• How to Fill Out + Send 1099-MISC forms

If you paid any Independent Contractors more than $600 in one year, for service work, you need to submit a 1099-MISC form (1099 for short).....both to the Recipient and to the IRS. To read more, click here.

Time Required: 5 - 10 minutes per form (+more time if you have to collect W-9s)

Cost: About $1.50 in postage to IRS + any postage costs to mail to recipients

Due: January 31st

Frustration: 3 out of 10

Tedium Factor: 10 out of 10

Summary

On a half sheet form, you fill in a few boxes. Your name, address, phone number, and tax ID number. Your recipients name, address, tax ID number. The amount you paid them.

You send a copy to the recipient, to the IRS, and you keep one for yourself.

In addition, you must work with two more forms. A 1096 acts as a cover sheet when mailing 1099-MISCs to the IRS. Use W-9s to collect information from recipients. More below....

Photos with notes below. First some information.

You can choose to use paper forms or to file electronically.

Paper forms are carbon and MUST be ordered from the IRS or another source. They canNOT be printed. To ORDER forms, click here. To see a walkthrough of ordering forms, click here.

I haven't worked with e-filing yet. Some tax software systems provide this, such as TurboTax. The IRS also gives this tip, "To locate an IRS business partner who may be able to offer low-cost or even free filing of certain forms, enter "e-file for business partners" in the search box on IRS.gov."

Some accountants will also do this for you.

What you need~

For each recipient:

• Full legal name (of the person)

• Legal name of the business

• Address

• Tax ID Number ~ Either their SSN (social security number) or EIN (employer ID number)

• Amount you paid them ~ called "Nonemployee compensation"

If filing with paper forms:

• 1096 Form

• Large Envelope

• Postage

• Black ball point pen

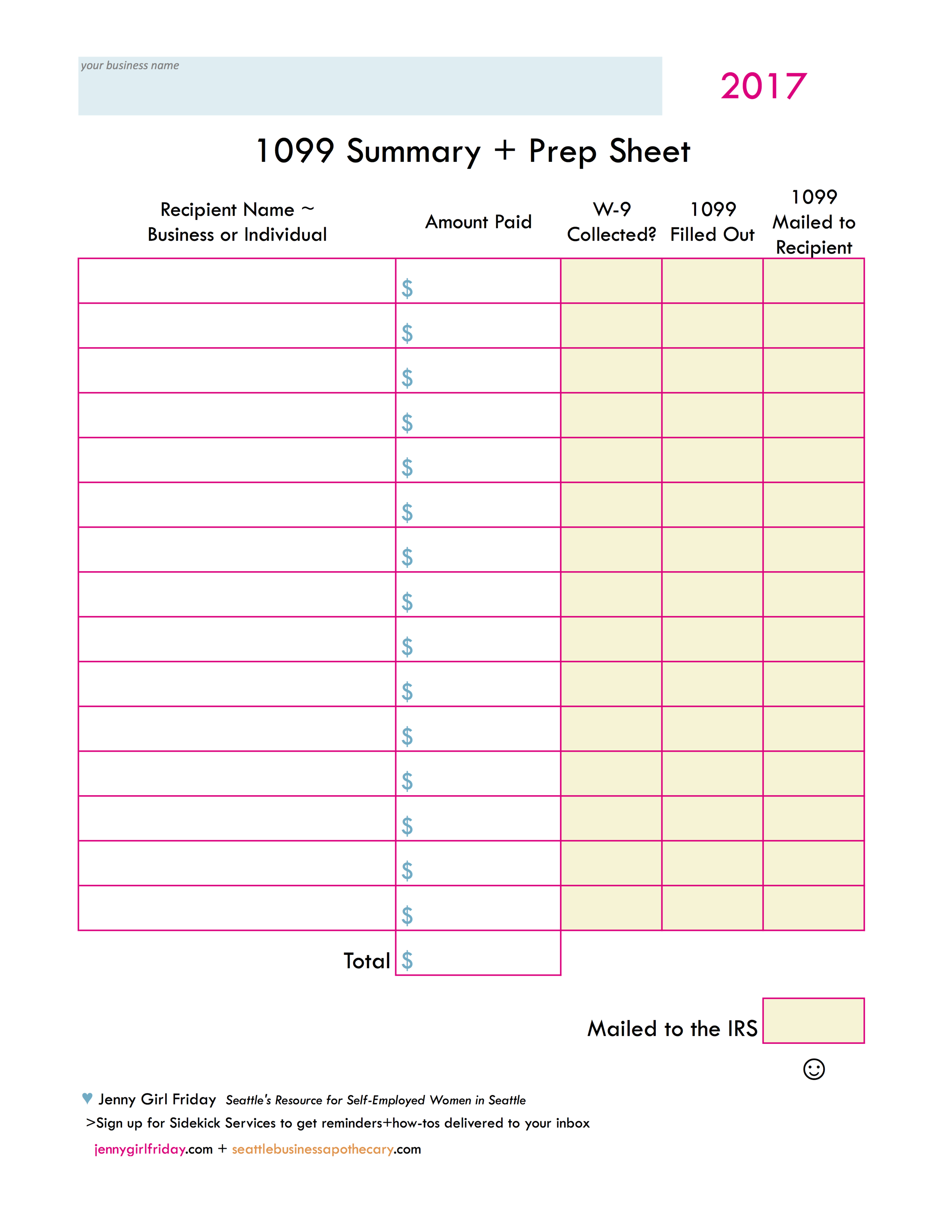

Use this prep sheet to keep things straight! Click on it to get a PDF. :) This will also help when it's time to file your IRS taxes later this Spring.

Heads Up! There are two more forms to know about! 1096 and W-9

Like the Charlie's Angels, there are actually 3 forms that you'll be working with! They always go together.

W-9 The IRS created a W-9 form to collect the required information from recipients, including their tax ID. It's a one page form with lots of pages attached. As you can imagine, tax ID numbers are sensitive information, and W-9 forms must be stored securely. You can collect W-9s on paper, or electronically. Click here to download from the IRS.gov site.

1096 This is like a cover letter. When you submit certain types of forms to the IRS, they want a 1096 as well. It's basically a summary of everything you're sending in.

Important Things to Know When Filling Out Paper Forms!

1. Use a BLACK ball point pen, press hard!

2. Use legible, block printing

3. Do NOT add any symbols. NO dollar signs, NO apostrophes, NO number signs.

For Susie's Flowers, you'd write: Susies Flowers

For an apartment #302, write APT 302

4. Do NOT cut the 1099 form top sheet (the one you send to the IRS)

5. Write the dollars + cents for all amounts. For example, 1235.00 is correct. (1235 is NOT correct.)

> > If you happen to make any mistakes, check the VOID box at the top of the form, and start again.

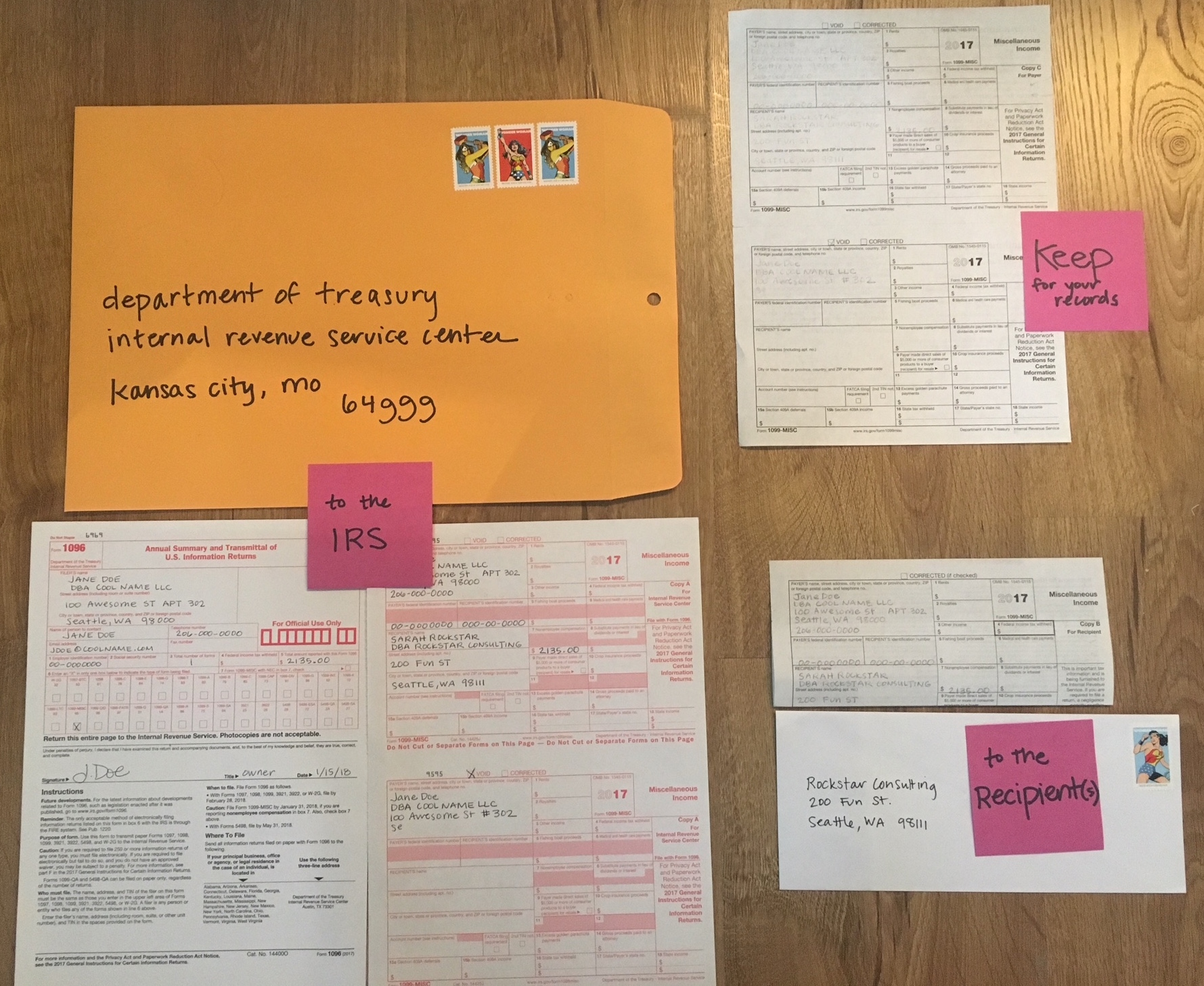

Mailing Information

• Address for Washington Residents:

Department of the Treasury

Internal Revenue Service

Kansas City, MO 64999

• You must use a FLAT envelope, with no folds.

• It must be postmarked on or before January 31, 2018.

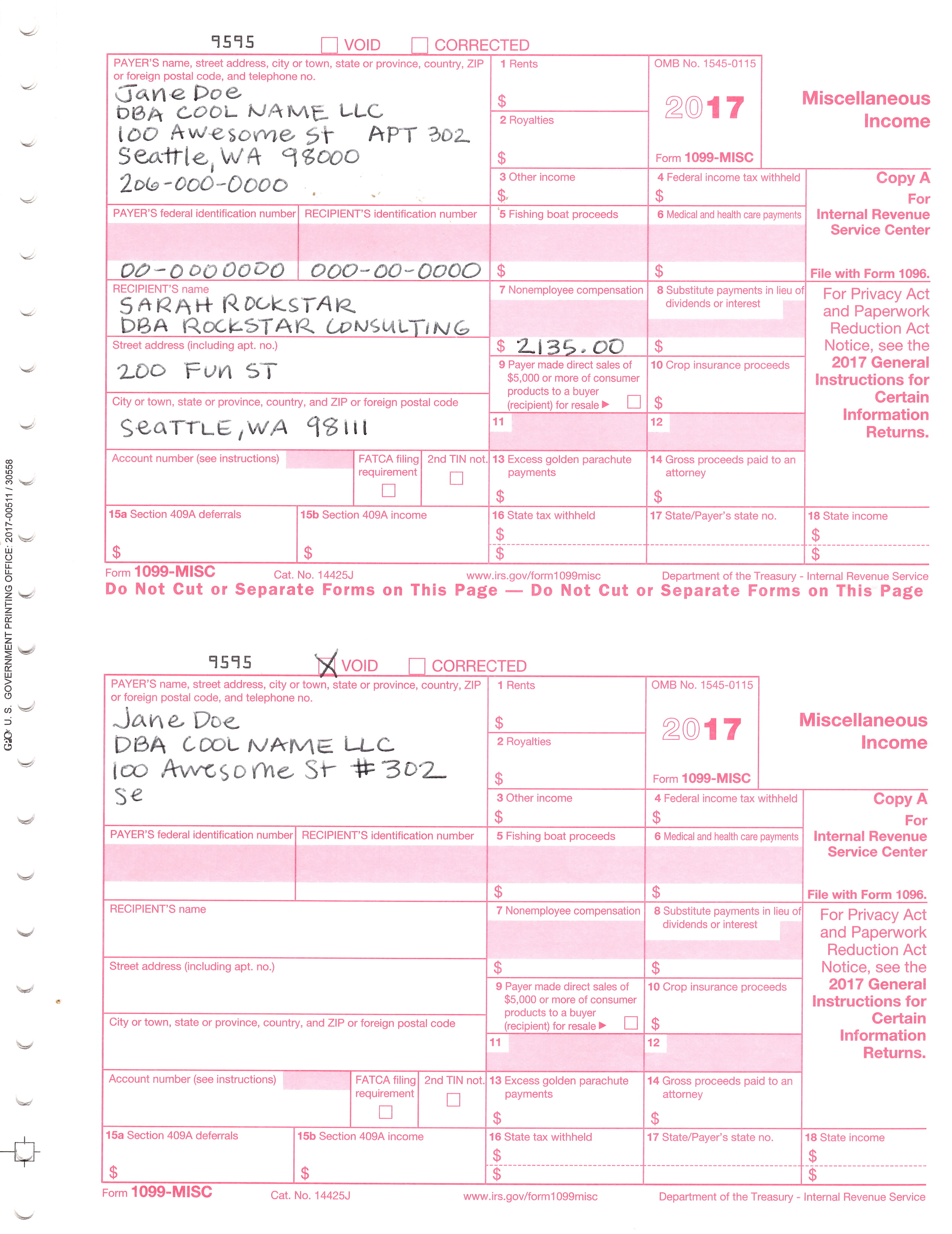

1099-MISCs Forms

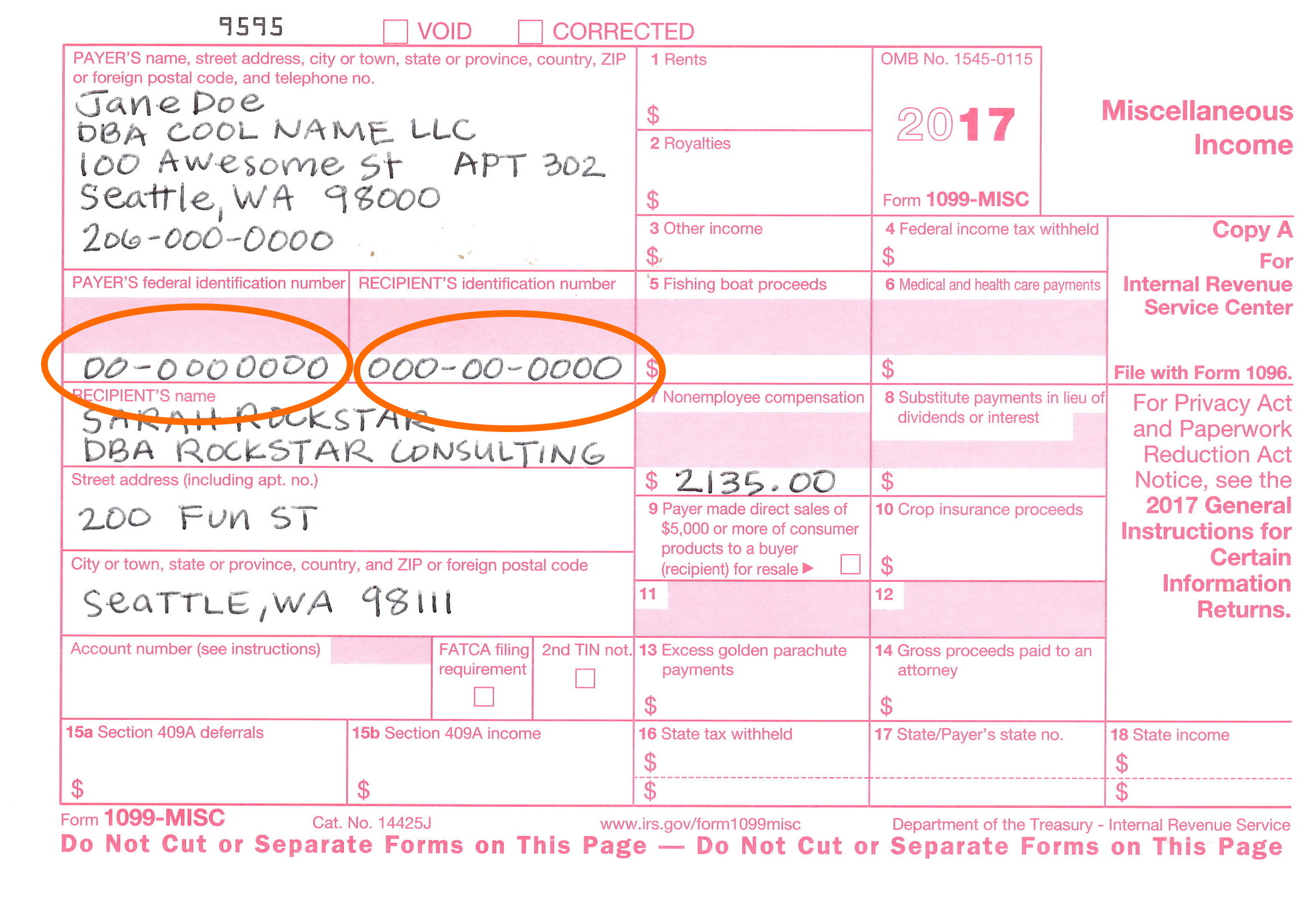

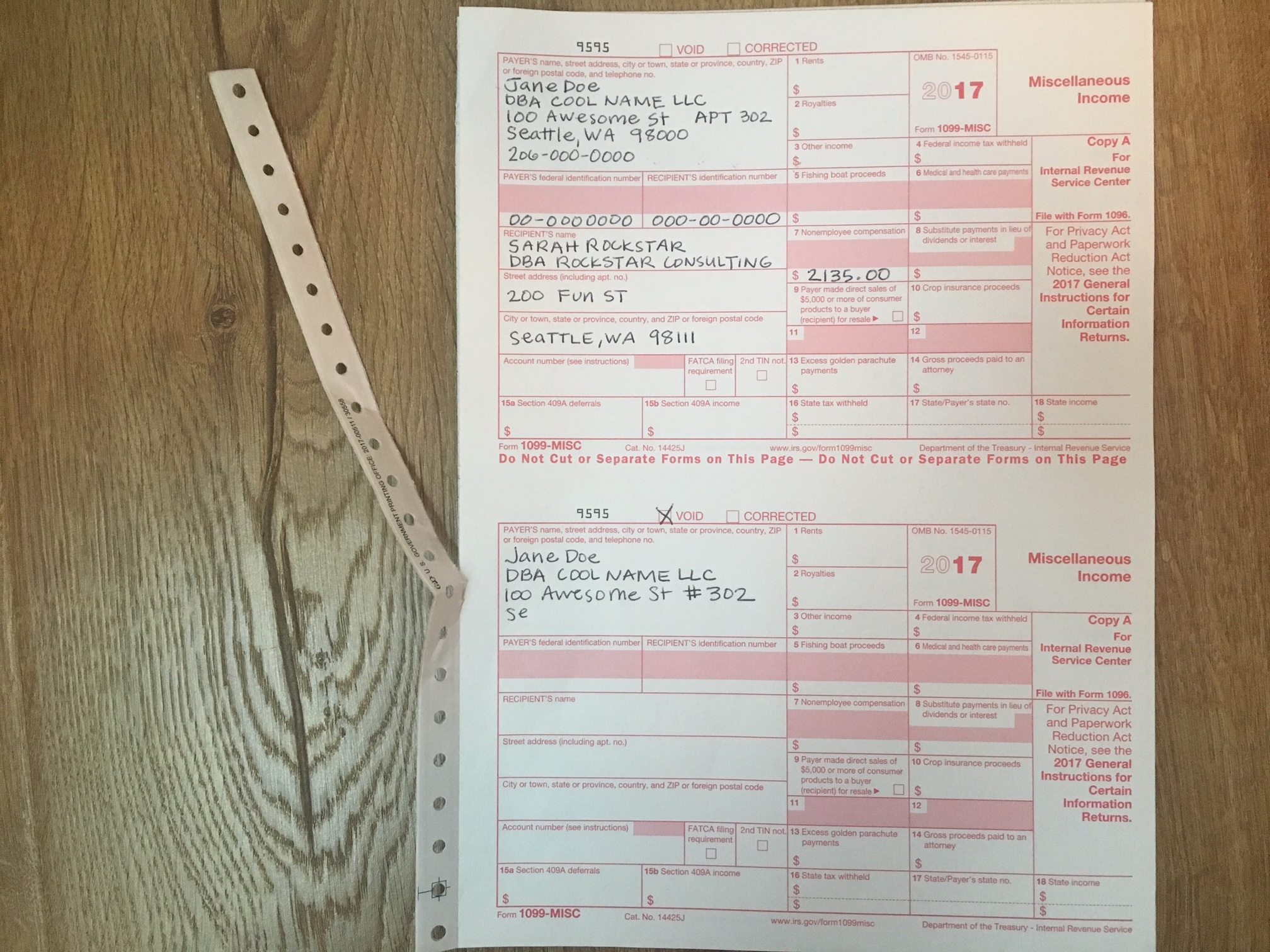

Two separate forms are on each page. This shows the top sheet which is sent to the IRS. Do NOT cut this page. The pages underneath are torn in half before giving to the recipients.

Notice the names. It's important to write both the recipients full legal name AND the business's legal name.

Whenever a business is a Sole Proprietor or Single Member LLC, you may use either the SSN (social security number) OR an EIN (employer identification number).

This example shows the Payer having an EIN.

The recipient using their SSN.

On the bottom form, I made a mistake! I used a # sign. This is not allowed, so I stopped filling it out and marked the VOID box.

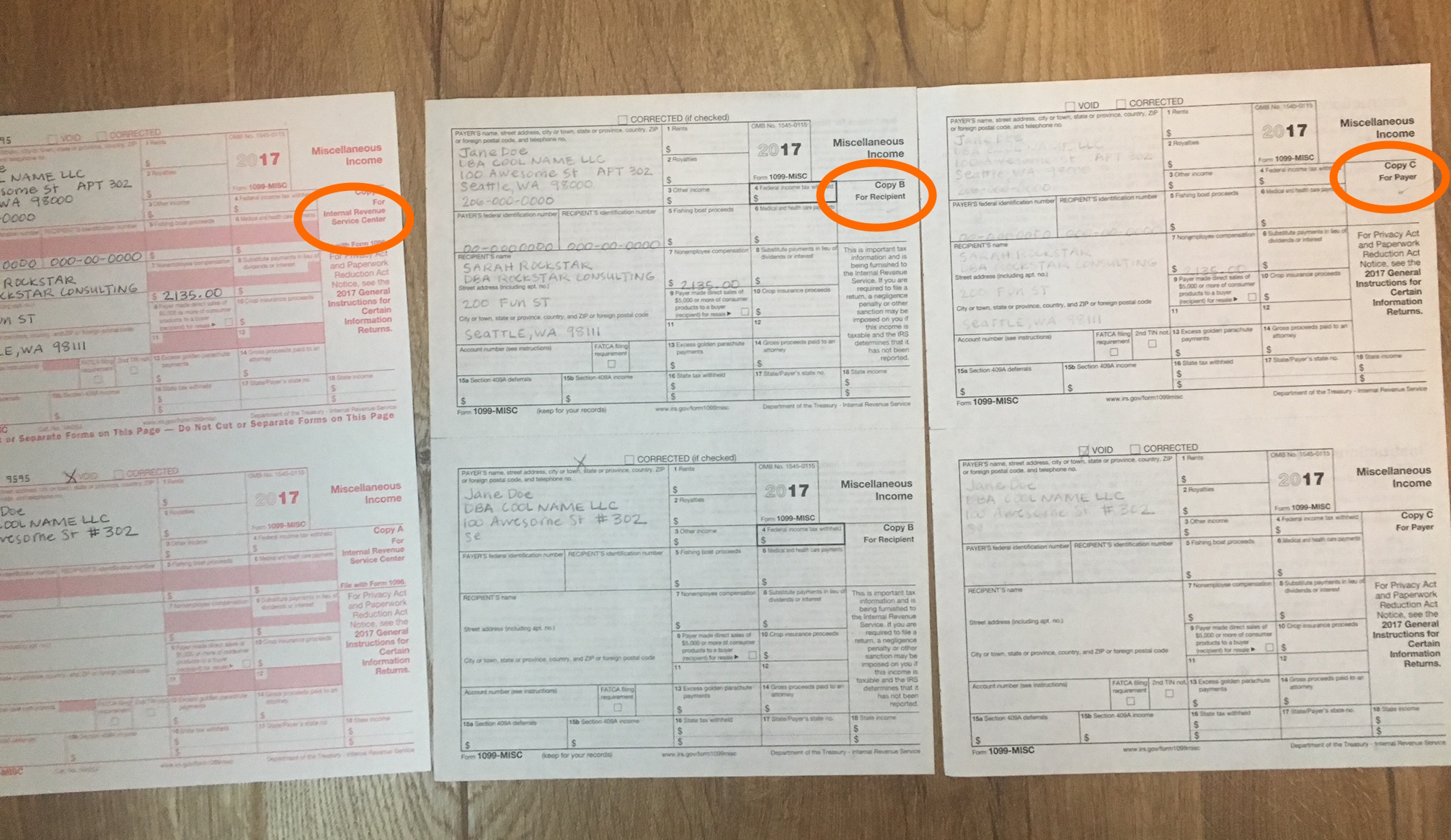

After they are filled out, tear the strip off and separate the forms.

Look for THREE to keep, and do the following:

1. For the IRS - send in the mail, in a flat envelope

2. For Recipient - send in the mail, may be folded

3. For Payer - keep in your tax records

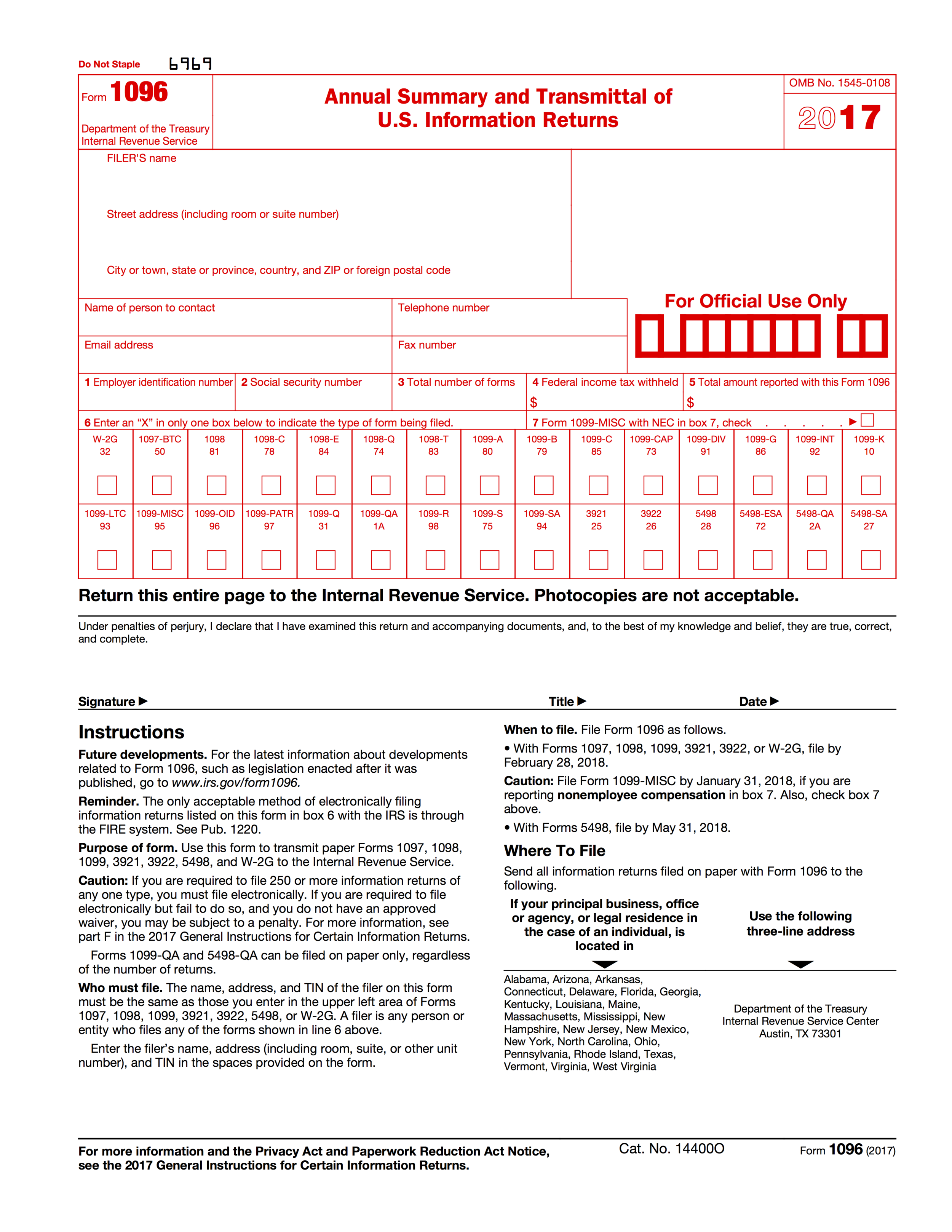

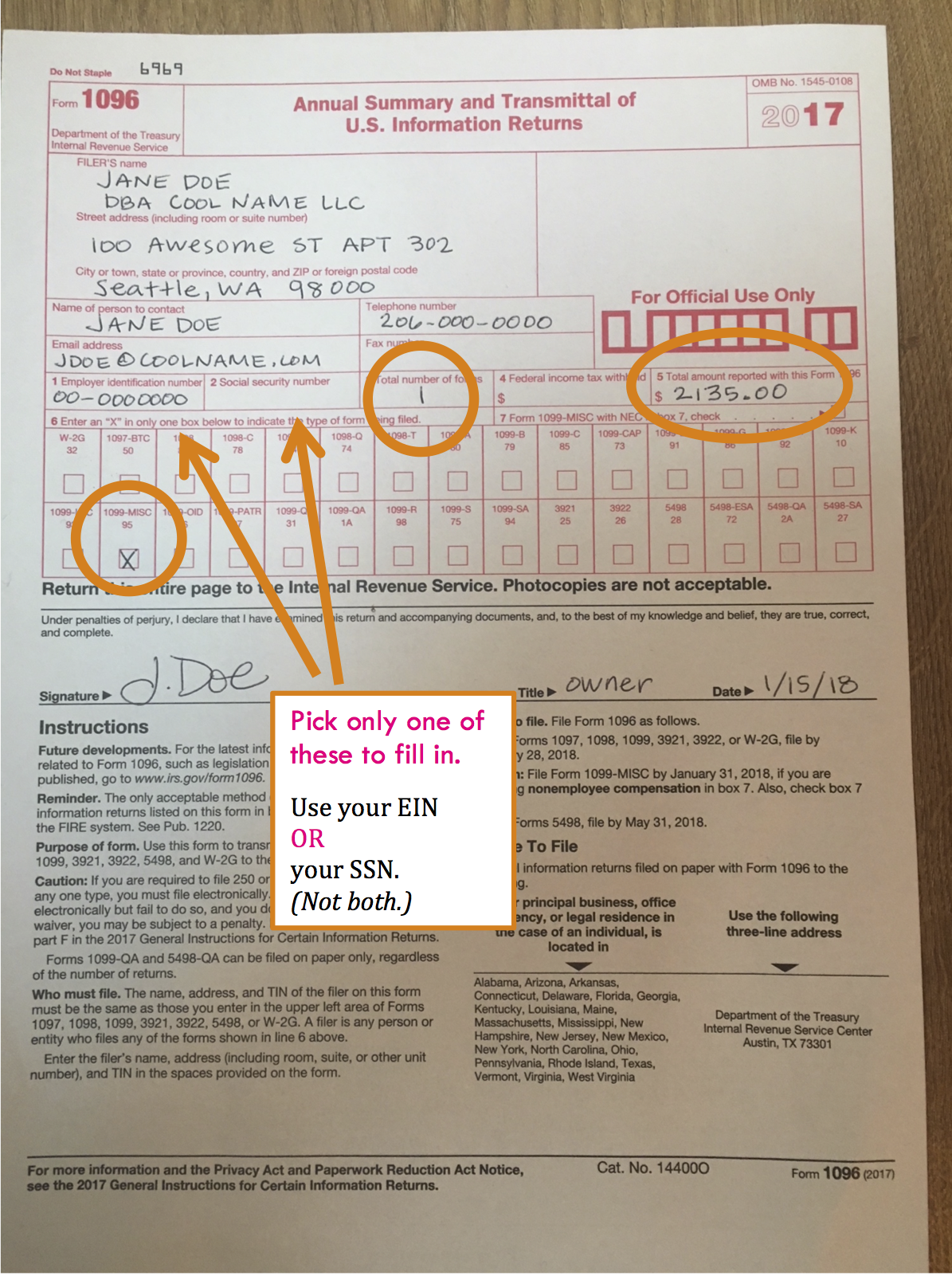

Here's a look at the 1096 Form.

Moving from left to right with notes:

1. Be sure to check the box 1099-MISC.

2. Use your EIN ....OR.....your SSN. (Not both)

3. Number of forms. Put the number of filled out 1099-MISCs. There are two per page. If you filled out for 3 recipients, you'd write "3".

4. "Total amount reported with this Form" Add up the total of all dollar amounts on all forms. If I was reporting $2100 for a coach and $1400 for a designer, I would record $3500 in this box.

Finishing up!

To the IRS - one 1096 form plus the top copies of all 1099-MISCs

To the recipients - their 1099-MISC copy

For your records - full page copies

Well done! Bravo! Even though the contents of this are straightforward, it can feel so taxing because it takes a lot of care and attention, yet it is boring. In addition, just the thought of the IRS can be triggering or get the adrenaline going. ♥ If you can, find a time to relax a bit. Perhaps a bath, a trip to Ladywell's, a long walk, even a short walk around the block.

Also, remember to check off of your Cheat Sheet / Sticker Chart!

Cheers!

: ) Jenny Girl Friday

P.S. Sign up for Sidekick Services to get these delivered right to your inbox! (Posting on social media is random....)

• How to Order 1099-MISC Forms (free!)

Not sure if you need 1099-MISC forms? Read about them here.

When: Order in Nov or Dec

Forms Due: January 31

Estimated Time: 3 minutes

Cost: Free

Frustration Factor: 1 out of 10

If you plan to use paper 1099-MISC forms (1099s for short), you'll need to order them from IRS.gov. It's not possible to simply print them off ... because they are carbon forms.

Here are the steps. There are screenshots are below.

1. Go to IRS.gov

2. Select "Forms & Publications" ~ Top right side

3. Select "Order Forms and Pubs" ~ Left side

4. Select "Online Ordering for Information Returns and Employer Returns"

5. Scroll Down to see chart of forms

6. Notice there are two empty boxes for each form ~ one is for 2017 forms, the other is for 2018 forms

7. Keep scrolling until you see 1099-MISC

8. Put the desired number of forms that you need in the left box, for 2017 forms

9. Put a number 1 next to the Instructions

10. Scroll down to the bottom and select "Add to Cart"

11. Follow the checkout process

The first picture starts on the "Order Forms and Pubs" page.

The Chart of Forms - The actual chart is longer than what's shown here.

The beginning of the checkout process.

To read about 1099s + w-9s, click here. (Coming soon.)

Need help filling out your 1099s? Click here. (Coming soon.)

Great job staying on top of things for tax season!

♥ Jenny Girl Friday

Would you like to receive friendly reminders for tax season ... delivered right to your inbox? Sign up for Sidekick Services! Asking for a small annual donation.