Covid-19 Relief Info + FAQs

This is an evolving page.

If you have new information, please email me at jennygirlfriday@gmail.com.

Paycheck Protection Program (PPP)

The Basics

• This was refunded (a 2nd time)… Friday, April 24, 2020.

• Apply through your bank.

• It's a loan funded by the SBA (Small Business Administration) ... if you use it for payroll, then in most cases, you will not have to pay it back.

• If your bank is no longer taking applications, consider trying a different bank.

• Learn more on your banks website, here are a few links:

Umpqua Bank

BECU

Wells Fargo

Verity Credit Union

Chase

Can I receive both a PPP loan and Unemployment?At this time, you can get one or the other. This might change though.

What is involved with applying?

This depends on your bank. I've heard reports that it's fairly straightforward.

Unemployment

• Self-employed people are allowed to apply! (This is a first.)

• WA state admits that the first round of application forms do not match our current situation, so just do your best.

• Learn more here: ESDWAGOV Unemployment for Self-Employed People and Independent Contractors.

• There is a lot of help on the WA page. They have checklists, guides and videos.

• Tip: If applying online, be sure to SAVE a lot. Sometimes people get timed out and kicked off the system...

What is PUA?

Pandemic Unemployment Assistance. Created by the CARES act. Read more on the WA state site. This broadens the support the government can offer … for example, unemployment pay for self-employed folks.

How do I calculate my quarterly earnings?

For the process for figuring out your earnings, it’s basically this:

Your Gross Sales (Total payments by customers)

minus

Business Expenses

= Profit …………Your profit = your income

Options for figuring out your profit:

To do the quickest job of this…always use one business account for all your deposits and expenses.When it’s time to figure out your quarterly earnings, do the following:

A - Log into online banking

B - Set a Search for Deposits within the date range.

C - Add all of these up to get your Gross Sales

D - Now, Search for all “debits” within the date range.

E - Add up all these for your total business expenses.

F - Calculate your Earnings.

If you don’t have one account for all deposits and business expenses, it’s no problem. Just look in all the places you got paid. Add them all up. Look for any receipts or bank/credit card statements where you spent money on the business. Add them up. Then take Gross Sales - Total Business Expenses = Profit.

Covid-19 Relief Checks

• Relief Checks are set to be mailed out within the next few weeks. Direct Deposits are starting now.

• If you filed in 2018, or 2019, there is no form to fill out, there is nothing special to do. (If you're a non-filer of taxes, click here.)

• To check on your payment, go to the IRS.gov site and choose the button, "Get My Payment". You can also update your Direct Deposit info here.

• The amount is $1200 per individual, $500 per child ... if your adjusted gross income was under $75,000 per individual, or $150,000 per married couple. (The check will be less if you earned over those thresholds.)

• The IRS will either use your 2019 or 2018 taxes to determine this amount. Whichever is the most recent return.

• To read the latest, go to the IRS Coronavirus page.

Changed Deadlines

Changed Deadlines

• Apr 15 moved to June 15 Many of you Make Annual Report to WA DOR

Click for Service Providers, Retail/Combo

• Apr 15 moved to Jul 15 Everybody File Annual Taxes with the IRS

Click for different help: How to Prep, How to Calculate the Numbers, Options for Filing

• Apr 15 moved to Jul 15 Many of you Send Estimated Quarterly Tax Payment to IRS

Click here to read about EQ$ • Click here to read about how to submit EQ$

• Apr 30 moved to June 30 Some of you Make Quarterly Report to WA DOR

Click for Service Providers, Retail/Combo

• Estimated Quarterly Payments to the IRS - What are they? Do I have to send them? How do I calculate payments?

What are estimated quarterly tax payments to the IRS? Why do I have to send them?

Our federal taxes are a "pay-as-you-go" system. When you're an employee, federal taxes are taken out of each check. If you are self-employed, the IRS requires that you send in tax payments throughout the year. For the smallest business, this is required 4 times. (Larger businesses may have to end in more often.)

I just had to make a report to Washington State and send in Sales Tax. Is this the same thing?

Great question and No. Every level of government wants to tax you...and it's easy and reasonable to get them confused.

Washington State - collects Sales Tax, B&O tax, and Use Tax. Some businesses report annually, some report quarterly.

The Federal Government (IRS) - collects Income and Self-Employment Tax. We file an annual report, but we're asked to send in estimated tax payments throughout the year.

This post is about tax payments to the IRS.

Do I have to send in the estimated quarterly payments (EQ$) to the IRS? What happens if I don't?

Technically speaking, YES—the letter of the law is that if a person is doing business, they must send payments in each quarter. In some cases, if you don't send in your EQ$, you'll have to pay a penalty.

The reality: I've met many self-employed folks who did not send in their EQ$ the first year, and they had no penalties, or the penalties were very low. Having said that, the IRS may choose to more vigorously enforce this rule at any time.

In some cases, if your income is low enough, it is allowable to NOT send in payments. To see if this applies to you, click here to read more (scroll down to page 24), or call the IRS at 800.829.4933

How do I calculate payments?

If you filed business taxes last year, usually your tax preparation software or accountant will provide you with a recommended amount for you to pay. It'll be based off of your earnings for the previous year.

If you are a brand new business, you'll need to calculate an amount to pay. There's a formula and worksheet below.

An important note: it's common for new businesses to grow quite a bit from year to year! Because of this, the estimate made for the quarterly payment can be too low. ProTip: Always transfer 30% of all business deposits into a savings account for taxes you may owe. (40% if you collect sales tax.) If what you're saving is more than what your EQ$ require, you can either....send in extra money for each EQ$. OR, hold the money in your account until you file your federal taxes.

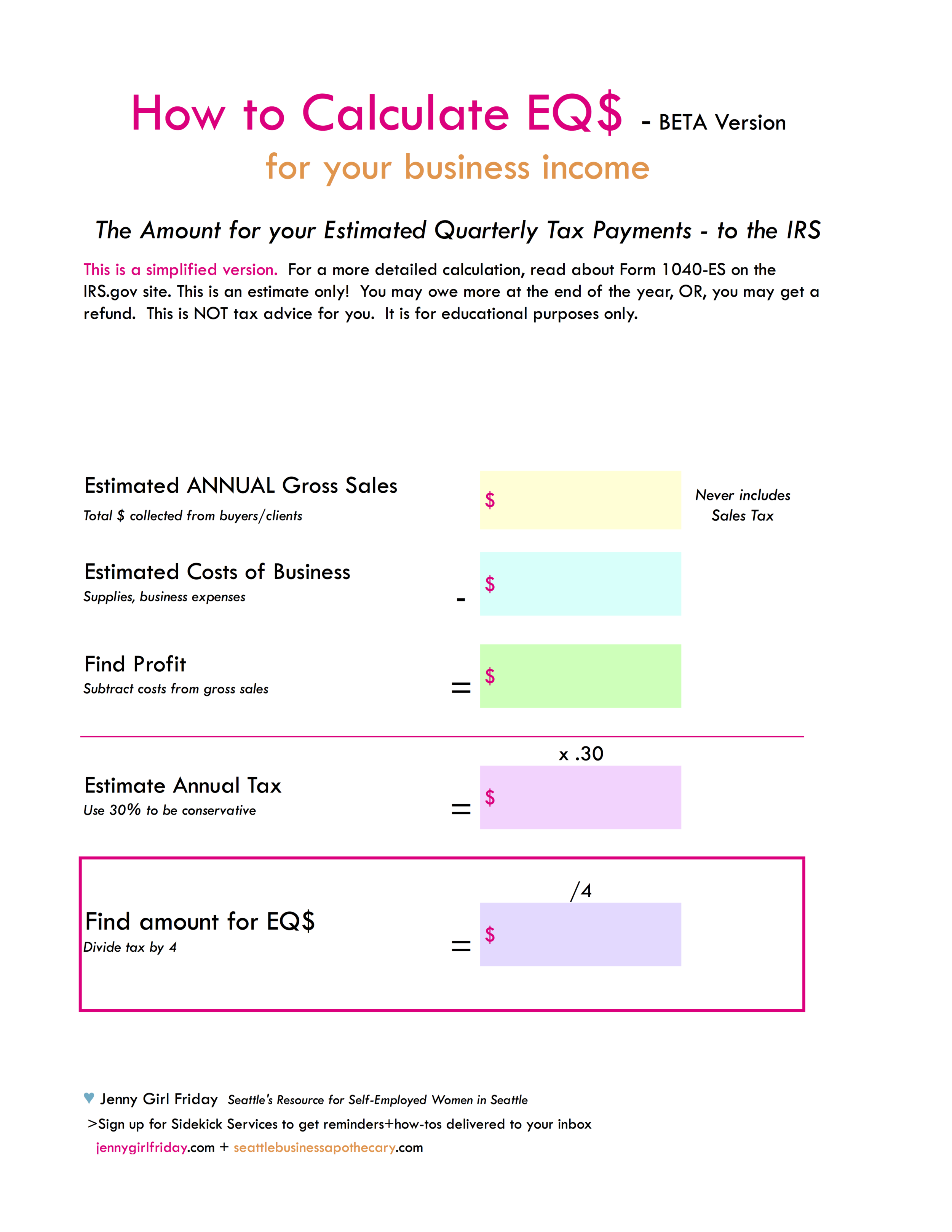

Simplified Formula for Calculating EQ$ + Worksheet

Click on the worksheet for a PDF version for download.

1. Estimate your Gross Sales - all the money you'll collect from buyers/clients. (Never include Sales tax in the amount.)

Example: $12,000

2. Estimate your costs of doing business.

Example: $3000

3. Subtract the costs of business from your Gross Sales.

Example: $12,000 - $3000

4. The answer is your Profit or Income.

Example: $9000

5. Estimate your tax owed. Multiply your profit by .30.

Example: $9000 x .3 = $2700

6. Divide tax owed by 4. This is the amount to use for your EQ$

Example: $2700 / 4 =$675

When are they due? How do I send them in?

They are due on the following dates each year. If a date falls on a weekend or holiday, the deadline is extended to the next business day.

January 15

April 15

June 15

September 15

You may submit payments electronically or through snail mail. Click here to read more on How To Submit EQ$.

ProTips + Doing Yourself a Favor

ProTip: Each year after you file taxes, print off all your Payment Vouchers. Find four envelopes and put stamps on them. Put these vouchers + envelopes in a visible place, for example, pin to a bulletin board, set on your bookshelf, or clip to your fridge.

ProTip: Add these dates to your calendar right now: Jan 1, Apr 1, Jun 1, Sep 1. Prep and send your payments on these days.

Do yourself a favor and send these payments in! If you skip these payments, it can be very tempting to spend the money from your account......leaving you high and dry next April! In addition to making your future brighter, it can feel very satisfying to mail the checks, and gives peace of mind right now.

Happy Working,

Jenny Girl Friday

Read more on the official FORM 1040-ES info sheet on the IRS.gov site.

• How to Send in Your Estimated Quarterly Tax Payment (EQ$) to the IRS

Most of us are required to send in part of our federal taxes each quarter to the IRS. These are referred to as estimated quarterly tax payments (EQ$).

There are two main things you need to know to send in your EQ$.

• How much money to send.

• How to submit payments.

This post covers how to submit the payments. Click here to read more about EQ$ and how to calculate the amount.

The Due Dates for EQ$

To download original calendar, click here. Thank you to scrappystickyinkymess.wordpress.com.

January 15

April 15

June 15

September 15

Note: These are NOT due every three months. The time in between varies.

Also, if the due date falls on a weekend or holiday, it is shifted to the nearest business day.

Payment Options

> You may pay electronically. Click here to go to the Payment Page on the IRS.gov site. In most cases, there is an additional fee. There are several options: credit card, direct pay from your bank account, wiring, and more.

> Or, send checks through snail mail.

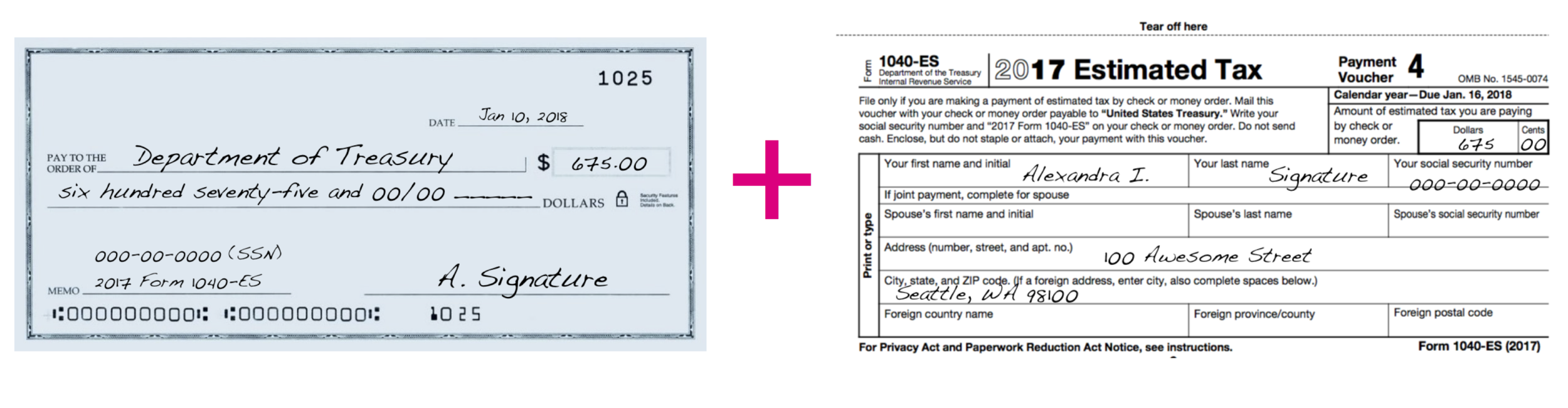

What You Need for Mailing in Checks

1. A Payment Voucher, also called, Form 1040-ES

2. Envelope

3. Check

4. Your SSN (social security number)

How to Get a Payment Voucher

If this is your first year doing business:

• Download from the IRS.gov site.

Click here to go to the Form 1040-ES page. Scroll to the bottom to get the vouchers.

If you've been in business for 1+ years:

• Tax Software programs will often generate these for you after you file your taxes.

• Accountants will often provide them

• IRS - sometimes they will send these to you in the mail

• IRS.gov - download from the website, scroll to the bottom to get the vouchers.

Steps to Take if You are Submitting Electronically

1. Calculate the amount to send in

2. Go to the IRS.gov payment site

3. Follow instructions to make payment

4. Print any receipts and file with all of your business documents

IMPORTANT - Be sure to select “PERSONAL Taxes” when asked. DO NOT select “business taxes.” This will send you to a confusing portal. “Business Taxes” are for places like Mighty-O, Starbucks, etc. You are paying “PERSONAL” taxes that you earned through your sole prop / LLC business.

Steps to Take if You are Submitting through Snail Mail

1. Calculate the amount to send in

2. Fill out the Form 1040-ES (payment voucher)

3. Write the check

4. Write on the Memo line of your check:

- your SSN

- "Form 1040-ES" and the year you're submitting tax for (See note below.)

5. Put in an envelope. Address to:

Internal Revenue Service

P.O. Box 510000

San Francisco, CA 94151-5100

6. Be sure it is postmarked by the Due Date.

7. Make a copy of your check OR make a note of the check# and amount paid. Put in your file of business documents.

What Year to Write on Your Check

Look at your payment voucher to know what year to write on your check. Generally, the estimated quarterly payment we're sending in is for the previous quarter. So....

Parting Thought

Do whatever you can! Sending any amount...at any time, is way better than skipping this step.

You can help yourself by marking these dates on your calendar: Jan 1, Apr 1, Jun 1, Sep 1....and taking 15 minutes to send these payments. If you're not sure how much, get a friend to help or just take a guess. You'll thank yourself next April, and can have more peace of mind in the meantime.

Happy Working,

Jenny Girl Friday