• For Retail + Combo Businesses ~ How To Make Your Annual Report To The City Of Seattle (For B&O Taxes)

Hello + Note from July 2, 2018: The state has a new portal, which looks a little different. I'm hoping to add screenshots of the new one sometime soon. Meanwhile, this post will still give you a good idea of the process. Thanks for your patience!

Does your work include: retail, retail-service, wholesale, manufacturing, or royalties. Or a combination?

Then this post is for you!

If your business is NON-retail SERVICE only, click here to see a different walkthrough.

Due: April 30

Time Required: 2 - 8 minutes to file

Frustration Factor: If you use the SELF Portal, 3 out of 10. If you use the FileLocal, 6 out of 10.

Cost/Taxes Due: If you earned under $100K (gross sales), then you will not pay any taxes to Seattle. To read about tax rates for over $100K with Seattle, click here.

Type of Tax: B&O (business and occupation)

With: City of Seattle

Use: Seattle SELF Portal (Recommended).........or FileLocal-wa.gov.

If you need help, call the city at: 206.684.8484

Summary

1. Log in to Seattle SELF Portal or FileLocal-wa.gov

2. Find that business categories that apply to you: retail, wholesale, service, printing, manufacturing

3. Fill in total sales for each category

4. Hit next until the end, confirm

5. If you earned over $100K in total gross sales, complete the payment screens

One Note: The state collects sales tax for Seattle. So if you have to submit sales tax, you'll do that through the WA state DOR, Department of Revenue.

Some Screenshots below.

How to Prepare - If You are NEW to This :)

Reporting to Seattle is very similar to reporting to the WA state DOR. I recommend preparing for both at once. Everyone's situation is a little different, so it's hard to give estimates or exact instructions.

Here's what I recommend:

1. Schedule some prep time on your calendar in the next week

2. Schedule a 20 - 40 minute block for tax filing, during the weekday, with a plan to call the city if needed (they will walk you through this). This is includes buffer time.

3. Print out the Ready, Set, File - Seattle!

4. During your prep time, fill out as many numbers as you can on the worksheet

5. On your scheduled day, give it a try. If you have to call the city, be prepared to wait...have something fun to do while on hold.

The directions say to choose the last month of the period you're filing for.

With Annual Reports, choose December of the last year.

It took a few seconds for these drop down menus to work. Choose "Seattle B&O tax form" and your Main branch. (Or whatever you named it.)

Fill in each box relevant to your business.

The total sales in each category, NOT including any sales tax that you collected.

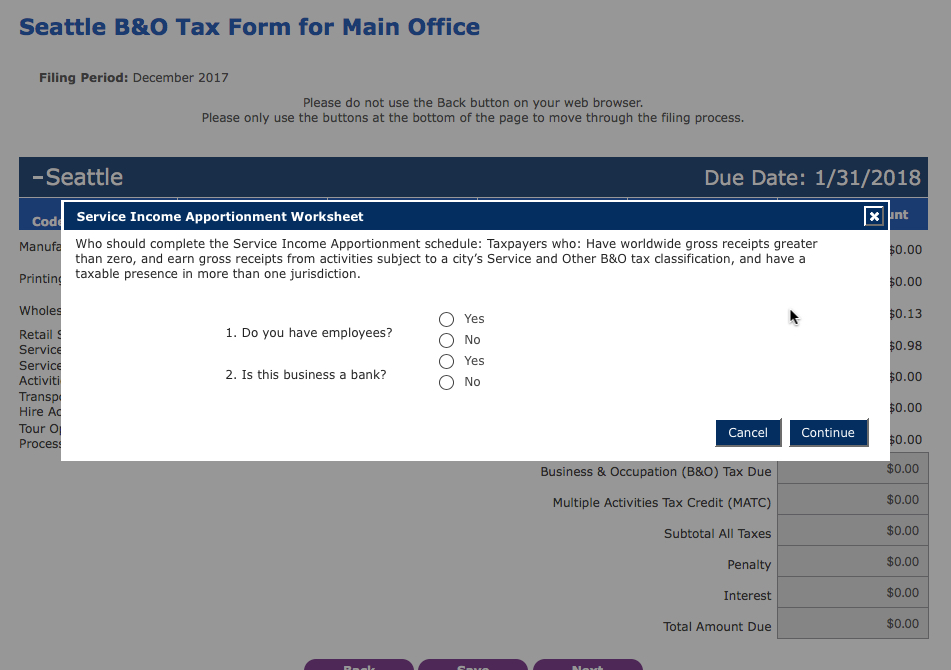

This is a second view of the same screen. Note, this symbol means a (confusing) worksheet is about to pop up.

It includes boxes for Royalties and NON-Retail Services

Some questions. Note: you are NOT an employee. You are the business owner.

Royalty information~ enter in the box circled in Orange.

Non-Retail Services, enter in two places.

1. Line 1 for Worldwide Gross Service Receipts. (Worldwide!!!)

2. Line 7 for Seattle Service Receipts

If you did all your work in Seattle, these should be the same.

Notice, the form will fill in some numbers for you.....

A shot after this screen is filled in. You can only change the numbers in White.

This example shows gross sales + taxes in three categories.

Note, no tax is due............because this person earned under $100K.

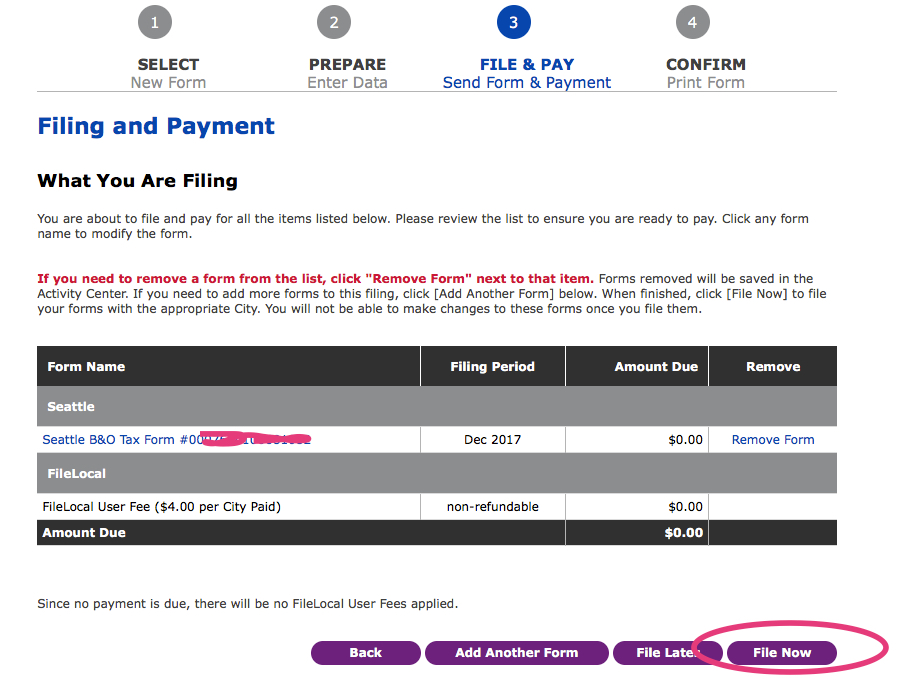

Eventually, this screen pops up as a confirmation. Hurray! Success!!!!!

FYI - the first 3 times I tried, I got this error message. I waited a few days, and tried again and it worked! One good thing........FileLocal had kept all my numbers, so I just had to move through all the screens.

Well done! Phew! One thing about reporting to the city is that it forces us to know our total sales number. I find that kind of rewarding, how about you?

One more hoop of tax season is all done. Be sure to give yourself a little or even medium reward! Perhaps some Theo's chocolate, some yummy juice from HeartBeet, or a trip to Ladywell's.

: ) Jenny Girl Friday

P.S. Did this help you? Pretty please share with any friends, or post on Facebook. I think self-employed folks are keeping the soul in Seattle. I want to make the chores of business easier, so you all can keep being awesome.

P.S. 2 Are you signed up for Sidekick Services via email? Get reminders and links to how-tos delivered right to your email inbox. :)

• Retail + Combo Businesses ~ How To Make Your Annual Report To The WA DOR (For Excise Taxes)

Hello + Note from January 2019: The state has a new portal, which looks a little different. I'm hoping to add screenshots of the new one sometime soon. Meanwhile, this post will still give you a good idea of the process. Thanks for your patience!

Does your work include: retail, retail-service, wholesale, manufacturing, or royalties. Or a combination?

Then this post is for you!

If your business is NON-retail SERVICE only, click here to see a different walkthrough.

A little warning. Reporting to the state isn't that bad........though, this blog post will perhaps make it look a little confusing. Additionally, the online tax forms will definitely make it look even more confusing!!! That is because there are SO many variables, and one form has to serve all industries.

The best thing to do is collect your numbers, then get help. You can call the state. It's their job to walk you through this. Or, get in touch for a one-time consult with me. Or, get a good friend to read through the instructions with you together. :)

Due - for ANNUAL Filers - April 15

Due - for QUARTERLY Filers - April 30, July 31, October 31, January 31

Time Required: 20 - 60 minutes to file, perhaps up to 2 hours

Frustration Factor: 5 out of 10

Cost/B&O Taxes Due: If you earned under about $45K (gross sales), then you will not pay any B&O taxes to the state. If your gross sales were over $45K, then it could be a few hundred dollars up to a thousand or more.

Sales Tax Due: Depends on your retail sales total(s) and locations

Type of Tax: B&O (business and occupation), Sales Tax, Use Tax (not covered in this post)

With: WA State Department of Revenue (DOR), using DOR.WA.gov

Options: Paper on Online. Recommended ~ use the ONLINE form!

More information and screenshots below. If you need help at any time, call the state at: 800.647.7706

Summary of the Task

1. Log in

2. Find the correct boxes for each business category: Retail, Service, Wholesale, Manufacturing, Royalties, etc.

3. Fill in total amounts by category

4. Enter all the cities you sold retail products or services

5. Enter retail sales by time period, from 1/1/17 - 3/31/17, then from 4/1/17 - 12/31/17

6. Click next through several screens

7. Confirm

8. Go through payment screens to submit sales tax + any B&O tax owed

**In some cases, enter "Tax Paid at the Source" as a deduction. (Explained on Prep Sheet, below.)

If you're ready, click here to get started at the DOR.WA.gov. More info and screenshots below.

If you have any trouble, call the DOR at 1.800.647.7706. It's their job to help you file your taxes!

How to Prepare - If You are NEW to This :)

Reporting to WA is very similar to reporting to Seattle, but just a little more complicated. I recommend preparing for both at once. Everyone's situation is a little different, so it's hard to give estimates or exact instructions.

Here's what I recommend:

1. Schedule some prep time on your calendar in the next week

2. Schedule a 30 - 120 minute block for tax filing, during the weekday, with a plan to call the state DOR if needed (they will walk you through this)

3. Print out the Prep sheet below

4. During your prep time, fill out as many numbers as you can on the Prep Sheet

5. On your scheduled day, call the state to help you. Be prepared to wait...have something fun to do while on hold.

Prep Sheet

Click on the image below, to get to a PDF to download.

A Little Info

Washington state collects three kinds of tax. The Department of Revenue handles this.

B & O Tax - Business and Occupation. Every business has to pay this tax, though small businesses get a credit, so you might not owe any! Different industries are taxed on business activities. The percentages vary.

Use Tax - This might apply to you. (Though I don't cover it in the screenshots below.) It's like sales tax for things you buy in other states. For example, if you buy a computer in Portland, you'd be required to pay Use Tax in WA state for it.

Sales Tax - This is a tax that businesses collect and submit, versus a tax one pays. If you're a (NON-Retail) Service provider, you don't have to collect this tax! Click here to read about Services vs. Retail Service. The DOR collects for both the state and the city/cities (referred to as local tax).

IMPORTANT NOTE - ONE

If you do not have an account yet with the DOR (Department of Revenue), you'll need to set one up. A blog post is coming soon to show this. Meanwhile, here's what I can tell you.

You will need your~

• UBI - Unified Business Identifier, the # that WA state assigned to your business

and

• PAC Code - I don't know what this stands for. You can find it on most letters from the DOR, or if they sent you a paper form for Excise Tax.

IMPORTANT NOTE - TWO

By any chance, did the state assign you to make Quarterly reports? Versus Annual reports? This sometimes happens when self-employed folks register an LLC. If you want to change from Quarterly to Annually, you must call the DOR (Department of Revenue) during the month of January. And only in January! The number is 1.800.647.7706. If your annual Gross Sales are under a certain amount, they will make the change for you.

Screenshots ~ Making Your Report to the WA DOR

To get started, click here to go to the DOR.WA.gov.

Follow the circles.

Log In.

Click on File Return.

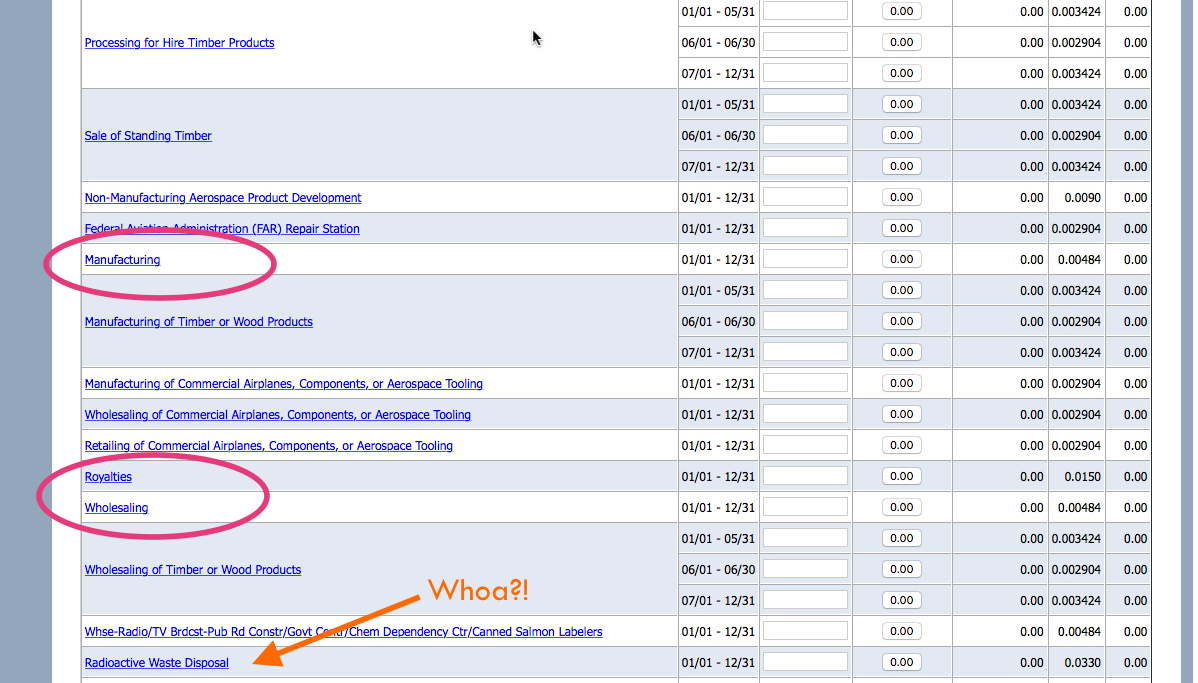

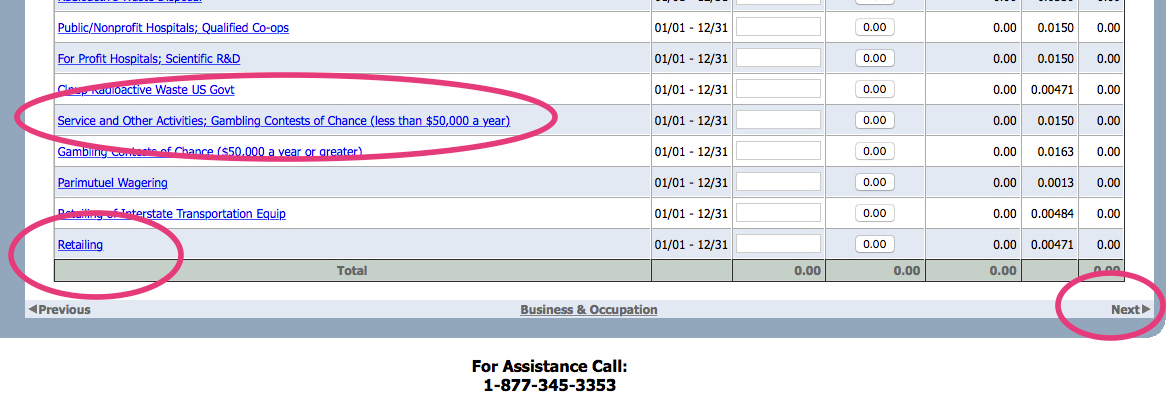

Scroll down........look out for the categories that apply to you. (And check out some of the others along the way!)

Enter the total Gross Sales in each box, next to the name of the category.

Hit Next.

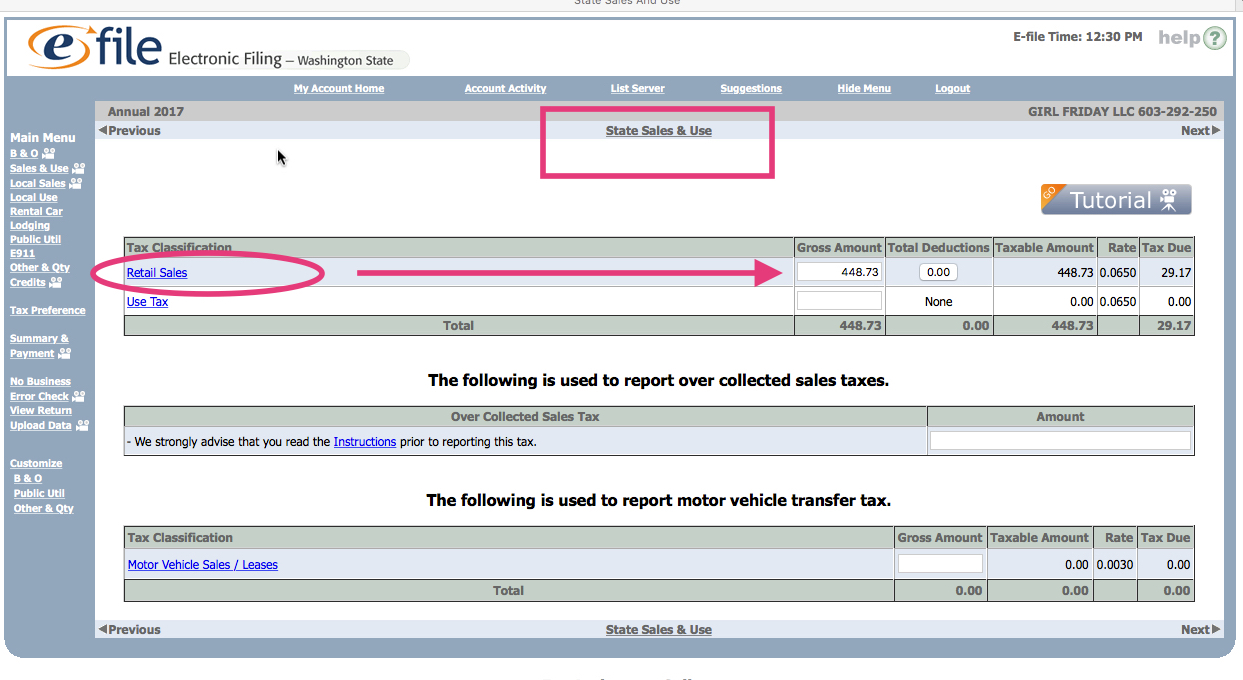

Now you're on the State Sales & Use Tax

Enter your Gross Sales in the Retail Sales box. (This might be pre-filled out for you because of the previous screen. This is collected for the state. The screen shows the rate of 6.5%.

If you know that you owe Use Tax, put that amount as well. (This is for items you bought out of state. If you have questions, call the DOR.)

This next page is for the Local Sales tax. This money is collected on behalf of the city/cities where you sold products and retail services.

> You'll need to add each city.

> For some, you'll need to give subtotals of gross sales in two different time periods.

(Because the tax went up midway through the year.) It shows the different rates to the right.

If you know you'll owe Use Tax, add Seattle, then add your amounts. (Sorry, I'm not going into detail here. This doesn't apply to most people.)

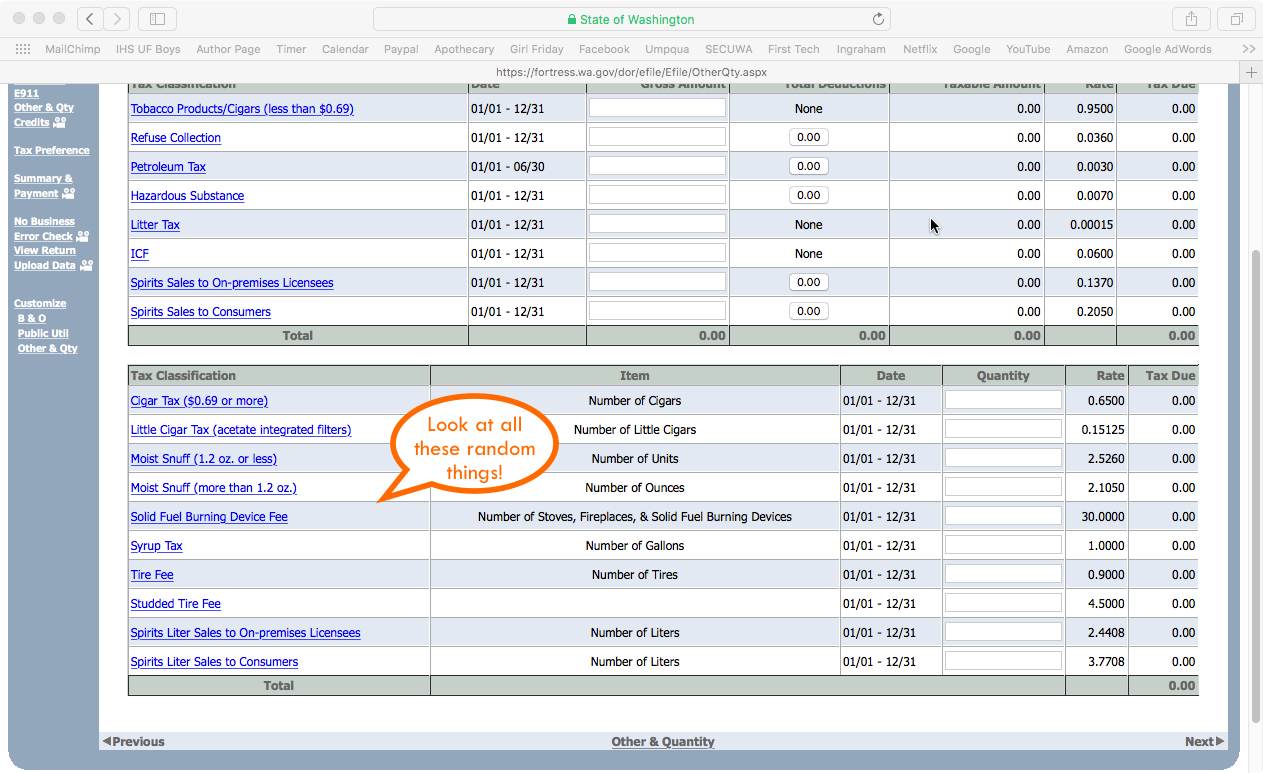

Click NEXT through the following screens until you get to the confirmation page.

>> One exception, if you need to take TAX PAID at the SOURCE, it may be on one of these pages. Sorry, I don't know where it is......

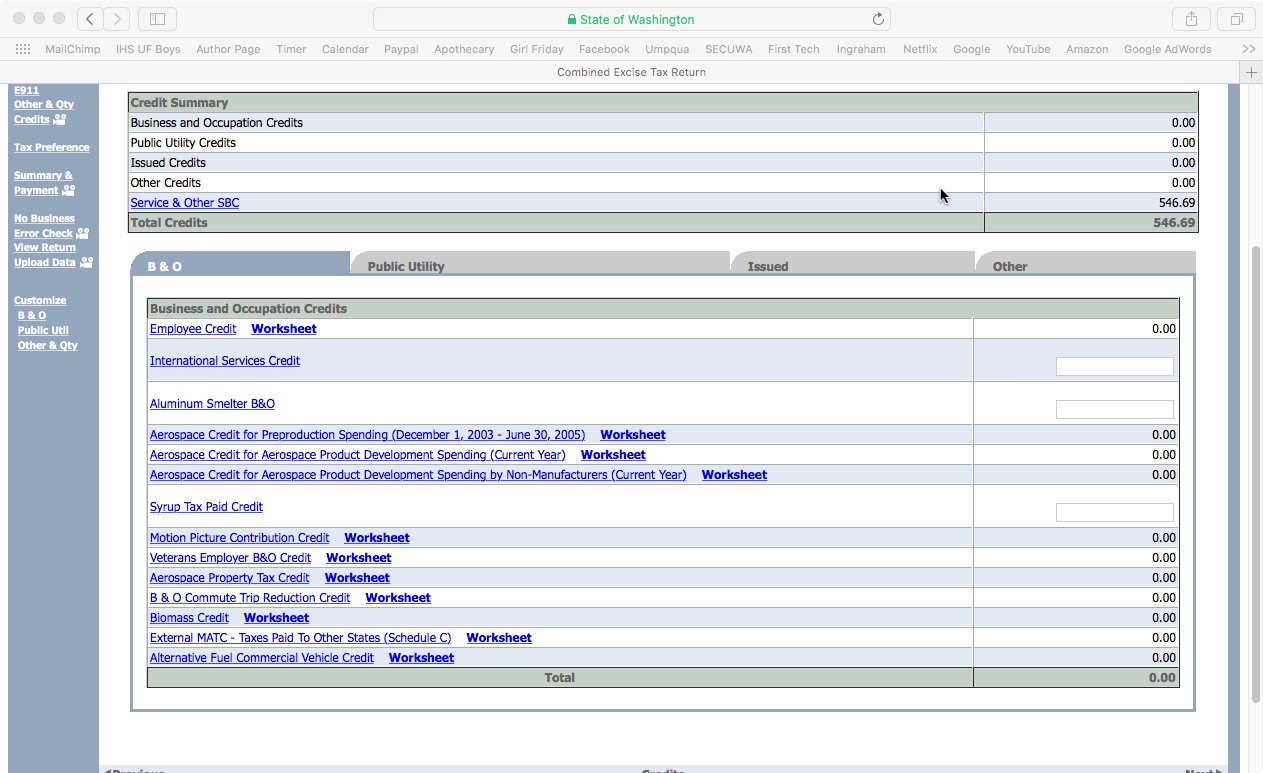

Finally, here we are. It'll show your B&O tax, sales tax, local tax, use tax, etc.

Also, any credits applied to you.

Fill out your contact info to file.

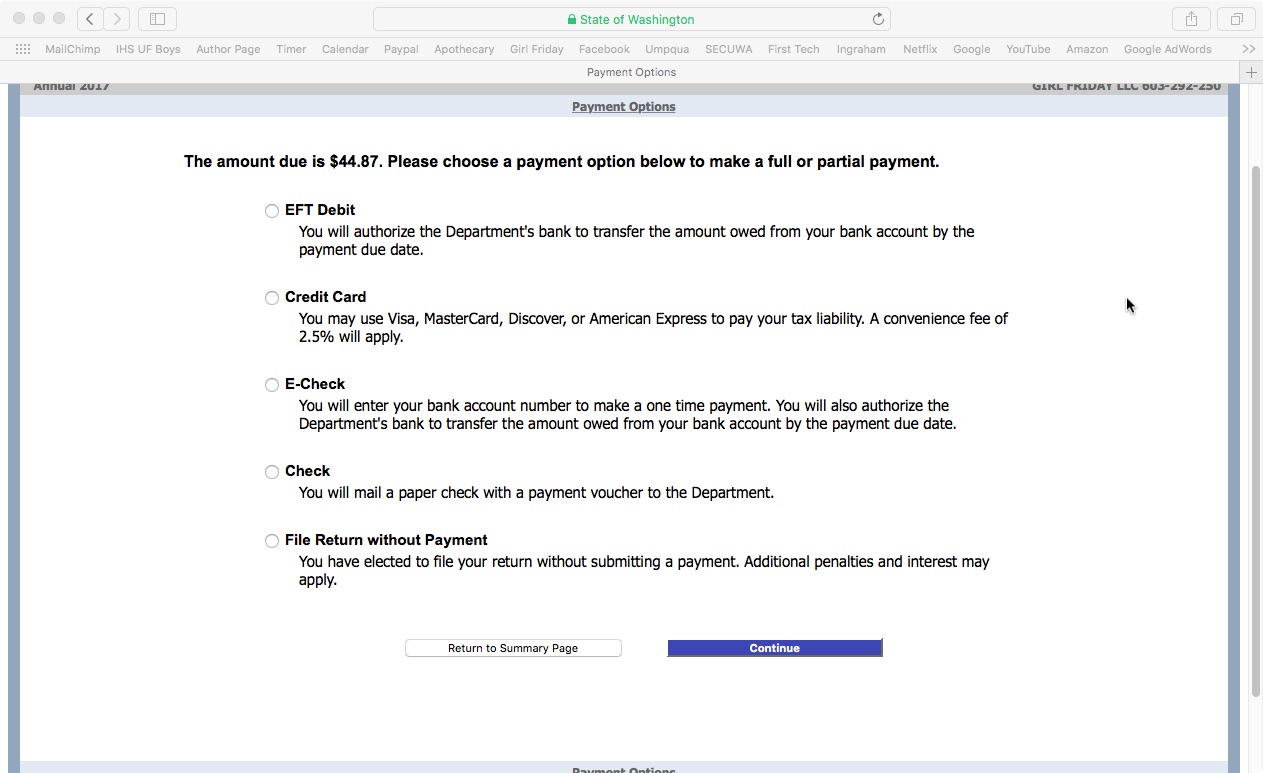

If you owe any money, it'll direct you to a payment screen.

Payment screen. The first one deducts directly from your bank account.

After you fill out your payment info, be sure you follow all the directions to Submit payment.

Check for the buttons at the bottom of each screen. (Sorry, I forgot to grab those screenshots for you.)

Woohoo! Confirmation screen. If you paid any B&O tax, be sure to put a copy in your receipts file.

You can deduct these taxes when you do your Federal filing with the IRS. (Sales and Use Tax is NOT deductible for IRS taxes.)

If you select "View Printable Return" this is what it looks like.

Well done! This will be way easier next year, now that you've been through it.

Please take a little moment to reward yourself. Perhaps some nice chocolate, a walk outside, a glass of wine, or order dinner in tonight.

Cheers!

Jenny Girl Friday

♥

P.S. Did this help? I hope so! Pretty please share with any friends, or post on Facebook. I think self-employed folks are keeping the soul in Seattle. I want to make the chores of business easier, so you can all keep being awesome and shining your light.

P.S. 2 Are you signed up for Sidekick Services via email? Get reminders and links to how-tos delivered right to your email inbox. :)