Renew Your Seattle (City) Business License - December 31st

A friendly reminder ~ all self-employed folks need to have two business licenses, one from the state and one from the city.

This post is about renewing your business license with Seattle. (It's longer name is Business License Tax Certificate.) To read more about it, go to: seattle.gov/licenses/get-a-business-license. [Post coming soon about state business licenses.]

Your city business license is the one with the year printed diagonally across ... and the Seattle symbol in the corner.

Due: December 31st (each year)

Time: 5 minutes

Frustration: 2 out of 10

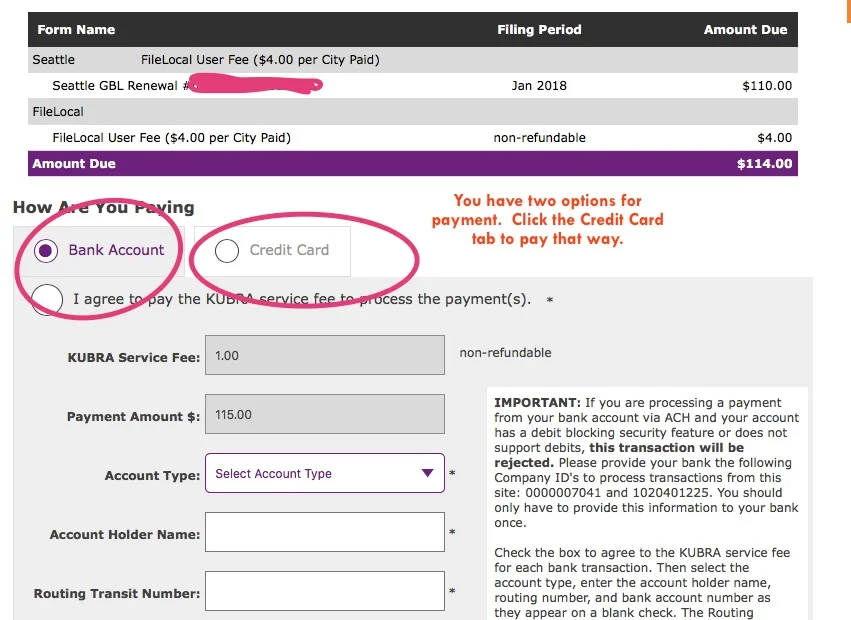

Cost: $55 if you make under $20K annually,

$110 if you make over $20K

+Fees: $2 - 7 for processing credit cards

Note: There is a grace period until January 31st. After that, a late penalty applies.

you have 2 options for renewing your license.

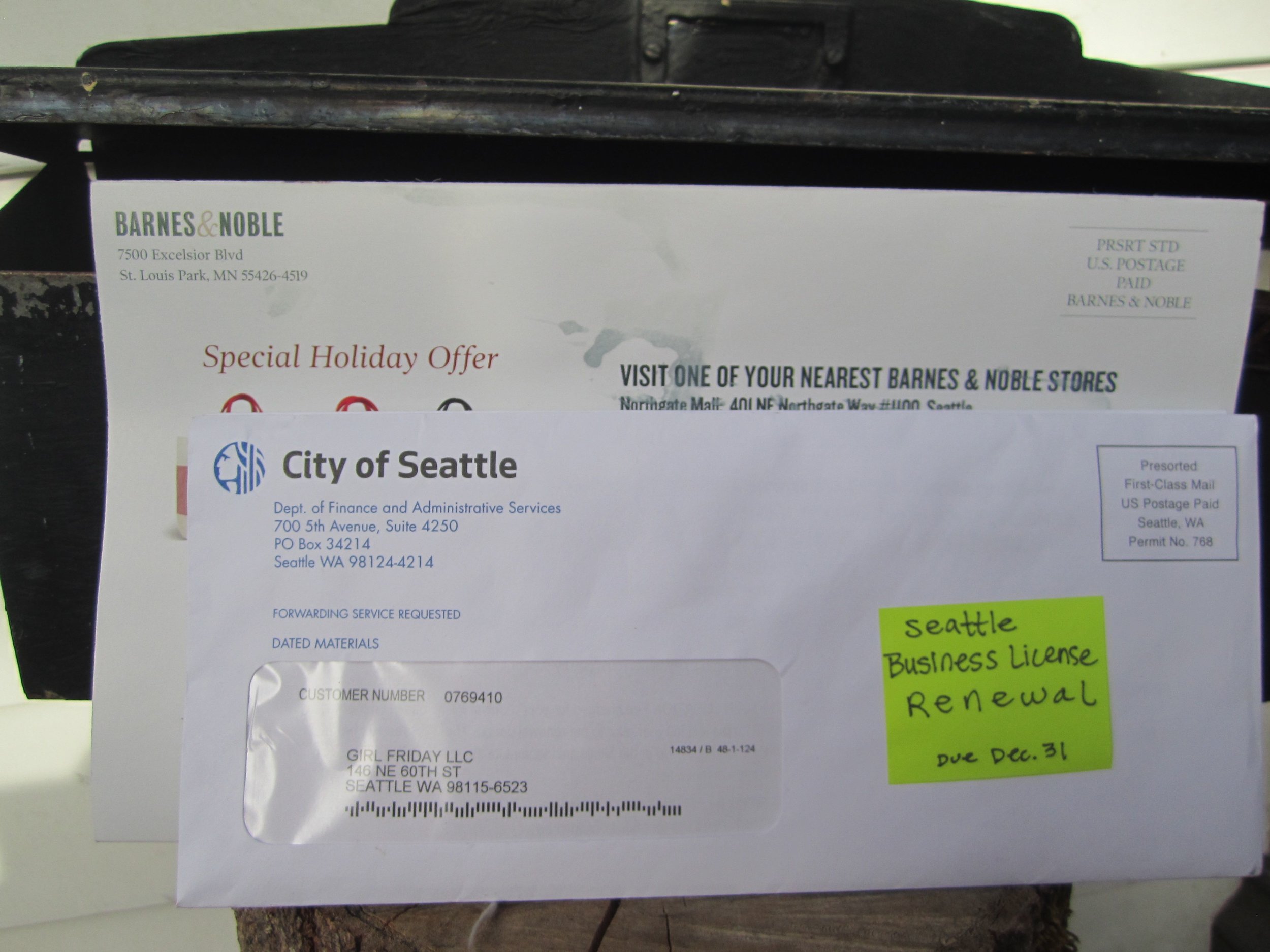

Renew through the mail.

Hopefully, you've received a renewal form in the mail. If not, and prefer to renew this way, call the city at: 206-684-8484. Or email them at: tax@seattle.gov

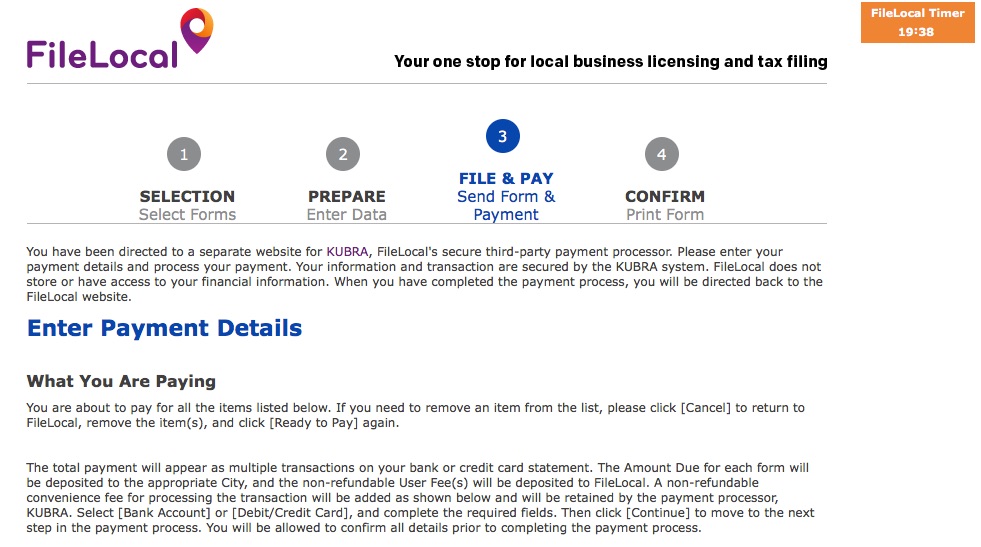

Online ~ FileLocal Portal - This is the new portal.

If you've already created your account, it's pretty easy to renew your license. If you haven't set up your new account, read this article, and plan an extra 20 - 30 minutes for that step. Instructions and screenshots below for renewing your license.

Renew with FileLocal

If you need to set up your account, read this article first. Allow 20 - 30 minutes.

1. Sign in to FileLocal

2. Select Renew A License

3. Now you're in the Activity Center. It should have "Renewals and Applications" set as the "TYPE" of activity, with your business information below. [If not, adjust as needed. Call FileLocal if you need help 1.877.693.4435 Select Continue.

4. Continue through screens to confirm your information. Then look for the "READY TO PAY" button.

5. Look for the HOW ARE YOU PAYING tabs. It's set on Bank Account. You can use that, or select the tab for CREDIT CARD.

6. Complete the checkout process.

7. Print a copy for your records. (It's an expense/deduction.) Or, save a pdf and put into special folder.

8. Check this off your Tax Season List!

Well Done! One more Hoop accomplished / one more thing checked off your TAX Season checklist!

♥ ♥ ♥ ♥ ♥ ♥ ♥ ♥ ♥

Are you already signed up for Sidekick Services? Get tax and license reminders delivered right to your Email Inbox, so you can stay current + feel peace of mind all year long. Did this article help you? Please share with a friend or two, or 5!

{I'm on a mission to help every self-employed woman* in Seattle get the support she needs to be awesome.}