How to Send in Your Estimated Quarterly Tax Payment (EQ$) to the IRS

Most of us are required to send in part of our federal taxes each quarter to the IRS. These are referred to as estimated quarterly tax payments (EQ$).

There are two main things you need to know to send in your EQ$.

• How much money to send.

• How to submit payments.

This post covers how to submit the payments. Click here to read more about EQ$ and how to calculate the amount.

The Due Dates for EQ$

January 15

April 15

June 15

September 15

Note: These are NOT due every three months. The time in between varies.

Also, if the due date falls on a weekend or holiday, it is shifted to the nearest business day.

Payment Options

> You may pay electronically. Click here to go to the Payment Page on the IRS.gov site. In most cases, there is an additional fee. There are several options: credit card, direct pay from your bank account, wiring, and more.

> Or, send checks through snail mail.

What You Need for Mailing in Checks

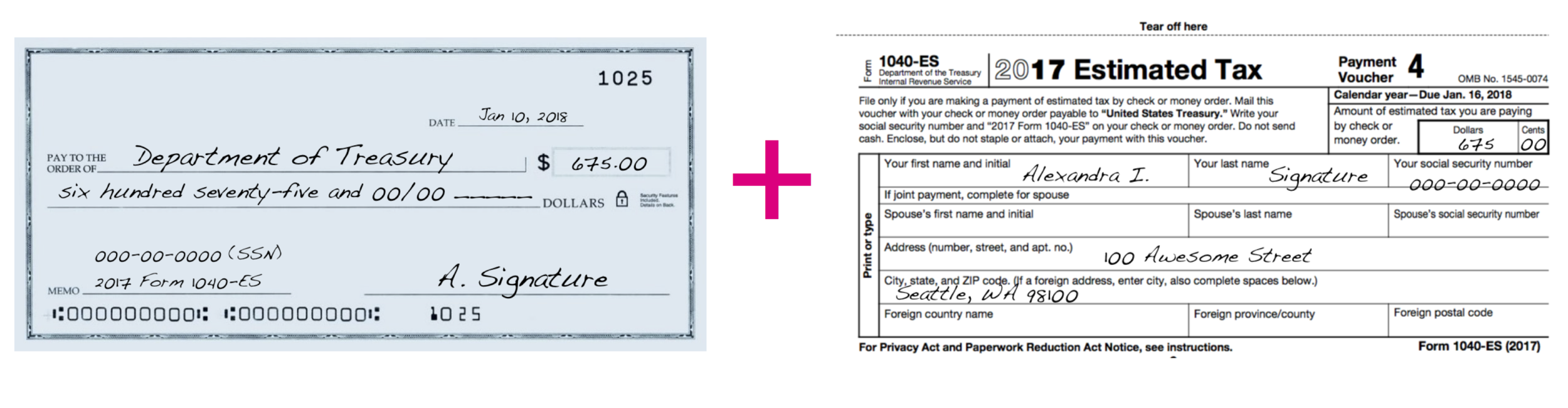

1. A Payment Voucher, also called, Form 1040-ES

2. Envelope

3. Check

4. Your SSN (social security number)

How to Get a Payment Voucher

If this is your first year doing business:

• Download from the IRS.gov site.

Click here to go to the Form 1040-ES page. Scroll to the bottom to get the vouchers.

If you've been in business for 1+ years:

• Tax Software programs will often generate these for you after you file your taxes.

• Accountants will often provide them

• IRS - sometimes they will send these to you in the mail

• IRS.gov - download from the website, scroll to the bottom to get the vouchers.

Steps to Take if You are Submitting Electronically

1. Calculate the amount to send in

2. Go to the IRS.gov payment site

3. Follow instructions to make payment

4. Print any receipts and file with all of your business documents

IMPORTANT - Be sure to select “PERSONAL Taxes” when asked. DO NOT select “business taxes.” This will send you to a confusing portal. “Business Taxes” are for places like Mighty-O, Starbucks, etc. You are paying “PERSONAL” taxes that you earned through your sole prop / LLC business.

Steps to Take if You are Submitting through Snail Mail

1. Calculate the amount to send in

2. Fill out the Form 1040-ES (payment voucher)

3. Write the check

4. Write on the Memo line of your check:

- your SSN

- "Form 1040-ES" and the year you're submitting tax for (See note below.)

5. Put in an envelope. Address to:

Internal Revenue Service

P.O. Box 510000

San Francisco, CA 94151-5100

6. Be sure it is postmarked by the Due Date.

7. Make a copy of your check OR make a note of the check# and amount paid. Put in your file of business documents.

What Year to Write on Your Check

Look at your payment voucher to know what year to write on your check. Generally, the estimated quarterly payment we're sending in is for the previous quarter. So....

Parting Thought

Do whatever you can! Sending any amount...at any time, is way better than skipping this step.

You can help yourself by marking these dates on your calendar: Jan 1, Apr 1, Jun 1, Sep 1....and taking 15 minutes to send these payments. If you're not sure how much, get a friend to help or just take a guess. You'll thank yourself next April, and can have more peace of mind in the meantime.

Happy Working,

Jenny Girl Friday