**This is an On-Going Blog Post - and will be updated as new information is discovered.**

Apply for a PPP Loan!

... as soon as you can.

Ideally this week.

Because it is 100% forgivable,

if you do a little paperwork.

The value is 2.5 x your average monthly profit.

The program was designed with you in mind

♥

Read on for FAQs ... and please let me know if you get one! ...or what happens.

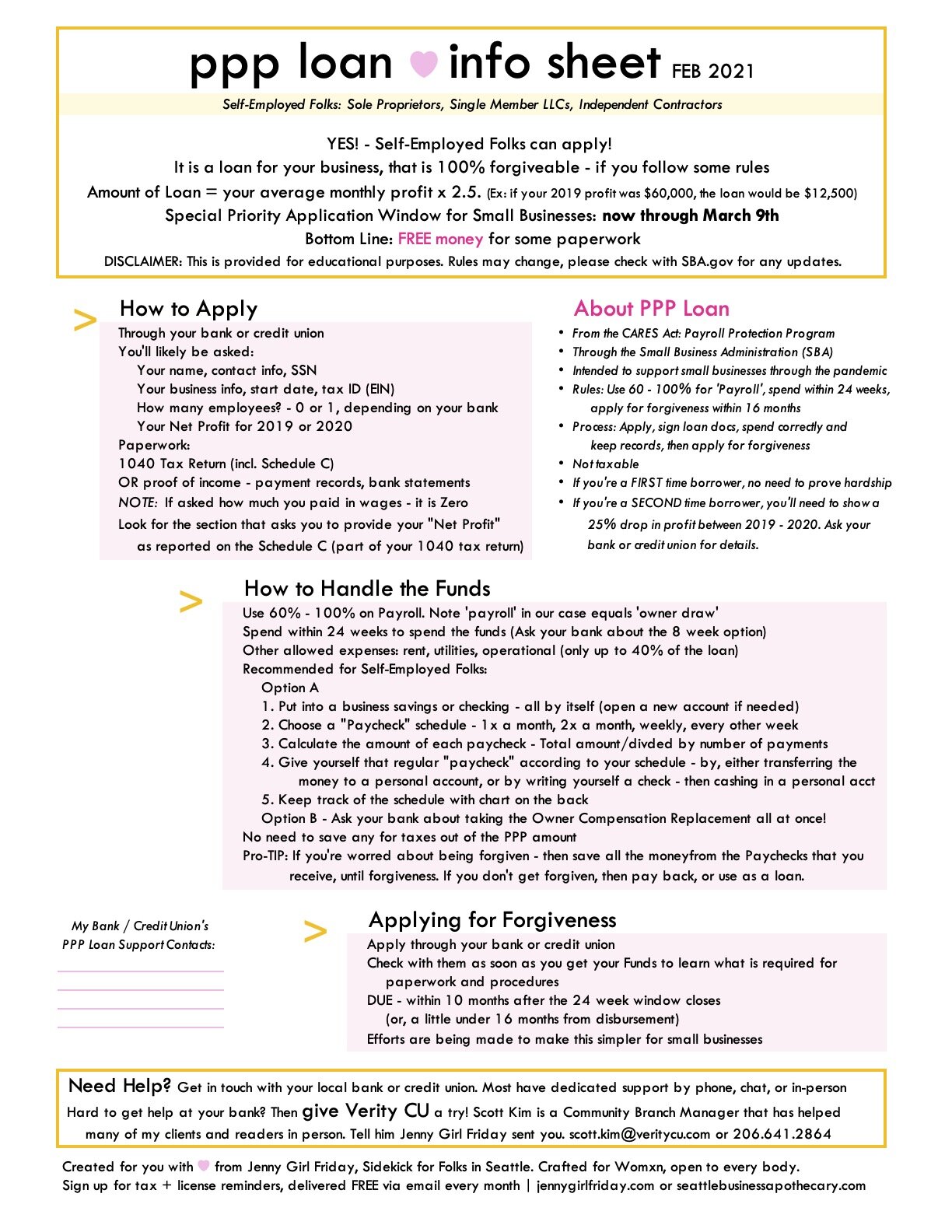

Check out this Info Sheet > > >

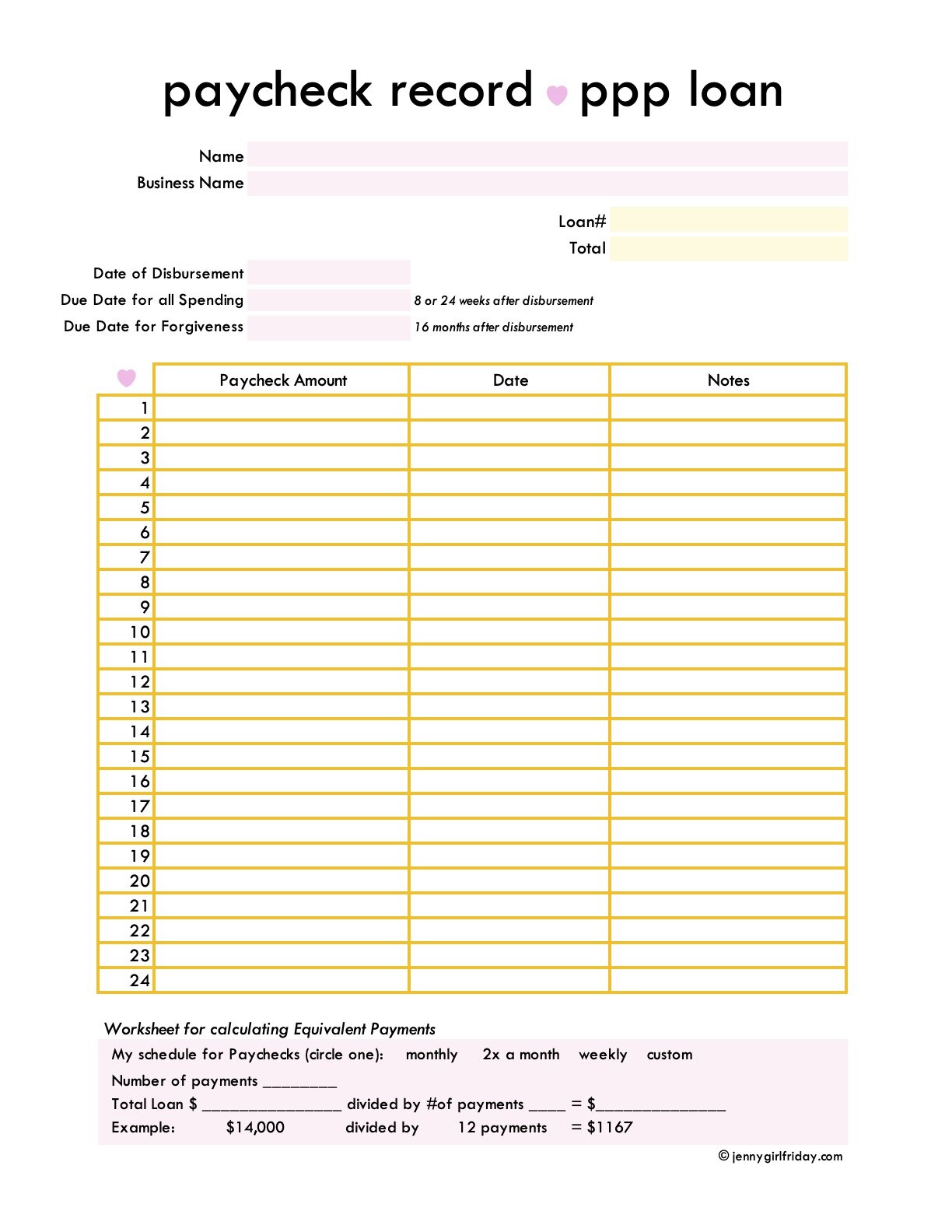

Includes a chart for keeping track of your Paycheck Schedule. Recommend printing back-to-back if possible. Click on either image to get the 2 page PDF.

The Basics

PPP = Paycheck Protection Program

It is part of the federal relief efforts, through the Small Business Administration.

Although we technically don't have Payroll (as a sole proprietor or single-member LLC) ... we're still invited to apply! We are still allowed to get help. For us, it's considered "owner recompensation".

> > The first step is to get in touch with your bank or credit union.

> New application deadline: May 31, 2021

> You will apply for the Funds through them.

> You'll receive the Funds.

> Then, later, you'll apply for the "Forgiveness" with the bank's help.

> When asked how many employees are in your business, some banks will instruct you to say 0 and others will ask you to say 1. Check with them! (Technically, you're the owner, not an employee. But some banks need a number 1 in there for the formula.)

> The only form you should need ... is your 1040 Tax Return from 2019 ... with your Schedule C - this will show what your business profit was. (Which equals your "payroll".) If you see request for other forms, ask the bank!

FAQs

Who can apply?

Anyone who owns a business, including self-employed folks. Even though sole proprietors and single-member LLCs don't technically have a "payroll", we are still allowed. The rules have been extended so that our profit = payroll.

What is the basic overview?

You apply through your bank ... who goes to the SBA to get the funds. Once the funds arrive, the bank may ask for more documents from you. Use the money to "pay yourself". Then, follow your bank's instructions for the Forgiveness Application. Once you pass that process, you do not have to pay it back.

What paperwork is required?

Usually, an online application through your bank. Then, submitting your 1040 Tax Form from 2019. It's possible some banks will take a Profit and Loss Statement from 2020. Then, the Forgiveness Application - I don't know what is on there, but I've read that it is simplified this round.

I tried before, but didn't get it ... is it worth it this time?

This time, more money has been allocated ... it is way more likely that you can secure the funds this time.

I work seasonally, is there anything I can do to boost my loan amount? (The formulas don’t reflect what was truly lost.)

Yes! Some banks have special steps for seasonal workers. Ask someone at your bank or credit union about this. One reader was able to apply as a seasonal work and received about $7000 instead of $4000 (with the classic application).

I have an EIDL loan ... is that an issue?

Yes and no. As far as I understand it - If you used EIDL loan to pay yourself a regular paycheck, then this will count against how much money you can get from the PPP ... but you can still get the PPP! You can use the PPP funds to pay off your EIDL loan (which is not forgiven). Also, if you used your EIDL loan for other things - like rent or business bills - you can get the full PPP loan for your "payroll". Again, ask your bank!

Hmm ... I feel like other businesses need it more than me ... wouldn't I be taking money away from them?

We all need support. If you get the PPP funds, and pay yourself, you can ensure that you'll remain a stable and secure part of our economic system and community. Plus, you can use your personal funds to support the small businesses you wish to support! And/or donate to causes you care about.

My business has been steady, so maybe I don't need it. Do you have thoughts around that?

Yes! Many people I know (including Yours Truly) have been able to continually work ... but it's been exhausting, and some of us are starting to hit a wall. If we hit a wall, then our businesses come to a total standstill - without sick pay or disability insurance. The PPP funds can allow you to throttle back a bit, if you've been working steadily. Also, keep in mind, the spirit of this is to "protect" your payroll. Who knows what will happen in the next 6 - 12 months. I, for one, could use some security moving forward.

I got the first round of PPP ... can I apply again?

Yes, you can apply again ... with some extra paperwork. You'll need to demonstrate a 25% drop in income ... for a particular month. For example, if you can show you made $4000 in February of 2019 ... then, only $3000 in Feb of 2020, that would suffice. Again, ask your bank!

I heard about the Special Window to apply, where women or minority-owned business are getting additional funds … What if I already received the PPP loan, can I get these additional funds?

Sorry, at this time, there is no retroactive pay available. Keep asking at your bank, in case this changes.

Do I have to space out the paychecks to myself? Or, can I take the money all at once?

It's possible you can take it all at once. I've been seeing the term Owner Compensation Replacement - referring to this idea. Ask you bank or credit union if this applies to you.

What is the best way to handle the funds, to get the forgiveness?

Put all of the loan funds into a separate Savings or Checking account. Open a new one if you need to. Then, choose a schedule to "Pay" yourself - by transferring your "paycheck" to a personal account. OR, write yourself a check. It's very important that the "paycheck" goes into your personal account. What we're trying to avoid, is using the PPP monies for other costs. Use the chart above to keep track.

What am I allowed to spend the money on?

You must use 60-100% of the PPP money for "payroll" costs. There are a few other approved things - benefits, rent, utilities, operational. Ask your bank.

Am I allowed to use it to pay taxes?

If you are a sole prop or single member LLC ... technically, you, as a person pay taxes (not your business). So, after you give yourself a Paycheck (into your personal account), you can send in IRS estimated taxes from those monies. Having said that, you may NOT use them for city or state taxes - those are taxes your business pays.

I work by myself, I thought Self-Employed people didn't get Paychecks or have Payroll.

You are absolutely correct! Technically, we have profit or an owner draw. Having said that, the PPP Loan is including us, and equating our "profit" with our "payroll".

What happens if it’s not forgiven?

It stays a loan with a 1% interest rate. I think you may also defer payments, but am not totally sure about that yet.

What if I’m too worried about not getting forgiven … so it makes me not want to apply, because that would be way to stressful?

Suggestion, get the loan, go through the steps of paying yourself AND save all in Personal Savings. Apply for Forgivess asap, if you get it, cool! Keep the money. If you don’t get forgiveness, then you can pay it back. It would have been a hassle, I get it …but know this, they want us to have the money to stay employed and to stimulate the economy. So, they’re trying to make it as easy as possible for us.

Want to talk to a real person about this?

Scott Kim is at Verity Credit Union ... and helped one of my clients, Dr. Annie Roepke, a resiliency expert, go through the process. He shared that he's willing to be a resource to NON-Verity Members. I'll be reaching out to him this week.

What?! Amazing!

♥ Scott Kim,

Community Branch Manager at Beacon Hill

scott.kim@veritycu.com

206.641-2864

Bottom Line

This program was created with you in mind!

It is here to support small businesses through the rocky waters of the pandemic, and post-pandemic world.

Get help! Help is available!

For a few hours of paperwork and research, you can receive 2.5x $$ what you earn in a month ... to keep for Free.

Please do let me know if works for you! I'd love to hear how many readers do this. All the best and luck to you!

Good luck to you,

Jenny Girl Friday

P.S. I work for tips! If you this article helped you in any way, please consider leaving a tip in the TIP JAR. Thanks! :)