What are 1099s? Do they apply to me? •

Whenever people are getting paid, or earning money, the IRS wants to know about it!

They have created a variety of forms to do just that. Just like a w-2 form is used to track an employee paycheck, 1099s are used to report other kinds of income.

Most often, when people say 1099, they are referring to a 1099-MISC. (Starting in 2020, 1099-NEC will be used instead.)

This refers to miscellaneous income—which is any time someone is paid for a service, and they are NOT an employee. For example, let's say Molly starts to teach yoga at her neighborhood studio, just one time a week. They pay her for each class, but do NOT hire her as an employee. At the end of the year, they would report all her earnings on a 1099-MISC.

As a self-employed person, it's common to both give and receive 1099s

For example, if you hire a photographer to do headshots for your website, or a designer to create a logo for you, or a bookkeeper to help you out, you'd likely have to give them 1099-MISCs at the end of the year. (More on criteria below.)

If you provide a service to someone or a business, then you would receive a 1099-MISC, if you meet the criteria.

[Note ~ 1099-MISCs have a partner form, the w-9. It's used to get someone's tax id number, either their social security number or employee identification number. Read more about w-9s here. (Coming soon.)]

The term 1099 + how the cool kids use it

It's important to know that there are a variety of 1099 forms, all with different suffixes and different purposes. For example, you might have gotten a 1099-INT from your bank. The INT refers to interest. Also, sometimes people use the term as a verb or adjective, as in – Did you have to 1099 him? Or, is it a 1099 job? I think this is part of being the cool kids, but I could be mistaken... ;)

Criteria, or, when to involve a 1099-MISC

For our purposes, we involve a 1099-MISC when...

- An independent contractor...

- Earns over $600 in one year...

- For service work.

To read about more situations, click here to read about 1099-MISCs on the irs.gov site.

Any time an individual—who's not an employee—is paid for a service, they are considered an independent contractors (IC). Sole proprietors and single-member LLCs are both considered ICs. It can also be a person without a business license, such as a neighborhood teen who mows your lawn all year round.

Some things to know ~

• You can order the 1099-MISC forms from the IRS for free, or you can purchase at office supply stores.

• Order or purchase these early! They can run out. Add to your November or early December calendar.

• If you fill out by hand, they will be carbon forms.

• You must provide a copy to the Independent Contractor and to the IRS. Currently, the due dates for these are the same. (Sometimes they vary.)

- Copies due to the Independent Contractors January 31st.

- Copies due to the IRS January 31st.

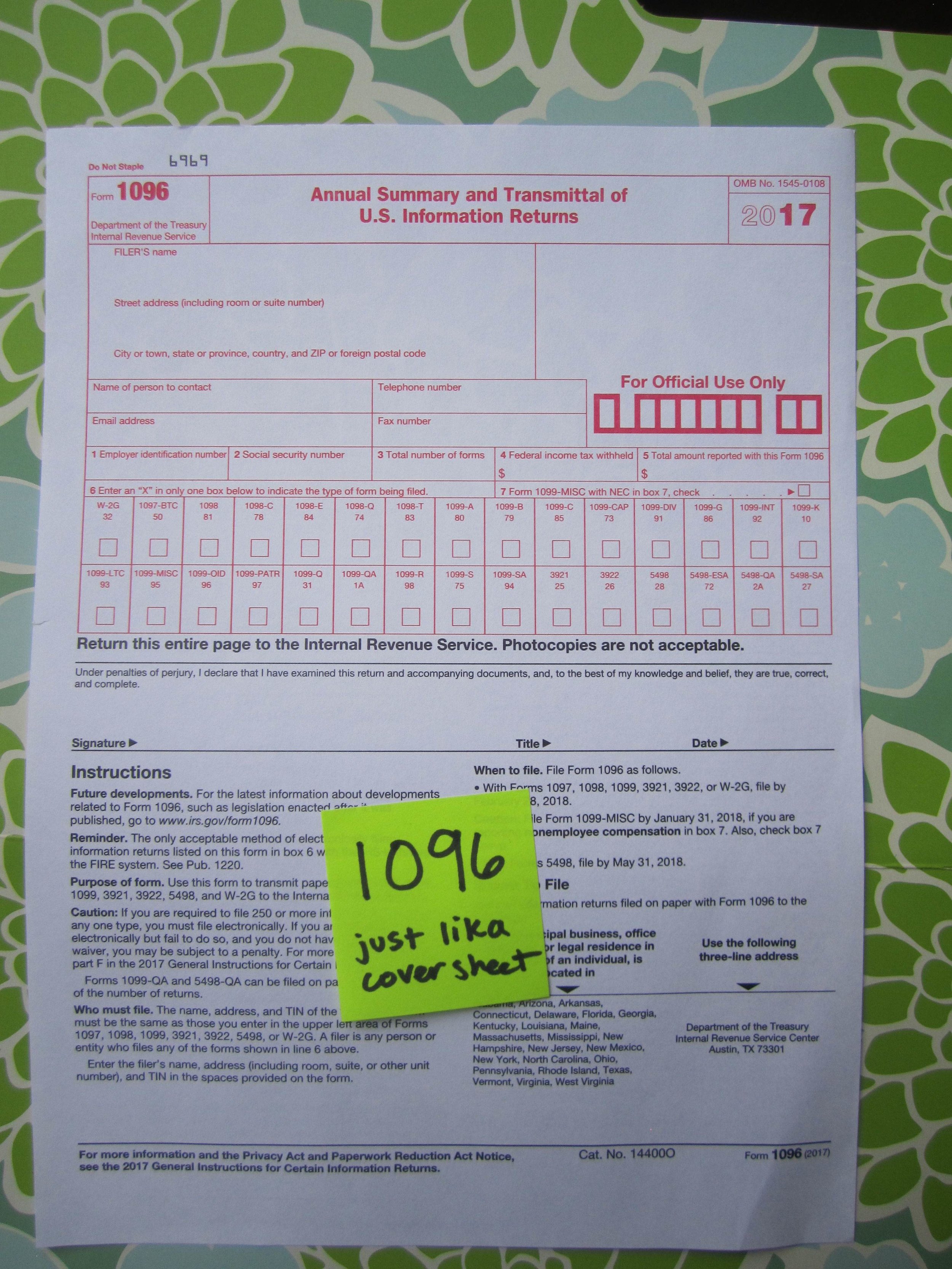

• 1099s are usually accompanied by a 1096 form. The IRS will send this automatically to you if you order from them. Do not be alarmed! It is very simple, and acts like a cover letter. You DO need to send it in, along with the 1099s.

More Help with 1099-MISCs

• To order 1099-MISCs from IRS.gov, click here.

• Click here to see a walkthrough of ordering.

• Click here for more on How to Fill 1099’s Out and Submit.

• 1099s have a partner, the w-9. To read more on this, click here. (Coming soon.)

• Meet the the 1096 form, like a cover page for 1099s. (Coming soon.)

1099s are good things!

If you're receiving a 1099, it means you got paid for something in the last year! If you're giving them out, it means you hired someone to help you or your business. These are good things! Whenever you're working with 1099s, it's nice to remember the experiences they represent.

Happy Working,

♥ Jenny Girl Friday