Tax Season for Self-Employed Folks in Seattle: A Handy List with Links

Hello! Tax season has a lot of hoops to jump through. Most of them don't take much time, it's just a matter of finding your rhythm and know what to do, when.

This handy list has got you covered! I do skip over some of the finer navigational directions...the objective is to give you the basic list of stuff to do and links. Most agencies have very helpful people to call if you need assistance. Wishing you an easy-breezy tax season.

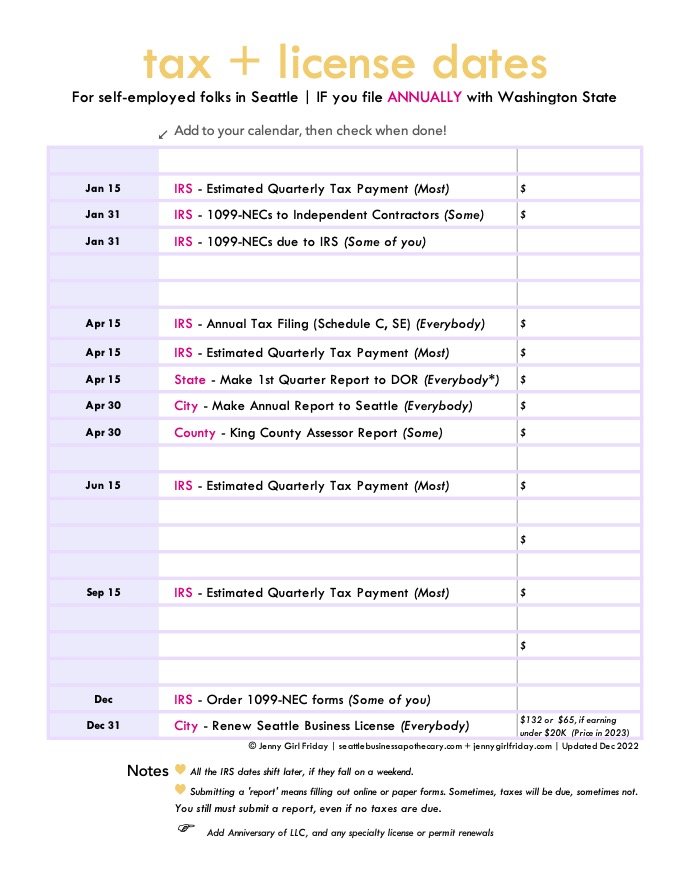

Click on the chart below - that matches your tax situation

1. December - Order 1099s ....if needed

SOME of you

Takes about 2 minutes to order

Free

These are due to the IRS and to Independent Contractors by January 31

If you paid any independent contractor for services...over $600, you need to fill out a 1099-MISC form for them. Think: designer, photographer, bookkeeper. It will arrive with a 1096 form also. Don't worry! This is just like a cover page for faxes...it just asks you for the basic summary of what you're sending.

Click here to go to Order Forms on IRS.gov. Look through the chart to find 1099-MISCs. Be sure to put the quantity that you want in the column for last year. (2016)

2. December - Renew City of Seattle Business License

EVERYBODY

About 15 minutes

Costs $65 if you plan to make under $20K,

$132 if you make over $20K

Due: December 31

Seattle uses a portal called FileLocal for registering/renewing licenses.

3. January - Send 1099-MISC forms to ICs + IRS

SOME OF YOU

About 10 - 40 minutes...if you have the numbers and w-9 forms

Needed: For each Independent Contractor ~ Total paid in 2018, Name, Address, EIN or SSN

Due: January 31

Whenever people are getting paid, or earning money, the IRS wants to know about it! They have created a variety of forms to do just that. Just like a w-2 form is used to track an employee paycheck, 1099s are used to report other kinds of income.

If you paid any independent contractors more than $600 in 2018....for services...then you must submit a 1099-MISC to both the IRS and to the independent contractor. (Referred to as the "Recipient" or “IC”.)

To read more about 1099s, click here.

To order 1099s on IRS.gov, click here.

To see a walkthrough of ordering forms, click here.

To see how to fill out, click here.

4. April 15 - Report to WA State

EVERYBODY

About 1 minute...if you have the numbers

Needed: Gross Sales by category*, UBI number, and payment method (if required)

Due: April 15

The state wants to know about your business activity. This means knowing your Gross Sales in each category of doing business: Services, Retailing, Wholesaling, Manufacturing, and Royalties (to name the biggest ones). Another way to think of Gross Sales...is Total Payments or Total Deposits. This figure is before any deductions or taxes. This form is quick to fill out. You do NOT need to know your business expenses. The state is there to help you! Call 1-800-647-7706. Or check out this page especially for annual filers.

*Note: if you purchased materials at wholesale prices, you'll need a total of all of those costs (before sales tax)....to take that deduction.

Go to DOR.WA.gov. Look at upper right corner to Logon. You need to register an account if you haven't already done so. For that, you'll need a PAC code. Call them at 1-800-647-7706, or look on any paper forms they have mailed to you.

5. April 30 - Report to the City of Seattle

EVERYBODY

About 5-10 minutes...if you have the numbers

Needed: Gross Sales by category

Due: January 31

This is similar to reporting to the state (above). You need Gross Sales by category...and the city has fewer than the state. The city only collects B&O taxes, if you earn over $100K. But you still need to fill out the form.

Go to the City of Seattle's FileLocal Portal. If you applied for your business license online, then you already have an account. If not, you may need to set up an account first. If you need help, call 206.684.8484.

6. April 15 - Report to IRS and Income Taxes + Self-Employment Taxes

EVERYBODY

From one hour to ten....to more!

Needed: Gross Sales, Expenses by Category, Payment method

The IRS taxes you on income. In this case, your business profit is considered your income. For this, the formula is to start with your Gross Sales figure, and then subtract all of your business expenses. The answer is what you get taxed on. To see how it works, I recommend printing out a Schedule C form. It's only 2 pages, and friendlier than you might think.

That's the basic idea. To back up your numbers, the IRS wants you to have proof, and may require you to fill out additional forms.... It is too detailed to cover here. Options for filing: TurboTax or other online programs, hire an accountant, or download and use paper forms.

To read more on IRS.gov, click here for the Self-Employed Individuals Tax Center.

7. April 30 - Report to King County

SOME OF YOU

IMPORTANT Notes First:

♥ If you have an account already set up, then a report is due to King County by April 30th. See below for more info.

♥ If you DO NOT have an account, then nothing is due for you at this time...and you're in good company. (Many people do not know about reporting to King County!)

♥ Do I have to report to King County?

Technically speaking, ALL businesses must register with King County and make a report every year. Realistically speaking, many micro and small businesses do not know about the County, and are not registered, and it has not been a problem (so far). One similar situation is the Speed Limit. Many people drive over the speed limit, but never get a ticket—especially if you're over by only 2-5 miles. I cannot give any advice about what to do, but want to give you some context so you can make your own decision!

5 - 10 minutes, if No Change in property; 10 - 40 if you have changes

Needed: Value of "Personal Property"

Free, if value is under $7500

Due April 30th

The county taxes us on property (as opposed to sales or profit). For business, "personal property" refers to equipment and supplies used for your business. If you've set up an account already + nothing has changed, you may simply email the county at Personal.Property@kingcounty.gov and say "NO CHANGE". Include your name, contact, and UBI.

Please contact the county for more information if: your personal property is over $7500, if you need to set up an account, your business owns real estate, if you have any questions. Click here to read about Personal Property Tax.

To set up a new account, click here. Scroll down to Personal Property section.

Note: These Due Dates May Also Apply to You

Estimated Quarterly Tax Payments (IRS) - If you are sending these in, one is due on January 15th, with another on April 15th. To read more about these, click here.

LLC/PLLC Renewal (State) - This is due on the anniversary month of when you set it up. An LLC is set up through the Secretary of State...but to renew it, you go through the Business Licensing Services (BLS). Click here to renew your LLC.

Reports to the DOR* (State) - Some businesses are required to make quarterly reports to the DOR instead of annual. If this is you, then April 30th is the due date for your second report. Click here to go to DOR.WA.gov.

*Department of Revenue

Now it's time to celebrate!

Pop some bubbly, or take a long weekend. You deserve it.

: ) Jenny