your taxes.

• Accountants will often provide them

• IRS - sometimes they will send these to you in the mail

• IRS.gov - download from the website, scroll to the bottom to get the vouchers.

Steps to Take if You are Submitting Electronically

1. Calculate the amount to send in

2. Go to the IRS.gov payment site

3. Follow instructions to make payment

4. Print any receipts and file with all of your business documents

IMPORTANT - Be sure to select “PERSONAL Taxes” when asked. DO NOT select “business taxes.” This will send you to a confusing portal. “Business Taxes” are for places like Mighty-O, Starbucks, etc. You are paying “PERSONAL” taxes that you earned through your sole prop / LLC business.

Steps to Take if You are Submitting through Snail Mail

1. Calculate the amount to send in

2. Fill out the Form 1040-ES (payment voucher)

3. Write the check

4. Write on the Memo line of your check:

- your SSN

- "Form 1040-ES" and the year you're submitting tax for (See note below.)

5. Put in an envelope. Address to:

Internal Revenue Service

P.O. Box 510000

San Francisco, CA 94151-5100

6. Be sure it is postmarked by the Due Date.

7. Make a copy of your check OR make a note of the check# and amount paid. Put in your file of business documents.

What Year to Write on Your Check

Look at your payment voucher to know what year to write on your check. Generally, the estimated quarterly payment we're sending in is for the previous quarter. So....

Parting Thought

Do whatever you can! Sending any amount...at any time, is way better than skipping this step.

You can help yourself by marking these dates on your calendar: Jan 1, Apr 1, Jun 1, Sep 1....and taking 15 minutes to send these payments. If you're not sure how much, get a friend to help or just take a guess. You'll thank yourself next April, and can have more peace of mind in the meantime.

Happy Working,

Jenny Girl Friday