• Renew Your Seattle (City) Business License - December 31st

Your first TAX season hoop is here! Renew your Seattle business license by December 31st. Cost is $55 if you earn under $20K, or $110 if over $20K (plus fees if you renew online).

A friendly reminder ~ all self-employed folks need to have two business licenses, one from the state and one from the city.

This post is about renewing your business license with Seattle. (Its longer name is Business License Tax Certificate.) To read more about it, go to: seattle.gov/licenses/get-a-business-license. [Post coming soon about state business licenses.]

Your city business license is the one with the year printed diagonally across ... and the Seattle symbol in the corner.

Due: December 31st

Time: 5 minutes

Frustration: 5 out of 10

(on FileLocal)

Cost:

$57 if you make under $20K annually

$113 if you make over $20K

+Fees: $2 - 7 for processing credit cards

Note: There is a grace period until January 31st. After that, a late penalty applies.

you have 2 options for renewing your license.

Renew through the mail.

Hopefully, you've received a renewal form in the mail. If not, and prefer to renew this way, call the city at: 206-684-8484. Or email them at: tax@seattle.gov

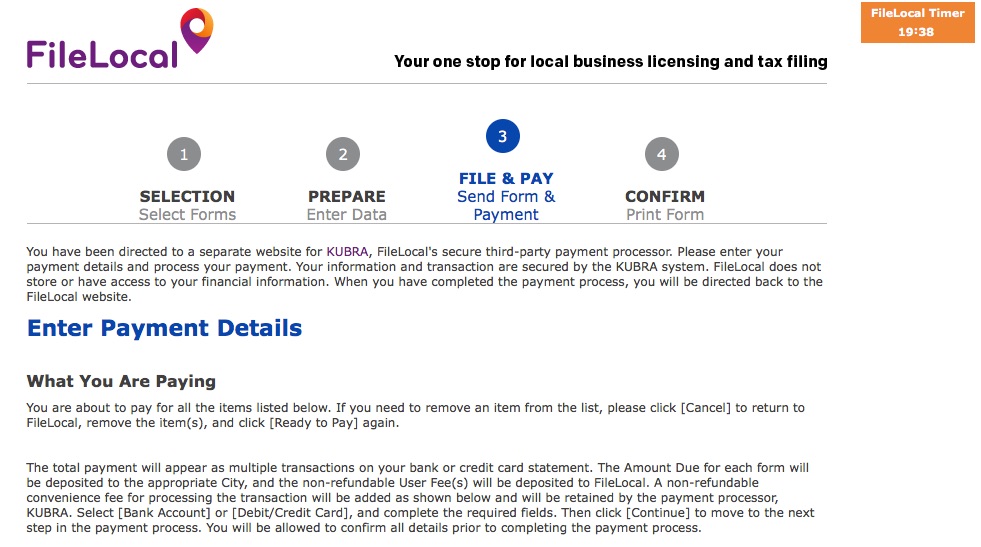

Online ~ FileLocal Portal - This is the new portal.

If you've already created your account, it's pretty easy to renew your license. If you haven't set up your new account, read this article, and plan an extra 20 - 30 minutes for that step. Instructions and screenshots below for renewing your license.

Renew with FileLocal

If you need to set up your account, read this article first. Allow 20 - 30 minutes.

NOTE - The specific screens and steps might have changed a little bit. This will at least give you an idea of what to expect.

1. Sign in to FileLocal

2. Select Renew A License

3. Now you're in the Activity Center. It should have "Renewals and Applications" set as the "TYPE" of activity, with your business information below. [If not, adjust as needed. Call FileLocal if you need help 1.877.693.4435 Select Continue.

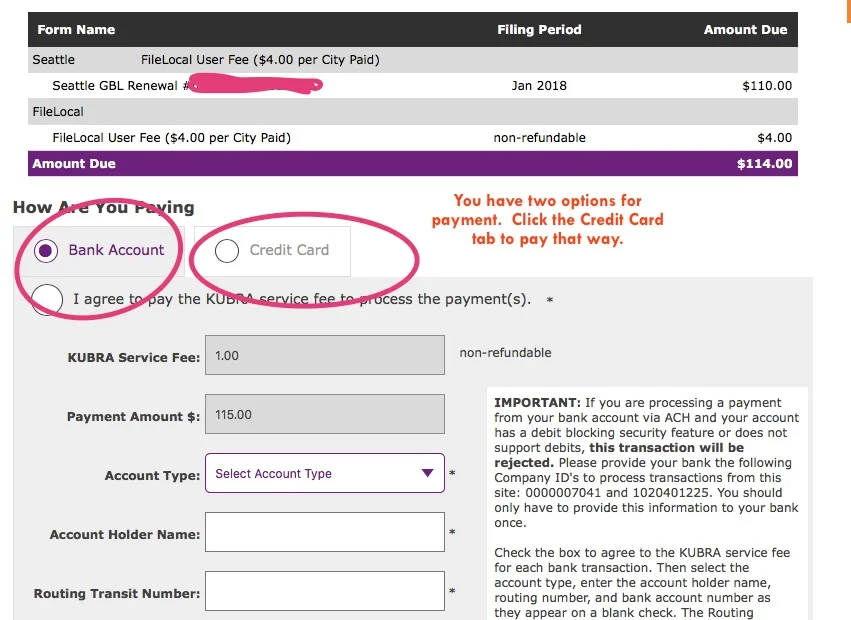

4. Continue through screens to confirm your information. Then look for the "READY TO PAY" button.

5. Look for the HOW ARE YOU PAYING tabs. It's set on Bank Account. You can use that, or select the tab for CREDIT CARD.

6. Complete the checkout process.

7. Print a copy for your records. (It's an expense/deduction.) Or, save a pdf and put into special folder.

8. Check this off your Tax Season List!

Well Done! One more Hoop accomplished / one more thing checked off your TAX Season checklist!

♥ ♥ ♥ ♥ ♥ ♥ ♥ ♥ ♥

Are you already signed up for Sidekick Services? Get tax and license reminders delivered right to your Email Inbox, so you can stay current + feel peace of mind all year long. Did this article help you? Please share with a friend or two, or 5!

{I'm on a mission to help every self-employed woman* in Seattle get the support she needs to be awesome.}

Cheers! Jenny Girl Friday

• How to Set Up Your Business in Seattle - As a Sole Proprietor

Opening a business as a sole proprietor is the quickest way to achieve lift off! ….Because, there is no business entity to create. In legal and tax terms, you and the business are the same. You simply to need to apply for some licenses, and possibly some permits.

(Not sure if you want to be a sole proprietor? Read Sole Proprietor or LLC: Which is Best for Me?)

Making things official is a great way to build momentum. I encourage you to get your licenses at any time! You can work on the other things later.

Let your dream take flight! (Is that too many metaphors?)

Pro Tip: Get a journal to record all your log-ins, passwords, IDs, and various notes as you go through the process. Use in the future for all research and calls related to taxes and licensing. Read more in Make Your Life Easier! - Simple Tips For Keeping Track Of License And Tax Stuff

1) Apply for your state business license.

Through: Washington State Business Licensing Service (BLS)

Uses MyDOR portal.

Click here to go to read more information on the BLS.WA.gov site

Cost: $19 plus $5 for each DBA

Time: 15 - 20 minutes

2) Apply for your city business license.

Through: City of Seattle Business Department

Uses the FileLocal Portal.

Click here to read more on the city’s website

Cost: $113 for standard, $56 if you plan to gross under $20K per year.

Time: 15 - 20 minutes

That's it! You're in business. …but you're not quite done. To be legal, you need to ensure that you have all of the special permits and licenses for your line of business.

3) Optional ~ Apply for an EIN

EIN stands for Employer Identification Number. It's a tax ID number assigned to businesses by the IRS. If you are a sole prop or a single-member LLC, you are allowed to use your SSN for business purposes. Having said that, banks and online forms will often required you to have an EIN. The issue is that the number formatting is different. With your social security number, it looks like 000-00-0000. With an EIN, it looks like 00-0000000.

Good news! It's easy, free, and only takes 10 minutes. Here's the link: Get EIN on IRS.gov. Or, go to IRS.gov and search for EIN. Heads up, this web service is only available during the daytime.

4) Do your due diligence.

At the state level, check the List of Licenses

This is a list by trade, with links to relevant licensing agencies.

Here's the list of Endorsements required by some businesses.

Or, call the BLS: 1-800-451-7985

And, at the city level, check the Regulatory Endorsements page.

Or, call the City of Seattle: 206.684.2489

Another nice tool is the WA Business Hub. It's created to walk anyone through the setting up a business. There's a TON on there.

5) Celebrate!

* * Please note: The intent of this post is to get you started! And, to provide you with the required framework for every business. Your field may require additional permitting or specialty licenses not covered here. For best results, call the city or state, numbers above.

Happy Working,

Jenny

Some Helpful Details

For the State Business License

Some things you'll be asked:

• what bank you'll be using

• your SSN and your partner's SSN

• description of your business: 1- 2 sentences

• trade name(s)

• which cities you'll be doing business in (you need a license for each one)

For the City Business License

Some things you'll be asked:

• the UBI - it is your Unified Business Identifier, you'll get this with your state license

• estimated income

• note: your legal business name will be the same as your name, to get a different name, you need to by a DBA, doing business as, also called a trade name. They are $5 each.

Photo Credit: Design for a Flying Machine by Leonardo da Vinci - http://www.drawingsofleonardo.org. Licensed under Public Domain via Wikimedia Commons