Filing WA State Taxes / Just the Basics!

Hello there,

The post below gives the most stripped-down basics for filing WA state taxes. If you’d like to read more detailed posts, and see some screenshots, click on these links: for Service Providers and Retail / Combo.

Also, I want to share this GOOD NEWS right upfront. Once you know what you’re doing, this business chore only takes 5 - 20 minutes. It will take way longer to learn about it, than to actually do them….

:) Jenny Girl Friday

Due for you IF:

You have a WA state Business License

Estimated Time:

5 - 10 minutes - Filing

0.5 - 2 hours - Prepping

How:

Online with MYDOR

Due Dates:

Businesses are assigned annually, quarterly, or monthly

Annual Due Date

• April 15

Quarterly Due Dates

• Apr 30

• Jul 31

• Oct 31

• Jan 31

The Tax Form is called:

Combined Excise Tax Return

What everybody will need:

__ MyDOR / SAW - Log-in and Password

__ Gross Sales Total - per time period

Annual Filers

• From January 1 - December 31

Quarterly Filers

• Q1 - January 1 - March 31

• Q2 - April 1 - June 30

• Q3 - July 1 - September 30

• Q4 - October 1 - October 31

Some of you:

__ Subtotals of Gross Sales by Category

And, if you Retail, you may need:

__ Retail Sales Subtotal

__ Retail Sales out-of-state

__ Retail Sales where Tax is collected by a "Facilitator"

__ Sales Tax Paid at the Source

Types of Tax:

B&O (Business & Occupation Tax)

Sales Tax

Use Tax

Note: These are all types of “Excise” tax. That is why the form is called “Combined Excise Tax Return” because it’s asking about all three - and some others - in one, combined form.

B&O Tax: small businesses will receive a tax credit. So, if you gross under about $55K, you will not have to pay any tax. As your income goes up above that number, the tax credit will get smaller, then disappear

Sales Tax: applies to selling products or retail services

Use Tax: applies if your business purchased items/tools outside of WA state

• Retail + Combo Businesses ~ How To Make Your Annual Report To The WA DOR (For Excise Taxes)

Hello + Note from January 2019: The state has a new portal, which looks a little different. I'm hoping to add screenshots of the new one sometime soon. Meanwhile, this post will still give you a good idea of the process. Thanks for your patience!

Does your work include: retail, retail-service, wholesale, manufacturing, or royalties. Or a combination?

Then this post is for you!

If your business is NON-retail SERVICE only, click here to see a different walkthrough.

A little warning. Reporting to the state isn't that bad........though, this blog post will perhaps make it look a little confusing. Additionally, the online tax forms will definitely make it look even more confusing!!! That is because there are SO many variables, and one form has to serve all industries.

The best thing to do is collect your numbers, then get help. You can call the state. It's their job to walk you through this. Or, get in touch for a one-time consult with me. Or, get a good friend to read through the instructions with you together. :)

Due - for ANNUAL Filers - April 15

Due - for QUARTERLY Filers - April 30, July 31, October 31, January 31

Time Required: 20 - 60 minutes to file, perhaps up to 2 hours

Frustration Factor: 5 out of 10

Cost/B&O Taxes Due: If you earned under about $45K (gross sales), then you will not pay any B&O taxes to the state. If your gross sales were over $45K, then it could be a few hundred dollars up to a thousand or more.

Sales Tax Due: Depends on your retail sales total(s) and locations

Type of Tax: B&O (business and occupation), Sales Tax, Use Tax (not covered in this post)

With: WA State Department of Revenue (DOR), using DOR.WA.gov

Options: Paper on Online. Recommended ~ use the ONLINE form!

More information and screenshots below. If you need help at any time, call the state at: 800.647.7706

Summary of the Task

1. Log in

2. Find the correct boxes for each business category: Retail, Service, Wholesale, Manufacturing, Royalties, etc.

3. Fill in total amounts by category

4. Enter all the cities you sold retail products or services

5. Enter retail sales by time period, from 1/1/17 - 3/31/17, then from 4/1/17 - 12/31/17

6. Click next through several screens

7. Confirm

8. Go through payment screens to submit sales tax + any B&O tax owed

**In some cases, enter "Tax Paid at the Source" as a deduction. (Explained on Prep Sheet, below.)

If you're ready, click here to get started at the DOR.WA.gov. More info and screenshots below.

If you have any trouble, call the DOR at 1.800.647.7706. It's their job to help you file your taxes!

How to Prepare - If You are NEW to This :)

Reporting to WA is very similar to reporting to Seattle, but just a little more complicated. I recommend preparing for both at once. Everyone's situation is a little different, so it's hard to give estimates or exact instructions.

Here's what I recommend:

1. Schedule some prep time on your calendar in the next week

2. Schedule a 30 - 120 minute block for tax filing, during the weekday, with a plan to call the state DOR if needed (they will walk you through this)

3. Print out the Prep sheet below

4. During your prep time, fill out as many numbers as you can on the Prep Sheet

5. On your scheduled day, call the state to help you. Be prepared to wait...have something fun to do while on hold.

Prep Sheet

Click on the image below, to get to a PDF to download.

A Little Info

Washington state collects three kinds of tax. The Department of Revenue handles this.

B & O Tax - Business and Occupation. Every business has to pay this tax, though small businesses get a credit, so you might not owe any! Different industries are taxed on business activities. The percentages vary.

Use Tax - This might apply to you. (Though I don't cover it in the screenshots below.) It's like sales tax for things you buy in other states. For example, if you buy a computer in Portland, you'd be required to pay Use Tax in WA state for it.

Sales Tax - This is a tax that businesses collect and submit, versus a tax one pays. If you're a (NON-Retail) Service provider, you don't have to collect this tax! Click here to read about Services vs. Retail Service. The DOR collects for both the state and the city/cities (referred to as local tax).

IMPORTANT NOTE - ONE

If you do not have an account yet with the DOR (Department of Revenue), you'll need to set one up. A blog post is coming soon to show this. Meanwhile, here's what I can tell you.

You will need your~

• UBI - Unified Business Identifier, the # that WA state assigned to your business

and

• PAC Code - I don't know what this stands for. You can find it on most letters from the DOR, or if they sent you a paper form for Excise Tax.

IMPORTANT NOTE - TWO

By any chance, did the state assign you to make Quarterly reports? Versus Annual reports? This sometimes happens when self-employed folks register an LLC. If you want to change from Quarterly to Annually, you must call the DOR (Department of Revenue) during the month of January. And only in January! The number is 1.800.647.7706. If your annual Gross Sales are under a certain amount, they will make the change for you.

Screenshots ~ Making Your Report to the WA DOR

To get started, click here to go to the DOR.WA.gov.

Follow the circles.

Log In.

Click on File Return.

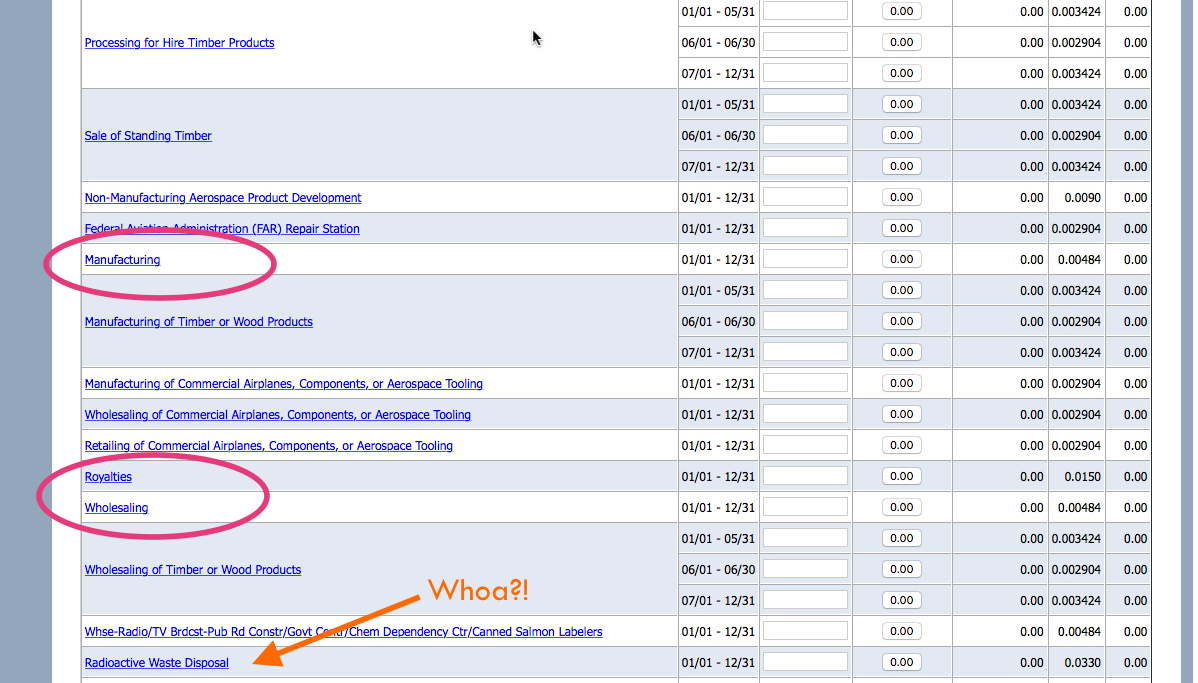

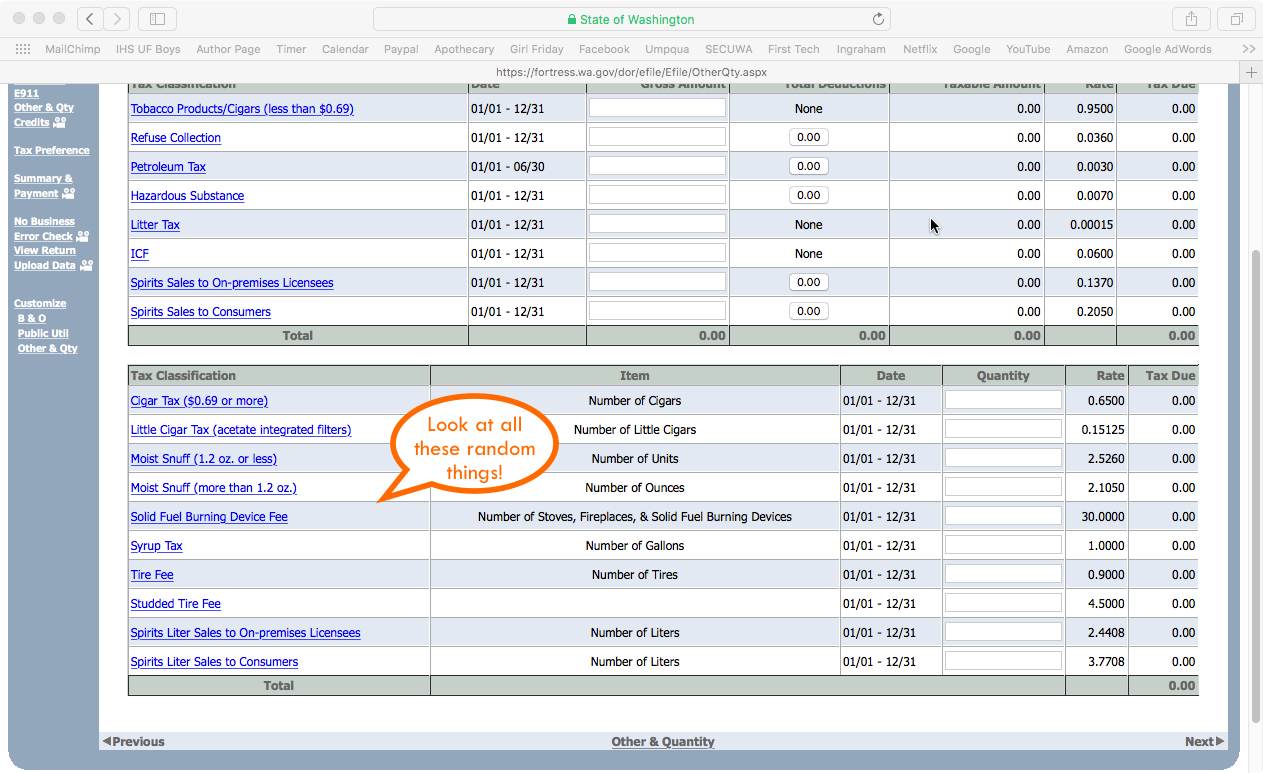

Scroll down........look out for the categories that apply to you. (And check out some of the others along the way!)

Enter the total Gross Sales in each box, next to the name of the category.

Hit Next.

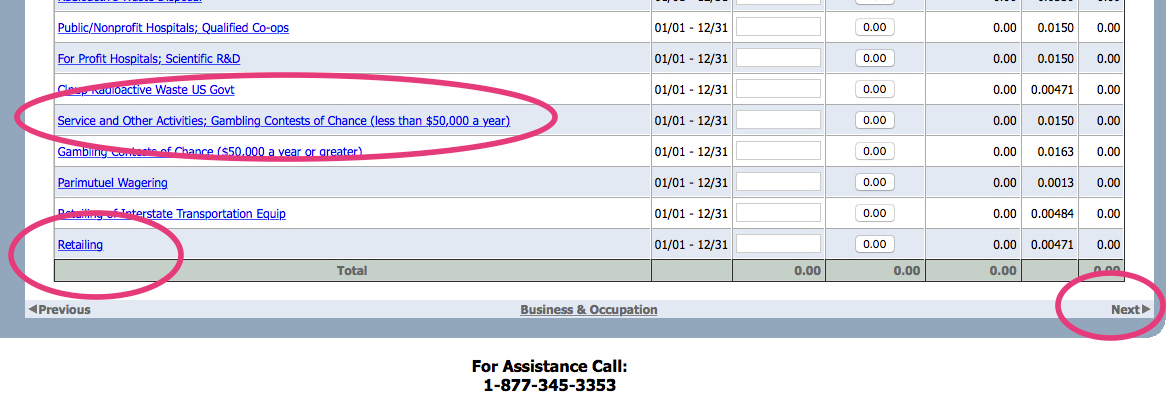

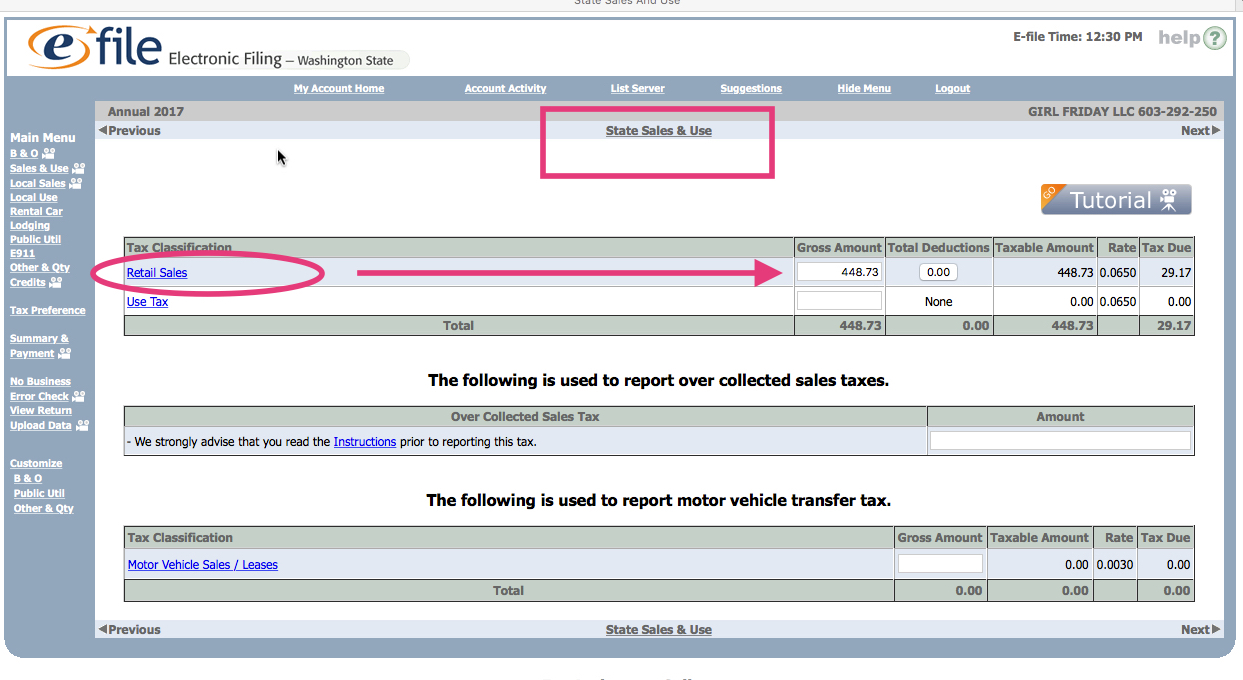

Now you're on the State Sales & Use Tax

Enter your Gross Sales in the Retail Sales box. (This might be pre-filled out for you because of the previous screen. This is collected for the state. The screen shows the rate of 6.5%.

If you know that you owe Use Tax, put that amount as well. (This is for items you bought out of state. If you have questions, call the DOR.)

This next page is for the Local Sales tax. This money is collected on behalf of the city/cities where you sold products and retail services.

> You'll need to add each city.

> For some, you'll need to give subtotals of gross sales in two different time periods.

(Because the tax went up midway through the year.) It shows the different rates to the right.

If you know you'll owe Use Tax, add Seattle, then add your amounts. (Sorry, I'm not going into detail here. This doesn't apply to most people.)

Click NEXT through the following screens until you get to the confirmation page.

>> One exception, if you need to take TAX PAID at the SOURCE, it may be on one of these pages. Sorry, I don't know where it is......

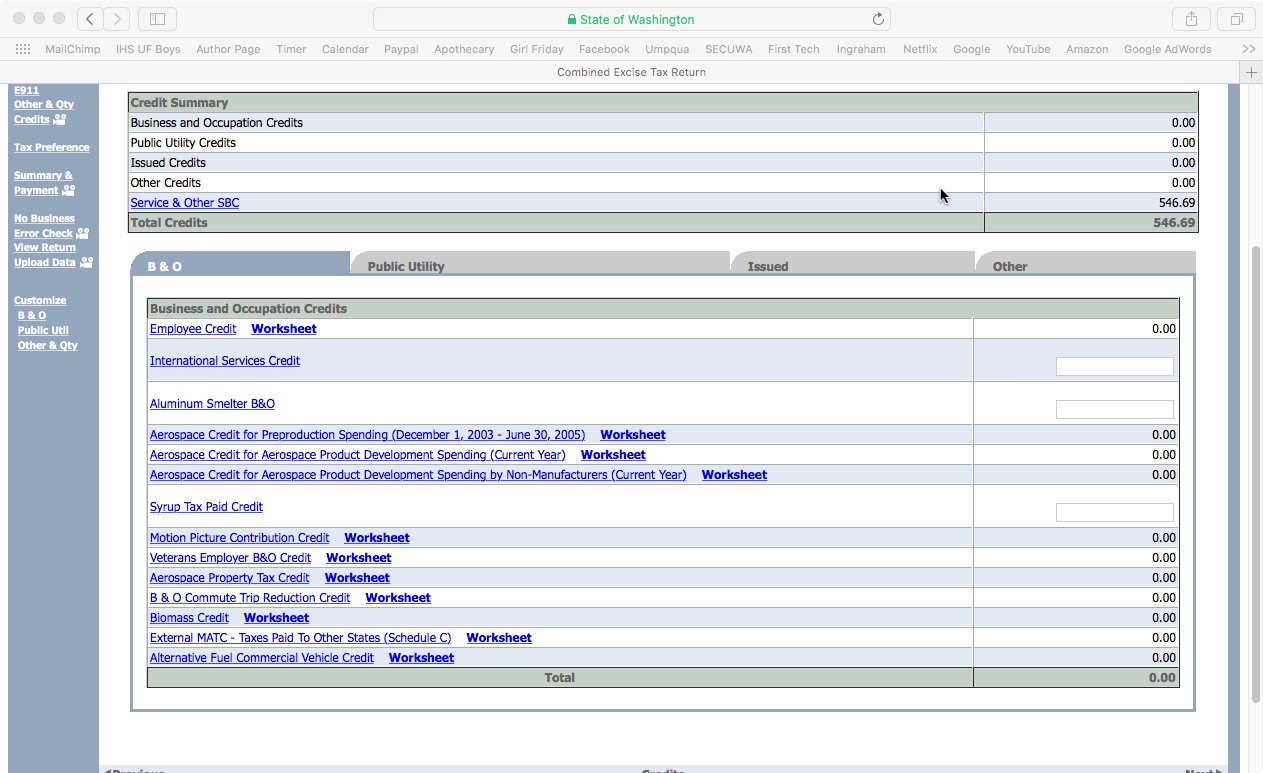

Finally, here we are. It'll show your B&O tax, sales tax, local tax, use tax, etc.

Also, any credits applied to you.

Fill out your contact info to file.

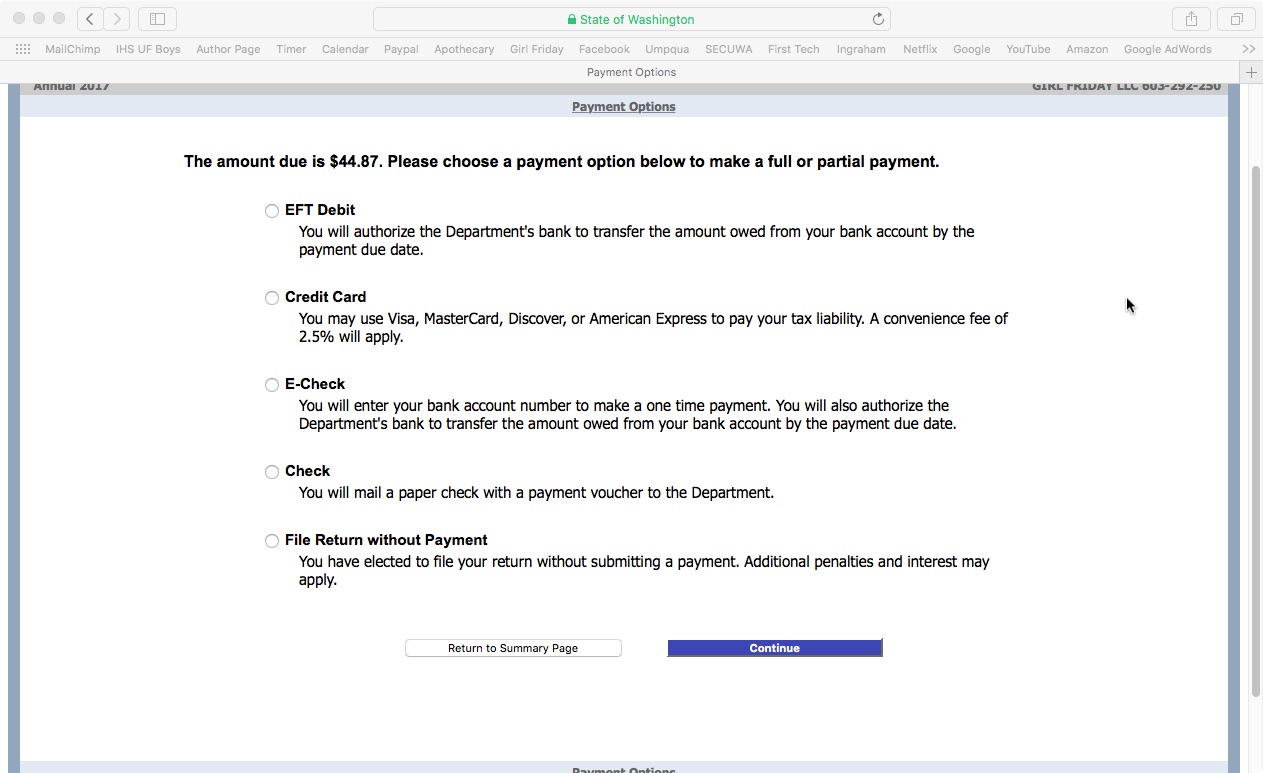

If you owe any money, it'll direct you to a payment screen.

Payment screen. The first one deducts directly from your bank account.

After you fill out your payment info, be sure you follow all the directions to Submit payment.

Check for the buttons at the bottom of each screen. (Sorry, I forgot to grab those screenshots for you.)

Woohoo! Confirmation screen. If you paid any B&O tax, be sure to put a copy in your receipts file.

You can deduct these taxes when you do your Federal filing with the IRS. (Sales and Use Tax is NOT deductible for IRS taxes.)

If you select "View Printable Return" this is what it looks like.

Well done! This will be way easier next year, now that you've been through it.

Please take a little moment to reward yourself. Perhaps some nice chocolate, a walk outside, a glass of wine, or order dinner in tonight.

Cheers!

Jenny Girl Friday

♥

P.S. Did this help? I hope so! Pretty please share with any friends, or post on Facebook. I think self-employed folks are keeping the soul in Seattle. I want to make the chores of business easier, so you can all keep being awesome and shining your light.

P.S. 2 Are you signed up for Sidekick Services via email? Get reminders and links to how-tos delivered right to your email inbox. :)