For Service Providers ~ How To Make Your Annual Report To The WA DOR (For Excise Taxes)

If you are a retail business, or a combination of service + retail, click here to read a different walkthrough. To learn more about Service vs. Retail Services, click here.

Hello + Note: If you file Quarterly, this post will still show you what to do. The only difference is that you will be reporting gross sales for the prior Quarter only.

There’s GOOD and BAD news. Good: Once you’ve got your profile set up, and know what to do ……..this only takes a few minutes. BAD: It’s kinda tricky getting set up and navigating to the right place.

Once there though, it’s easy! All you have to do is enter your Gross Sales in one box.

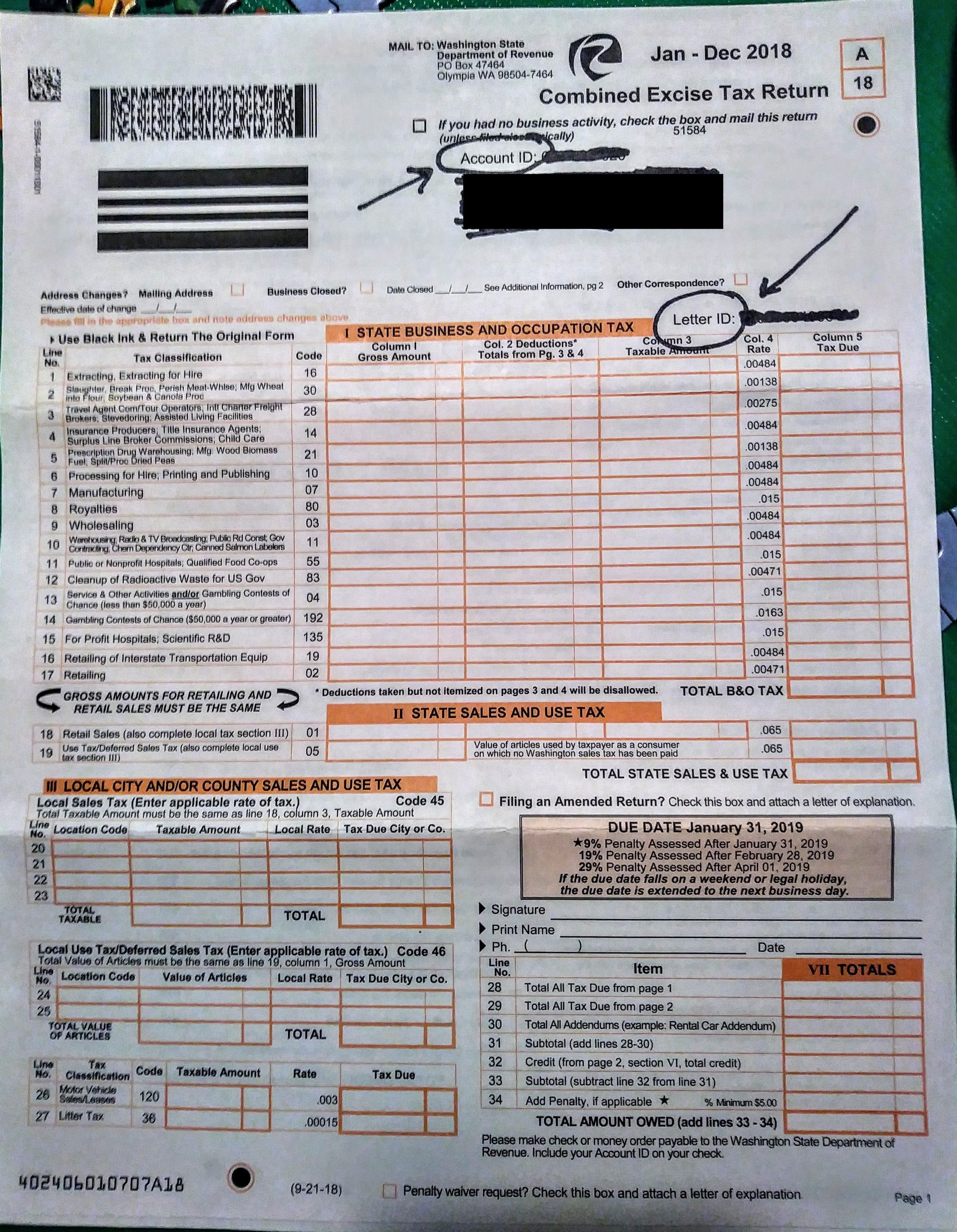

IMPORTANT! You will need a LETTER ID to set up your profile. (Because it’s a new portal.)

If it’s your first year of business: it will be on a tax form they sent~ with orange boxes. See below.

If you’ve filed online, it will be in a letter. See below.

If you can’t find this letter, call the state and ask them for help. 1-800-647-7706

(Blog post coming soon to walk you through this and/or to request letter online.)

Due - for ANNUAL Filers - April 15

Due - for QUARTERLY Filers - April 30, July 31, October 31, January 31

Time Required: 2 - 8 minutes

Frustration Factor: 6 out of 10 the first year, 2 out of 10 afterward

Cost/Taxes Due: $0 if you earned under about $45K. Over $45K, it can be a few hundred dollars to a thousand or more.

Type of Tax: B&O - business and occupation

(And Use Tax if applicable, though this is not covered in this blog post.)

With: The Washington state DOR, Department of Revenue

Click here to go to the DOR.WA.gov

OR, read on for more information and screenshots.

Summary of the Task

1. Log in

2. Add the Services category to your account

3. Enter your gross sales in the correct spot

4. Confirm

5. Pay, if required

If you have any trouble, call the DOR at 1.800.647.7706. It's their job to help you file your taxes!

Screenshots below.

A Little Info

Washington state collects three kinds of tax. The Department of Revenue handles this.

B & O Tax - Business and Occupation. Every business has to pay this tax, though small businesses get a credit, so you might not owe any! Different industries are taxed on business activities. The percentages vary.

Use Tax - This might apply to you. (Though I don't cover it in the screenshots below.) It's like sales tax for things you buy in other states. For example, if you buy a computer in Portland, you'd be required to pay Use Tax in WA state for it.

Sales Tax - This is a tax that business collect and submit, versus a tax one pays. If you're a (NON-Retail) Service provider, you don't have to collect this tax! Click here to read about Services vs. Retail Service.

IMPORTANT NOTE 1 - You need an online Profile

If you do not have an ONLINE account yet with the DOR (Department of Revenue), you'll need to set one up. A blog post is coming soon to show this. Meanwhile, here's what I can tell you.

First - you set up a profile in MyDOR

Second - connect your Business to this account

You will need your~

UBI - Unified Business Identifier, the # that WA state assigned to your business

+

To link your business, your Letter ID - Look for a letter from the state or a tax form sent to you. At the top is the Letter ID code. Don’t have it? Or it got lost? Sign into your MyDOR account, look for “Link Existing Business”. Once in that screen, look for the box that says something like, “Send a letter”. Confused? Call the state: 1.800.647.7706

IMPORTANT NOTE 2 - Changing from Quarterly to Annually

By any chance, did the state assign you to make Quarterly reports? Versus Annual reports? This sometimes happens when self-employed folks register an LLC. If you want to change from Quarterly to Annually, you must call the DOR (Department of Revenue) during the month of January. And only in January! The number is 1.800.647.7706. If your annual Gross Sales are under a certain amount, they will make the change for you.

Screenshots ~ Making Your Report to the WA DOR

Note: some of these images have been edited…..so may look a little different than what you see on the screen. (My screenshots included some Retail fields that I covered up, since this post is for SERVICE only.)

To get started, click here to go to the DOR.WA.gov.

Here we go!

Click Log In to get started.

If you need to set up a user account, you can do so on the next page.

This is where it gets confusing for a minute………

At some point in the past, you may have gotten a SAW User ID. If you can find this, use it. And/or use the ‘Forgot’ links to get this log in.

If this all looks super new to you……..then Sign Up as a new user. The link is to the right of the circle.

Once in the system………..

If you’ve already set up this profile and linked your Business to it, then select “Business (B&O), Excise, and Sales Tax”

OR

If this is your first time, you’ll need to link your Business License to this profile. Select “Access your account using a letter ID”. Walkthrough coming soon, meanwhile:

If you have the letter, follow the screens and fill in your information to link your Business account.

If you don’t have the letter, follow the next screens until you can click a button that says: “Click here to request a Letter ID be mailed to the address on file.”

At this point, you’ll have to wait for the letter to complete this process. (It’s possible if you call the state, that they could give you the codes over the phone.

P.S. If you end up filing past January 31, usually……….you only pay penalties IF you owe any tax. Very often, the penalties are not too bad

Once you’re in…………….select your business and confirm.

Click “File Return”.

On this screen ……….we’re setting up which “Tax Classifications” (business categories) apply to us.

For SERVICE providers, you only need one. It’s shown here. In theory, it should already be on your profile.

IF NOT: click the “Add/Delete Tax Classifications” button. It will bring up a very large menu of classifications. Find the one that says, “SERVICE and Other Activities; Gambling Contests of Chance (less than $50,000 a year).

Select the bullet next to it. scroll down and hit NEXT. It should put you back on this screen.

Once your Tax Classifications are correct, hit NEXT.

Enter your Gross Sales in the spot shown below.

Then, hit TAB………..look at the following Screenshot to see what happens next.

Notice, now some more fields are filled in:

Total B&O Tax for your business

B&O Credits offered to you

Usually, the credits will cover what you owe……….up to about $45K

Now, hit NEXT.

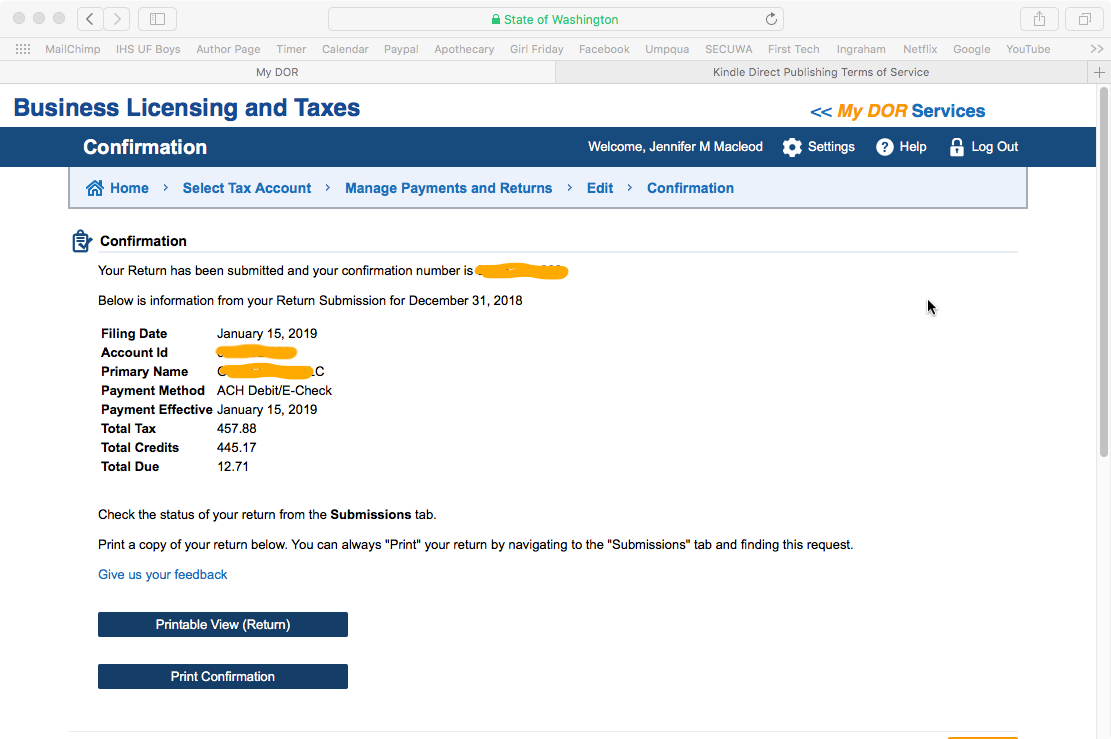

This is an example of what your SUMMARY screen might look like.

This image had other tax categories on it that I covered up, so yours will maybe look a little different.

Fill out your Info, then hit NEXT.

IF you do NOT owe any money, you’ll be sent to the Confirmation Screen (a few images below).

IF you do OWE money, it’ll send you to this payment option screen.

This image shows some fields that might not be on your screen. It’s just to show what it might look like if you owe some money.

Confirmation! You’re all done!

Well done! This will be way easier next year, now that you've been through it.

Please take a little moment to reward yourself. Perhaps some nice chocolate, a walk outside, a glass of wine, or order dinner in tonight.

Cheers!

Jenny Girl Friday

♥

P.S. Did this help? I hope so! Pretty please share with any friends, or post on Facebook. I think self-employed folks are keeping the soul in Seattle. I want to make the chores of business easier, so you can all keep being awesome and shining your light.

P.S. 2 Are you signed up for Sidekick Services via email? Get reminders and links to how-tos delivered right to your email inbox. :)