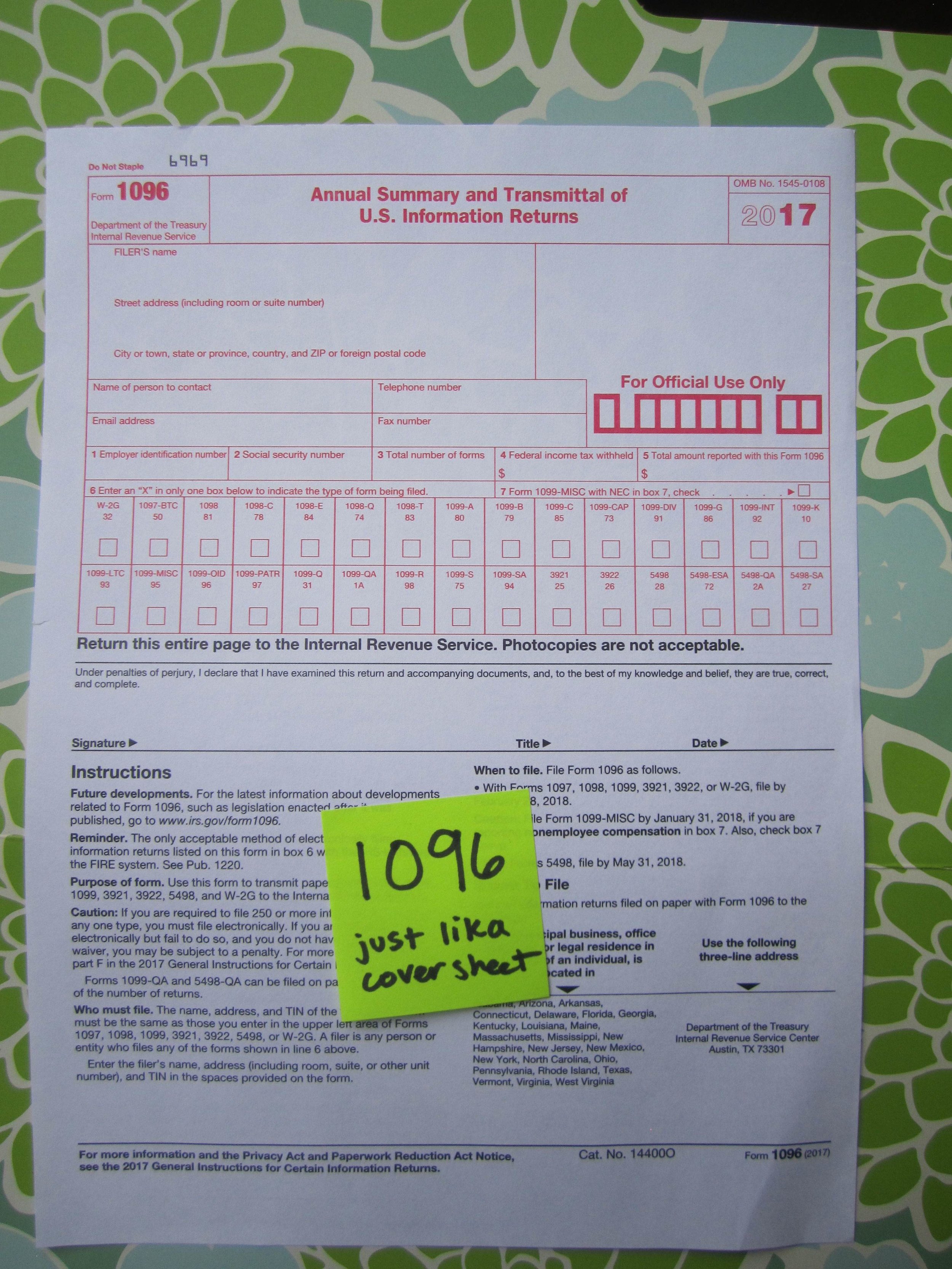

Not sure if you need 1099-MISC forms? Read about them here.

When: Order in Nov or Dec

Forms Due: January 31

Estimated Time: 3 minutes

Cost: Free

Frustration Factor: 1 out of 10

If you plan to use paper 1099-MISC forms (1099s for short), you'll need to order them from IRS.gov. It's not possible to simply print them off ... because they are carbon forms.

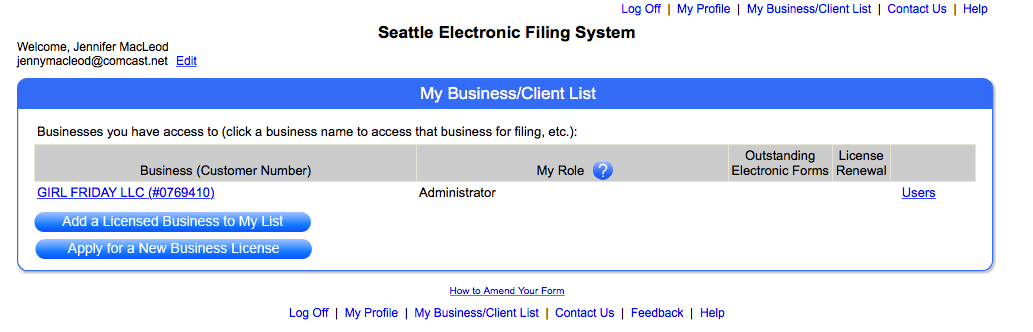

Here are the steps. There are screenshots are below.

1. Go to IRS.gov

2. Select "Forms & Publications" ~ Top right side

3. Select "Order Forms and Pubs" ~ Left side

4. Select "Online Ordering for Information Returns and Employer Returns"

5. Scroll Down to see chart of forms

6. Notice there are two empty boxes for each form ~ one is for 2017 forms, the other is for 2018 forms

7. Keep scrolling until you see 1099-MISC

8. Put the desired number of forms that you need in the left box, for 2017 forms

9. Put a number 1 next to the Instructions

10. Scroll down to the bottom and select "Add to Cart"

11. Follow the checkout process

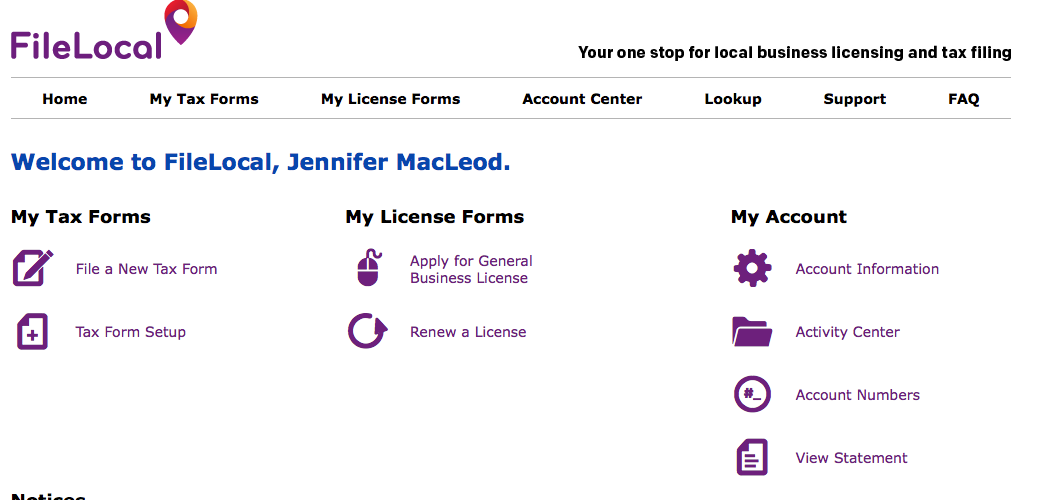

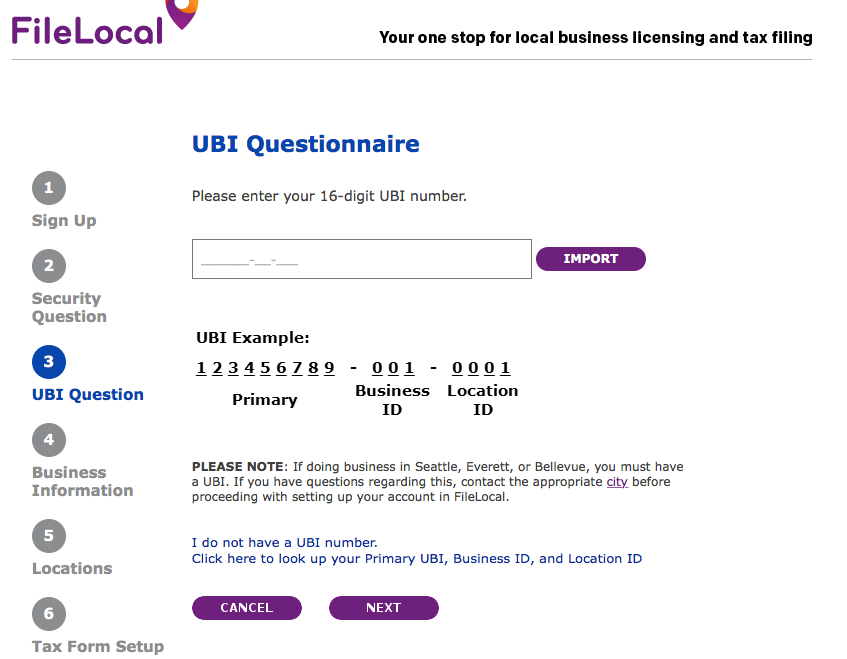

The first picture starts on the "Order Forms and Pubs" page.

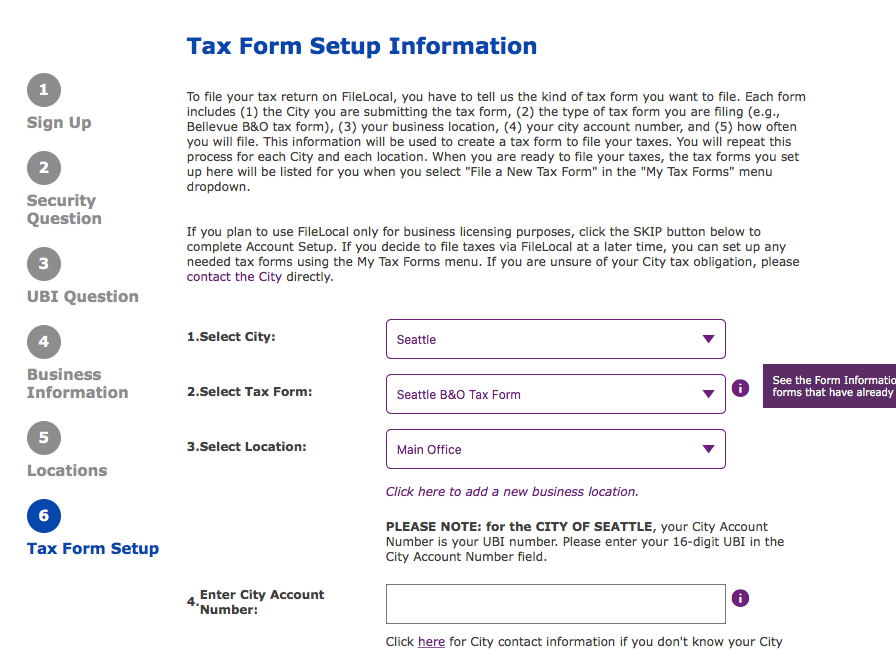

The Chart of Forms - The actual chart is longer than what's shown here.

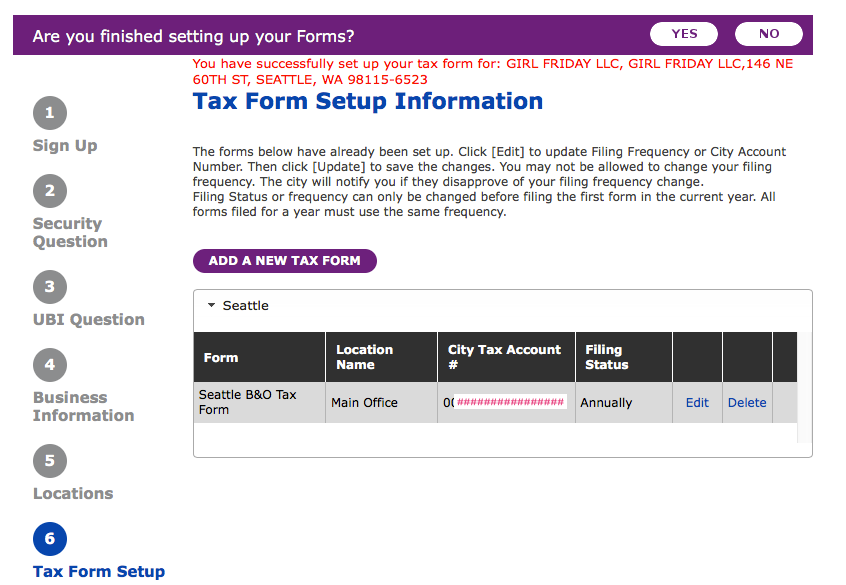

The beginning of the checkout process.

To read about 1099s + w-9s, click here. (Coming soon.)

Need help filling out your 1099s? Click here. (Coming soon.)

Great job staying on top of things for tax season!

♥ Jenny Girl Friday

Would you like to receive friendly reminders for tax season ... delivered right to your inbox? Sign up for Sidekick Services! Asking for a small annual donation.