Retail + Combo Businesses ~ How To Make Your Annual Report To The WA DOR (For Excise Taxes)

Hello + Note: If you file Quarterly, this post will still show you what to do. The only difference is that you will be reporting gross sales for the prior Quarter only.

Does your work include: retail, retail-service, wholesale, manufacturing, or royalties. Or a combination?

Then this post is for you!

If your business is NON-retail SERVICE only, click here to see a different walkthrough.

Hello + Note from January 2019: The state has a new portal, which looks a little different.

♥ ♥ ♥ ♥

There’s GOOD and BAD news. Good: Once you’ve got your profile set up, and know what to do ……..this only takes a few minutes. BAD: It’s kinda tricky getting set up and navigating to the right place.

BASICS

Due - for ANNUAL Filers - April 15

Due - for QUARTERLY Filers - April 30, July 31, October 31, January 31

Time Required: 2 - 20 minutes to set up profile, then 2 - 10 minutes to File

Frustration Factor: 5 out of 10

Cost/B&O Taxes Due: If you earned under about $45K (gross sales), then you will not pay any B&O taxes to the state. If your gross sales were over $45K, then it could be a few hundred dollars up to a thousand or more.

Sales Tax Due: Depends on your retail sales total(s) and locations

Type of Tax: B&O (business and occupation), Sales Tax, Use Tax (not covered in this post)

With: WA State Department of Revenue (DOR), using DOR.WA.gov

Options: Paper on Online. Recommended ~ use the ONLINE form!

More information and screenshots below. If you need help at any time, call the state at: 800.647.7706

One little warning…….

Reporting to the state isn't that bad........though, this blog post will perhaps make it look a little confusing. The best thing to do is collect your numbers, then get help. You can call the state. It's their job to walk you through this. Or, get in touch for a one-time consult with me. Or, get a good friend to read through the instructions with you together. :)

Summary of the Task

1. Log in / Set up Profile + Link Business to profile (if needed)

2. Choose/Confirm the Tax Classifications that apply to you: Retail, Service, Wholesale, Manufacturing, Royalties, etc.

3. Fill in total Gross Sales by classification (category)

4. Fill in Retail Sales for the State

5. Enter Retail Sales for each City

6. Review summary + confirm

7. Go through payment screens to submit sales tax + any B&O tax owed

**In some cases, enter "Tax Paid at the Source" as a deduction. (Explained on Prep Sheet, below.)

If you're ready, click here to get started at the DOR.WA.gov. More info and screenshots below.

If you have any trouble, call the DOR at 1.800.647.7706. It's their job to help you file your taxes!

How to Prepare - If You are NEW to This :)

Reporting to WA is very similar to reporting to Seattle, but just a little more complicated. I recommend preparing for both at once. Everyone's situation is a little different, so it's hard to give estimates or exact instructions.

Here's what I recommend:

1. Schedule some prep time on your calendar, perhaps 1 - 3 hours to get all your totals

2. Schedule a 30 - 120 minute block for tax filing, during the weekday, with a plan to call the state DOR if needed (they will walk you through this)

3. Print out the Prep sheet below

4. During your prep time, fill out as many numbers as you can on the Prep Sheet

5. On your scheduled day, call the state to help you. Be prepared to wait...have something fun to do while on hold.

Prep Sheet

Click on the image below, to get to a PDF to download.

IMPORTANT NOTE

If you do not have an account yet with the DOR (Department of Revenue), you'll need to set one up. A blog post is coming soon to show this. Meanwhile, here's what I can tell you.

You will need your ~

• UBI - Unified Business Identifier, the # that WA state assigned to your business

and

• LETTER ID - You will find this on a letter that the DOR sent to you in the mail. Can’t find it? Call the state at 1-800-647-7706. (Blog post coming soon with how to request on line.)

A Little Info

Washington state collects three kinds of tax. The Department of Revenue (DOR) handles this.

B & O Tax - Business and Occupation. Every business has to pay this tax, though small businesses get a credit, so you might not owe any! Different industries are taxed on business activities. The percentages vary.

Use Tax - This might apply to you. (Though I don't cover it in the screenshots below.) It's like sales tax for things you buy in other states. For example, if you buy a computer in Portland, you'd be required to pay Use Tax in WA state for it.

Sales Tax - This is a tax that businesses collect and submit, versus a tax one pays. If you're a (NON-Retail) Service provider, you don't have to collect this tax! Click here to read about Services vs. Retail Service. The DOR collects for both the state and the city/cities (referred to as local tax).

Screenshots ~ Making Your Report to the WA DOR

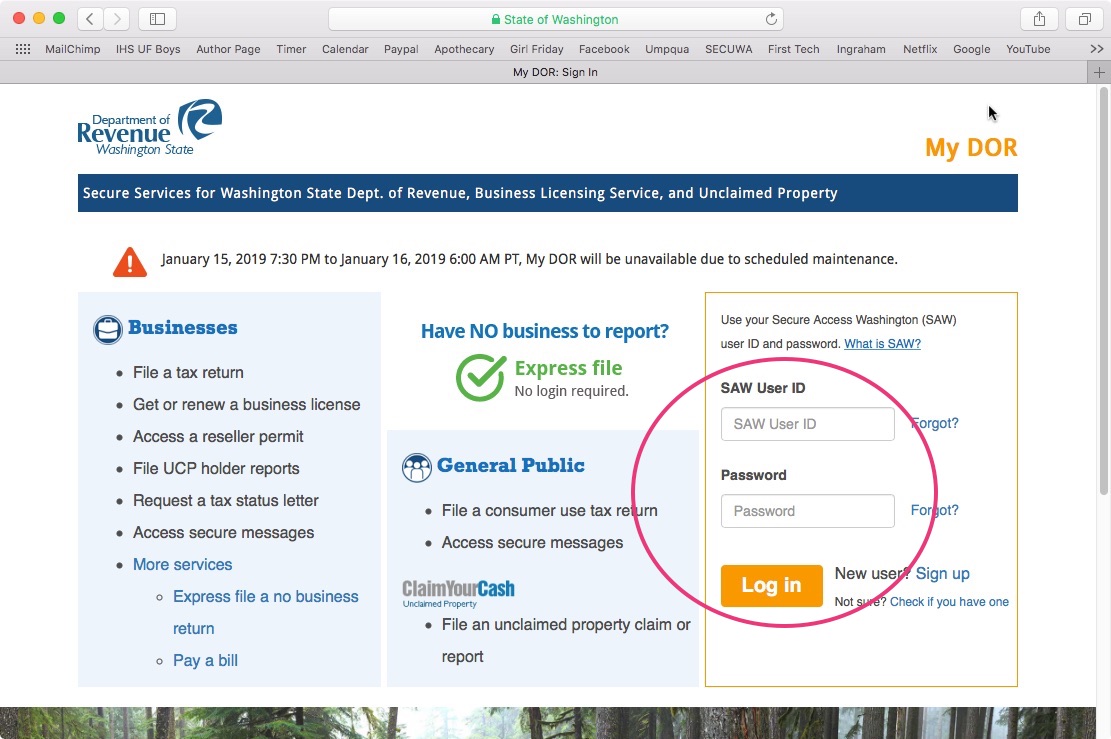

To get started, click here to go to the DOR.WA.gov.

Follow the circles.

This is where it gets confusing for a minute………

At some point in the past, you may have gotten a SAW User ID. If you can find this, use it. And/or use the ‘Forgot’ links to get this info.

OR

IF this all looks super new to you……..then Sign Up as a new user. The link is to the right of the circle.

Once in the system………..

If you’ve already set up this profile and linked your Business to it, then select “Business (B&O), Excise, and Sales Tax”

OR

If this is your first time, you’ll need to link your Business License to this profile. Select “Access your account using a letter ID”. Walkthrough coming soon, meanwhile:

If you have the letter, follow the screens and fill in your information to link your Business account.

If you don’t have the letter, follow the next screens until you can click a button that says: “Click here to request a Letter ID be mailed to the address on file.”

At this point, you’ll have to wait for the letter to complete this process. (It’s possible if you call the state, that they could give you the codes over the phone.)

P.S. If you end up filing past January 31, usually……….you only pay penalties IF you owe any tax. Very often, the penalties are not too bad

Once you’re in…………….select your business and confirm.

Click “File Return”.

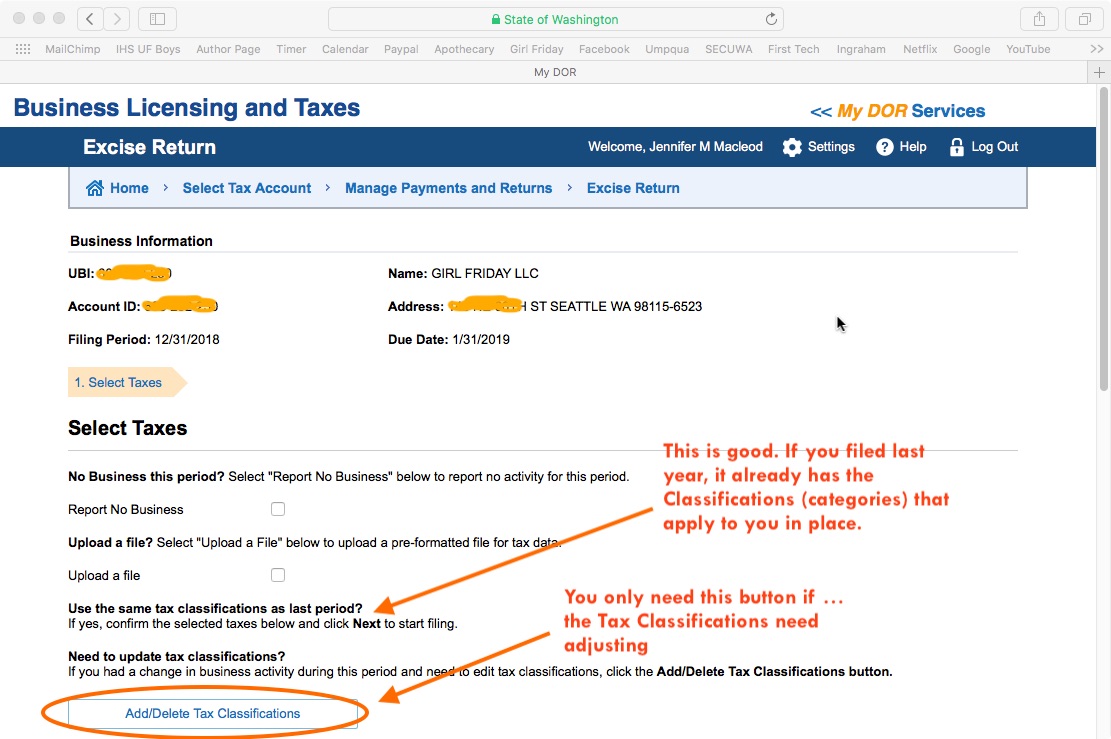

On this screen ……….we’re setting up which “Tax Classifications” (business categories) apply to us.

Probably ~ There are some listed for you already. Review them to see if they match your business.

IF you do RETAIL, you’ll need both of these on your:

“Retail Sales”

“Local City and/or County Sales Tax” ~ (The state collects Sales Tax on behalf of cities + counties.)

If you need to adjust the List

Click the “Add/Delete Tax Classifications” button. It will bring up a very large menu of classifications. Find all that apply to you. If you do any Non-Retail Service, then look for one that says, “SERVICE and Other Activities; Gambling Contests of Chance (less than $50,000 a year).

Select the bullet next to each relevant classification (category). Then, scroll down and hit NEXT. It should put you back on this screen.

Once your Tax Classifications are correct, hit NEXT.

Okay finally!

Now we’re on the Business & Occupation (B&O) Tax page.

Enter the Gross Sales for each category. (The Gross Sales NEVER includes the sales tax collected.)

> > > NOTE! If you had sales OUTSIDE of WA state, you will not owe Sales Tax for those transactions.

Because this system is so new, I haven’t figured out to Deduct the Out-of-state gross sales yet. I suspect it’s on this screen …..by clicking the Add Deduction button. Try that. If you don’t find it there, call the state’s HELP with electronic filing number: 1-877-345-3353.

This is the page for State SALES Tax

The Gross Amount is probably filled in. If not, add it in this box and hit TAB.

This is the page for CITY Sales Tax

You’ll need to add the Gross Retail Sales for each city.

(Remember, this is the amount before sales tax was collected.)

If you had Retail sales in cities not showing on the list, click the “Add Locations” button and follow the prompts.

There’s a 2nd screenshot with more notes about this page.

You’re almost there!

This is the Summary Page ……..showing Gross Amounts and

Taxes owed by category, along with credits.

Look it over to see if everything looks right.

When it looks good, fill out the Submitter Information (that’s you!)

If you owe $0, then you’ll be sent to a Confirmation Screen (example at the bottom).

If you owe any tax $$, then you’ll be sent to a payment option screen, like this one:

Final review time………with the Tax Amount that you need to submit.

Yay! Confirmation screen!

It’s a good idea to save a pdf on your computer / or print for your records.

Well done! This will be way easier next year, now that you've been through it.

Please take a little moment to reward yourself. Perhaps some nice chocolate, a walk outside, a glass of wine, or order dinner in tonight.

Cheers!

Jenny Girl Friday

PS. ProTip

By any chance, did the state assign you to make Quarterly reports? Versus Annual reports? This sometimes happens when self-employed folks register an LLC. If you want to change from Quarterly to Annually, you must call the DOR (Department of Revenue) during the month of January. And only in January! The number is 1.800.647.7706. If your annual Gross Sales are under a certain amount, they will make the change for you.

♥

P.S.2 Did this help? I hope so! Pretty please share with any friends, or post on Facebook. I think self-employed folks are keeping the soul in Seattle. I want to make the chores of business easier, so you can all keep being awesome and shining your light.

P.S. 3 Are you signed up for Sidekick Services via email? Get reminders and links to how-tos delivered right to your email inbox. :)